Utah Acknowledgment Form for Consultants or Self-Employed Independent Contractors

Description

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

If you want to be thorough, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Utilize the site’s simple and user-friendly search feature to find the documents you need.

A variety of templates for businesses and individual purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Acquire now button. Choose your preferred payment plan and input your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Utah Acknowledgment Form for Consultants or Self-Employed Independent Contractors in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Utah Acknowledgment Form for Consultants or Self-Employed Independent Contractors.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the appropriate city/state.

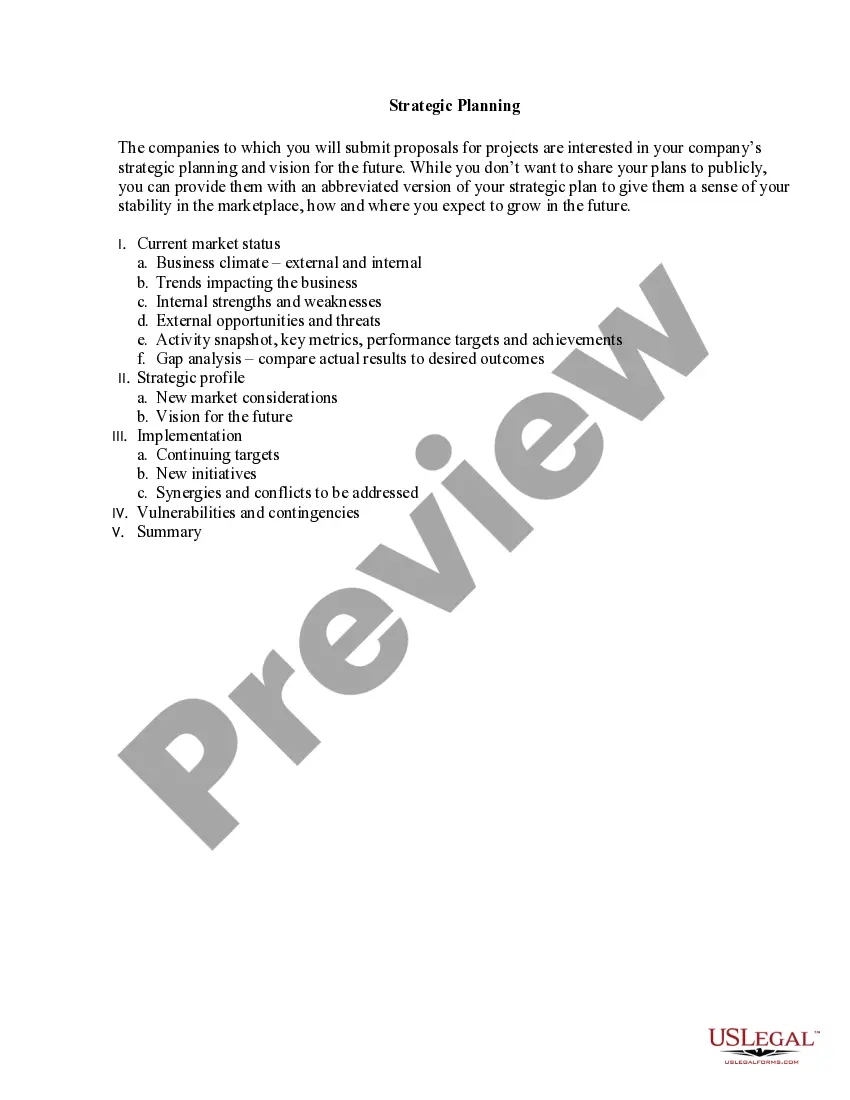

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the overview.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

An independent contractor agreement between an individual independent contractor (a self-employed individual) and a client company for consulting or other services. This Standard Document is drafted in favor of the client company and is based on federal law.

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

The basic test for determining whether a worker is an independent contractor or an employee is whether the principal has the right to control the manner and means by which the work is performed.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Yes! It's true that many self-employed individuals, especially those who work from home, never get a business license in Utah. But if your local government finds out that you're running an unlicensed business, you might be fined, or even be prevented from doing business until you obtain the license.

How to demonstrate that you are an independent worker on your resumeMention that time when you had to work on a project on your own.Talk about projects that required extra accountability.Describe times when you had to manage several projects all at once.More items...

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.