Refund of Duplicate Payment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

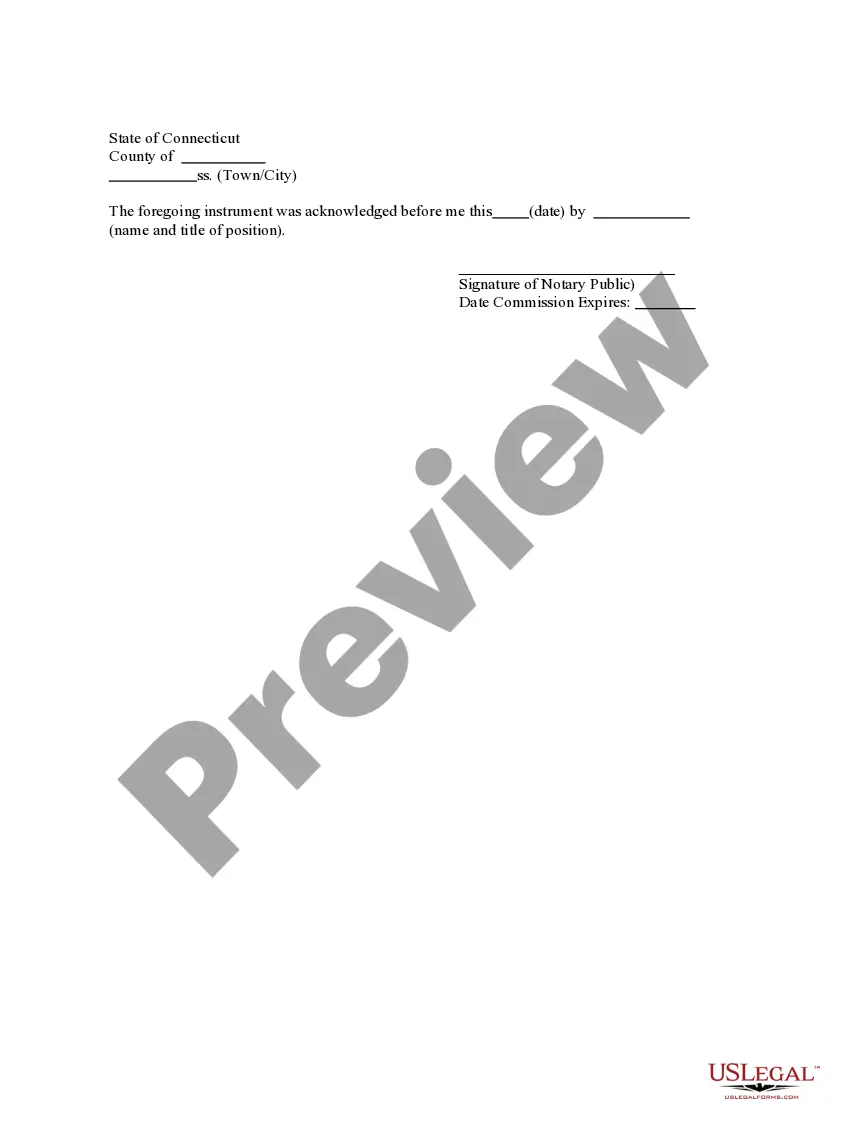

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Refund Of Duplicate Payment?

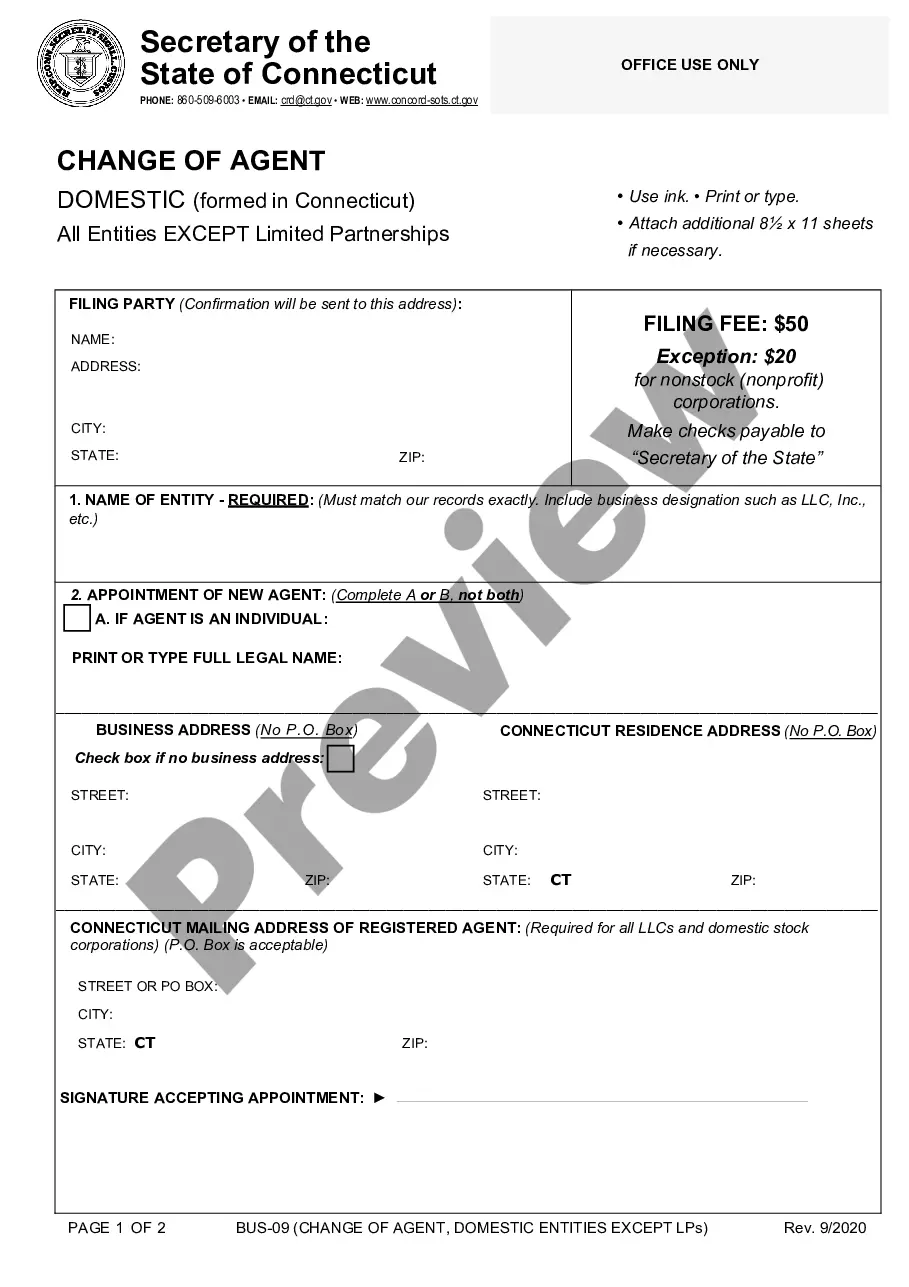

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state regulations and are examined by our experts. So if you need to complete Refund of Duplicate Payment, our service is the best place to download it.

Obtaining your Refund of Duplicate Payment from our service is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they locate the proper template. Afterwards, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a brief guide for you:

- Document compliance check. You should carefully examine the content of the form you want and make sure whether it satisfies your needs and fulfills your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find an appropriate blank, and click Buy Now once you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Refund of Duplicate Payment and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Request Letter to Refund of Access/Double Payment Dear Sir, You are requested to return our payment which was overpaid for the (product name) order. Therefore, please refund the excessive payment of ($amount) as soon as possible. I will be thankful to you.

Ref: Account or Invoice Number Dear Name of Recipient: Thank you for your recent payment of Payment Amount which we received on Date. However, it appears that this is a duplicate payment. We previously received a separate payment of Payment Amount on Date. Therefore, I am refunding your second payment.

Hi (Recipient's name), I can confirm that a refund of (amount) was returned to you for (product/service/order) on (date). The payment was sent to (usually the original payment method, but provide details.) It can take up to (number) days for refunds to be processed.

Refund Letter Format: Guidelines and Tips Ask for a refund in a polite and respectful manner. Include the details about the product such as was purchased, when and at what price. Mention why you returned the item. Mention the relevant information of the transactions such as the date and place of delivery.

How to eliminate duplicate payments Reduce manual invoice data entry.Collect standard vendor documents.Cleanse your vendor database.Pay your invoices promptly.Reduce the number of vendors you work with.Limit vendor payment methods.Centralize invoice processing.Conduct regular AP audits.

Duplicate invoice payments occur far more often than most realize, resulting in cash leakage. It's estimated that companies make duplicate payments at the rate of 0.1% up to 0.5%.

Provide a Refund Businesses often issue overpayment refunds in the same format as the customer provided payment. For example, if your customer paid by check, you may return a check for the overpayment refund. If he paid by credit card, however, you can usually issue a refund directly to the card.