Texas Lease Purchase Report Form 2

What this document covers

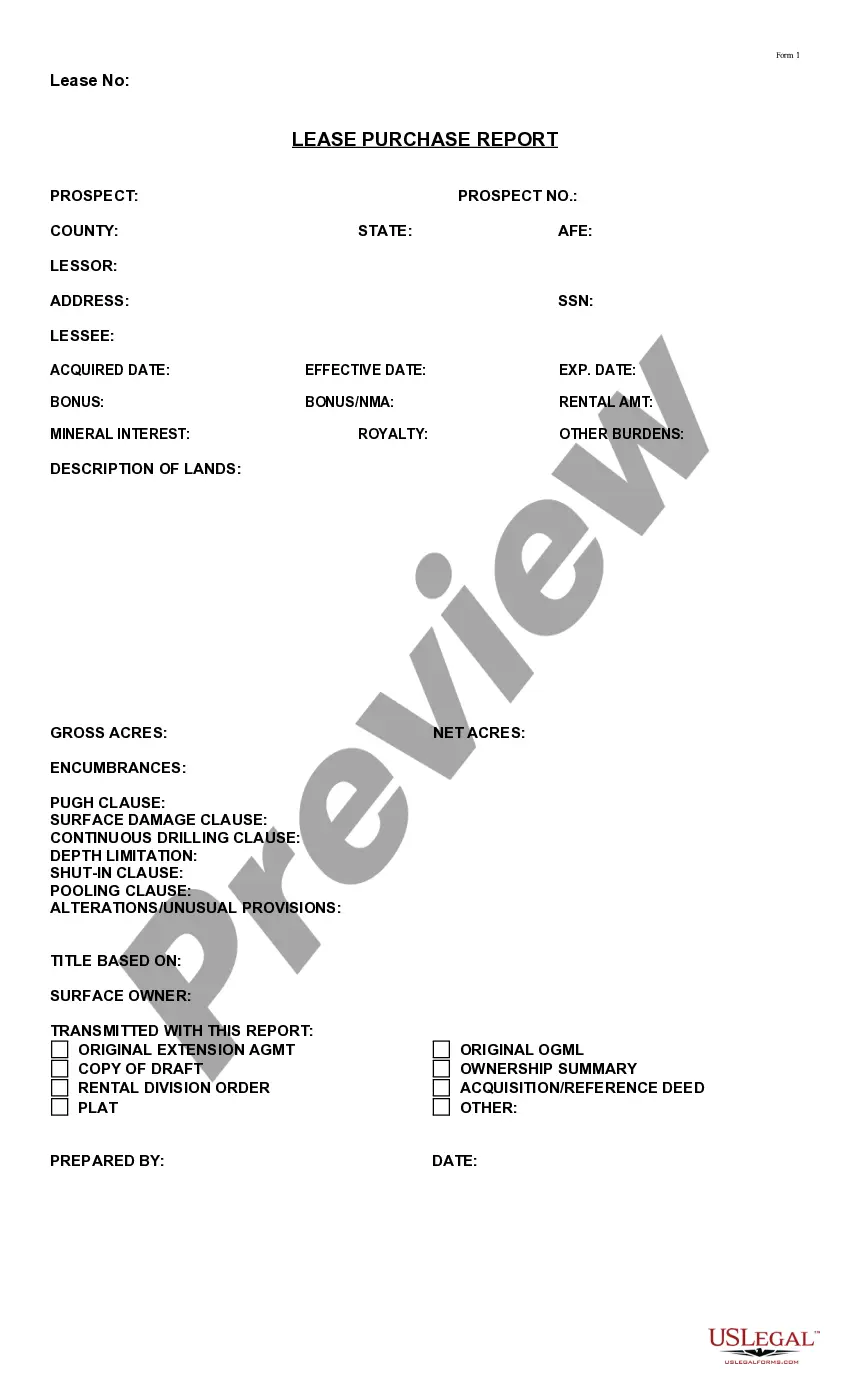

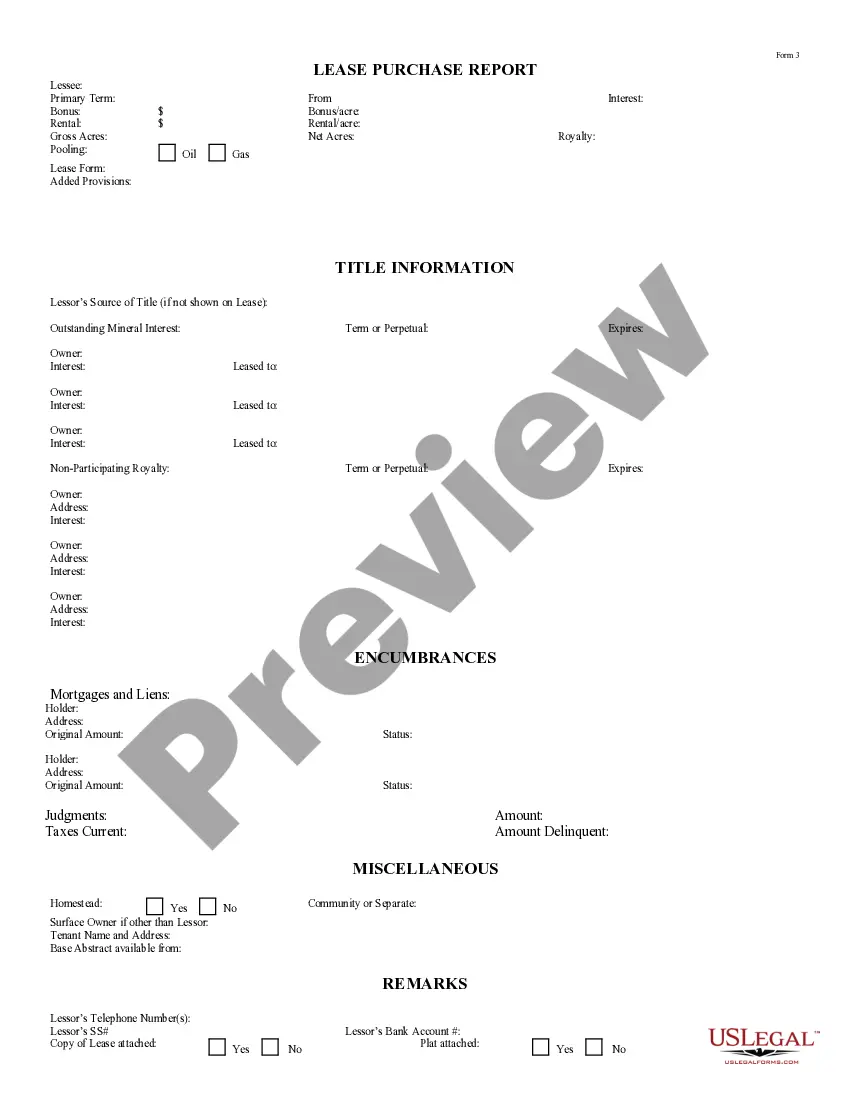

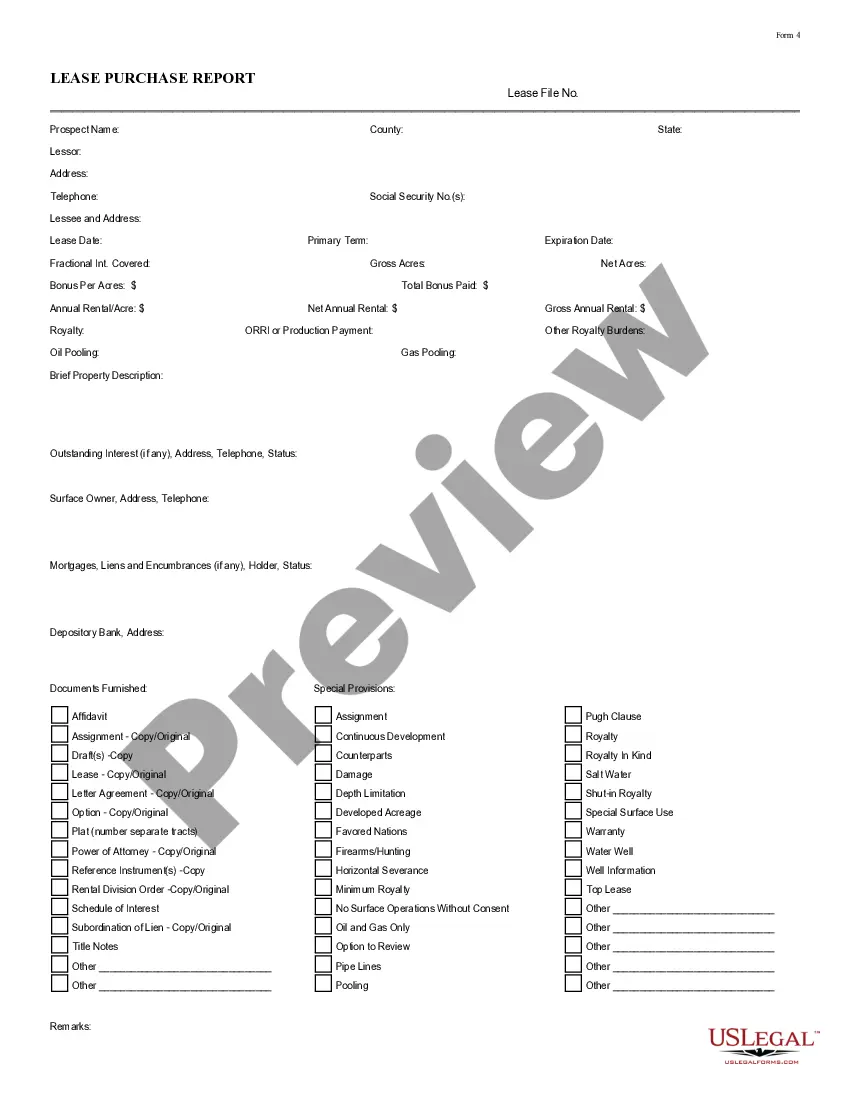

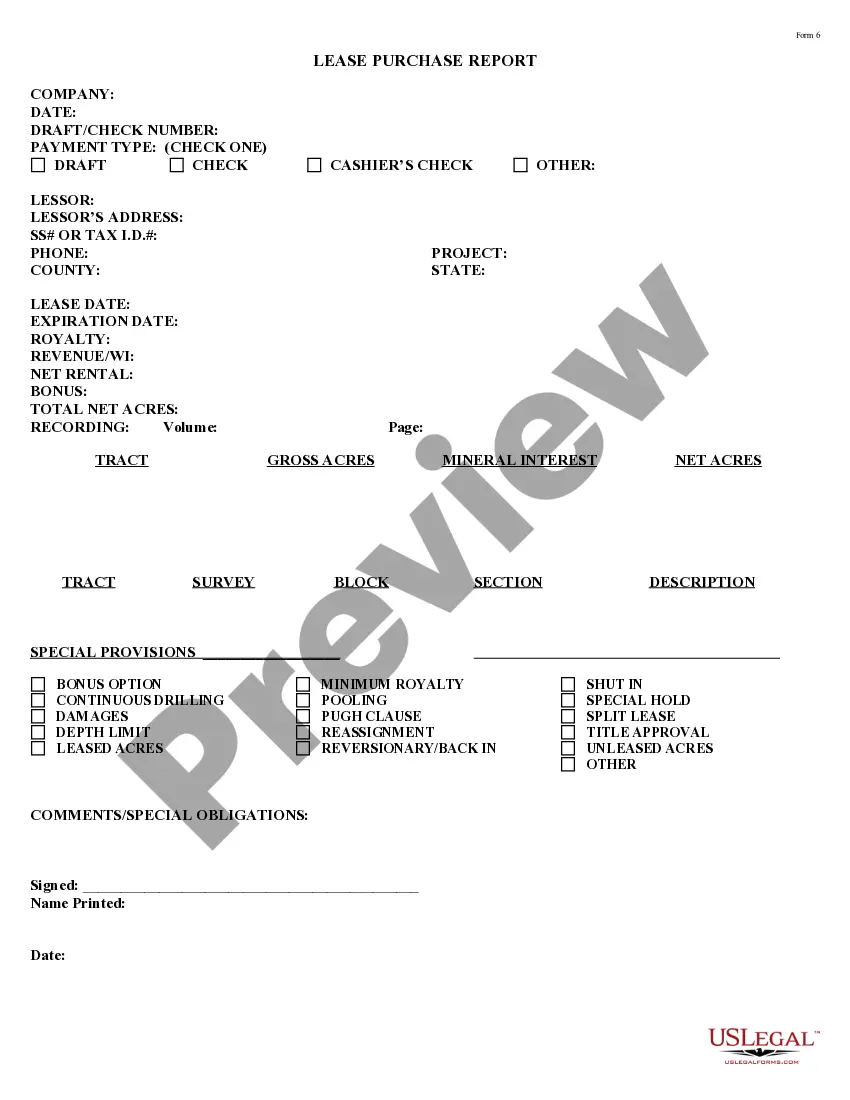

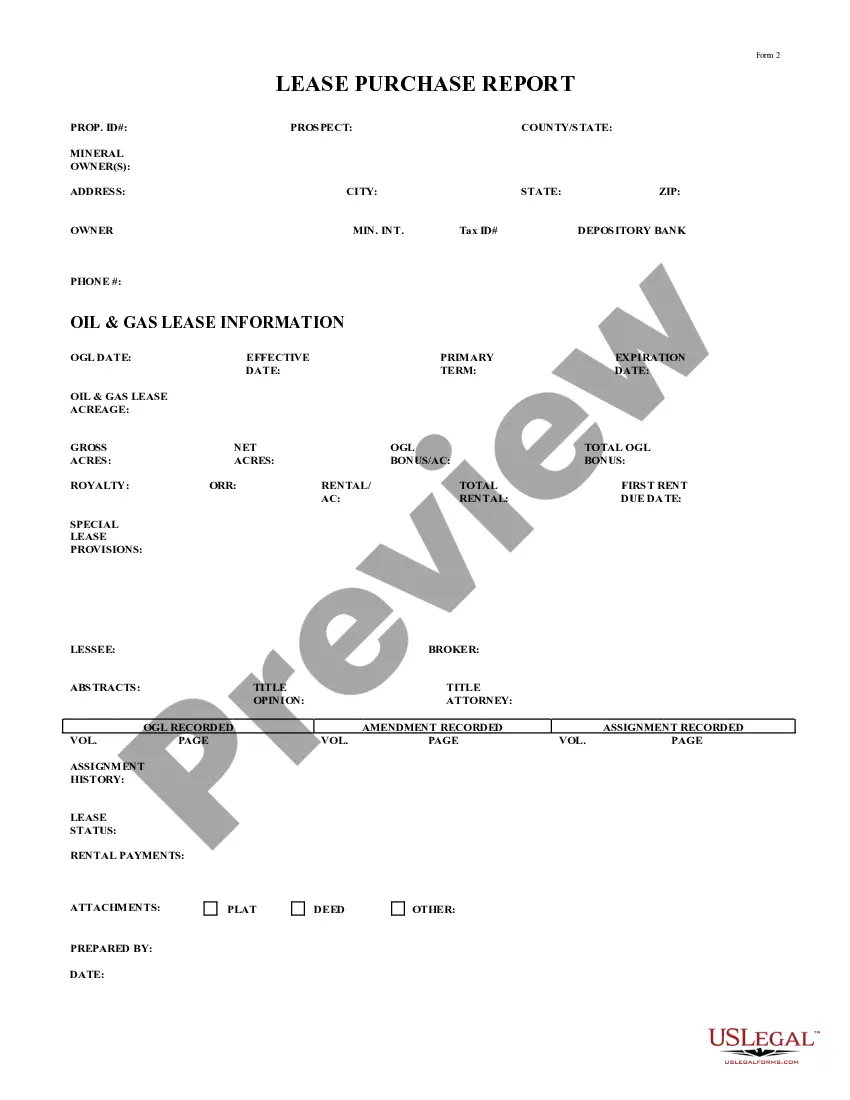

The Lease Purchase Report Form 2 is a document used in the oil, gas, and minerals sectors to record the essential details of sellers and purchasers involved in a lease agreement. This form documents the legal obligations to sell and purchase real property during or at the end of the lease term. It specifically captures information related to oil and gas leases, differentiating it from general real estate purchase agreements.

Form components explained

- Property identification including prospect and county/state details.

- Information about mineral owners and their respective addresses.

- Tax ID details and bank information for financial transactions.

- Comprehensive oil and gas lease information, including dates and terms.

- Details on acreage and bonuses related to the oil and gas leases.

- Section for lease status and rental payment details.

When to use this form

This form is essential when entering a legal agreement to buy or sell mineral rights or properties within the oil and gas sector. Use it when you need to document the critical details of a lease purchase at the end of a lease term or during an active lease, ensuring all parties understand their rights and obligations.

Intended users of this form

- Mineral owners wishing to sell their rights.

- Purchasers interested in acquiring mineral rights or oil and gas leases.

- Real estate professionals managing transactions in the oil and gas sector.

Completing this form step by step

- Identify the property by entering the property identification details and location.

- Complete the seller and purchaser information, including names, addresses, and tax identification details.

- Fill in the oil and gas lease information, including important dates and lease terms.

- Document the details regarding acreage, bonuses, and royalties associated with the lease.

- Sign and date the form to ensure all parties acknowledge the agreement.

Notarization requirements for this form

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include all necessary parties' information.

- Omitting key dates that impact the lease agreement.

- Not verifying jurisdiction-specific requirements.

- Using outdated information regarding the property or lease terms.

Why complete this form online

- Convenience of downloading and filling the form at your own pace.

- Editable fields to customize according to specific transaction details.

- Access to attorney-drafted templates, ensuring legal reliability.

Summary of main points

- The Lease Purchase Report Form 2 is essential for documenting oil and gas property transactions.

- Accuracy in completing the form is critical to ensure all parties' legal obligations are understood.

- Online access to the form enhances convenience and compliance with legal standards.

Looking for another form?

Form popularity

FAQ

Verbal contracts in Texas are legally binding and enforceable, provided they meet certain legal requirements like specificity and adequate consideration. A consideration is said to be adequate if either: It involves mutual exchange between the parties (after having bargained for it) It has a legal value.

The difference between a lease option and lease purchase agreement is that the lease option only obligates the seller to sell. A lease purchase agreement commits both parties to the sale barring breach of contract or the buyer's inability to secure a mortgage.

A lease-option-to-buy arrangement can be a solution for some potential homebuyers, but it's not right for everyone. If you're not certain that you're going to be able to purchase the rental home at the end of the lease period, you might be better served with a standard rental agreement.

Make no mistake, one can still do a lease-option in Texas, but many requirements now exist that did not apply before 2005. Property Code Sections 5.069 and 5.070 contain a number of these requirements, which must be met before the executory contract is signed by the purchaser (i.e., before and not at closing).

Rent-to-own agreements include a standard lease agreement and also an option to buy the property at a later time. Lease-option contracts give you the right to buy the home when the lease expires, while lease-purchase contracts require you to buy it.

"Contracts for Deed" - Contracts for deed, sometimes referred to as "rent to own" financing arrangements, are legal in Texas.Under a contract for deed, the buyer only has an equity interest after they have paid 40% of the loan or more, or have made 48 monthly payments.

What is a lease-option-to-buy? A lease-option is a contract in which a landlord and tenant agree that, at the end of a specified period, the renter can buy the property. The tenant pays an up-front option fee and an additional amount each month that goes toward the eventual down payment.

No, lease agreements do not need to be notarized in Texas. Signatures on the lease do not need to be witnessed.

In general, option fees are non-refundable.If you want to demand a refund to an option fee, you may choose to ask the seller to apply the amount to closing.