Sample Letter for Foreclosure Services Rendered

Understanding this form

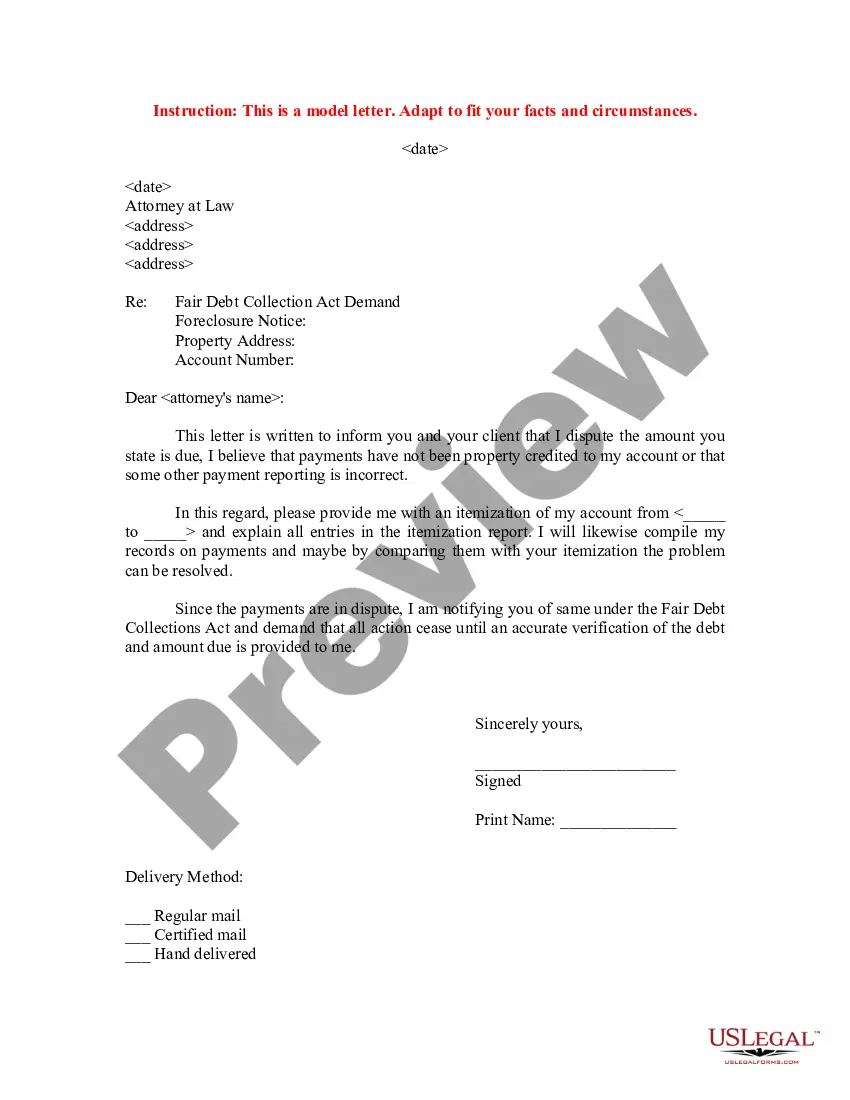

The Sample Letter for Foreclosure Services Rendered is a template intended for individuals or businesses seeking to communicate with a mortgage company regarding foreclosure services. This letter serves as a formal notification and can be customized to reflect your specific situation. It is designed to provide clarity in communication and ensure that all necessary information is conveyed effectively, distinguishing it from other types of foreclosure documents or notices.

Main sections of this form

- Date of the letter

- Name and address of the mortgage company

- Name of the foreclosure services department

- Reference to the subject of foreclosure

- Expected actions or responses required from the mortgage company

Situations where this form applies

This form is useful in scenarios where you need to formally notify a mortgage company about foreclosure services provided. It can be used by homeowners facing foreclosure, real estate professionals, or legal representatives acting on behalf of clients to ensure clear communication regarding foreclosure status and any services rendered.

Who this form is for

This letter can be used by:

- Homeowners addressing their mortgage provider

- Real estate agents managing foreclosure cases

- Legal representatives acting on behalf of clients involved in foreclosure

- Any party involved in the foreclosure process requiring formal communication

Steps to complete this form

- Identify the parties involved, including your name and the mortgage company's name.

- Enter the date at the beginning of the letter.

- Specify the details of the foreclosure services rendered.

- Clearly state any actions or responses you expect from the mortgage company.

- Sign the letter and include your contact information as needed.

Does this document require notarization?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include correct and complete information about the mortgage company.

- Not specifying the services rendered, leading to confusion.

- Neglecting to include a clear call to action or expected response.

Why complete this form online

- Easy customization to suit your specific situation.

- Quick access and instant download options.

- Reliable templates drafted by licensed attorneys for peace of mind.

What to keep in mind

- The Sample Letter for Foreclosure Services Rendered is a template for effective communication with mortgage companies.

- It is essential for homeowners facing foreclosure to document their inquiries in writing.

- Ensure the letter is tailored to your specific circumstances for maximum effectiveness.

Looking for another form?

Form popularity

FAQ

Respected sir, I, ___________(Name) hold a ____________ (type of loan account) account in your bank. I am writing this letter to request you to close my ____________ (type of loan account) account bearing account number ____________ (Loan Account no.).

Sub:- Request to close the account and supply No dues certificate. Sir/madam, I ramesh kumar verma s/o R/o heaving 3 loan account in your esteemed bank . I would like to inform you that I have paid all the loan due on me you can check in your records.

Most likely they will respond in 3 to 5 business days. On some occasions, they will respond in 24 hours. We have no control over the bank's decision making process. Some banks do not look at offers until the property has been on the market for 5 to 10 days or even 20 days before they review an offer.

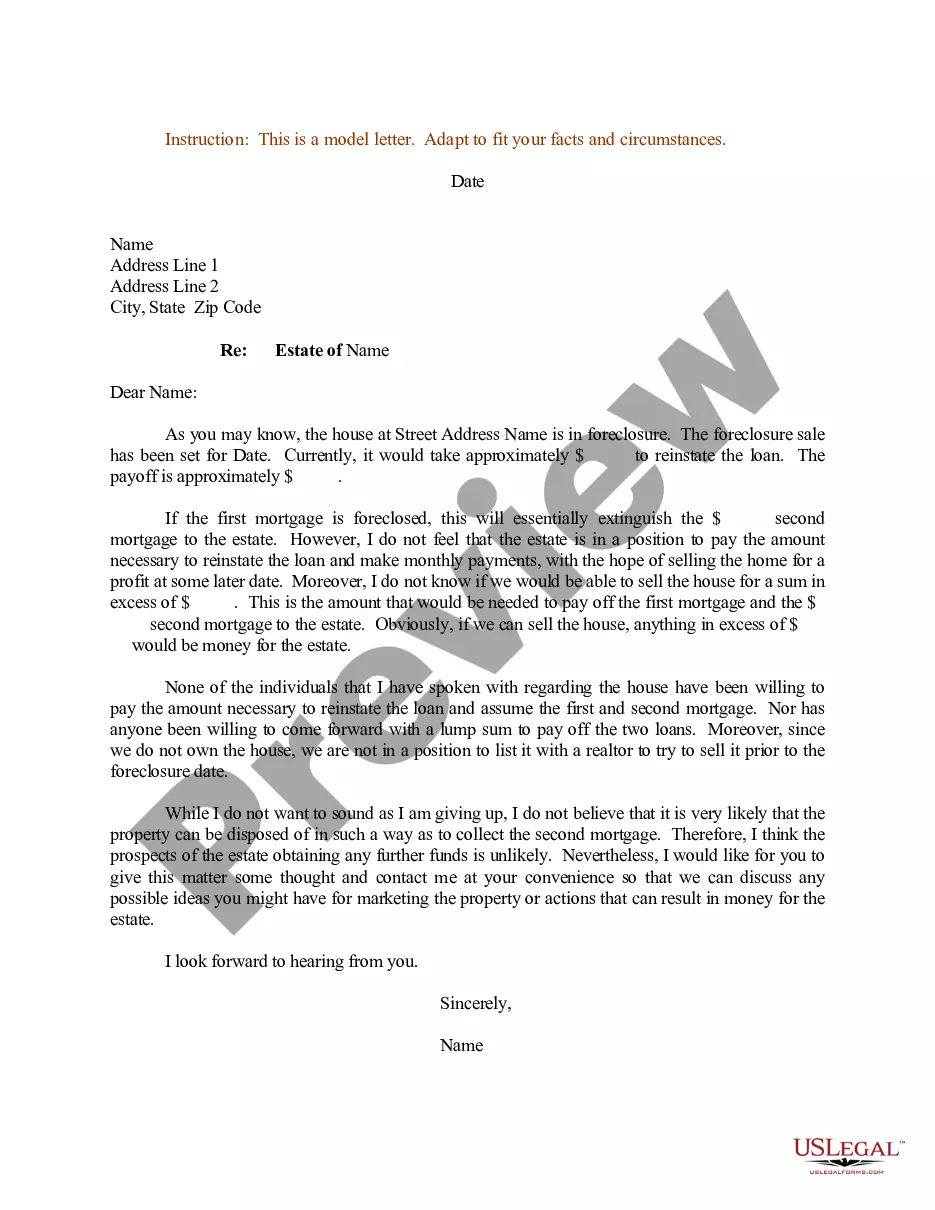

The borrower defaults on the loan. The lender issues a notice of default (NOD). A notice of trustee's sale is recorded in the county office. The lender tries to sell the property at a public auction.

Respected sir, I, ___________(Name) hold a ____________ (type of loan account) account in your bank. I am writing this letter to request you to close my ____________ (type of loan account) account bearing account number ____________ (Loan Account no.).

A hardship letter should Start by stating the purpose of the letter whether it is a loan modification or a short sale so the lender knows what homeowners want. It should say something like I need to restructure my mortgage and obtain a lower, fixed interest rate2026, in a way that force them to find out why.

Begin the hunt. One of the trickiest aspects to buying during this stage of foreclosure is finding properties. Drive by. Get a status update. Learn the values. Do some math. Reach out. Walk through. Negotiate.

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)