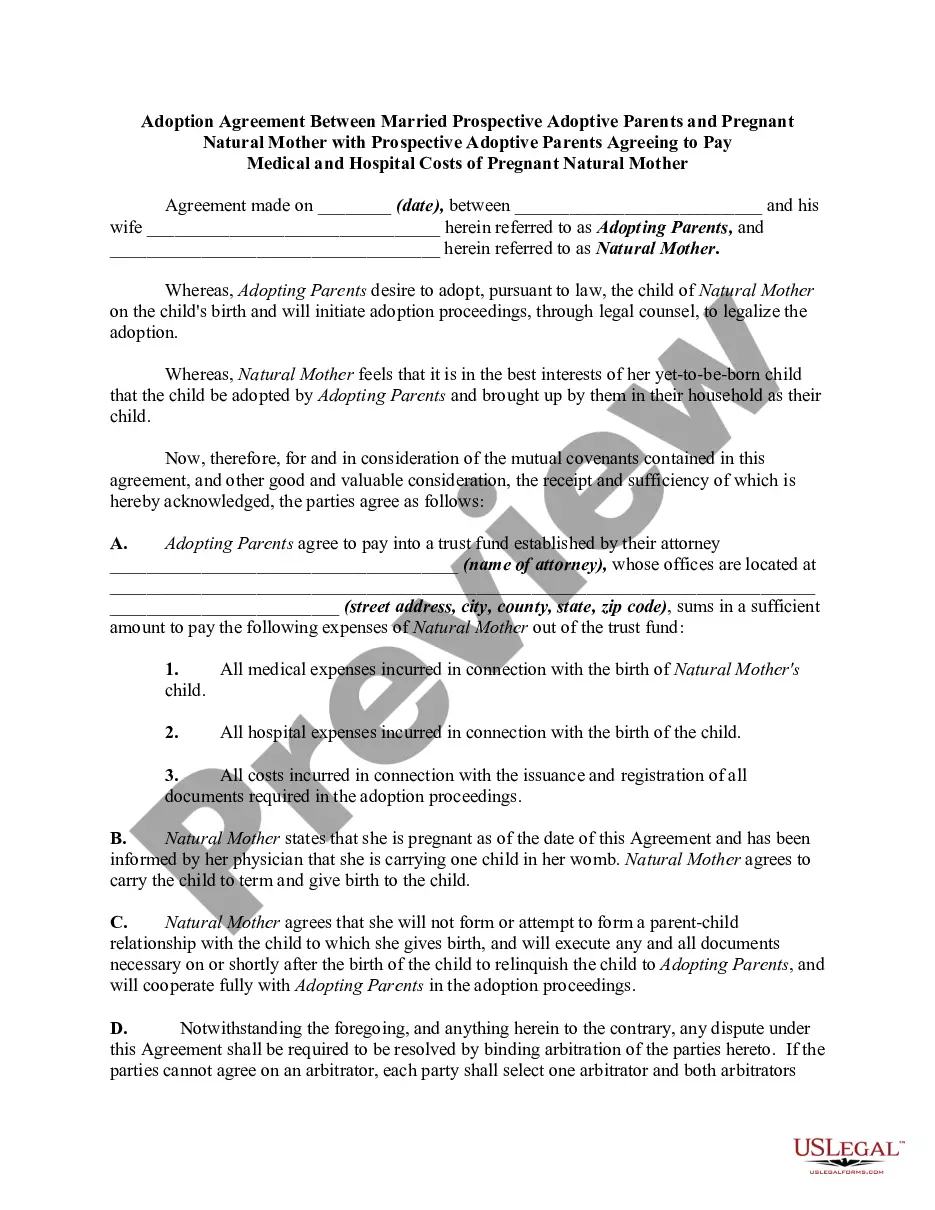

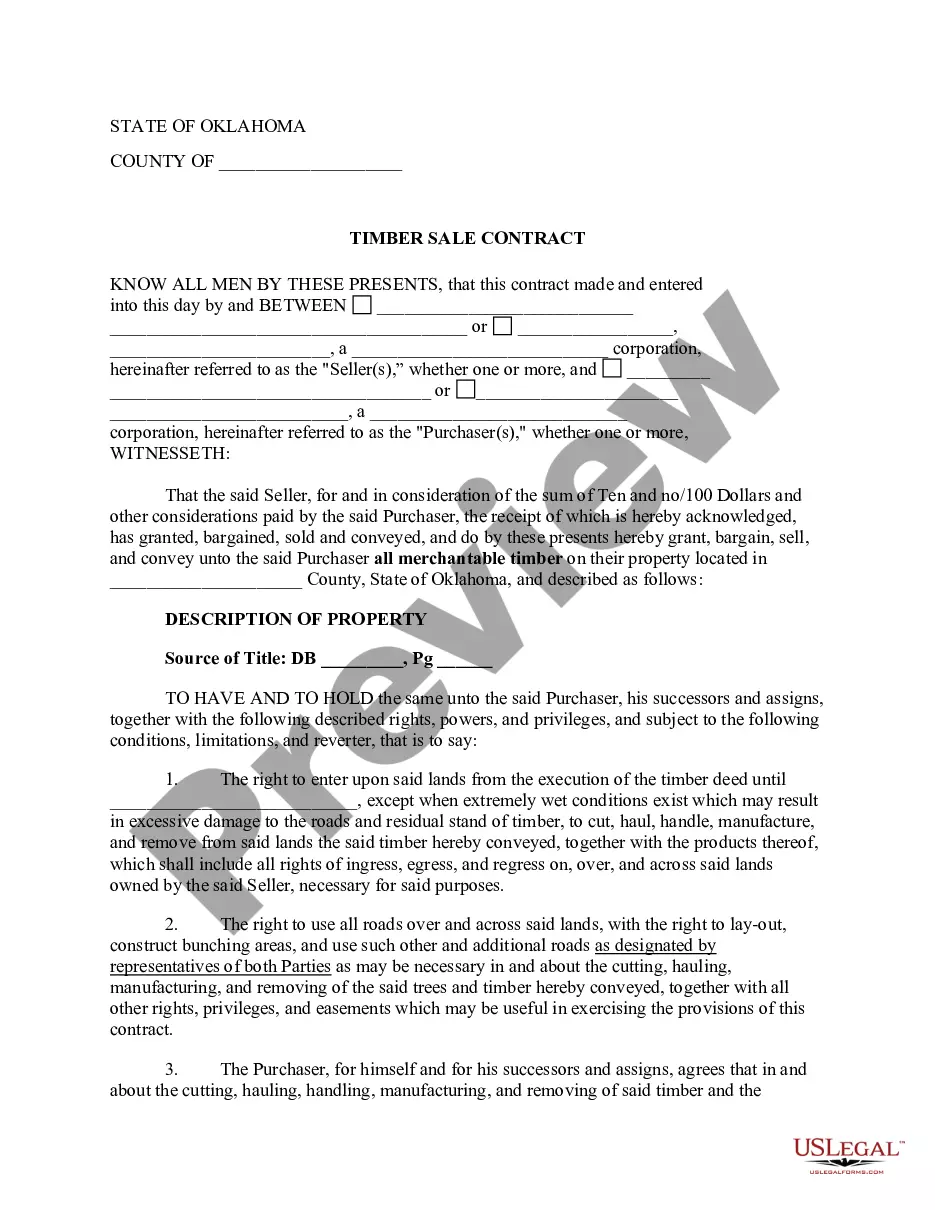

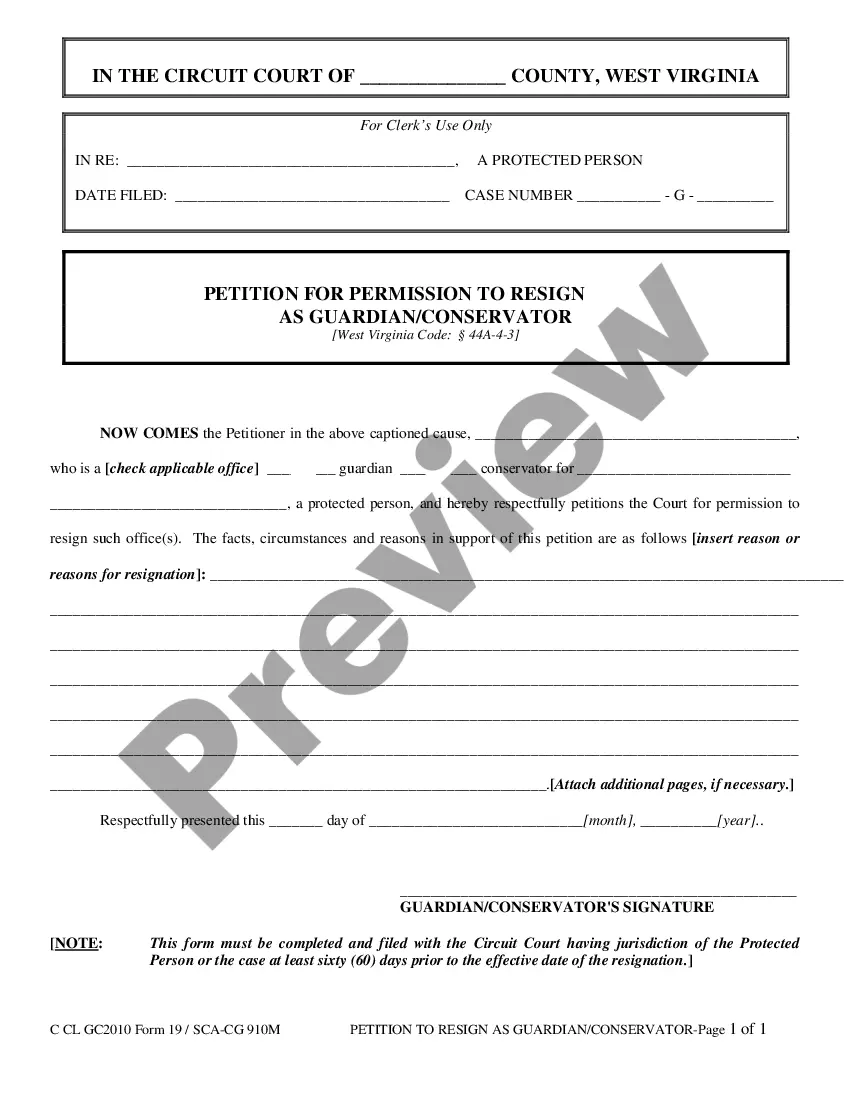

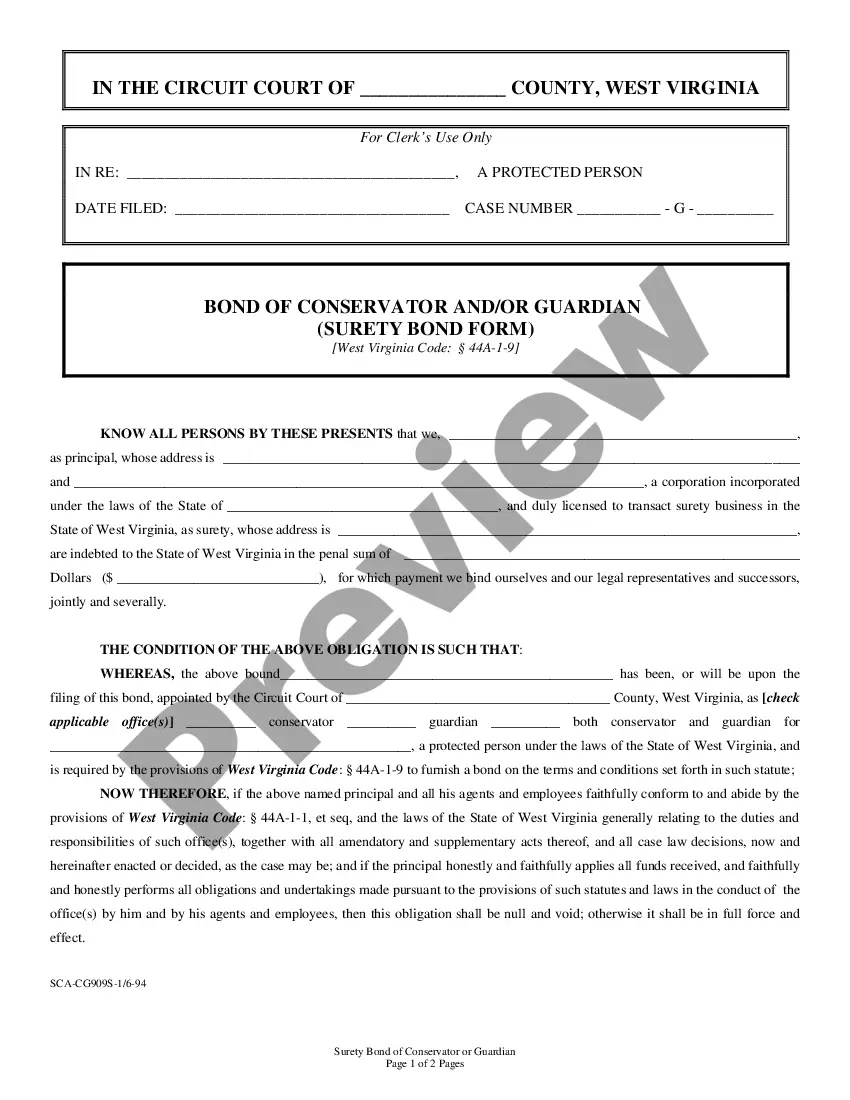

Employee Time Report (Nonexempt)

What is this form?

The Employee Time Report (Nonexempt) is a crucial document used to record the actual hours worked by non-exempt employees. This form allows both employees and employers to keep an accurate account of time worked, ensuring compliance with labor laws regarding overtime and compensation. Unlike general time sheets, this specific form is tailored for non-exempt employees who are entitled to overtime pay, making it essential for meeting legal requirements and maintaining transparency in the workplace.

Main sections of this form

- Employee details including name and social security number.

- Sections for recording arrival and departure times, along with lunch breaks.

- Field for total hours worked each day.

- Space for any notes on deviations from the standard schedule.

- Employee and manager signatures for verification.

When to use this form

This form should be used during regular work periods to document actual hours worked by non-exempt employees. Employers should require this report any time there are changes in an employee's work hours, such as adjustments due to vacations, sickness, or unforeseen events. It is essential for payroll processing and ensuring compliance with wage and hour laws.

Intended users of this form

- Non-exempt employees who are entitled to overtime compensation.

- Employers and managers responsible for payroll and timekeeping.

- HR professionals who oversee compliance with labor laws.

How to prepare this document

- Fill in your personal details, including your name and social security number.

- Record the period ending date for the time report.

- Indicate your arrival time, lunch breaks, and departure times for each day worked.

- Calculate and enter the total hours worked for each day in the provided field.

- Provide any explanations for deviations from your usual work schedule.

- Sign the form, and have your manager sign it for verification.

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to record break times accurately.

- Not signing the report before submission.

- Leaving fields blank, especially total hours.

- Not explaining deviations from normal hours which can lead to payroll discrepancies.

Benefits of completing this form online

- Convenient digital access allows for easy updates and tracking.

- Ensures accuracy in time reporting, reducing errors that can impact pay.

- Easier storage and retrieval compared to paper forms.

- Allows for efficient communication between employees and management regarding time records.

Looking for another form?

Form popularity

FAQ

The number of hours worked doesn't affect an exempt employee's pay because the salary is considered full compensation for all hours worked, whether more or fewer than 40 in a week. However, there is nothing illegal about requiring exempt employees to clock in and out at the start and end of the workday, or for lunch.

From March 1, it will be compulsory for employers to keep a record of the starting and finishing times of work, and any unpaid breaks taken, of salaried staff covered by these awards earning up to $148,700.

Non-exempt employees are eligible for overtime, rest and meal breaks, and are subject to California's minimum wage laws. Exempt employees may not be eligible for overtime or breaks.As an exempt employee, an employer could require the employee to work more than 40-hours per week without overtime pay.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

Time clocks typically are used for recordkeeping purposes. The FLSA doesn't mandate time clocks at all, not even for hourly, non-exempt employees. The FLSA's Fact Sheet No. 21, titled "Recordkeeping Requirements Under the Fair Labor Standards Act (FLSA)" states: "Employers may use any timekeeping method they choose.

The FLSA does not limit the amount of working hours an employer can expect of exempt workers. However, nothing in the FLSA prohibits employers from requiring exempt employees to clock in or track time either. Tracking time is a good idea, because it prevents disagreements between the employee and employer.

These rules and regulations apply to both part-time and full-time employees. When an employee is considered non-exempt, it means they aren't covered by FLSA standards and regulations.However, any paid leave they take during the week will not apply to the traditional 40 hours of work.

The number of hours worked doesn't affect an exempt employee's pay because the salary is considered full compensation for all hours worked, whether more or fewer than 40 in a week. However, there is nothing illegal about requiring exempt employees to clock in and out at the start and end of the workday, or for lunch.

If they're exempt, which a majority of salaried employees are, you're not required to have them fill out a timesheetbut if they fall under the non-exempt category (for example, if the employee's salary is less than $684 per week) then they would need to fill out a timecard.