Dancer Agreement - Self-Employed Independent Contractor

Understanding this form

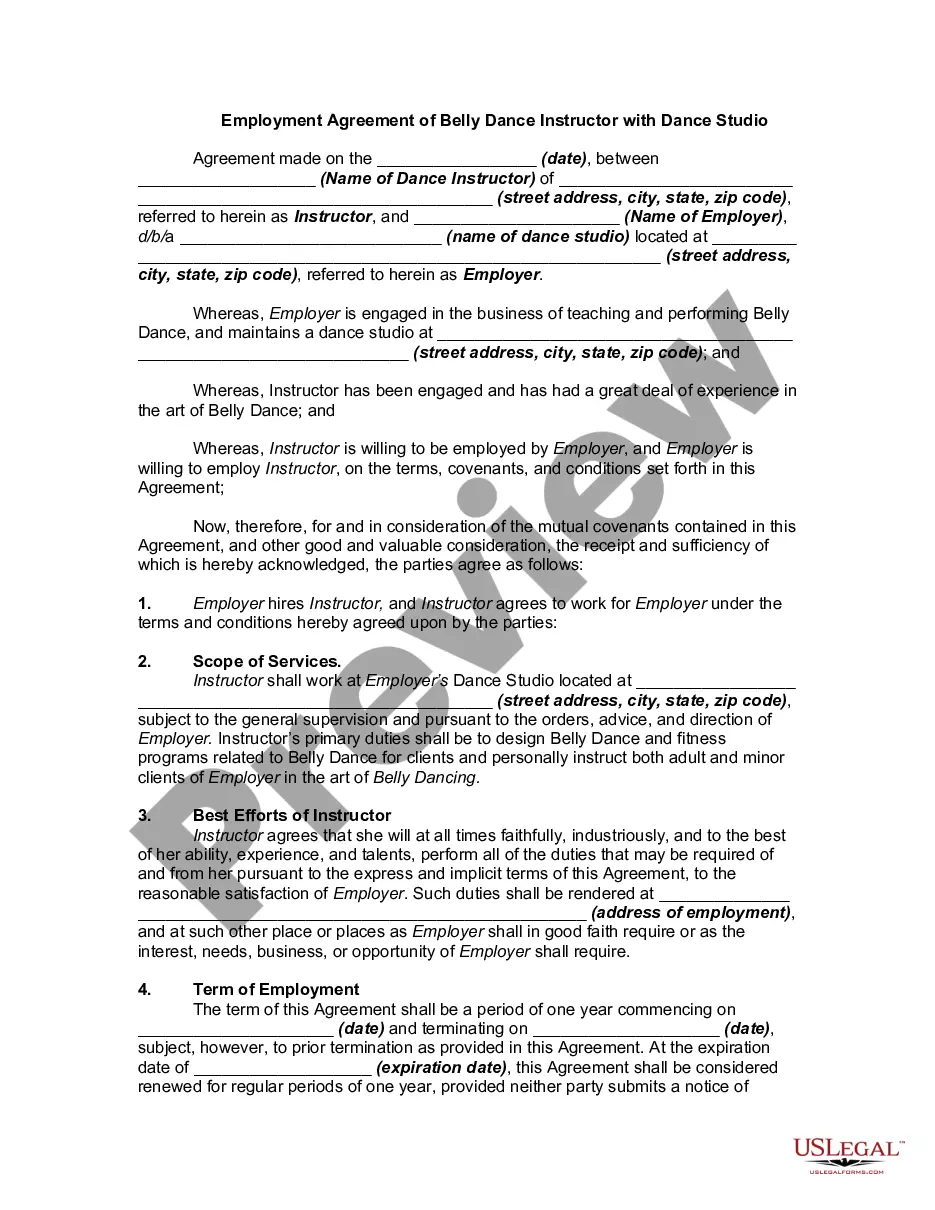

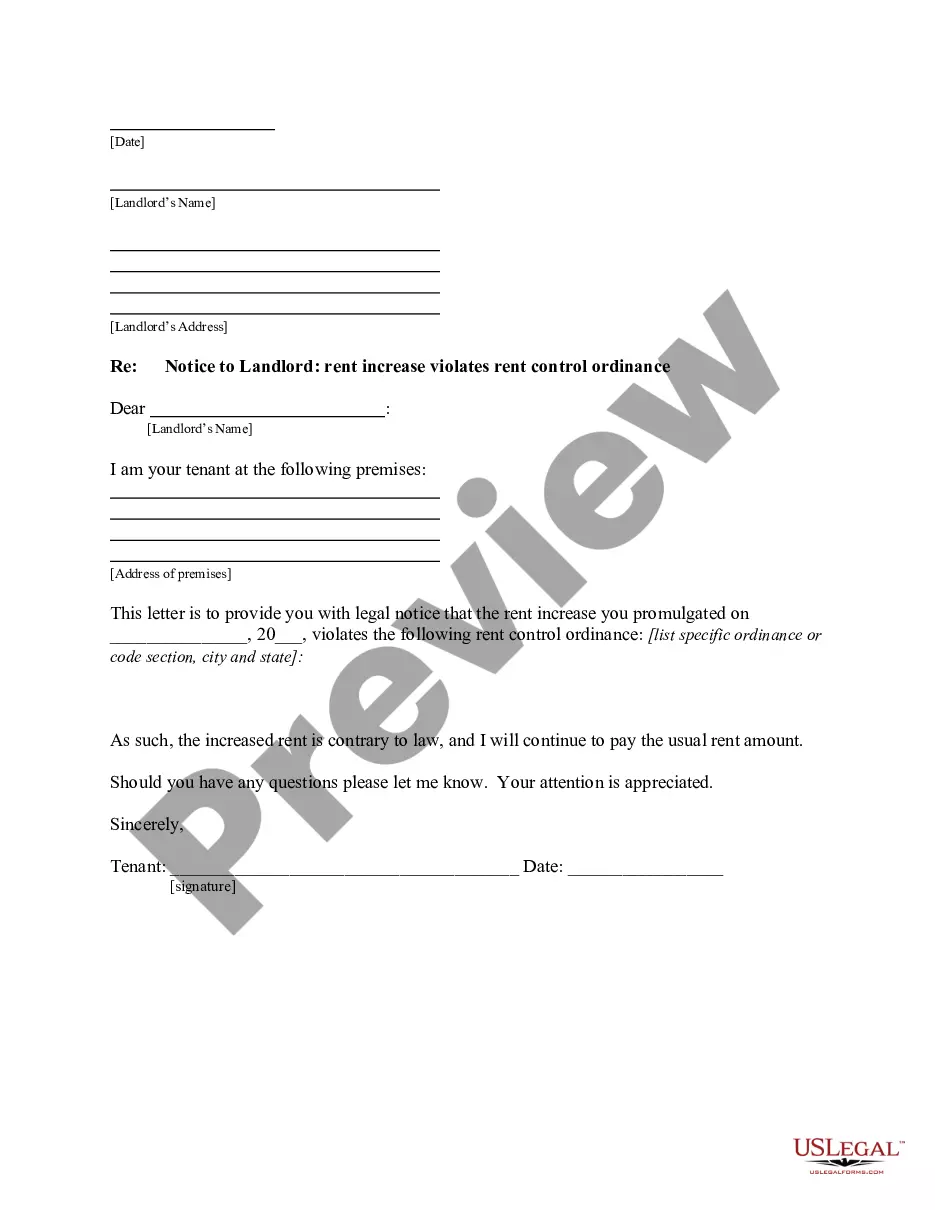

The Dancer Agreement - Self-Employed Independent Contractor is a legal document that formalizes the relationship between an employer and a dancer engaged to provide specific dance services. Unlike employment contracts, this agreement clearly establishes the dancer as an independent contractor, outlining the scope of services and responsibilities for both parties. This distinction is crucial for matters related to taxes and liabilities.

Form components explained

- Identification of the parties: Information about the Employer and Dancer.

- Scope of services: Detailed description of the dance services to be provided.

- Tax responsibilities: Clarification that the Dancer is responsible for personal taxes and insurance.

- Terms of agreement: Conditions under which the contract can be modified or terminated.

- Governing law: Specification of the state law that governs the agreement.

- Legal fees: Provisions regarding the payment of attorneys' fees if enforcement is needed.

Situations where this form applies

This agreement should be used when an employer seeks to hire a dancer as an independent contractor for performances, events, or other dance-related services. It is ideal for situations where the dancer will not be treated as an employee, ensuring both parties understand their rights and obligations regarding taxes and liability.

Who needs this form

- Employers hiring dancers for specific engagements or events.

- Dancers operating as independent contractors seeking formal arrangements.

- Event planners organizing performances and needing contractual clarity.

Instructions for completing this form

- Identify the parties: Enter the names of the Employer and the Dancer.

- Specify the services: Clearly outline the dance services to be performed.

- Note tax responsibilities: Ensure the Dancer understands their tax obligations.

- Fill in the governing law: Indicate the state law applicable to the agreement.

- Sign the agreement: Both parties should sign to validate the contract.

Does this form need to be notarized?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to clearly define the scope of services.

- Not specifying who is responsible for taxes and insurance.

- Neglecting to include a governing law clause, leading to potential disputes.

- Forgetting to sign the agreement, rendering it unenforceable.

Why use this form online

- Convenient access: Download and fill the form from anywhere.

- Editable templates: Customize the agreement to fit specific needs.

- Time-saving: Quick completion and ability to obtain legal documents without delays.

Looking for another form?

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

The glib answer is yes. Webster's defines tutor as a person employed to instruct another, esp. privately. California wage order 15 says a tutor may be considered a household employee, along with other staff such as maids.

If you're self-employed or a freelancer, you likely get paid as an independent contractor rather than an employee. The IRS defines an independent contractor as someone who performs work for someone else, while controlling the way in which the work is done.

In most cases of studio owners I've encountered, your teachers are considered employees, not independent contractors. However, the business of dance studios is a very diverse group when it comes to schedules and employee structures.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

Teachers are independent contractors only if (a) you do not control or direct how they teach their classes, (b) if teaching yoga is outside of your yoga business, and (c) the teacher has an independent business that is the same as they work they do for you.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed. To find out what your tax obligations are, visit the Self-Employed Tax Center.

However, for the most part, under the Federal regulations (and most states including California), a crew member on a film or other similar type production should never be categorized as an independent contractor they are really employees and are subject to federal and state withholding (from their paychecks) as

For colleges and universities, the general rule is that instructors, adjunct faculty, and proctors are employees. Guest speakers and performers are independent contractors. Researchers and consultants must be determined on a case to case basis.