Tax Evasion — Willfully Defined (revised 2014) is the intentional and voluntary act of avoiding or underpaying taxes. It can be done by individuals, businesses, or both, and can take various forms. These forms include, but are not limited to, filing false or incomplete tax returns, not reporting all income, claiming false deductions, hiding assets or income, and intentionally misclassifying income. The IRS has revised its definition of tax evasion in 2014 to include the intentional avoidance of paying taxes, even if there is no criminal intent. The four main types of Tax Evasion — Willfully Defined (revised 2014) are: 1. Filing False or Incomplete Tax Returns: When an individual or business deliberately files a false or incomplete tax return with the intention of evading taxes, it is considered tax evasion. 2. Not Reporting All Income: Taxpayers who do not report all of their taxable income are guilty of tax evasion. This can include unreported income from real estate, business, investments, freelance work, or other sources. 3. Claiming False Deductions: Claiming false deductions, such as overstating charitable donations, business expenses, or medical expenses, is considered tax evasion. 4. Hiding Assets or Income: Taxpayers who hide their assets or income in order to avoid paying taxes can be guilty of tax evasion. This can include using offshore accounts, transferring assets to family members, or using trusts.

Tax Evasion - Willfully Defined (revised 2014)

Description

How to fill out Tax Evasion - Willfully Defined (revised 2014)?

US Legal Forms is the most easy and profitable way to find appropriate formal templates. It’s the most extensive web-based library of business and individual legal documentation drafted and verified by attorneys. Here, you can find printable and fillable templates that comply with federal and local laws - just like your Tax Evasion - Willfully Defined (revised 2014).

Obtaining your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Tax Evasion - Willfully Defined (revised 2014) if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to guarantee you’ve found the one meeting your needs, or find another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you like most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Tax Evasion - Willfully Defined (revised 2014) and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more proficiently.

Benefit from US Legal Forms, your reputable assistant in obtaining the corresponding formal paperwork. Give it a try!

Form popularity

FAQ

Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years. We usually don't go back more than the last six years. The IRS tries to audit tax returns as soon as possible after they are filed.

The lookback period is the five-year period before the excess benefit transaction occurred. The lookback period is used to determine whether an organization is an applicable tax-exempt organization.

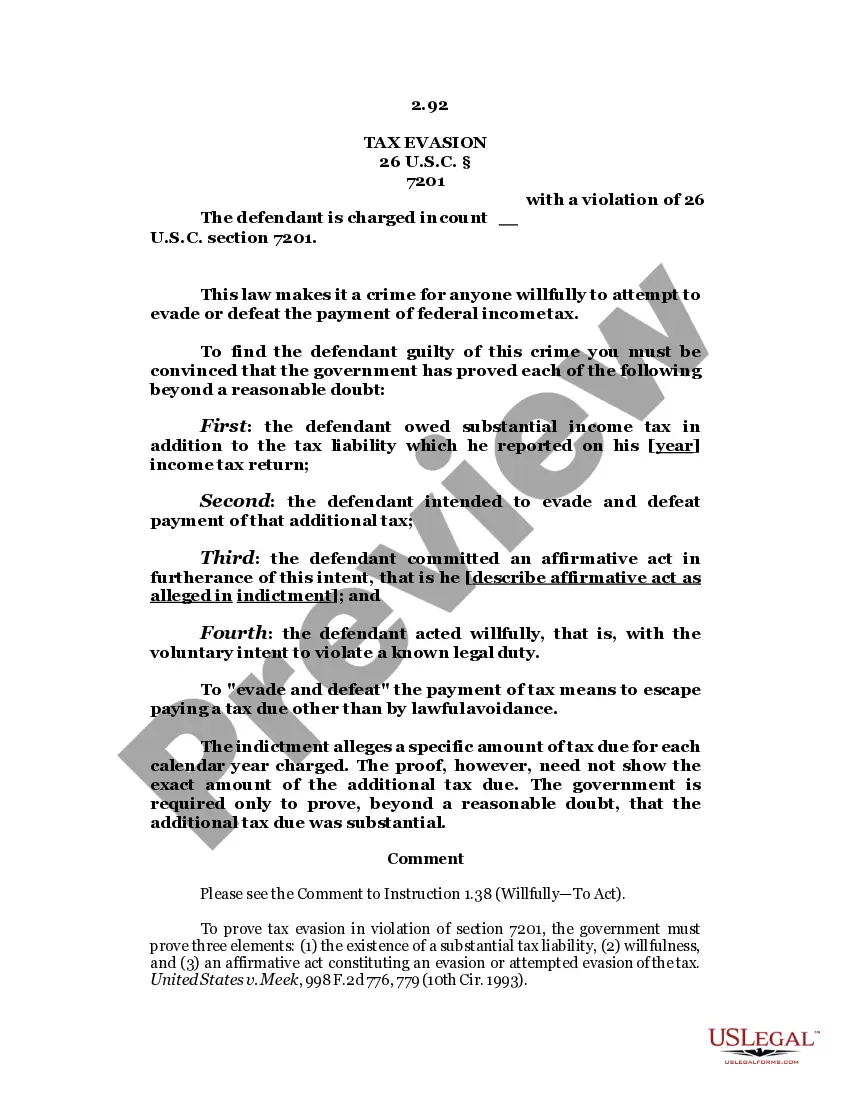

The three elements of tax evasion are: The existence of a tax deficiency. An attempt to evade or defeat tax. The taxpayer's willingness.

1 Two kinds of tax evasion. Section 7201 creates two offenses: (a) the willful attempt to evade or defeat the assessment of a tax, and (b) the willful attempt to evade or defeat the payment of a tax. Sansone v. United States, 380 U.S. 343, 354 (1965).

The average jail time for tax evasion is 3-5 years. Evading tax is a serious crime, which can result in substantial monetary penalties, jail, or prison. The U.S. government aggressively enforces tax evasion and related matters, such as fraud.

Willful Failure to Pay Income Taxes Tax fraud is a deliberate attempt to evade taxes or to defraud the IRS. Tax fraud takes place when a person or company willfully does one of the following: Intentionally fails to pay taxes owed. Willfully fails to file a federal income tax return. Fails to report all income.

The federal tax statute of limitations describes the time the IRS has to file charges against you if you are suspected of tax fraud. In most cases, the IRS can audit your tax returns up to three years after you file them, which means the tax return statute of limitations is three years.