Virginia Corporate Guaranty - General

Description

How to fill out Corporate Guaranty - General?

US Legal Forms - one of the largest collections of legal documents in the country - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can quickly find the most recent versions of forms like the Virginia Corporate Guaranty - General.

If you already have a subscription, Log In to download the Virginia Corporate Guaranty - General from the US Legal Forms database. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Download the form in the desired format and Edit. Fill out, modify, print, and sign the downloaded Virginia Corporate Guaranty - General.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct form for your city/state.

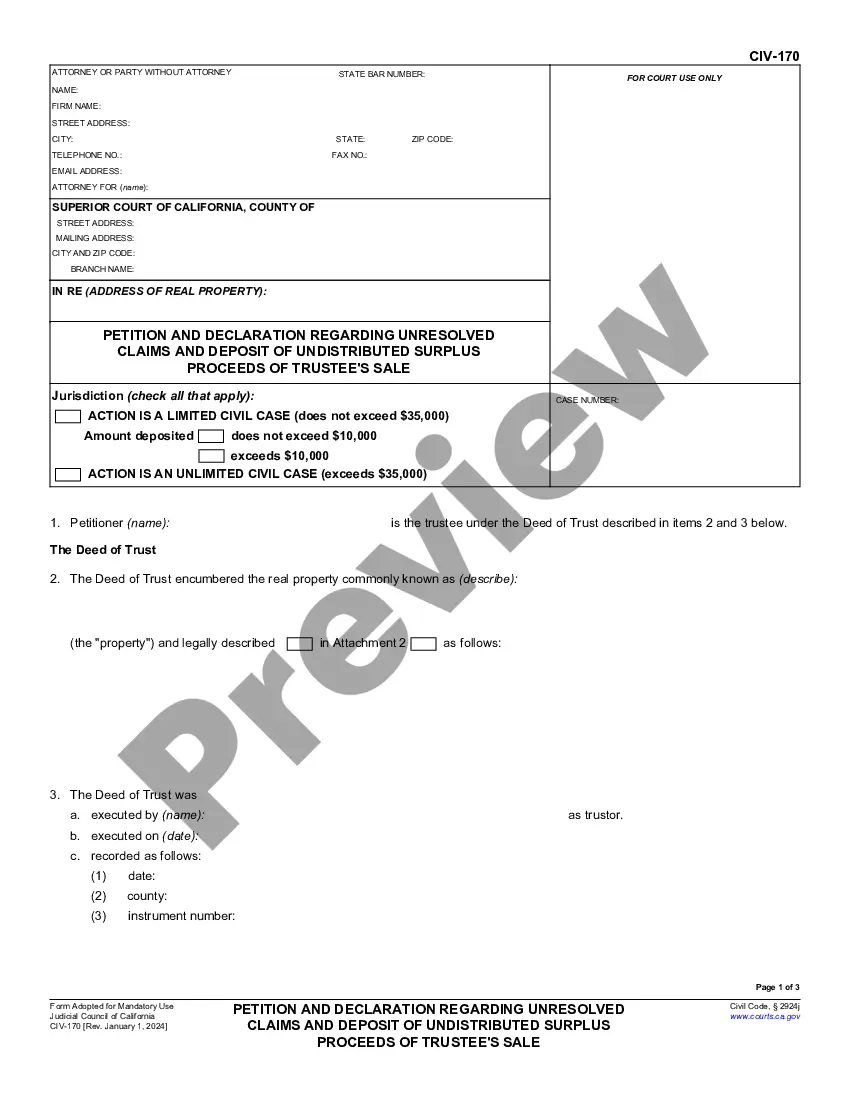

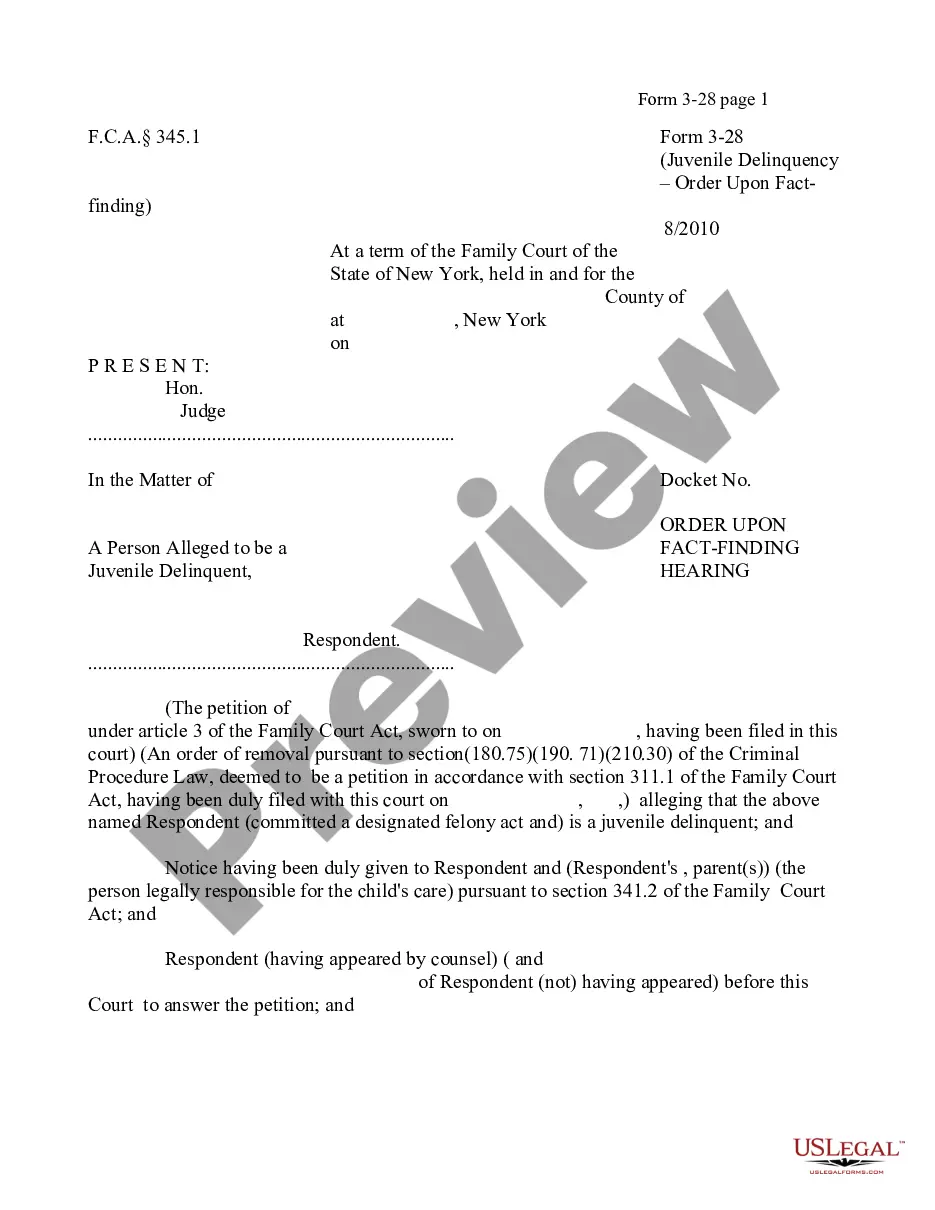

- Click the Preview button to review the form's contents.

- Check the form's details to confirm you have selected the right one.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

To fill out a letter of guarantee, begin by including your name and contact info at the top of the letter. Clearly state the purpose of the guarantee and the obligations being secured. Make sure the language reflects your understanding of the commitments, particularly under the guidelines of Virginia Corporate Guaranty - General, and conclude with your signature.

Writing a personal guarantee involves detailing the specific terms of the guarantee and your personal information. Start with an introduction that states the purpose of the guarantee, then describe the obligations you're guaranteeing. Always include a clear statement of acceptance and consult resources like uslegalforms for templates that comply with Virginia Corporate Guaranty - General.

The process of a personal guarantee involves several steps. First, you should identify the business obligation you are supporting, along with any related parties. Then, draft the guarantee document clearly outlining your obligations. Finally, sign the document in the presence of a witness or notary if required, ensuring compliance with Virginia Corporate Guaranty - General regulations.

To fill out a personal guarantee, start by providing your personal information, including your full name and contact details. Next, specify the obligations you are guaranteeing, along with the terms of the agreement. It's essential to understand what you are committing to, particularly under Virginia Corporate Guaranty - General, so review each section carefully before signing.

Virginia does not automatically grant tax extensions; you must formally request one before the original filing deadline. This allows you to gain more time to finalize your submissions while ensuring compliance with the Virginia Corporate Guaranty - General. Knowing these requirements helps you avoid potential issues in the future.

Closing a company in Virginia requires careful steps to ensure compliance with state laws. Initially, you must complete and file the articles of dissolution with the state. It is crucial to notify any stakeholders and settle all debts, keeping in line with the Virginia Corporate Guaranty - General regulations for a smooth closure.

Eligible owners of a Ptet, or Pass-Through Entities, in Virginia generally include individuals and certain types of businesses, typically LLCs and partnerships. To qualify, owners must meet specific criteria outlined by the state. Properly understanding ownership requirements supports compliance with the Virginia Corporate Guaranty - General.

A fiduciary extension in Virginia applies to trusts and estates, allowing them additional time to file tax returns. This extension provides peace of mind, giving fiduciaries time to gather necessary information. By understanding this extension, you can better navigate your obligations under the Virginia Corporate Guaranty - General.

Virginia does allow corporations to request extensions for filing tax returns under specific conditions. If your corporation needs extra time, you must submit the proper extension form by the due date. This option provides a valuable way to ensure compliance with the Virginia Corporate Guaranty - General while avoiding penalties.

You should file the VA form 500, which is related to corporate taxes, with the Virginia Department of Taxation. This form can be submitted online through the state's tax portal or by mail. Ensuring timely filing helps your corporation adhere to the Virginia Corporate Guaranty - General standards and maintain good standing.