Sample Letters - A Package of Sample Letters and Forms for Foreclosure

Description

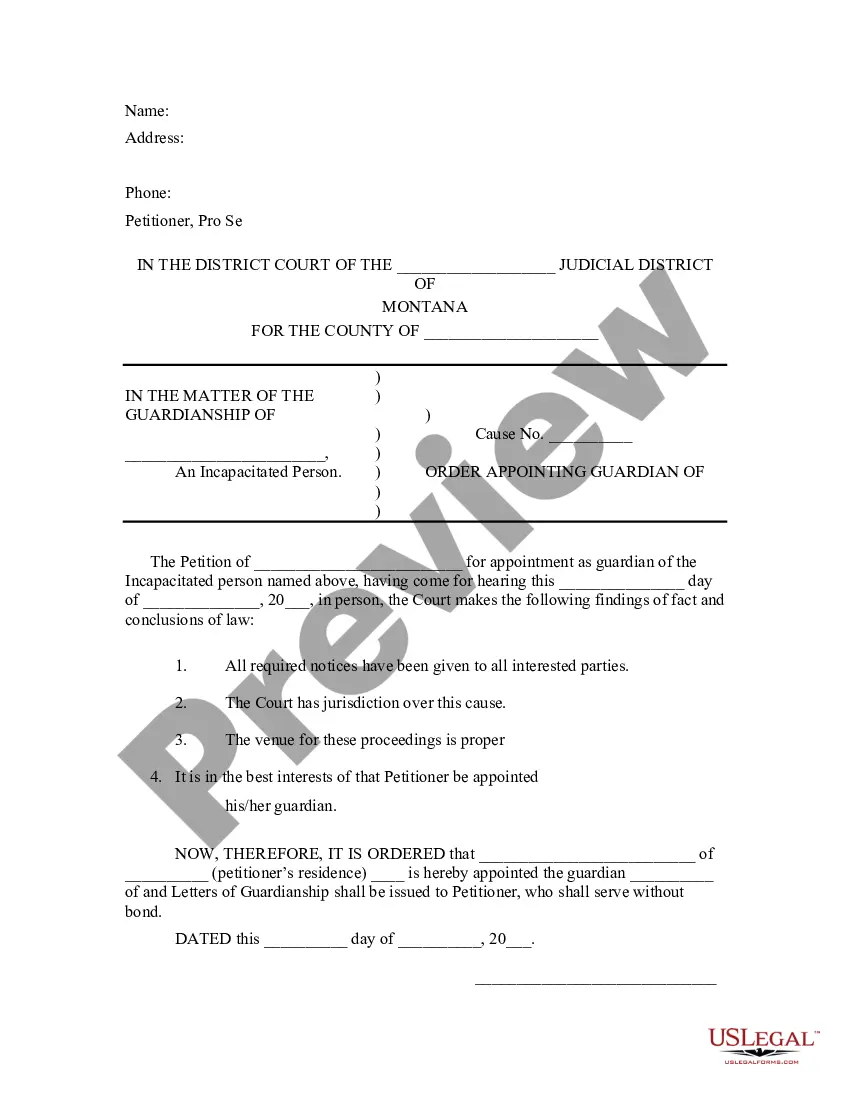

How to fill out Sample Letters - A Package Of Sample Letters And Forms For Foreclosure?

Use US Legal Forms to get a printable Sample Letters - A Package of Sample Letters and Forms for Foreclosure. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms catalogue on the internet and provides cost-effective and accurate templates for customers and attorneys, and SMBs. The templates are categorized into state-based categories and a few of them might be previewed before being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to easily find and download Sample Letters - A Package of Sample Letters and Forms for Foreclosure:

- Check out to ensure that you have the proper form with regards to the state it is needed in.

- Review the form by looking through the description and by using the Preview feature.

- Hit Buy Now if it is the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Use the Search engine if you need to find another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including Sample Letters - A Package of Sample Letters and Forms for Foreclosure. Over three million users have used our service successfully. Choose your subscription plan and get high-quality forms within a few clicks.

Form popularity

FAQ

First, the costs and expenses of conducting the foreclosure sale are paid. Second, the lien that was foreclosed on is paid off. Third, if there is any money remaining after the foreclosed lien is paid, then any liens junior to the foreclosed lien are paid in their order of priority.

Respected sir, I, ___________(Name) hold a ____________ (type of loan account) account in your bank. I am writing this letter to request you to close my ____________ (type of loan account) account bearing account number ____________ (Loan Account no.).

You need to prepare an official offer, submit it to the home owner and then have them take it to their bank. This can be a slow process, so be patient. If the bank accepts your offer then either they can help arrange the closing (if you get financing through them) or just contact a local title company to handle it.

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.

Respected sir, I, ___________(Name) hold a ____________ (type of loan account) account in your bank. I am writing this letter to request you to close my ____________ (type of loan account) account bearing account number ____________ (Loan Account no.).

Make your opener as personal as possible. Tell them about yourself. Point out the home's attributes. Find a connection. Explain your bid, even if it's low. Close with lots of thanks.

Most likely they will respond in 3 to 5 business days. On some occasions, they will respond in 24 hours. We have no control over the bank's decision making process. Some banks do not look at offers until the property has been on the market for 5 to 10 days or even 20 days before they review an offer.

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)

The borrower defaults on the loan. The lender issues a notice of default (NOD). A notice of trustee's sale is recorded in the county office. The lender tries to sell the property at a public auction.