Escrow Agreement - Long Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Overview of Escrow Agreement Long Form

An Escrow Agreement Long Form is a detailed legal document that outlines the terms and conditions under which property or money is held by a third party, the escrow agent, until specific conditions are met. This type of agreement is particularly critical in transactions involving large sums or complex arrangements.

Key Elements of an Escrow Agreement Long Form

- Duties of the Escrow Agent: Specifies the responsibilities and obligations of the escrow agent.

- Conditions for Release of Funds: Details the circumstances under which the escrow agent can release the funds or property.

- Liability Clauses: Defines the extent of liability for each party involved in the escrow.

- Duration of the Agreement: States the time period during which the agreement will be active.

Step-by-Step Guide to Creating an Escrow Agreement Long Form

- Determine the transaction requirements and identify all parties involved.

- Appoint a neutral third-party as the escrow agent.

- Agree upon the terms such as the amount of funds, conditions for release, and duties of the escrow agent.

- Draft the agreement including all legal requirements and conditions.

- Have all parties review and sign the agreement.

- Execute the agreement by depositing the funds or property with the escrow agent.

Risk Analysis of Using Long Form Escrow Agreements

- Legal Disputes: Poorly drafted agreements can lead to misunderstandings and legal disputes between the parties involved.

- Delay in Transaction: Strict conditions can sometimes delay the progress of transactions if not met timely.

- Third-Party Risks: Dependence on the honesty and efficiency of the escrow agent.

Comparative Analysis of Long Form Vs. Short Form Escrow Agreements

| Feature | Long Form Agreement | Short Form Agreement |

|---|---|---|

| Detail Level | Highly detailed covering all aspects extensively | General, covering only the essential aspects |

| Duration | Usually longer to allow for complex requirements | Shorter, suitable for simpler transactions |

| Suitability | Ideal for complex and high-value transactions | Best for smaller or less complex deals |

How to fill out Escrow Agreement - Long Form?

Aren't you sick and tired of choosing from hundreds of templates every time you require to create a Escrow Agreement - Long Form? US Legal Forms eliminates the wasted time an incredible number of American people spend browsing the internet for suitable tax and legal forms. Our skilled team of lawyers is constantly modernizing the state-specific Templates collection, to ensure that it always offers the proper files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have a subscription should complete a few simple steps before having the ability to download their Escrow Agreement - Long Form:

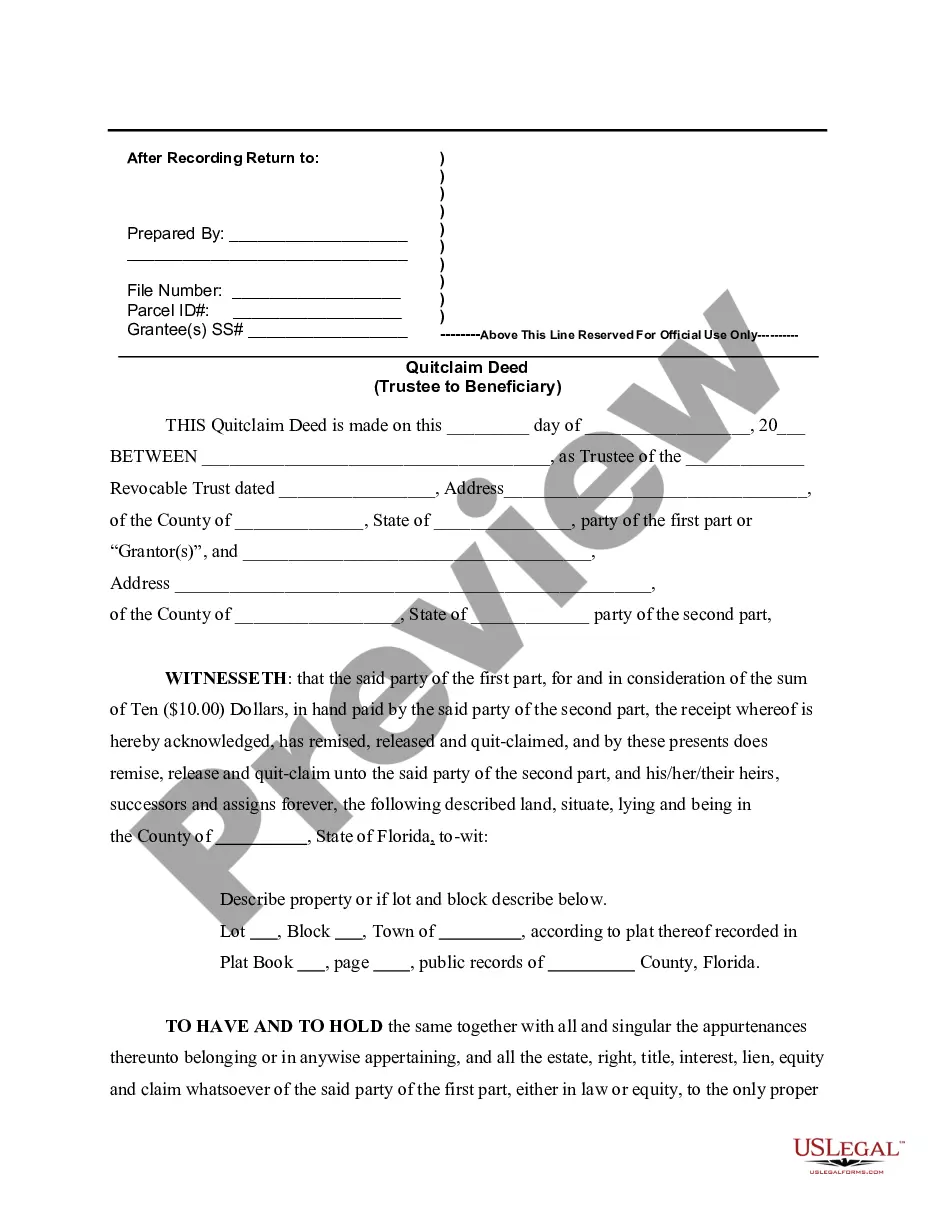

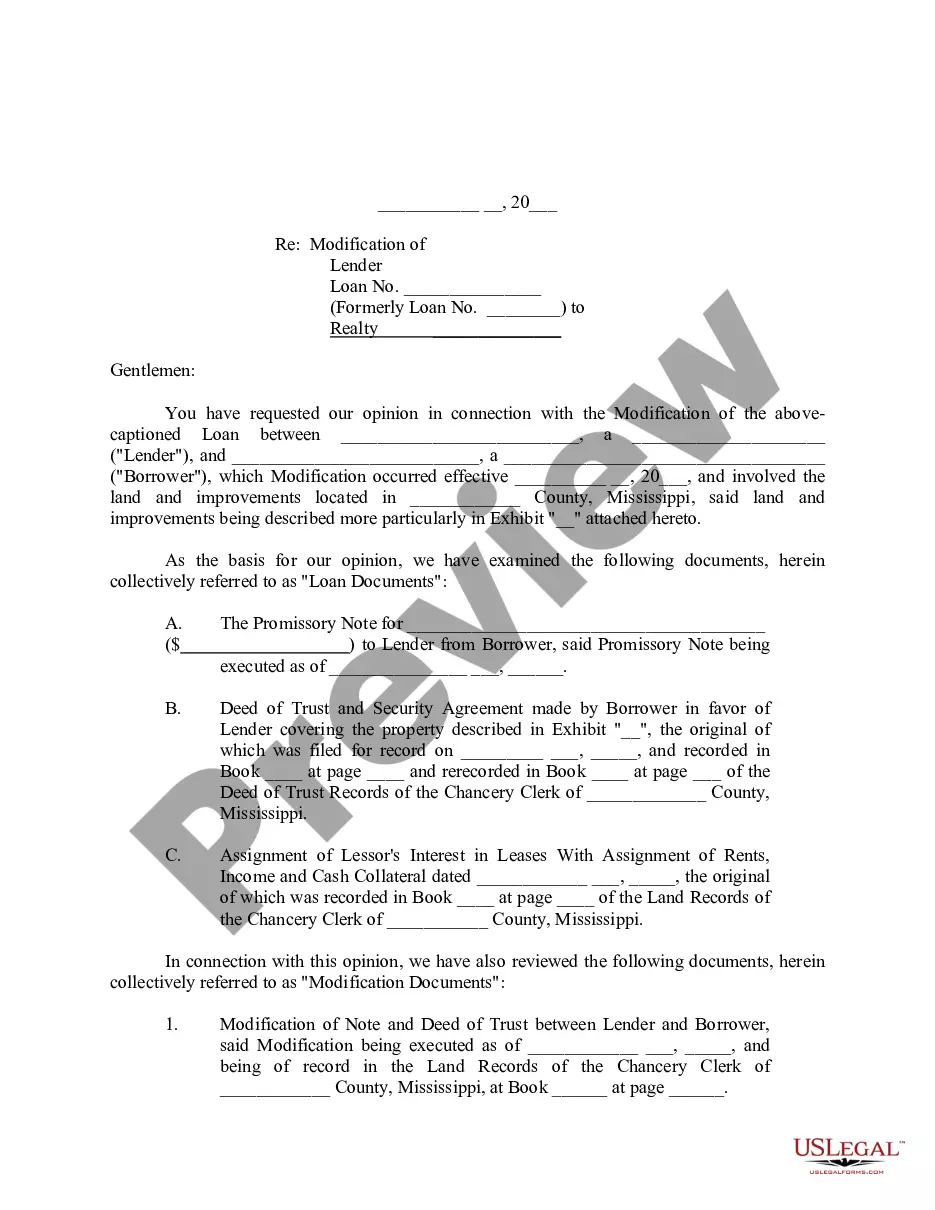

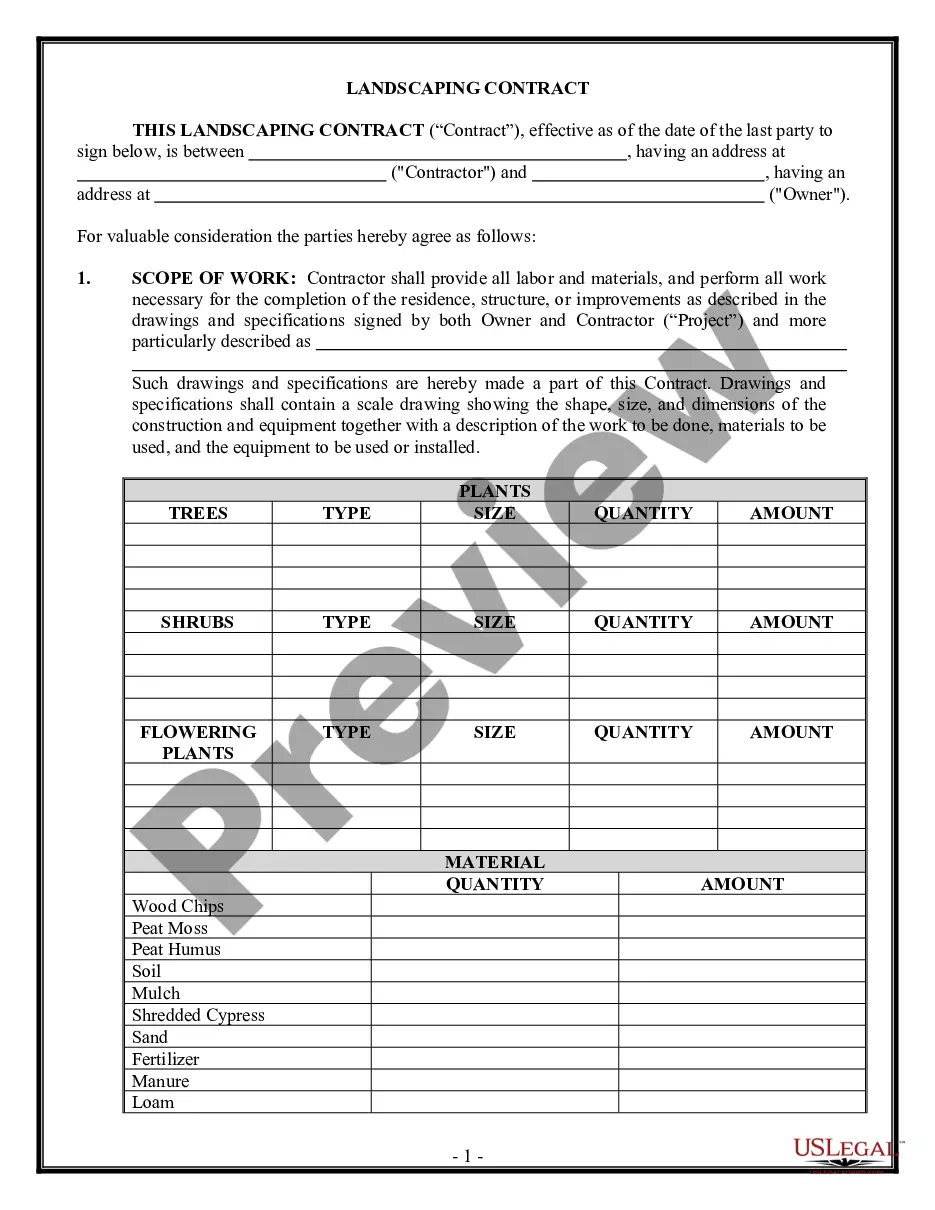

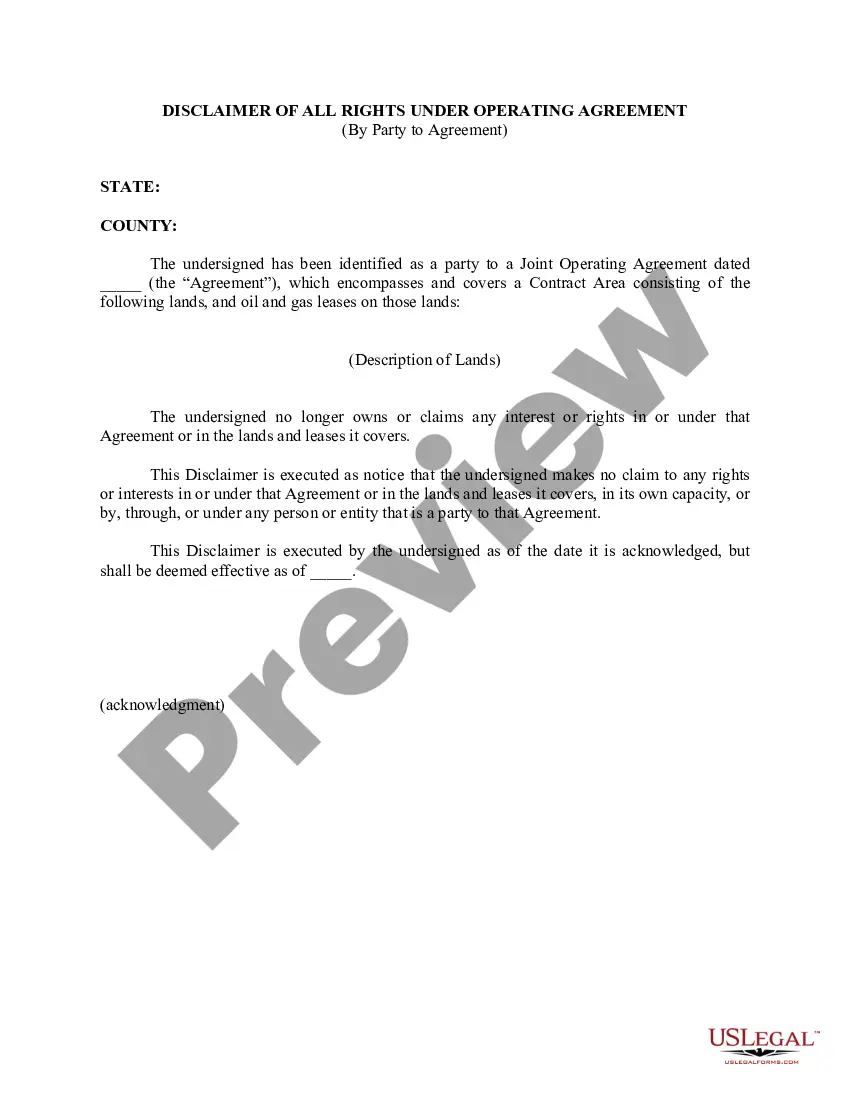

- Make use of the Preview function and read the form description (if available) to make certain that it is the best document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct template for your state and situation.

- Make use of the Search field at the top of the site if you need to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your sample in a convenient format to complete, create a hard copy, and sign the document.

After you’ve followed the step-by-step guidelines above, you'll always have the ability to sign in and download whatever document you need for whatever state you want it in. With US Legal Forms, completing Escrow Agreement - Long Form templates or other official files is not difficult. Get started now, and don't forget to look at your examples with certified lawyers!

Form popularity

FAQ

In financial transactions, the term "in escrow" indicates a temporary condition of an item, such as money or property, that has been transferred to a third party. This transfer is usually done on behalf of a buyer and seller.Valuables held in escrow can include real estate, money, stocks, and securities.

An escrow agreement is a contract that outlines the terms and conditions between parties involved, and the responsibility of each. Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met.

Escrow is a legal arrangement in which a third party temporarily holds large sums money or property until a particular condition has been met (e.g., the fulfillment of a purchase agreement).

An escrow service is a third party contractor that will agree to facilitate a transaction between a buyer and seller.They point out that this option can be provided more cheaply than a letter of credit and that it ensures the seller does not bear the same risk as in open account trade.

A Definition. Escrow is a legal arrangement in which a third party temporarily holds large sums money or property until a particular condition has been met (e.g., the fulfillment of a purchase agreement).

Each month, the lender deposits the escrow portion of your mortgage payment into the account and pays your insurance premiums and real estate taxes when they are due. Your lender may require an escrow cushion, as allowed by state law, to cover unanticipated costs, such as a tax increase.

Include your name, home address, and mortgage account number. Identify the error. Tell your servicer exactly what error you believe occurred. Do not write your letter on your payment coupon or other payment form you get from your servicer. Send the letter to the proper address.

Your mortgage lender or servicer is allowed to collect the amount of your homeowners insurance and property tax payments, plus a cushion, month in and month out, in escrow. While it's nice to not have to think about making these payments, this pro can be a con for savers who may be able to put the funds to better use.

So, while a "typical" escrow is 30 days, they can go from one week to many weeks. A: The length of an escrow can vary widely depending upon the terms agreed upon by the parties.