Virginia Dissolution Package to Dissolve Corporation

What is this form?

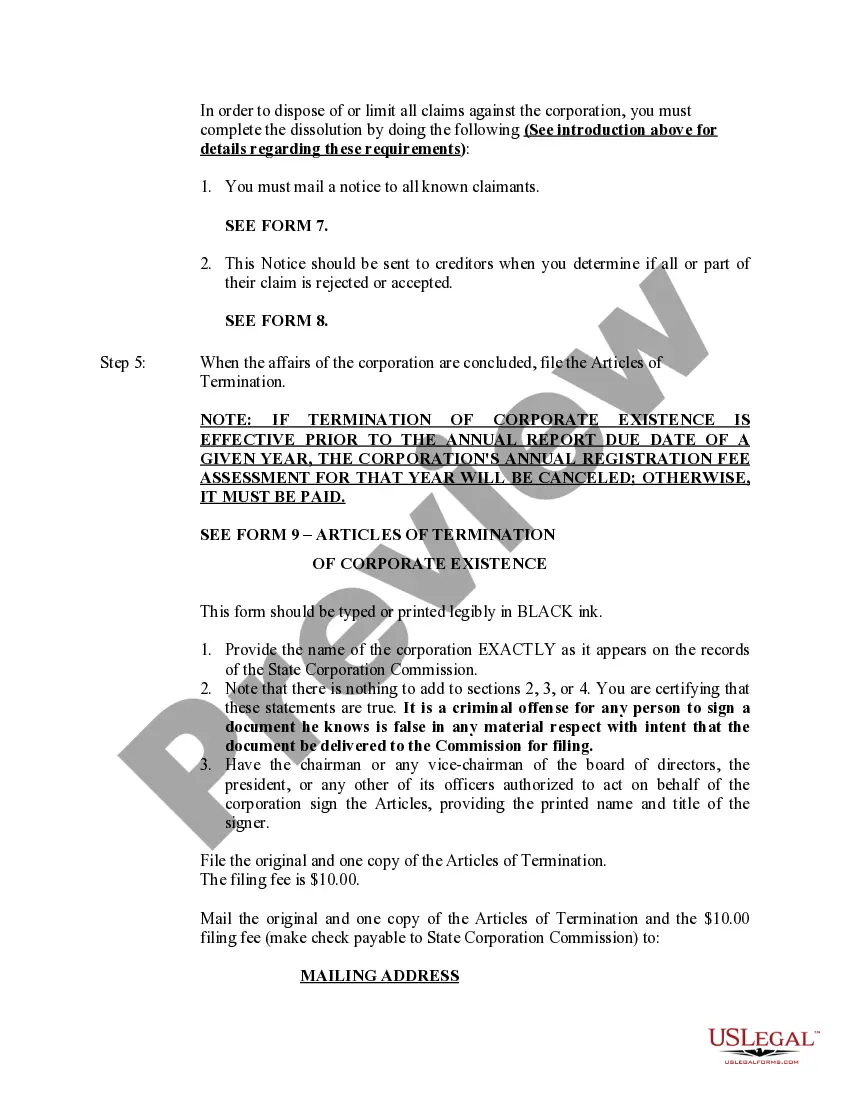

The Virginia Dissolution Package to Dissolve Corporation contains all necessary legal forms and instructions required to voluntarily dissolve a corporation in Virginia. This package simplifies the dissolution process by providing step-by-step instructions, transmittal letters, and relevant contact information, ensuring compliance with Virginia's legal requirements. Unlike other forms that address involuntary dissolution or those for different business entities, this package is specifically tailored for voluntary corporate dissolution in Virginia.

What’s included in this form

- Articles of Termination of Corporate Existence: Essential document for certifying dissolution.

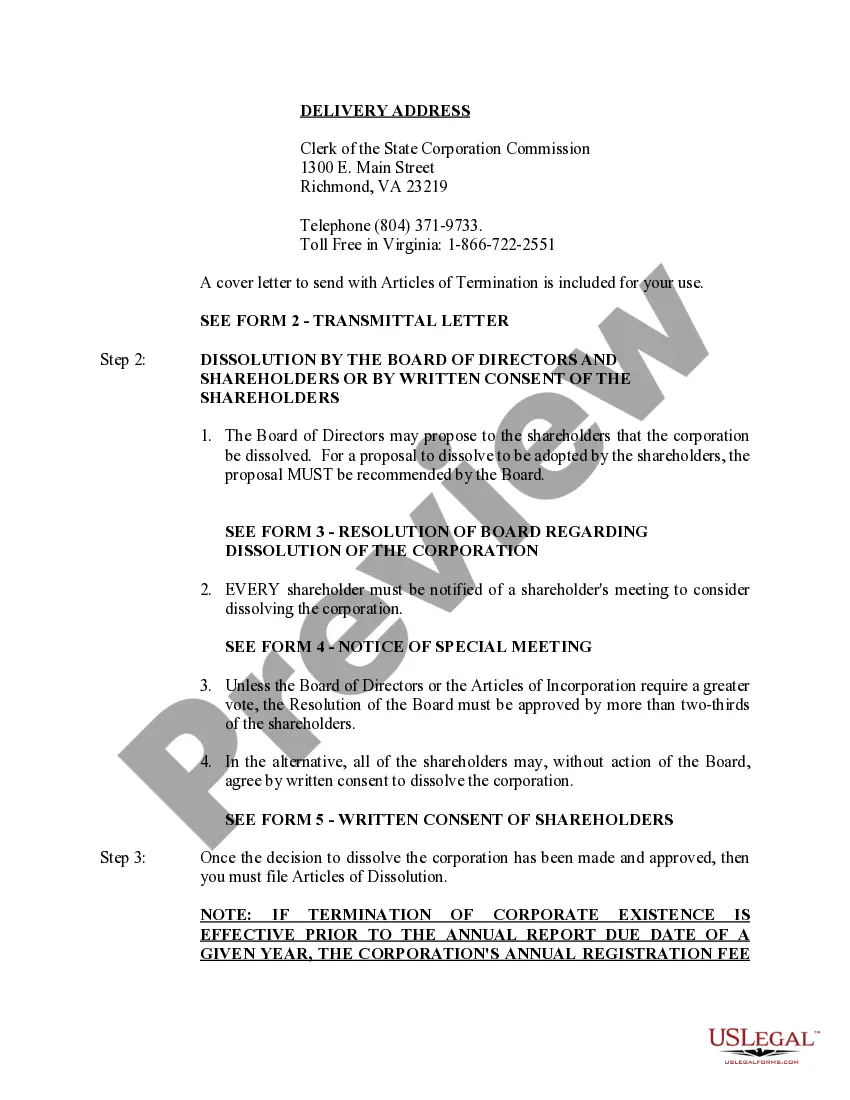

- Resolution of Board Regarding Dissolution: Formal proposal from the board of directors.

- Notice of Special Meeting: Required notice to inform shareholders about the dissolution proposal.

- Written Consent of Shareholders: Record of shareholder agreement to dissolve the corporation.

- Notice of Intent to Voluntarily Dissolve: Informative notice to claimants for claims submission.

- Articles of Dissolution: Final step to officially dissolve the corporation after settling obligations.

Situations where this form applies

This form package should be used when a Virginia corporation decides to formally dissolve by following voluntary procedures. You may find yourself in this scenario if your corporation is no longer engaging in business, if you have determined that the costs of maintaining the corporation outweigh the benefits, or if the shareholders wish to discontinue the company's operations for any reason.

Who needs this form

- Corporation owners or shareholders contemplating the dissolution of their business.

- Corporate officers tasked with initiating the dissolution process.

- Directors who need to formally propose and facilitate the dissolution.

- Initial directors or incorporators of a corporation that has never issued shares or commenced business.

How to prepare this document

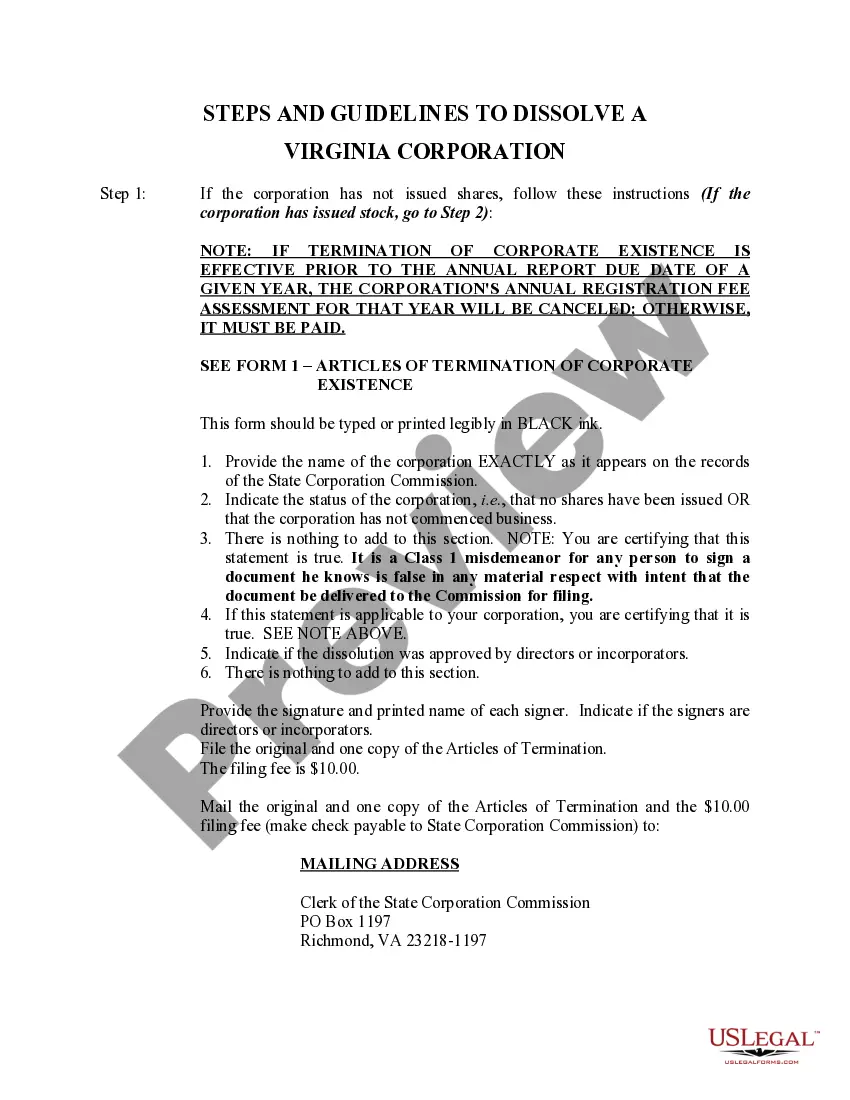

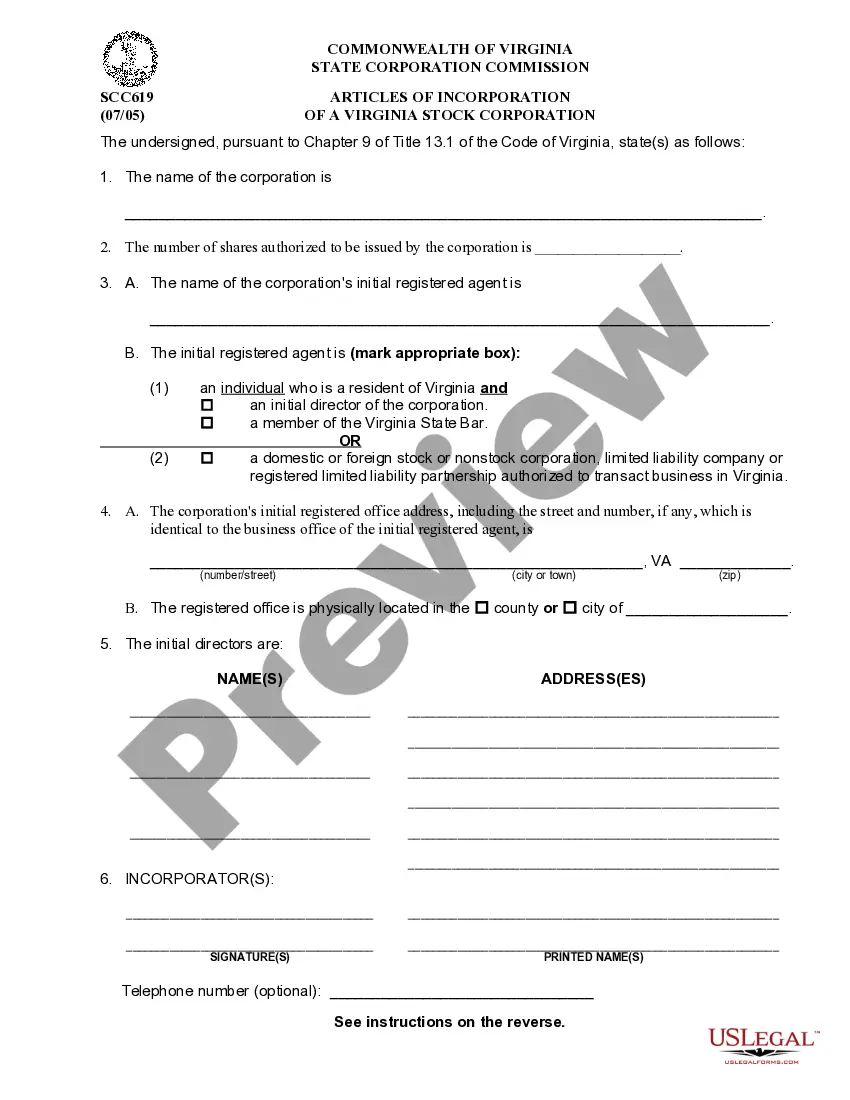

- Identify whether the corporation has issued shares or commenced business, and proceed to the appropriate termination form.

- Gather necessary details such as the corporation name, status, and approval from directors or incorporators.

- Complete the Articles of Termination and Articles of Dissolution with appropriate signatures and dates.

- Notify all shareholders and claimants as required, ensuring all necessary meetings and consents are documented.

- File the completed documents with the Virginia State Corporation Commission along with the applicable filing fees.

Notarization requirements for this form

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to notify all shareholders about the dissolution proposal.

- Inaccurately completing the Articles of Termination, particularly regarding the corporation's status.

- Not adhering to the required voting thresholds for approval of the dissolution.

- Neglecting to mail notices to claimants and not allowing sufficient time for claims to be submitted.

Why use this form online

- Immediate access to all necessary forms and instructions without needing to visit a legal office.

- Edit and customize forms easily to fit your specific corporate details.

- Reduction in the risk of errors through provided templates that guide you through each step.

- Convenient access to legal resources and support to assist you throughout the dissolution process.

Looking for another form?

Form popularity

FAQ

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

Definition. The ending of a corporation, either voluntarily by filing a notice of dissolution with the Secretary of State or as ordered by a court after a vote of the shareholders, or involuntarily through government action as a result of failure to pay taxes.

Hold a Directors meeting and record a resolution to Dissolve the Virginia Corporation. Hold a Shareholder meeting to approve Dissolution of the Virginia Corporation. File a Articles of Dissolution with the VA State Corporation Commission.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

An inactive business is a business that still exists but has no activity, which means no business transactions during a specific year.Even if the business has no income, it may still be considered active for tax purposes. There are many reasons a business may become inactive.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

In most states, to keep a corporation active, the owners must file annual reports and income tax returns. They may have to pay annual fees as well. Failure to do these things can render the corporation inactive. A corporation may also voluntarily become inactive by ceasing to do business.