Sample Letter for Judicial Foreclosure

What is this form?

The Sample Letter for Judicial Foreclosure is a template document designed to communicate key information concerning the foreclosure of a property. This specific letter addresses the finding of a title search that revealed issues with the property's title, which may affect the foreclosure process. It is distinct from other forms in that it is tailored for notifying relevant parties about title discrepancies that could impact foreclosure rights.

Key components of this form

- Date: The date when the letter is issued.

- Recipient details: Including the private name, company, and address.

- Property description: Overview of the parcels related to the foreclosure.

- Disclosure of title search results: Information on issues found in the title search.

- Call to action: Request for guidance on proceeding with the foreclosure.

- Signature block: Space for the sender's name and any enclosed documents.

Situations where this form applies

This form is typically used when there is a need to initiate a judicial foreclosure process, particularly when title issues have been identified that could complicate or hinder the foreclosure of a property. It is essential for notifying involved parties about findings that may affect their rights concerning the property in question.

Who this form is for

- Property owners facing foreclosure.

- Lenders requiring communication with property owners regarding title issues.

- Attorneys representing clients in foreclosure matters.

- Real estate professionals involved in foreclosure processes.

How to prepare this document

- Identify the date the letter is being sent.

- Fill in the recipient's name and complete address.

- Provide a clear description of the property and associated title issues.

- State your concerns regarding the diminished value of the property.

- Request prompt communication regarding the next steps to take.

- Sign the letter and include any necessary enclosures.

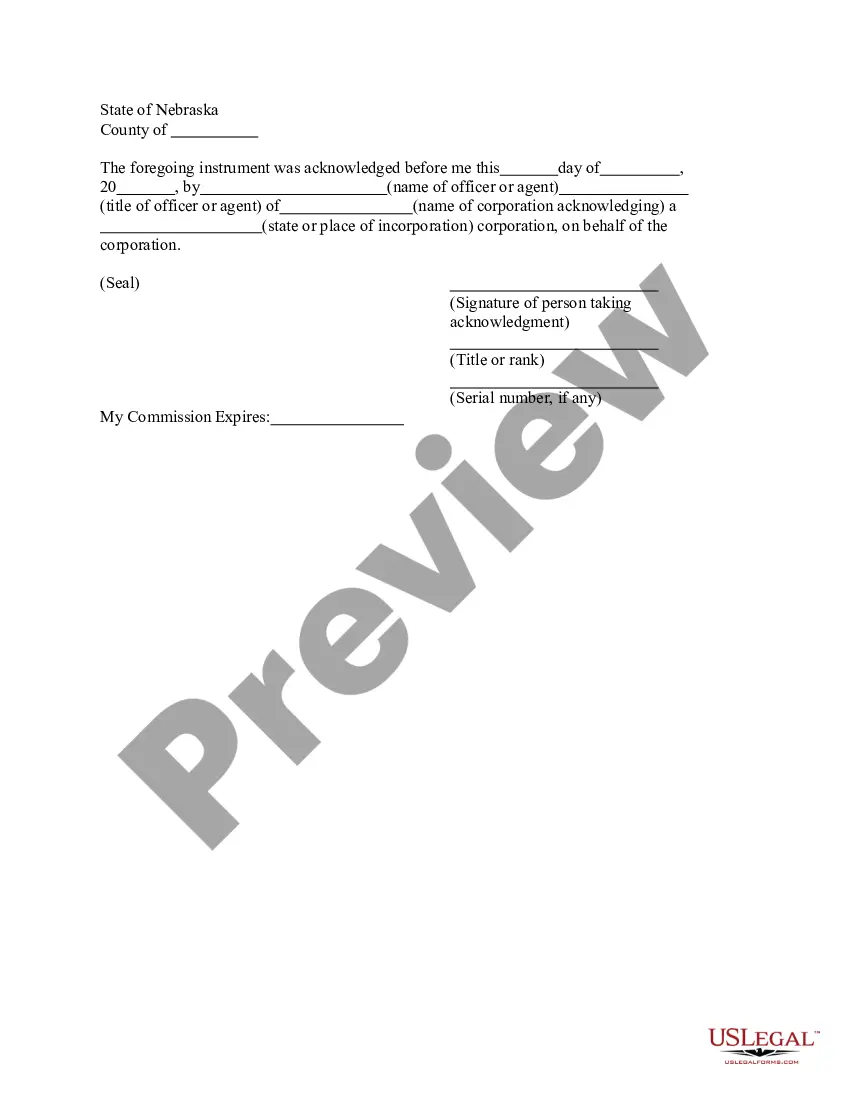

Does this document require notarization?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include the date of the letter.

- Providing inaccurate recipient information.

- Omitting relevant property details or legal descriptions.

- Neglecting to specify the title issues clearly.

- Not leaving sufficient space for a signature.

Benefits of completing this form online

- Convenience of accessing and downloading the form from anywhere.

- Editable Word format allows for customization to fit specific needs.

- Drafted by licensed attorneys, ensuring legal reliability.

- Time-saving compared to creating a letter from scratch.

Looking for another form?

Form popularity

FAQ

In a non-judicial foreclosure, the lender is proceeding on the basis that the mortgage or deed of trust provides for its right of foreclosure. This means that your lawsuit will ask the judge to stop the foreclosure proceeding until they can review your argument against the foreclosure.

Gather your loan documents and set up a case file. Learn about your legal rights. Organize your financial information. Review your budget. Know your options. Call your servicer. Contact a HUD-approved housing counselor.

A hardship letter should Start by stating the purpose of the letter whether it is a loan modification or a short sale so the lender knows what homeowners want. It should say something like I need to restructure my mortgage and obtain a lower, fixed interest rate2026, in a way that force them to find out why.

To contest a judicial foreclosure, you have to file a written answer to the complaint (the lawsuit). You'll need to present your defenses and explain the reasons why the lender shouldn't be able to foreclose. You might need to defend yourself against a motion for summary judgment and at trial.

As part of the lawsuit, the foreclosing party includes a petition for foreclosure that explains why a judge should issue a foreclosure judgment. In most cases, the court will do so, unless the borrower has a defense that justifies the delinquent payments.

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)

You can bring your loan current and stave off the foreclosure sale filing by paying the past due amount, plus penalties.You typically have to reinstate at least five days before the lender's deadline or risk the lender rejecting your payment and proceeding with a sale.

A lender can rescind a foreclosure sale if a borrower requests to reinstate the loan agreements and then makes payment to bring the loan balance current, provided this is done more than five days before the scheduled sale date.

It takes several months for a lender to foreclose on a California property. If everything goes according to schedule, the process typically takes approximately 120 days about four months but the process can take as long as 200 or more days to conclude.