Virginia Personal Guaranty - General

Description

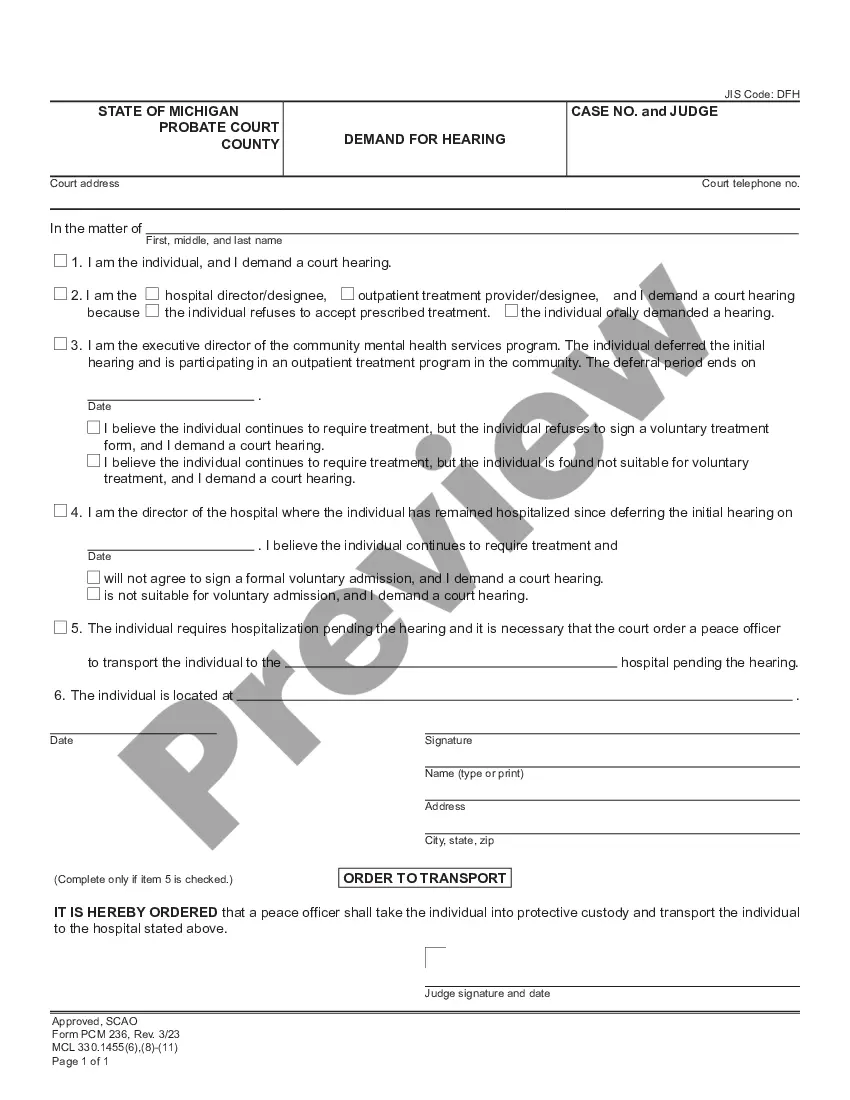

How to fill out Personal Guaranty - General?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a selection of legal form templates that you can download or print.

Utilizing the website, you can discover thousands of forms for corporate and personal purposes, categorized by types, states, or keywords.

You can acquire the latest versions of forms such as the Virginia Personal Guaranty - General within moments.

If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- If you already have a subscription, Log In and download the Virginia Personal Guaranty - General from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously saved forms in the My documents section of your account.

- To utilize US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the appropriate form for your city/state.

- Click the Review option to inspect the form's content.

Form popularity

FAQ

A personal guarantee may become invalid for several reasons, such as lack of consideration or if it was signed under duress. Additionally, if the agreement does not meet legal requirements or is ambiguous in wording, it could be contested in court. Understanding these nuances can help you form a stronger agreement. To avoid invalidation risks, utilize resources from uslegalforms to craft your Virginia Personal Guaranty - General.

The strength of a personal guarantee often relies on its clarity and the debtor's financial situation. In Virginia, a clearly defined personal guarranty can offer substantial security to lenders, indicating a commitment to fulfill obligations. Factors like personal assets and financial history can influence its strength. For a robust agreement, think about creating one through uslegalforms.

A personal guarantee is generally enforceable in Virginia, especially if clear terms define the obligations. The enforceability can depend on the specific wording and the circumstances surrounding the agreement. If proper procedures are followed, such as having the document signed in front of a witness, you enhance its enforceability. It's wise to use tools available on uslegalforms to create a solid document.

Yes, a Virginia Personal Guaranty - General can hold up in court if it meets legal requirements. Courts typically uphold personal guarantees when they are properly drafted, signed, and executed. If you ensure your personal guarantee complies with state laws, you increase its likelihood of being enforceable. For peace of mind, consider consulting with a legal professional or utilizing resources like uslegalforms.

Being a guarantor does not directly show up on your credit report. However, if the primary borrower defaults, your credit could be affected by their failure to repay. Understanding the implications of a Virginia Personal Guaranty - General is essential to safeguard your credit health.

Not everyone can be a personal guarantor; typically, lenders seek individuals with good credit and a stable financial background. This requirement helps mitigate risk for the lender. Before signing, consider whether you fully understand the commitment you are making with a Virginia Personal Guaranty - General.

A personal guarantee typically does not appear directly on your credit report. However, the debts associated with the guaranty can affect your credit if the primary borrower defaults. It's essential to monitor your credit report regularly and understand how a Virginia Personal Guaranty - General can indirectly influence your financial standing.

Yes, being a personal guarantor can affect your credit. When you agree to a personal guaranty, lenders may consider your financial responsibility and include it in their assessment of your creditworthiness. This means that if the primary borrower defaults, your credit score could be impacted, highlighting the importance of understanding the Virginia Personal Guaranty - General.

Yes, you can lose your house if you sign a personal guarantee and fail to fulfill your obligations. In Virginia, a personal guaranty can lead to legal actions that may result in the seizure of your assets, including your home. It is crucial to understand the risks involved before agreeing to any personal guaranty.

To fill out a personal guarantee, begin by gathering your identification and financial information. Write your name, address, and relationship to the borrower on the form. The Virginia Personal Guaranty - General often requires you to clarify your commitment to cover the debt if the borrower defaults. Finally, review the terms carefully before signing.