Utah Consulting Agreement with Independent Contractor

Description

How to fill out Consulting Agreement With Independent Contractor?

If you wish to finalize, acquire, or print lawful document templates, utilize US Legal Forms, the largest array of legal forms, available online.

Employ the site's straightforward and user-friendly search to locate the documents you need.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Every legal document template you obtain is yours permanently. You can access each form you downloaded in your account.

Visit the My documents section and select a form to print or download again.

- Use US Legal Forms to find the Utah Consulting Agreement with Independent Contractor in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Utah Consulting Agreement with Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

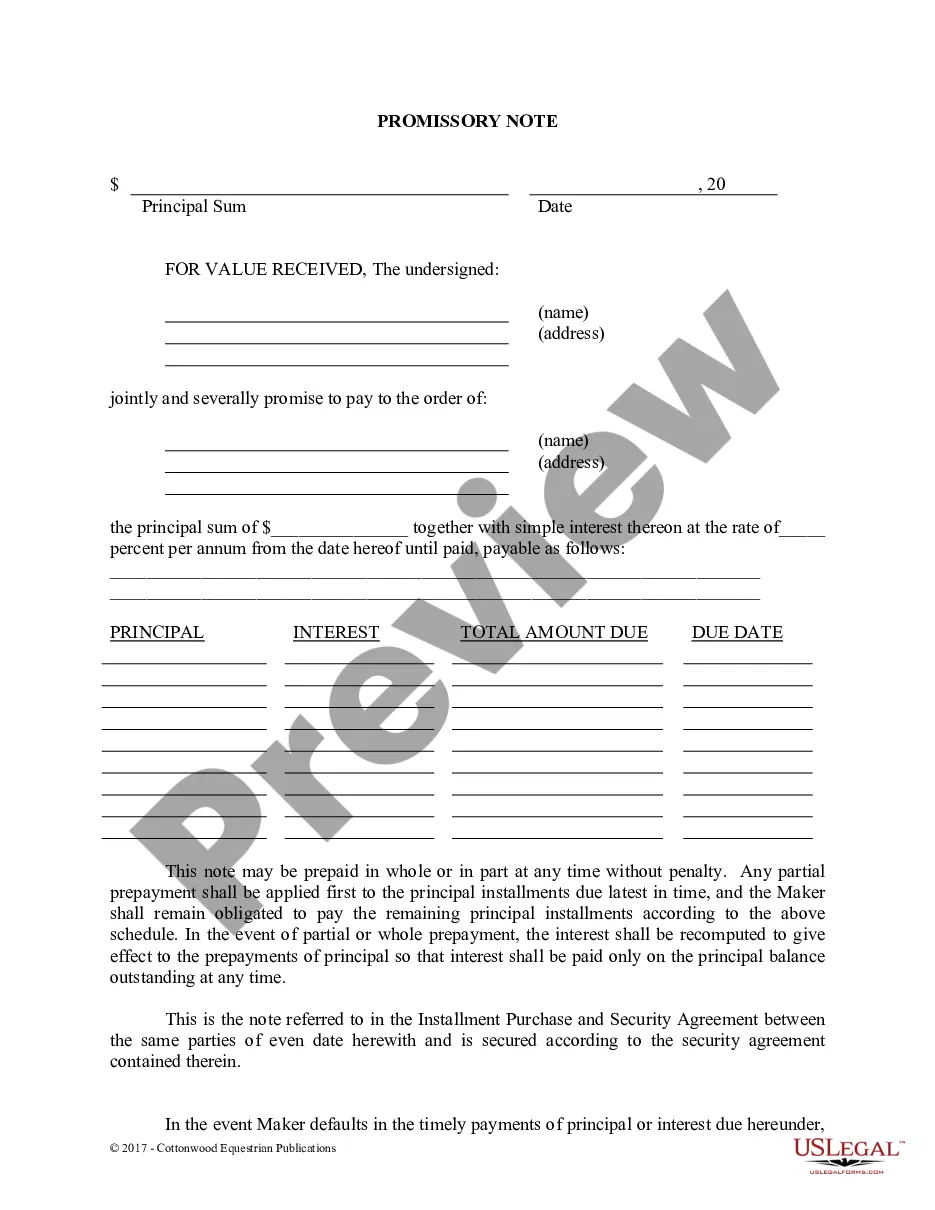

- Step 2. Use the Preview option to review the form's details. Remember to read the information carefully.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have located the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to carry out the payment.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Utah Consulting Agreement with Independent Contractor.

Form popularity

FAQ

To write an independent contractor agreement in Utah, begin by clearly identifying the parties involved, including the contractor and the business. Next, outline the scope of work, payment terms, and deadlines. It's important to include specific terms regarding confidentiality and intellectual property, as well. Utilizing a Utah Consulting Agreement with Independent Contractor template from USLegalForms can simplify this process and ensure compliance with state laws.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

Five Things Your Contracts Should IncludeGet it in Writing. The most important part of every contract is that it must be in writing.Be Specific in Your Terms. Your contract should be specific in its terms.Dictate Terms for Contract Termination.Confidentiality Matters.

Independent contractors are not classified as employees by the Internal Revenue Service (IRS), so instead of being paid through your payroll system, they're paid separately as a business expense.

There are two main accounting methods that independent contractors can choose from when filing their first tax returns as a business.Cash basis is the most simple form of tax returns.Accrual basis will count your expenses and cash when it is earned, not when the money is received.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Write-Off Personal ExpensesBy writing off partial personal expenses, you can deduct the amount that is used for business. For example, if you use your personal phone for your delivery job and show that 50% of the usage on the phone is for work, you can deduct 50% of the phone bill on your 1099.

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.30-Apr-2014

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.