Farm Hand Services Contract - Self-Employed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Farm Hand Services Contract - Self-Employed?

Among hundreds of paid and free samples which you find on the web, you can't be sure about their reliability. For example, who created them or if they’re competent enough to deal with what you require those to. Keep relaxed and utilize US Legal Forms! Get Farm Hand Services Contract - Self-Employed templates created by skilled attorneys and get away from the costly and time-consuming procedure of looking for an lawyer or attorney and then having to pay them to draft a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the form you’re trying to find. You'll also be able to access all your earlier downloaded templates in the My Forms menu.

If you’re making use of our website the very first time, follow the guidelines below to get your Farm Hand Services Contract - Self-Employed quick:

- Make sure that the file you find applies in the state where you live.

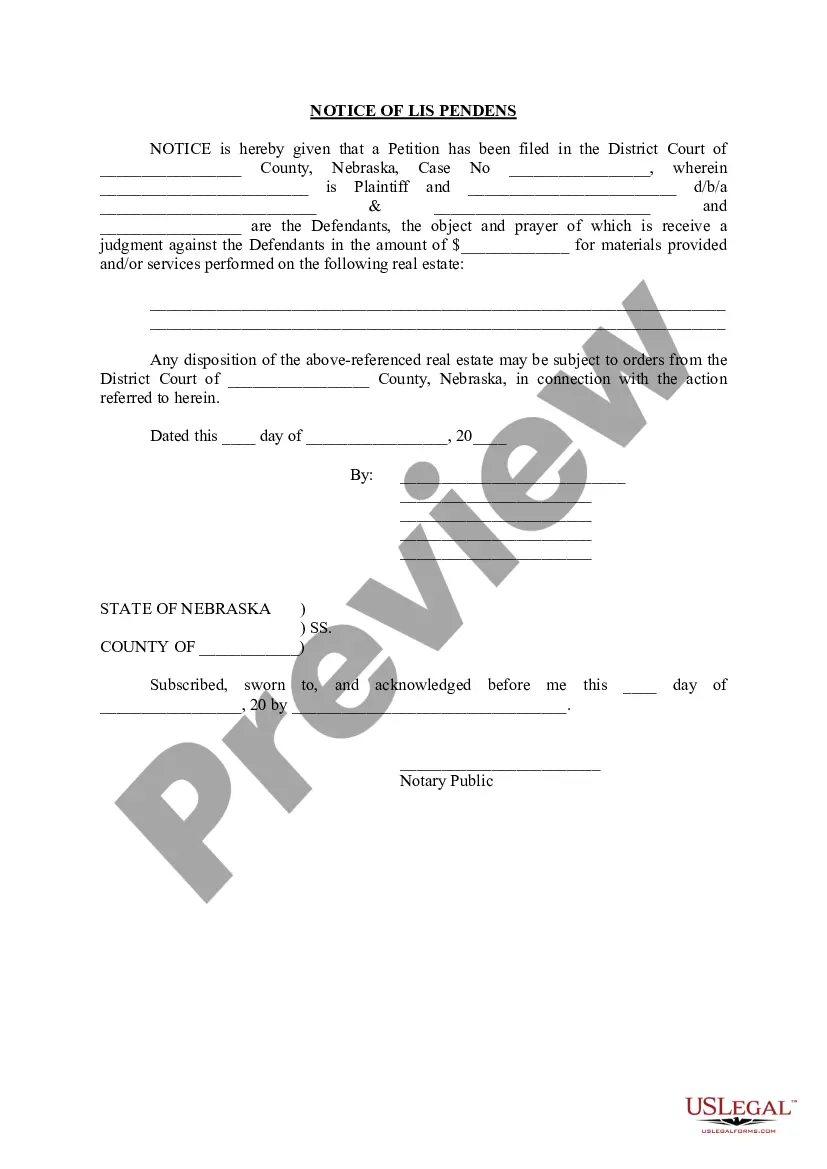

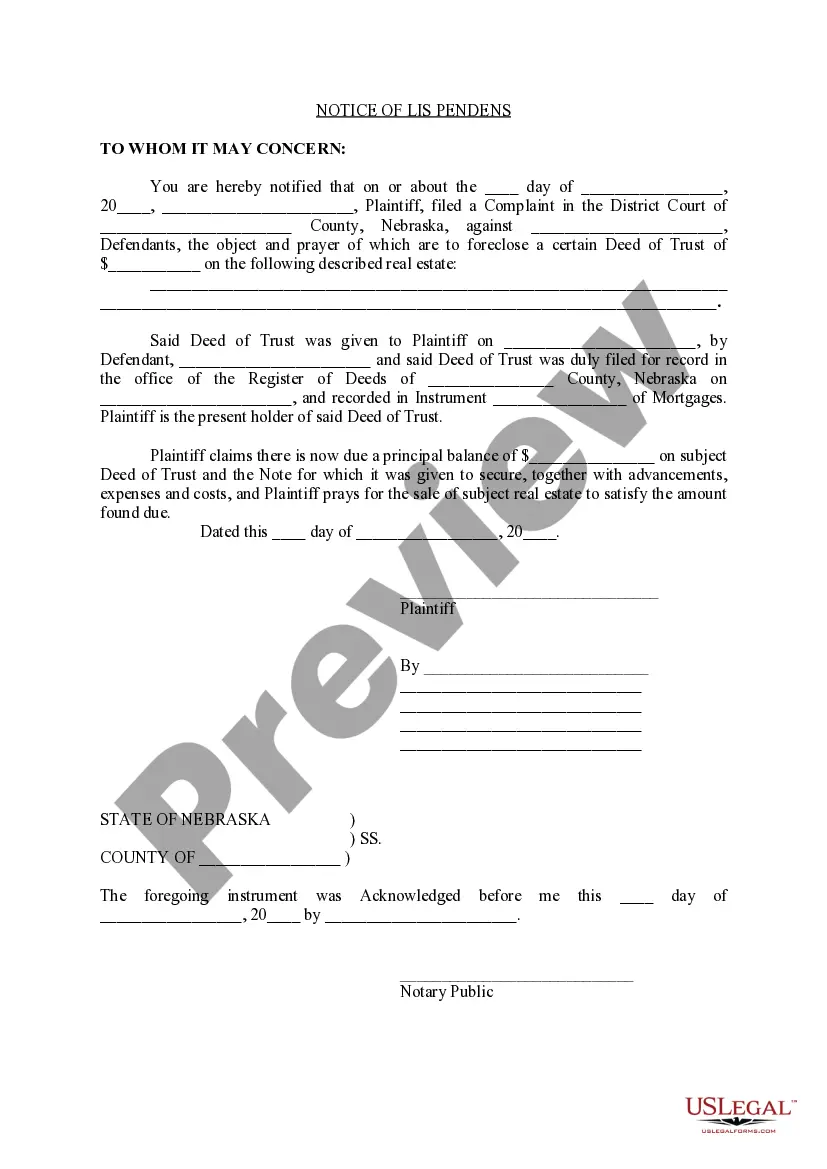

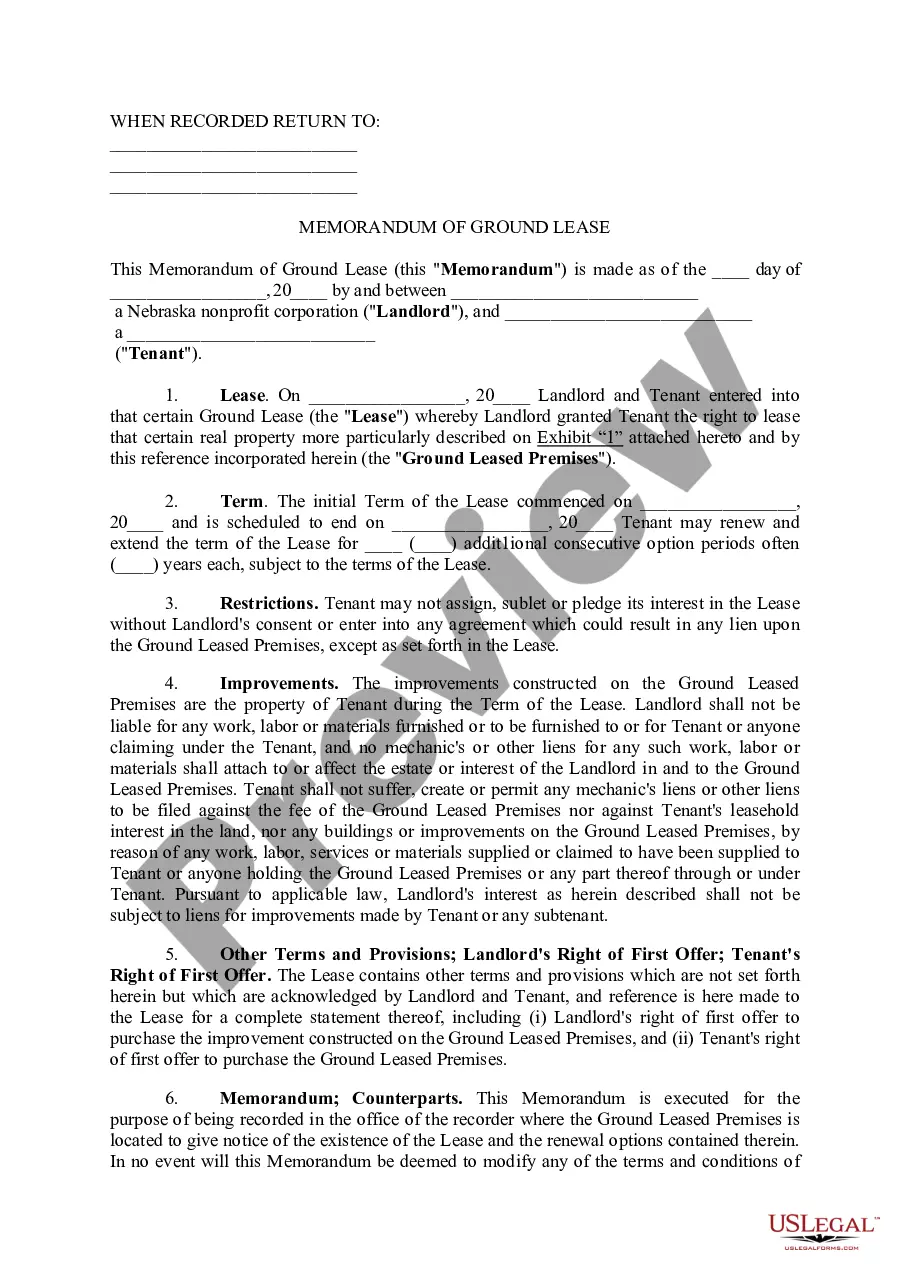

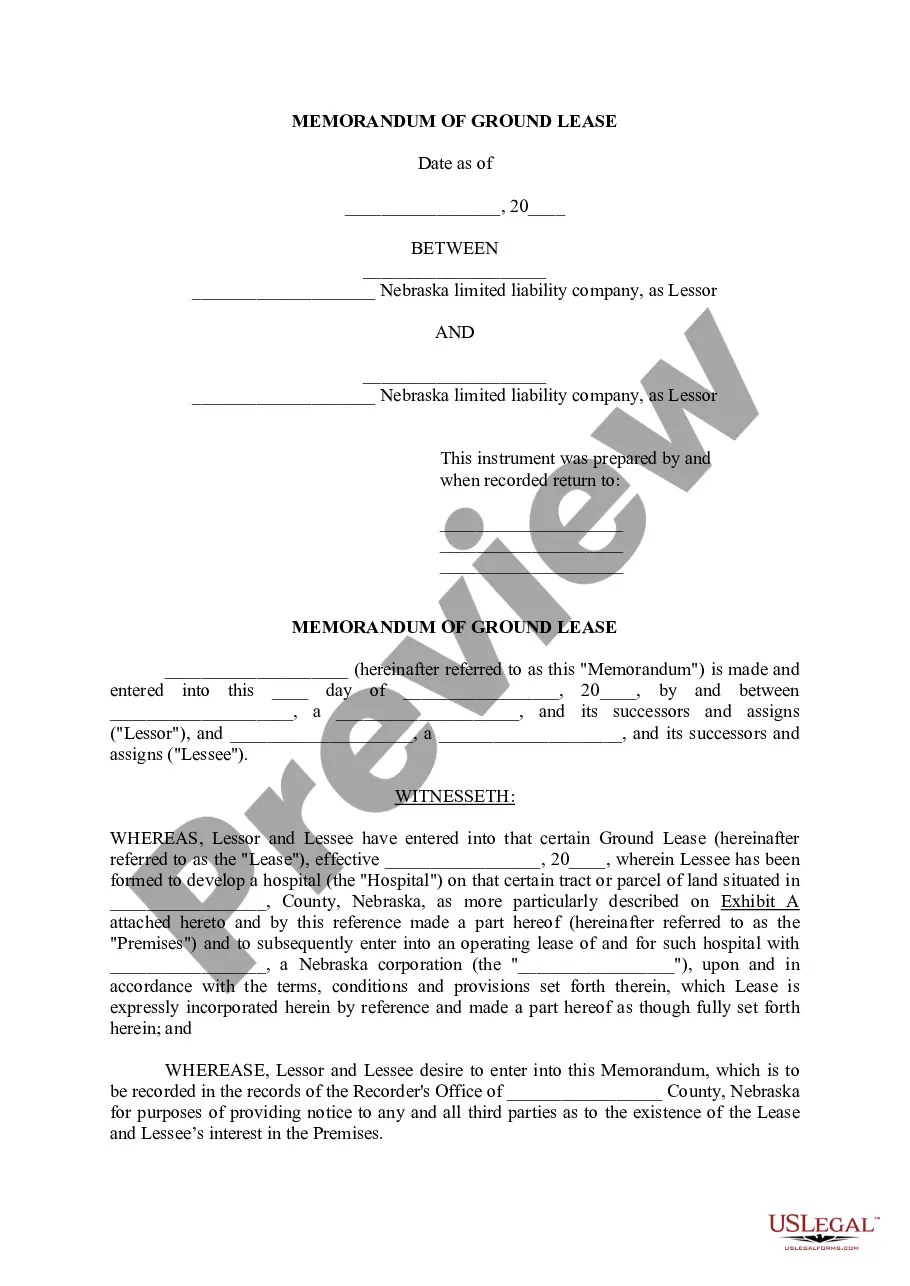

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or find another template utilizing the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you have signed up and paid for your subscription, you can use your Farm Hand Services Contract - Self-Employed as many times as you need or for as long as it continues to be valid in your state. Revise it in your preferred editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

Independent contractors are both 1099 workers and self-employed. This term includes anyone who is contracting for a company or firm.But like all independent work, these contractors are responsible for covering their own taxes and insurance (if they don't already receive insurance from another job, parent, or spouse).

Custom farm workers are usually independent contractors. If a farmer hires someone to be a custom harvester, for example, that custom harvester supplies their own equipment and supplies, and are paid a per-acre rate to harvest the crop.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed.You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done).

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

If you received a 1099 form instead of a W-2 , then the payer of your income did not consider you an employee and did not withhold federal income tax or Social Security and Medicare tax. A 1099-MISC or NEC means that you are classified as an independent contractor and independent contractors are self-employed.

Because of the limited scope of the time commitment, an independent contractor is considered to be self-employed. Business owners are responsible for providing Independent contractors with a 1099-MISC form instead of a W-2, showing the total income paid to the independent contractor.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

If payment for services you provided is listed on Form 1099-NEC, Nonemployee Compensation, the payer is treating you as a self-employed worker, also referred to as an independent contractor. You don't necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.