Master Lease Agreement

Definition and meaning

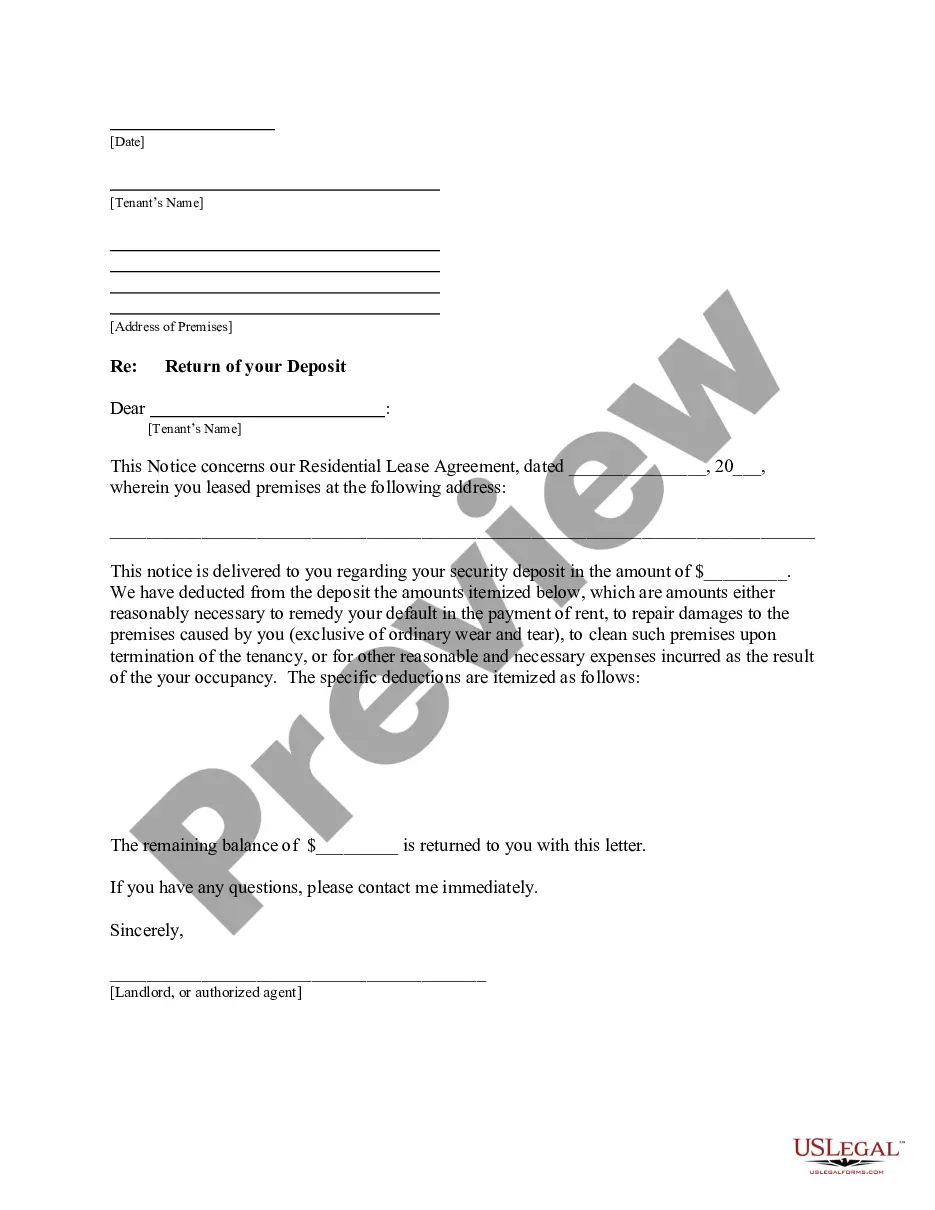

A Master Lease Agreement is a comprehensive legal document that outlines the terms and conditions under which one party (the lessee) leases property from another party (the lessor). This type of lease typically involves multiple sub-leases, allowing the lessee to lease the property to other tenants while retaining the overall responsibility for the property.

Key components of the form

The Master Lease Agreement includes several critical elements:

- Parties Involved: Identification of the lessor and lessee, including their legal names and addresses.

- Property Description: Detailed information about the leased premises, including location and intended use.

- Term and Rent: Length of the lease and the rent amount, payment schedule, and any late fee provisions.

- Obligations of Lessee and Lessor: Responsibilities for property management, maintenance, and upkeep.

- Termination and Extensions: Conditions under which the agreement can be terminated or extended.

How to complete a form

When filling out a Master Lease Agreement, consider the following steps:

- Enter the date of the agreement.

- Fill in the names and addresses of the lessee and lessor.

- Provide a detailed description of the property being leased.

- Specify the lease term and the rental payment amount.

- Outline the obligations of both parties and terms for potential termination or extension.

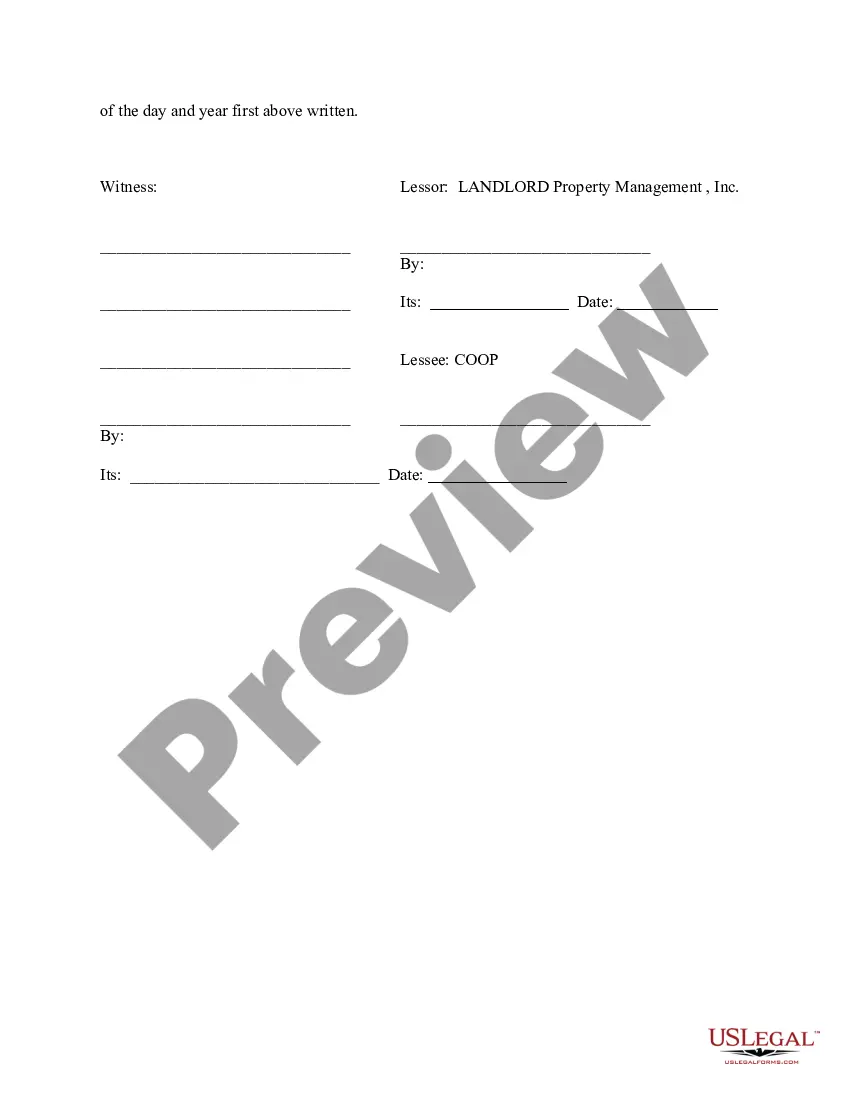

- Sign and date the agreement, ensuring all parties have copies.

Legal use and context

The Master Lease Agreement is commonly used in commercial real estate transactions, where property owners allow leaseholders to manage and sublet the premises. This agreement is particularly beneficial in settings like multi-family properties or commercial complexes, enabling flexible arrangements for property management.

Who should use this form

This form should be utilized by:

- Property owners looking to lease their space while retaining some control over its use.

- Individuals or companies interested in leasing properties to manage subleases.

- Non-profit organizations that require leased space for operational purposes.

Common mistakes to avoid when using this form

To ensure the effectiveness of the Master Lease Agreement, avoid these common pitfalls:

- Failing to clearly define terms, which can lead to misunderstandings.

- Not specifying maintenance responsibilities, causing disputes later.

- Overlooking state-specific regulations that may affect the lease terms.

- Neglecting to keep signed copies with all involved parties.

Form popularity

FAQ

What is Master Leasing? A master lease is a type of lease that gives the lessee the right to control and sublease the property during the lease, while the owner retains the legal title. In this case, a housing authority or service provider would be the lessee, allowing them to sublease the property to its clients.

A Master Lease makes it easier on business owners as they will only have to pay one lease invoice every month, and have consolidated itemized billing. You can purchase new equipment within the allotted timeframe without having to go through the underwriting process more than once.

Advantages Lower monthly payments. Little or no down payment. More expensive car for less money. More cash available for other purchases. Sales taxes paid over term of lease. Possible tax benefits - check with your accountant.

A master lease is an agreement where a property manager (PM) leases a building from an owner for a negotiated price and then subleases the building to other tenants.

A master lease agreement is legal document where you lease an income-producing property as a single tenant-landlord and sublease to two or more tenants to produce income. One common example are shopping malls, which have many stores renting space from one landlord.

From a landlord's perspective, master leases carry at least two additional risks ? the bankruptcy of the master tenant and a potential re-characterization of the master lease as a guaranty.

A master lease in real estate is an agreement where you lease an income-producing property as a single tenant and then sublease it to occupant tenants to get rental income. Under the master lease option, the owner of the property will have no other responsibilities for the property.