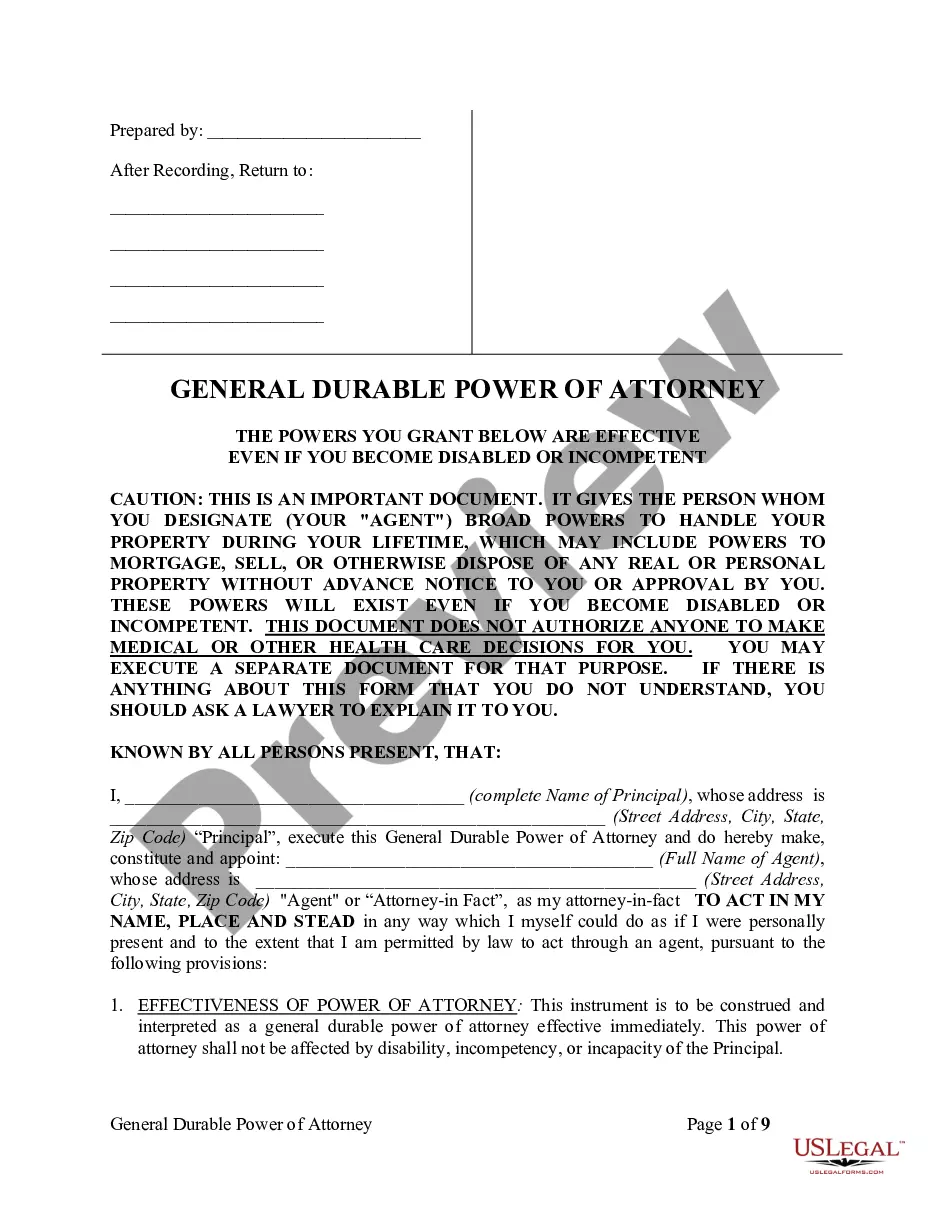

A Trust is an entity which owns assets for the benefit of a third person (the beneficiary). A Living Trust is an effective way to provide lifetime and after-death property management and estate planning. When you set up a Living Trust, you are the Grantor. Anyone you name within the Trust who will benefit from the assets in the Trust is a beneficiary. In addition to being the Grantor, you can also serve as your own Trustee. As the Trustee, you can transfer legal ownership of your property to the Trust. A revocable living trust does not constitute a gift, so there are no gift tax consequences in setting it up.

Revocable Trust Agreement Regarding Coin Collection

Description

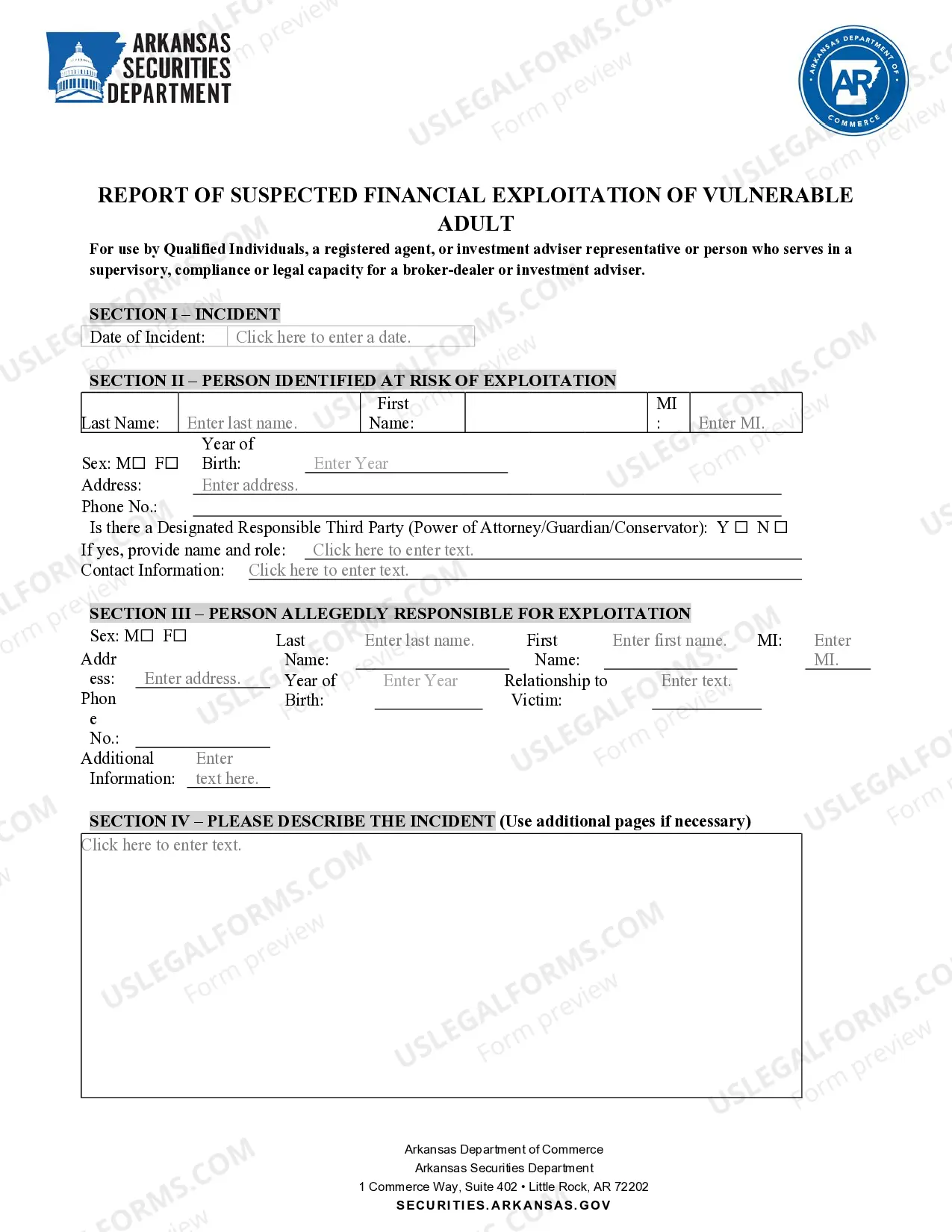

How to fill out Revocable Trust Agreement Regarding Coin Collection?

Aren't you tired of choosing from hundreds of templates each time you want to create a Revocable Trust Agreement Regarding Coin Collection? US Legal Forms eliminates the lost time millions of American people spend exploring the internet for perfect tax and legal forms. Our professional group of attorneys is constantly updating the state-specific Forms collection, to ensure that it always has the right documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Users who don't have an active subscription should complete easy steps before having the capability to download their Revocable Trust Agreement Regarding Coin Collection:

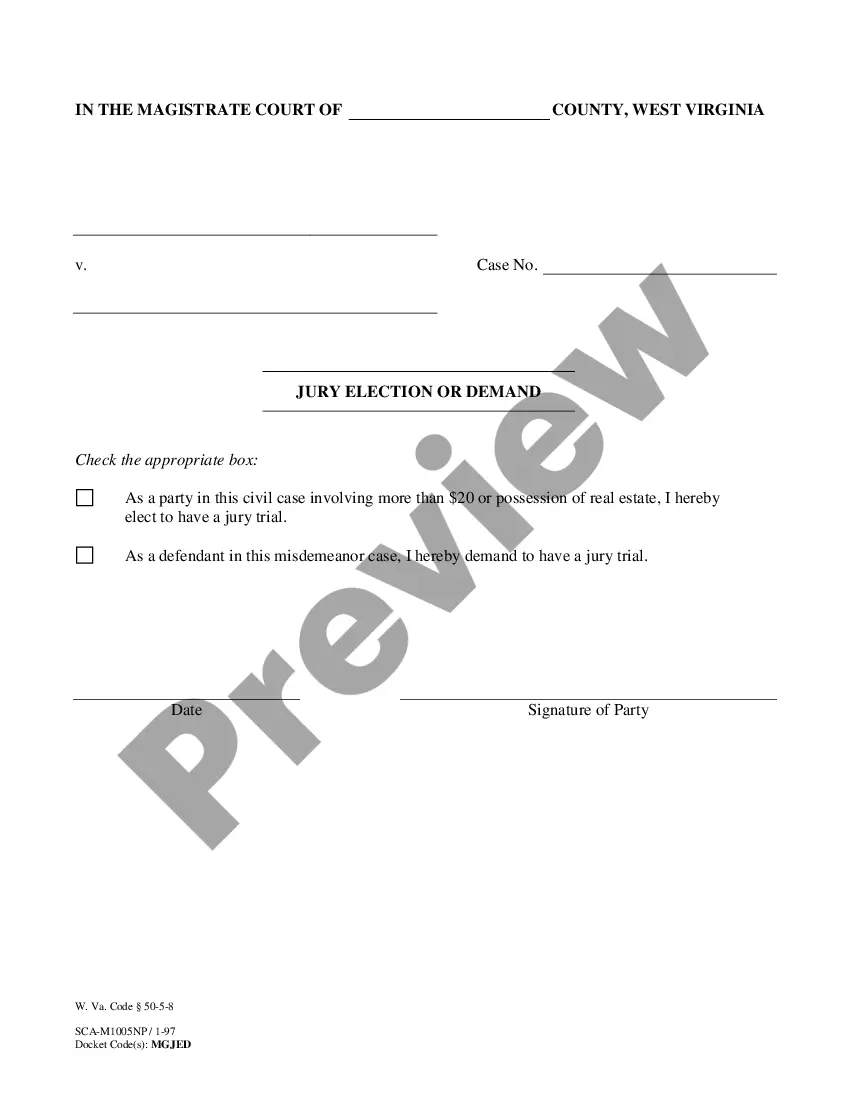

- Utilize the Preview function and look at the form description (if available) to make sure that it is the proper document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the correct template for the state and situation.

- Use the Search field at the top of the site if you want to look for another file.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your template in a required format to finish, create a hard copy, and sign the document.

After you have followed the step-by-step instructions above, you'll always be able to log in and download whatever file you require for whatever state you require it in. With US Legal Forms, completing Revocable Trust Agreement Regarding Coin Collection samples or other legal paperwork is not difficult. Get started now, and don't forget to recheck your samples with accredited attorneys!

Form popularity

FAQ

A Revocable Living Trust Defined Assets can include real estate, valuable possessions, bank accounts and investments. As with all living trusts, you create it during your lifetime.

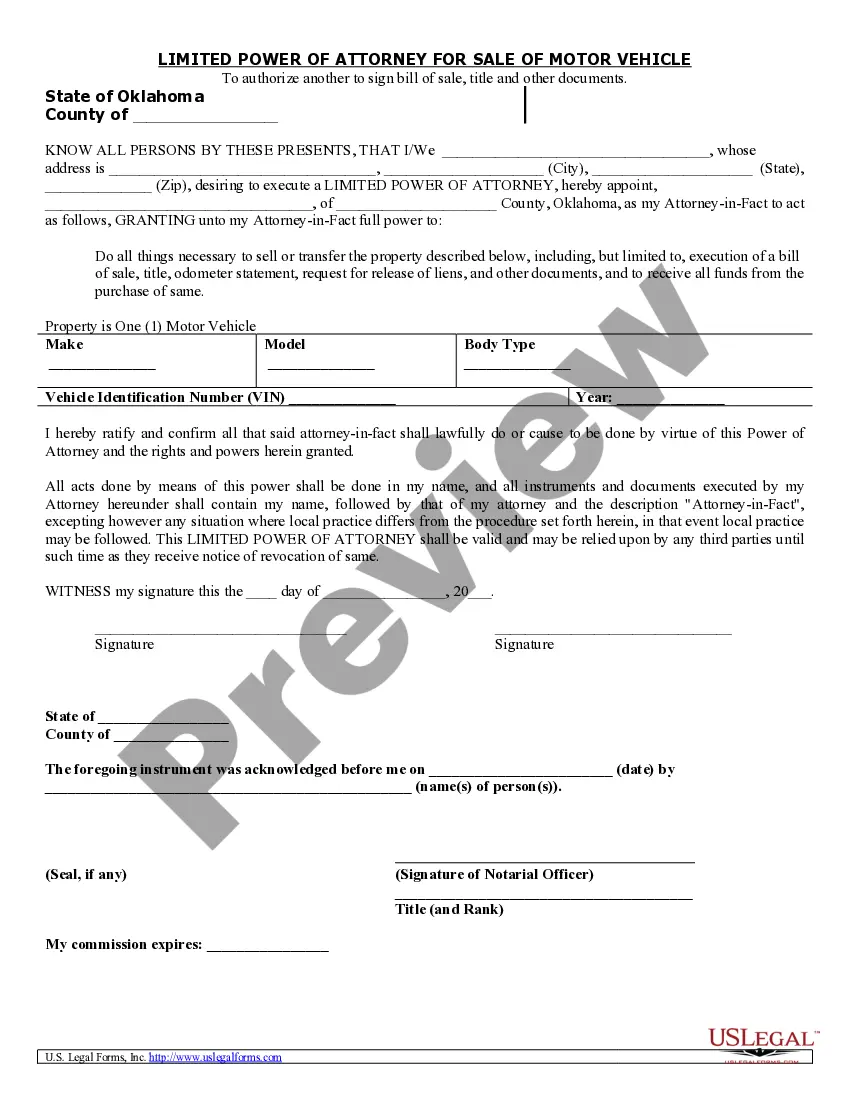

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

If you have created a revocable trust and have appointed someone else as trustee, you will have to request the cash withdrawal from the person you appointed as the trustee. However, the trustee has a fiduciary duty to administer the trust for your benefit while you are alive.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Its primary purpose is to avoid probate court, since revocable living trusts do not reduce estate taxes. With a revocable trust, your assets will not be protected from creditors looking to sue.With this kind of trust, assets are more protected from creditors.