Utah Self-Employed Independent Contractor Agreement

Description

How to fill out Self-Employed Independent Contractor Agreement?

Have you been in the position in which you require papers for both business or person functions just about every day? There are plenty of legal record web templates available on the net, but finding kinds you can depend on isn`t straightforward. US Legal Forms gives a large number of form web templates, much like the Utah Self-Employed Independent Contractor Agreement, that happen to be composed in order to meet federal and state demands.

If you are already acquainted with US Legal Forms internet site and get a free account, just log in. Afterward, you may down load the Utah Self-Employed Independent Contractor Agreement format.

Should you not provide an accounts and need to begin to use US Legal Forms, abide by these steps:

- Find the form you want and ensure it is for the right city/region.

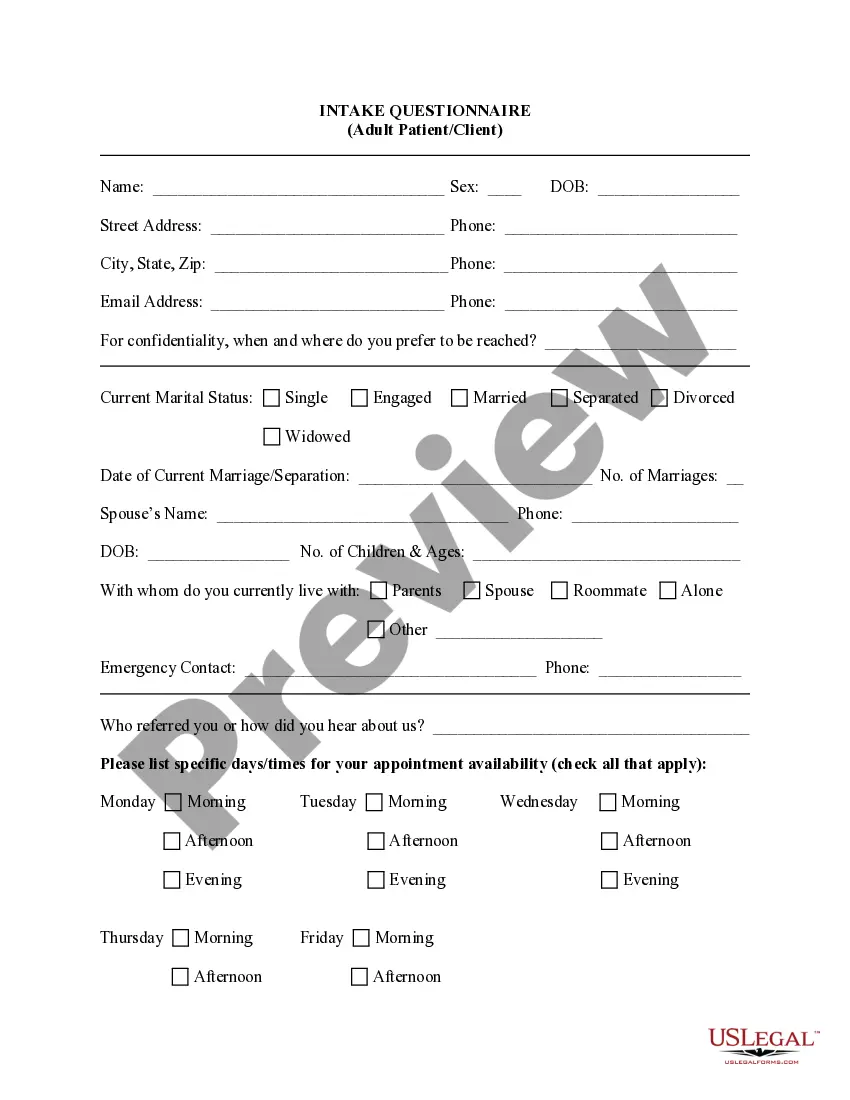

- Take advantage of the Preview option to check the form.

- See the information to actually have selected the proper form.

- If the form isn`t what you`re seeking, make use of the Lookup industry to find the form that fits your needs and demands.

- Once you find the right form, just click Get now.

- Opt for the rates strategy you would like, complete the necessary info to generate your bank account, and pay money for the transaction utilizing your PayPal or charge card.

- Decide on a practical paper format and down load your copy.

Get all of the record web templates you have bought in the My Forms food selection. You can aquire a more copy of Utah Self-Employed Independent Contractor Agreement whenever, if possible. Just click on the required form to down load or printing the record format.

Use US Legal Forms, probably the most substantial variety of legal varieties, to conserve time and steer clear of faults. The services gives professionally created legal record web templates which can be used for an array of functions. Create a free account on US Legal Forms and commence generating your life a little easier.

Form popularity

FAQ

Yes! It's true that many self-employed individuals, especially those who work from home, never get a business license in Utah. But if your local government finds out that you're running an unlicensed business, you might be fined, or even be prevented from doing business until you obtain the license.

All businesses in Utah are required by law to register with the Utah Department of Commerce either as a "DBA" (Doing Business As), corporation, limited liability company or limited partnership. Businesses are also required to obtain a business license from the city or county in which they are located.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The HMRC recommends that you register your business as soon as it is possible for you to do so. However, there is a cut off involved with registering your business, and it is 5 October after the end of the tax year that you began your self-employment.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The Utah Workers' Compensation Act defines an independent contractor as "any person engaged in the performance of any work for another who, while so engaged, is (A) independent of the employer in all that pertains to the execution of the work; (B) not subject to the routine rule or control of the employer; (C) engaged