Virginia Personal Guaranty - Guarantee of Lease to Corporation

Description

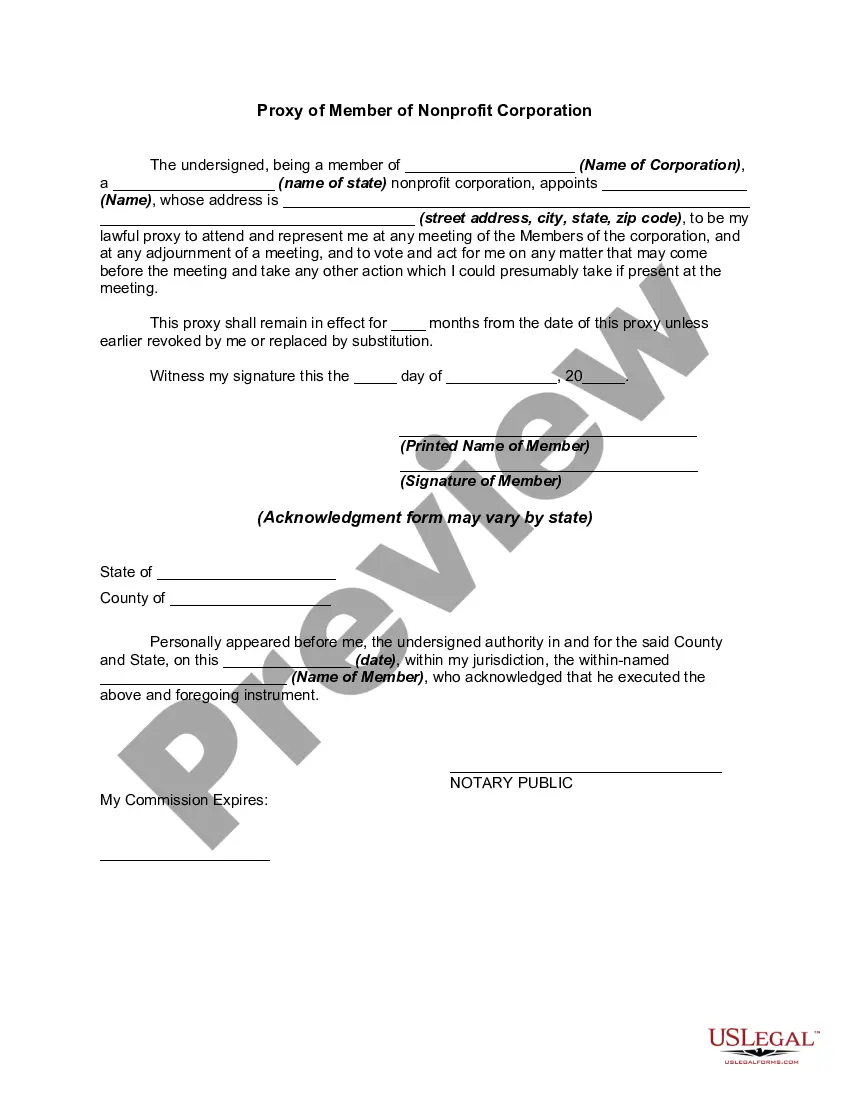

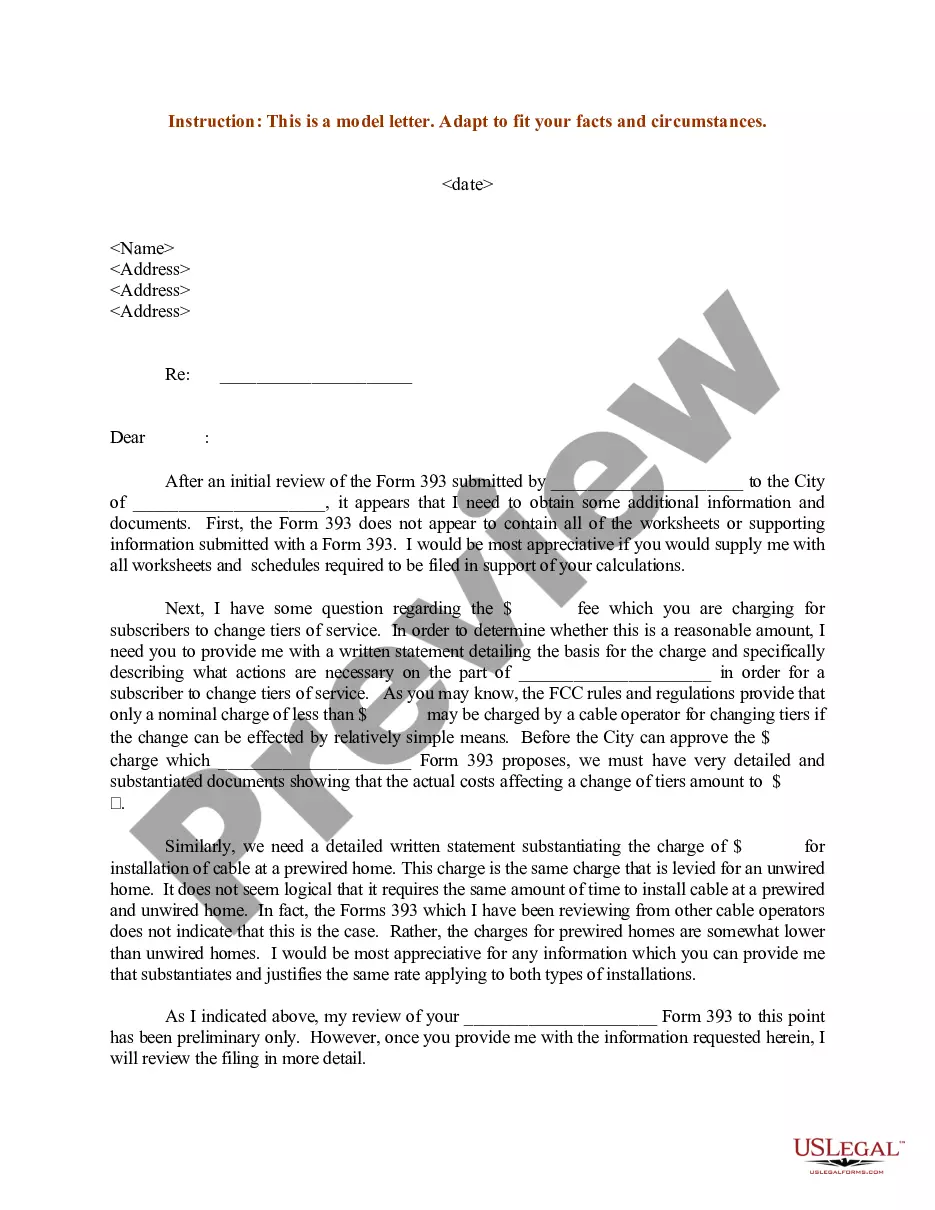

How to fill out Personal Guaranty - Guarantee Of Lease To Corporation?

If you wish to complete, download, or print authentic document templates, utilize US Legal Forms, the most extensive selection of legal forms available online. Leverage the website’s straightforward and efficient search to locate the documents you need. A variety of templates for business and personal uses are organized by categories and states, or keywords.

Utilize US Legal Forms to access the Virginia Personal Guaranty - Guarantee of Lease to Corporation with just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Virginia Personal Guaranty - Guarantee of Lease to Corporation. You can also access forms you have previously downloaded from the My documents tab in your account.

Every legal document template you acquire belongs to you permanently. You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Complete, download, and print the Virginia Personal Guaranty - Guarantee of Lease to Corporation using US Legal Forms. There are countless professional and state-specific forms available for your business or personal requirements.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form's content. Don't forget to read the description.

- Step 3. If you are not content with the form, take advantage of the Search feature at the top of the screen to find alternative forms in the legal template catalog.

- Step 4. After identifying the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your credentials to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Virginia Personal Guaranty - Guarantee of Lease to Corporation.

Form popularity

FAQ

A corporate guarantee is an agreement in which one party, called the guarantor, takes on the payments or responsibilities of a debt if the debtor defaults on the loan.

The difference between corporate and personal guarantors is quite simple: a personal guarantor is an individual who agrees to take on the obligations of a debt for a debtor, whereas a corporate guarantor is a corporation that takes on payment responsibilities.

Requesting a releaseThe Retiring Guarantor would typically send a written request for its release to the lender or, in a syndicated facility, the agent. Often the Retiring Guarantor's parent company or the borrower would also be party to the request (the Requesting Parties).

A guarantor is someone who agrees to pay your rent if you don't pay it, for example a parent or close relative. If you don't pay your landlord what you owe them, they can ask your guarantor to pay instead. If your guarantor doesn't pay, your landlord can take them to court.

Getting out of the Guarantee Early If you did sign a personal guarantee as part of the commercial lease, your options for an early exit are fairly limited. You could ask for an amendment to the lease or renegotiate the guarantee terms. You could offer your landlord a settlement on the remaining rent debt.

Do I have to personally guarantee the lease for commercial property? When a limited liability company takes on a property the landlord will often ask for a third party to guarantee the obligations under the lease which, in the most part, is to pay the rent and service charge.

A corporate guaranty is one usually signed by a parent or more developed affiliated company. It is a comfort to a landlord to have an extra set of assets to go after should its tenant default.

A lease guarantee is an official agreement signed by the landlord, tenant, and in addition, a third party who meets the monetary requirements of the landlord. A lease guarantor serves as a financial intermediary and is responsible for the tenant's defaults, which protects the tenant from eviction.

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.

In a commercial setting, a guaranty is typically the promise of an owner or officer of a corporate entity to pay the debt of that corporate entity should it default on its obligation.