The Utah Application For Withdrawal (Foreign Profit Or Nonprofit Corp) is a form that must be completed and filed with the Utah Department of Commerce in order to dissolve a foreign profit or nonprofit corporation registered in the state. The form must be accompanied by a Certificate of Good Standing from the foreign jurisdiction in which the corporation was originally formed. This form is required for all foreign profit and nonprofit corporations that are registered in Utah, regardless of whether they have conducted business in the state. There are two types of Utah Application For Withdrawal forms: one for foreign profit corporations and one for foreign nonprofit corporations. Both of these forms must be filled out completely and accurately, including the required documents, and filed with the Utah Department of Commerce. Once the application is approved, the foreign corporation will be officially dissolved.

Utah Application For Withdrawal (Foreign Profit Or Nonprofit Corp)

Description

How to fill out Utah Application For Withdrawal (Foreign Profit Or Nonprofit Corp)?

If you’re looking for a way to properly prepare the Utah Application For Withdrawal (Foreign Profit Or Nonprofit Corp) without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every personal and business situation. Every piece of documentation you find on our online service is designed in accordance with federal and state laws, so you can be sure that your documents are in order.

Adhere to these simple guidelines on how to acquire the ready-to-use Utah Application For Withdrawal (Foreign Profit Or Nonprofit Corp):

- Make sure the document you see on the page meets your legal situation and state laws by examining its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and choose your state from the list to locate an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Utah Application For Withdrawal (Foreign Profit Or Nonprofit Corp) and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Submit a UT Registration Information Change form When you remove a member from a Utah LLC, you must submit an LLC Registration Information Change form ($13) with the Utah Division of Corporations. You can file this form online, by mail, or by fax. By Fax: (801) 530-6438.

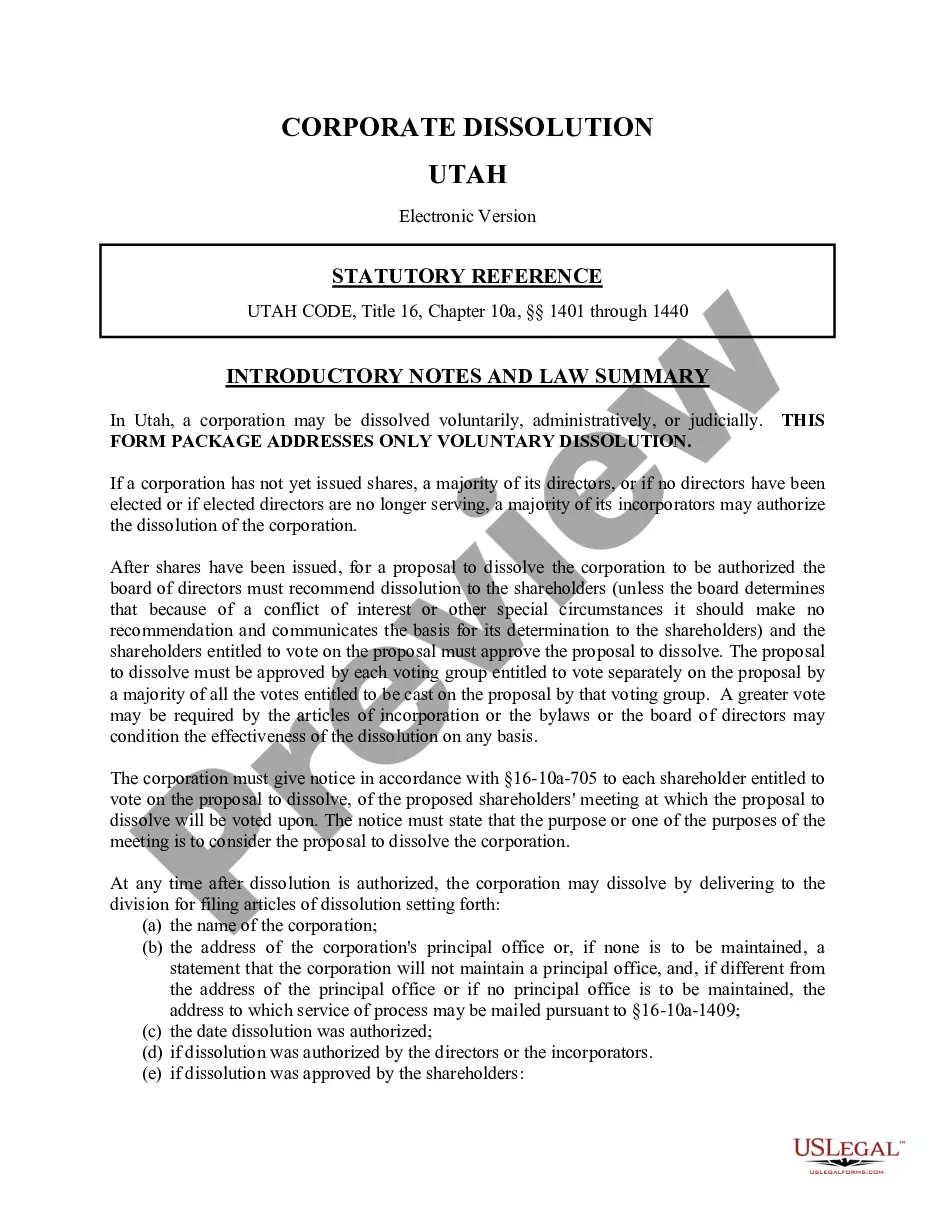

File articles of dissolution with the Secretary of State. You can submit this document by mail to Utah Division of Corporations and Commercial Code. There is no filing fee required for filing articles of dissolution. The state agency usually takes five to seven business days to process the articles of dissolution.

A Foreign Non-Profit Corporation is organized and chartered under the laws of another state, government, or country. You are always encouraged to consult an attorney to ensure appropriate consideration of all the legal implications of your choice of entity and filing.

These nonprofit organizations focus on issues of global concern. Many offer professional exchange and/or volunteer opportunities abroad.

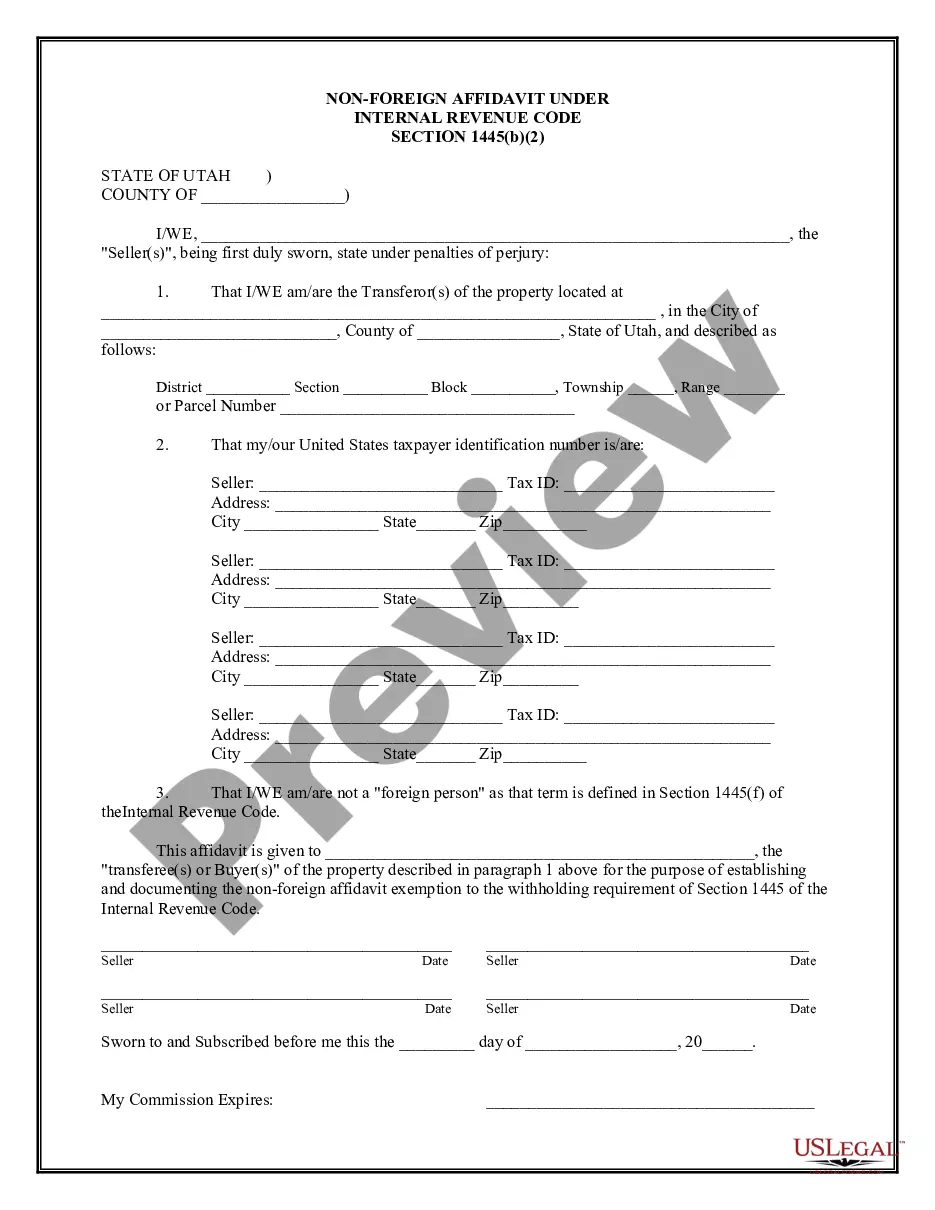

Utah law requires corporations seeking withdrawal to submit a Tax Clearance Certificate with the Application for Withdrawal. Please inquire with the Utah Tax Commission at 210 NO. 1950 West Salt Lake City, Utah 84134. Phone: (801) 297-2200.

A qualified foreign nonprofit corporation is a taxable entity and subject each year to an $800 minimum California franchise tax unless the corporation has applied for tax-exempt status and the Franchise Tax Board (FTB) determines the corporation qualifies for tax-exempt status.

What is the difference between a ?foreign? and ?domestic? corporation/LLC/nonprofit? A business is considered ?domestic? when it conducts business in the state it was formed. A business is considered ?foreign? when it originated in another state but would like to conduct business in Iowa.

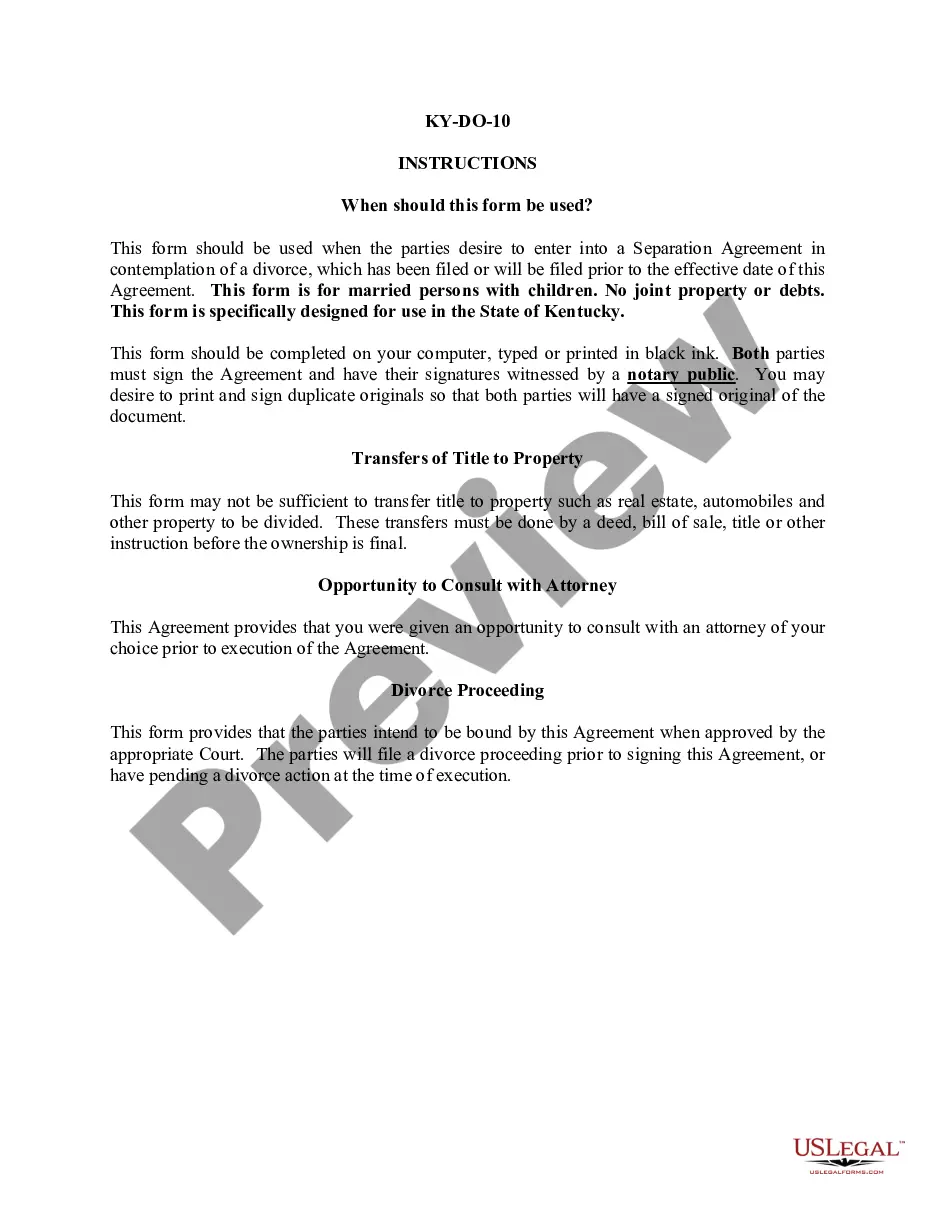

An Application for Certificate of Authority for Foreign Corporation ( Form FC-1 ) must be filed along with a Certificate of Good Standing, from the state or country in which the corporation was organized, dated no earlier than 60 days prior to filing.