Virginia Guaranty by Corporation - Complex

Description

How to fill out Guaranty By Corporation - Complex?

If you have to total, obtain, or printing legitimate document themes, use US Legal Forms, the greatest variety of legitimate forms, that can be found online. Take advantage of the site`s simple and easy practical lookup to get the files you will need. Different themes for enterprise and person uses are sorted by classes and states, or keywords and phrases. Use US Legal Forms to get the Virginia Guaranty by Corporation - Complex with a handful of mouse clicks.

When you are currently a US Legal Forms client, log in to your profile and then click the Download option to get the Virginia Guaranty by Corporation - Complex. Also you can access forms you in the past acquired within the My Forms tab of your own profile.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape to the proper metropolis/nation.

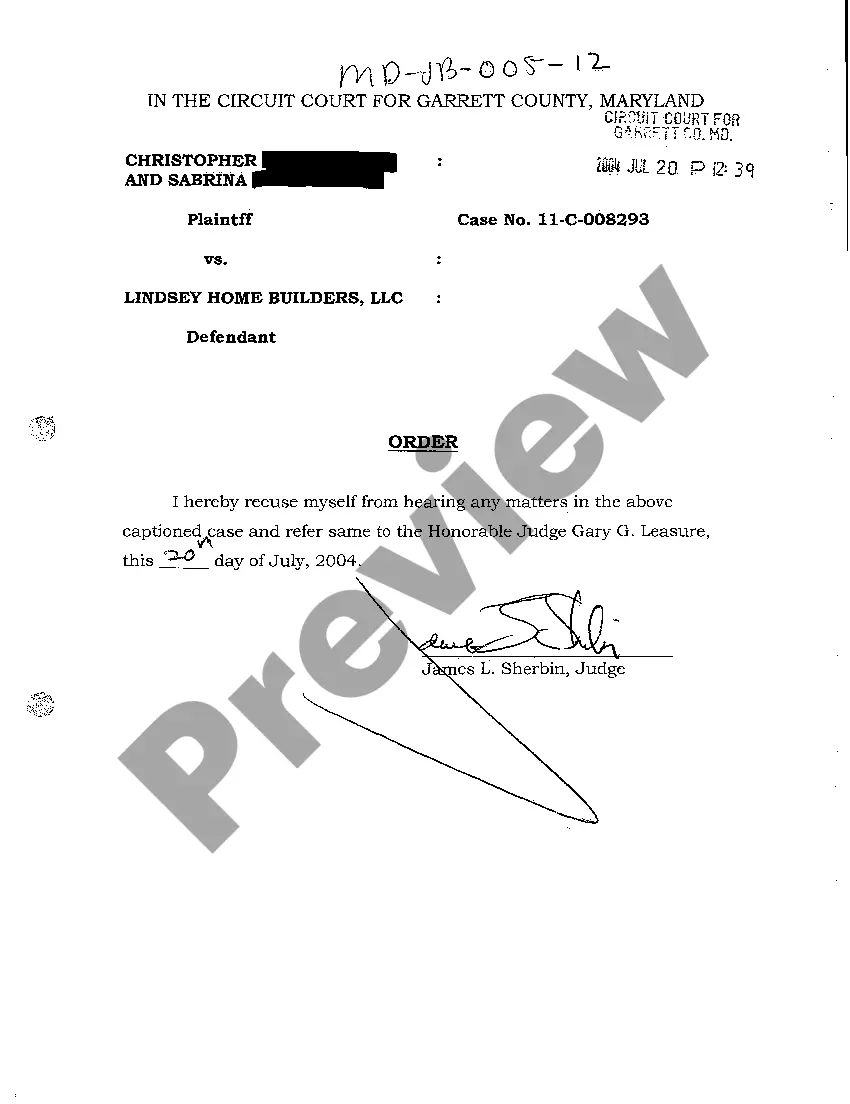

- Step 2. Use the Preview choice to look over the form`s articles. Don`t forget about to read the explanation.

- Step 3. When you are not happy with all the kind, make use of the Search discipline at the top of the screen to find other versions of the legitimate kind template.

- Step 4. When you have located the shape you will need, go through the Buy now option. Opt for the rates program you choose and put your credentials to sign up on an profile.

- Step 5. Process the transaction. You should use your bank card or PayPal profile to perform the transaction.

- Step 6. Select the format of the legitimate kind and obtain it on your own system.

- Step 7. Comprehensive, revise and printing or sign the Virginia Guaranty by Corporation - Complex.

Each legitimate document template you get is your own eternally. You possess acces to every single kind you acquired within your acccount. Click the My Forms segment and choose a kind to printing or obtain once again.

Compete and obtain, and printing the Virginia Guaranty by Corporation - Complex with US Legal Forms. There are many specialist and state-distinct forms you may use for your personal enterprise or person requires.

Form popularity

FAQ

The guaranty association provides coverage to owners of covered policies issued by member insurers (life, health, and annuity insurers licensed to write business in the state).

The guaranty association is a private entity, with its membership made up of all the life and health insurers licensed in the state (in fact, under state law an insurer must be a member of the association to be licensed to do business).

VAPCIGA does not cover life, annuity, health or disability insurance, mortgage guaranty, financial guaranty or other forms of insurance offering protection against investment risks, fidelity or surety bonds, credit and credit property insurance, insurance of warranties or service contracts, title insurance, insurance ...

An insurance guaranty association is a state-sanctioned organization that protects policyholders and claimants in the event of an insurance company's impairment or insolvency.

What is the difference between state guaranty associations and FDIC insurance? The FDIC is an independent federal agency that provides deposit insurance for bank deposits. State guaranty associations are nonprofit organizations that operate at the state level to protect insurance policyholders.

Generally speaking, guaranty association coverage benefits are limited to the lesser of (1) the contractual obligations of the insurer under the policy or contract or (2) the statutory dollar limit on coverage benefits (see question 10 above), which is applied on the basis of an individual life.

In 1986, Life of Virginia was acquired by Combined Insurance for $557 million. It became Aon in 1987. In 1996, Life of Virginia was acquired by GE Capital. The company was incorporated as Genworth Financial, Inc.

If you own an annuity policy, the state guaranty fund for the state where you reside protects your benefits up to set limits. The most common limits are between $250,000 - $300,000, but can be as much as $500,000 in select states.