Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Obtain any version from 85,000 legal records such as Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate online with US Legal Forms. Each template is crafted and refreshed by state-authorized lawyers.

If you already possess a subscription, Log In. When you’re on the form’s page, click on the Download button and navigate to My documents to access it.

If you have not yet subscribed, follow the steps outlined below.

With US Legal Forms, you will consistently have instant access to the appropriate downloadable example. The platform provides you with access to documents and categorizes them to simplify your search. Utilize US Legal Forms to acquire your Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate quickly and effortlessly.

- Review the state-specific criteria for the Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate you wish to utilize.

- Browse through the description and preview the example.

- Once you’re assured the template meets your needs, just click Buy Now.

- Choose a subscription plan that fits your financial plan.

- Establish a personal account.

- Make a payment in one of two convenient methods: by credit card or via PayPal.

- Choose a format to download the document in; two choices are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable template is downloaded, print it or save it to your device.

Form popularity

FAQ

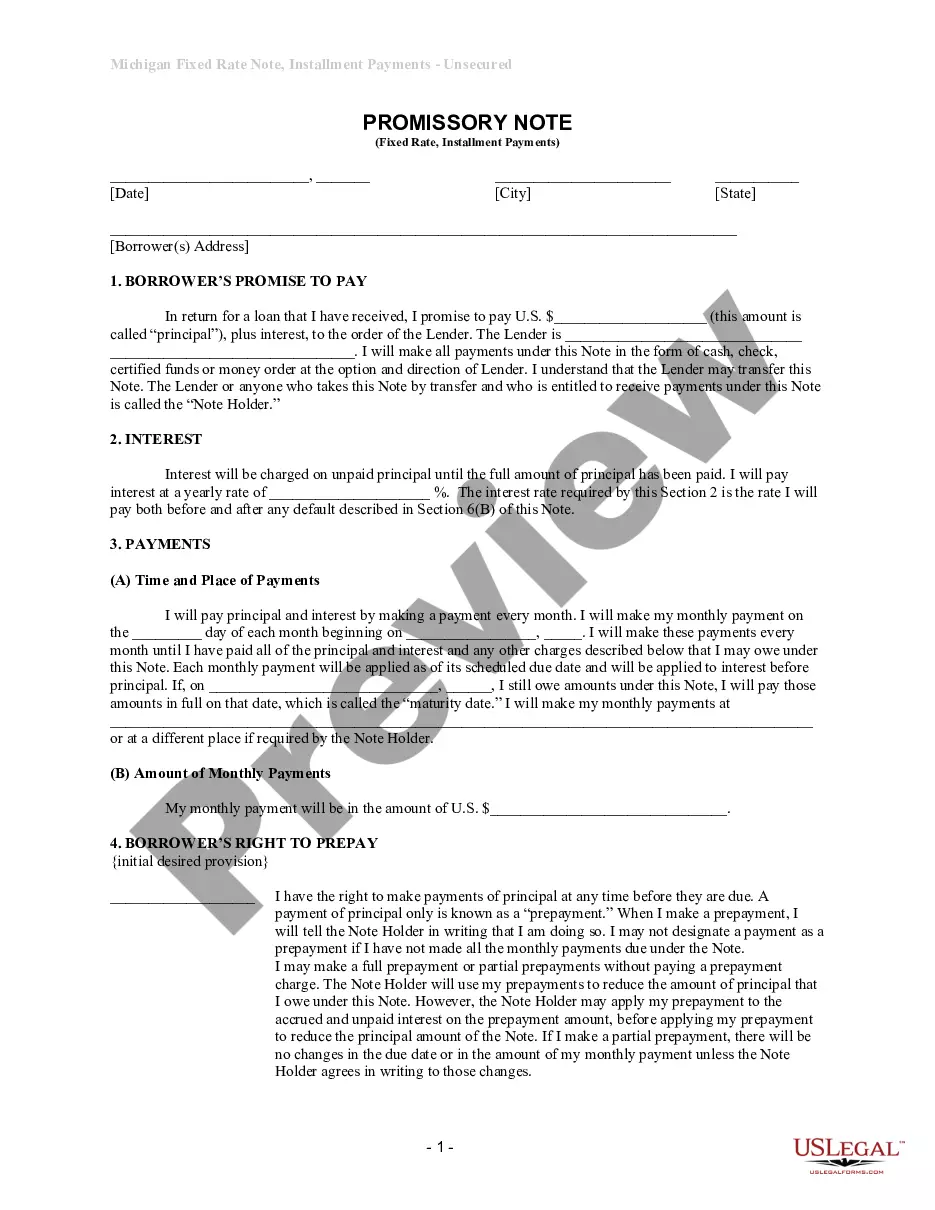

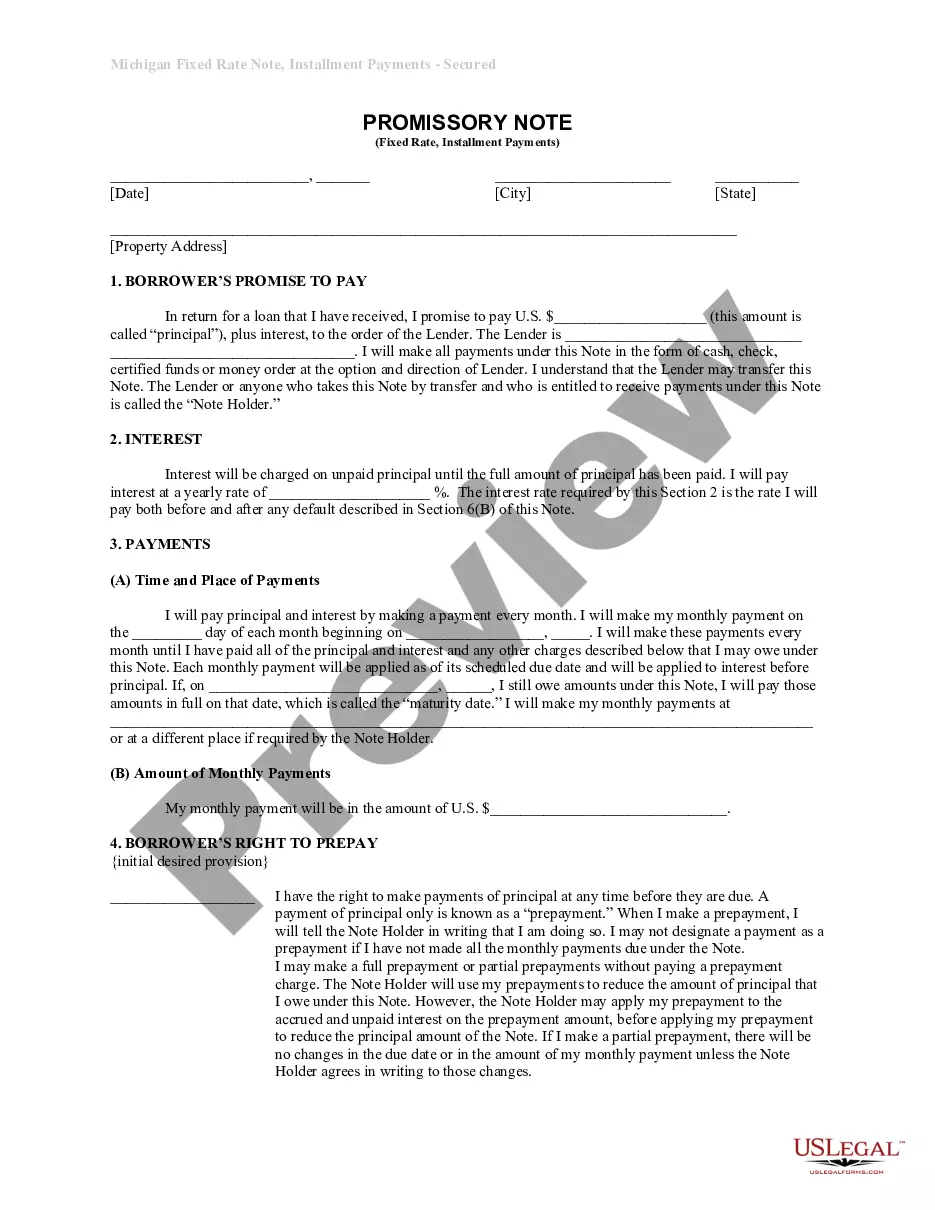

Promissory notes, such as the Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, are secured by collateral. This means that the borrower pledges an asset, typically commercial real estate, to guarantee repayment. If the borrower defaults, the lender can seize the collateral to recover the owed amount. This security provides peace of mind for lenders, making financing more accessible.

While you do not necessarily need a lawyer to write a promissory note, it may be beneficial for complex agreements. A Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate often requires precise language to outline terms and conditions clearly. Using services like US Legal Forms can help ensure your note is compliant and addresses all necessary legal aspects.

Yes, a promissory note can indeed be secured, particularly by tangible assets such as real estate. Utilizing a Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate gives lenders the assurance that they can recover their funds by claiming the secured asset if the borrower defaults. This adds a layer of security and trust to financial transactions.

Generally, a promissory note itself isn’t used as collateral. Instead, it represents a borrower's obligation to repay. However, when it is secured by a Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the property associated with the note serves as collateral, providing security to the lender.

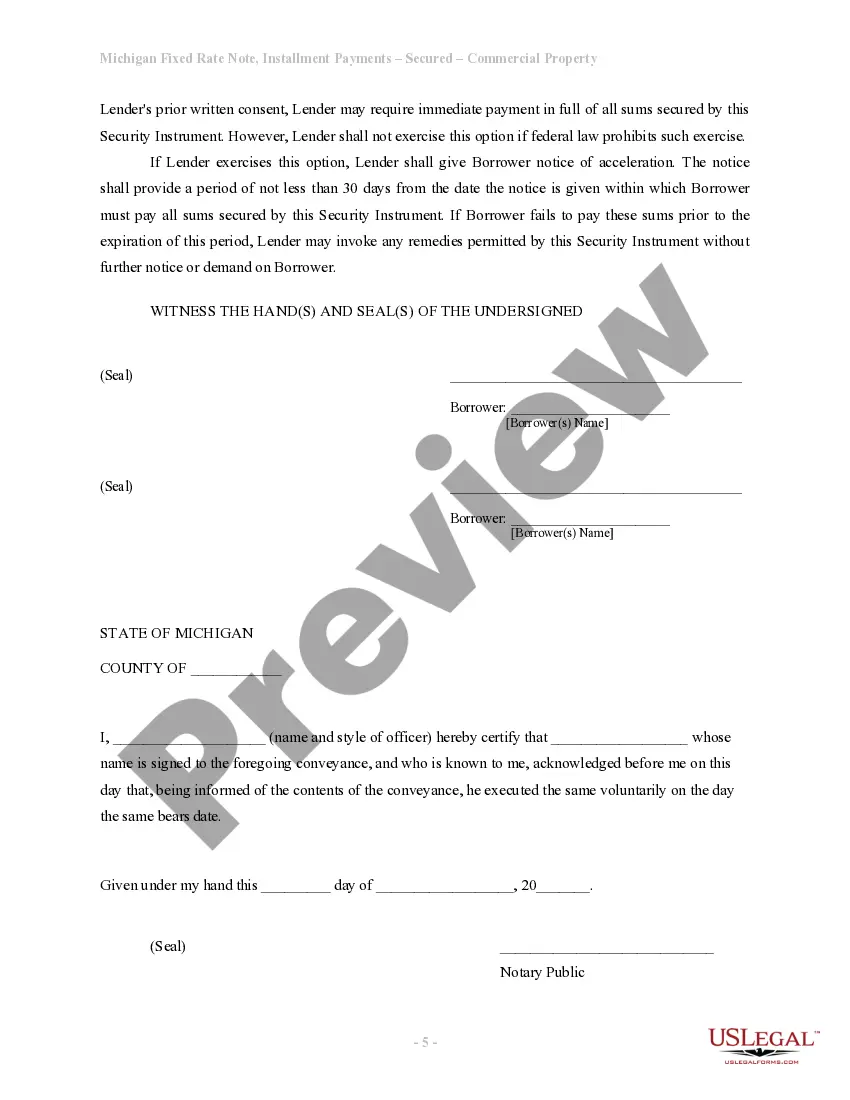

In Michigan, a promissory note does not legally require notarization to be valid, but having it notarized can offer added protection. Notarization helps confirm the identities of the parties involved and can strengthen the enforceability of the note. For complete peace of mind, consider using a Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate with notarization to ensure all parties are secured.

Certainly, a promissory note can be secured by real property, making it a secured promissory note. This arrangement gives lenders a claim on the property if the borrower does not meet their payment obligations. Therefore, utilizing a Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate provides clear legal rights for lenders.

To secure a promissory note with real estate, the borrower must create a security agreement that specifies the real property being offered as collateral. This agreement is often recorded to protect the lender's interest in the asset. By using a Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, both parties clearly define their rights and responsibilities concerning the property.