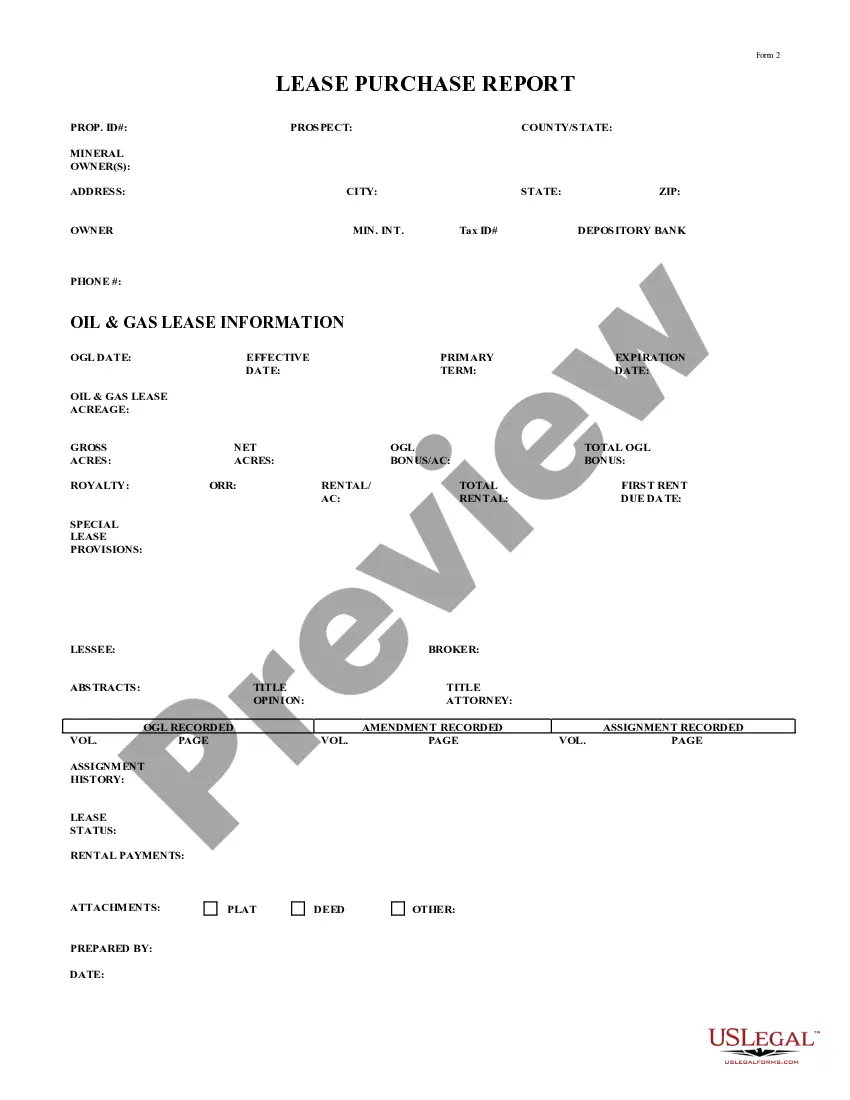

Texas Lease Purchase Report Form 2

Understanding this form

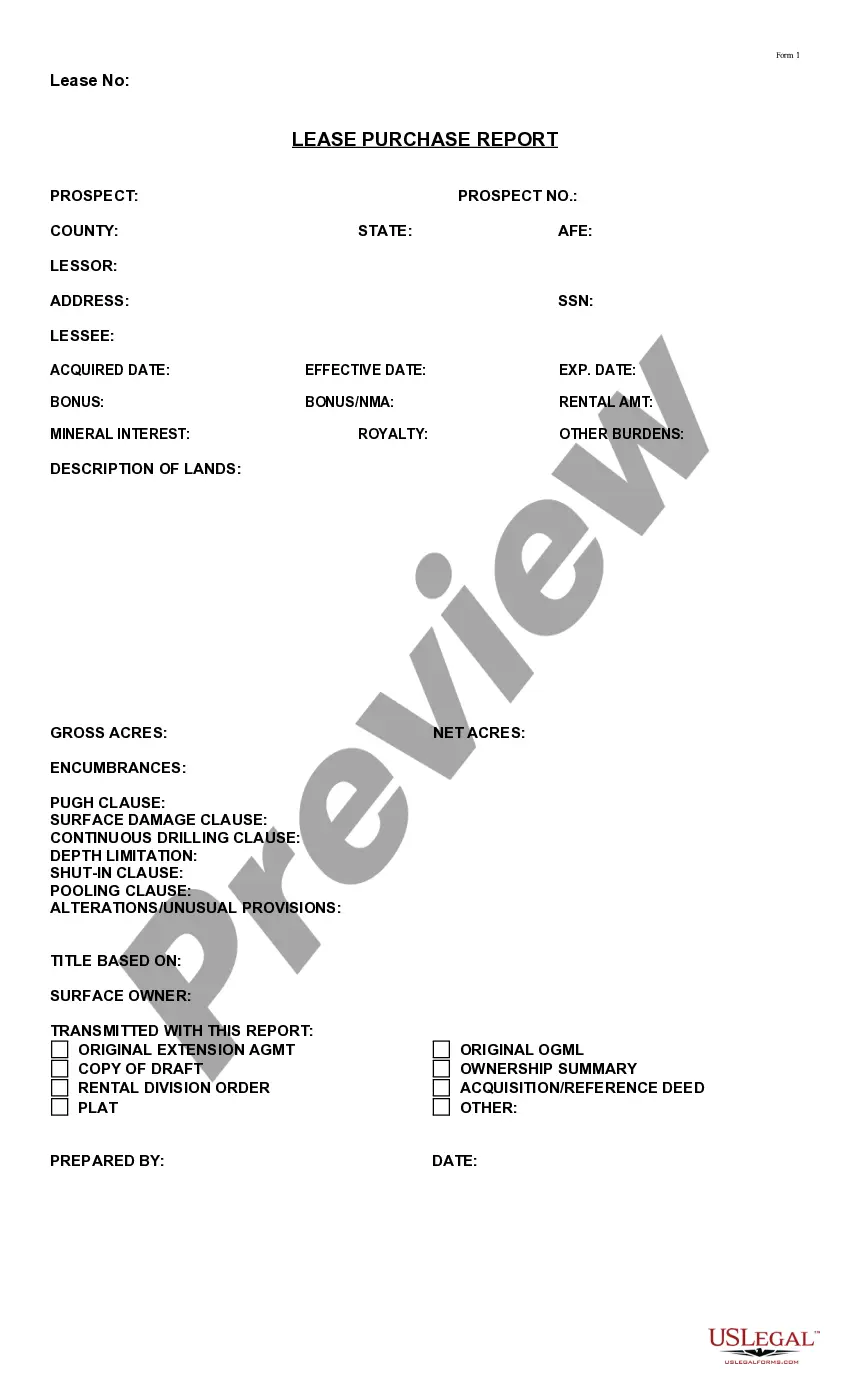

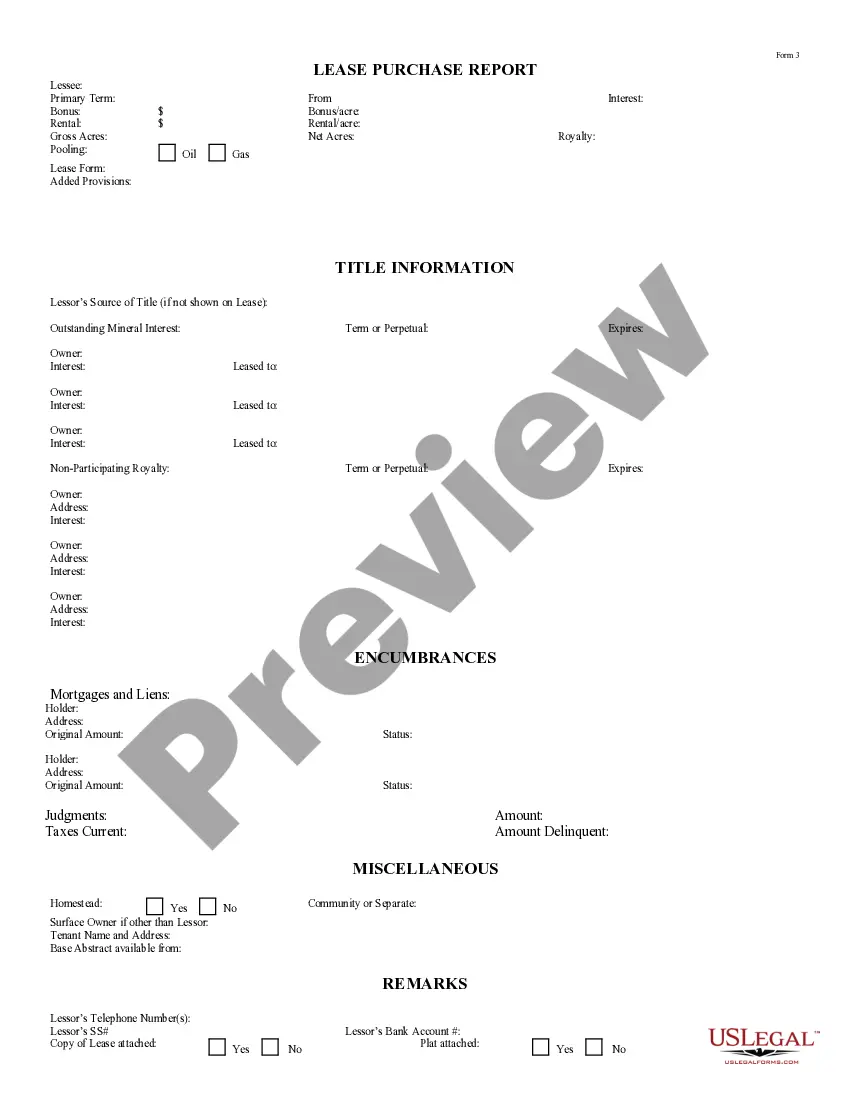

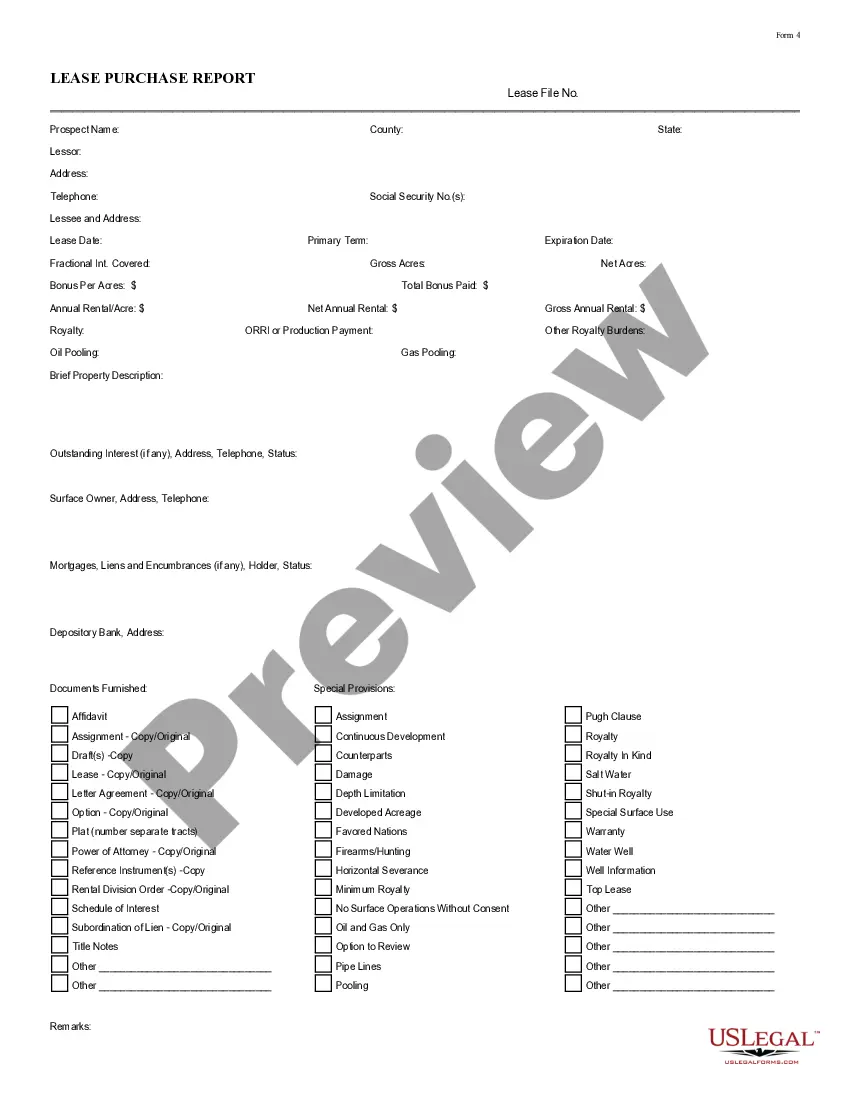

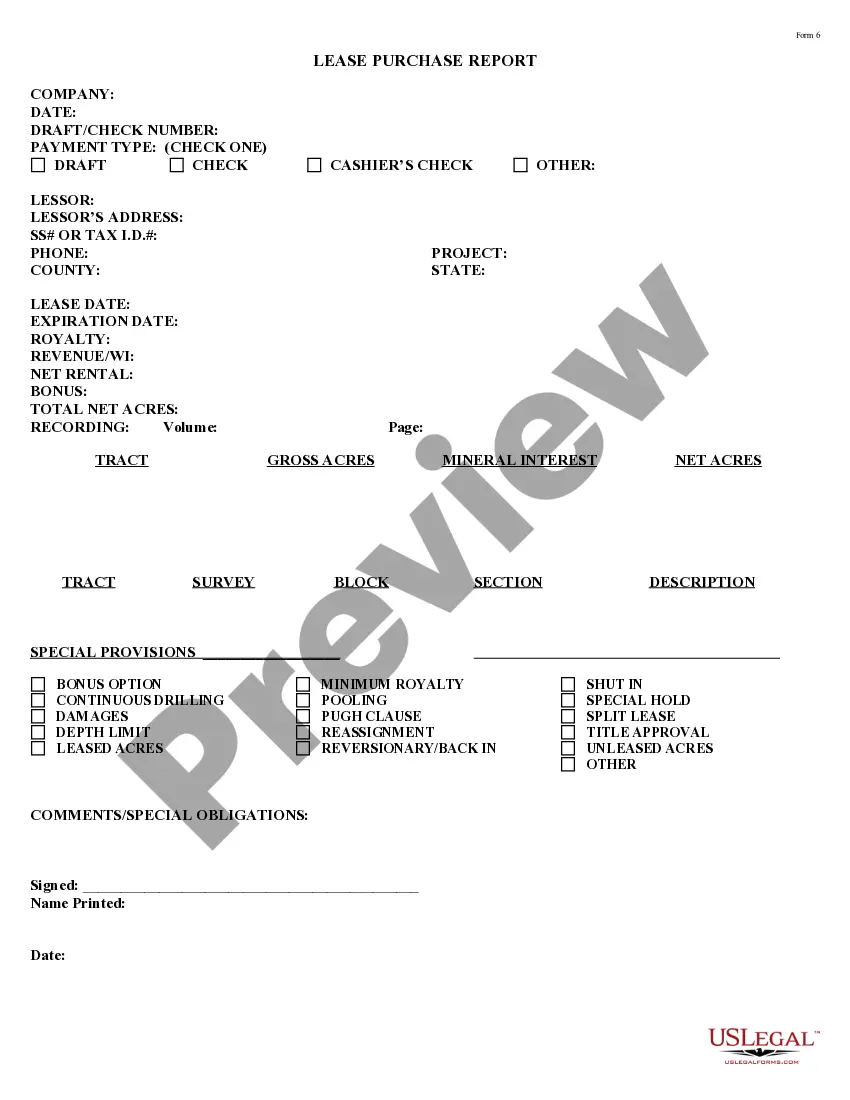

The Lease Purchase Report Form 2 is a legal document used to formally record essential information about the sellers and purchasers involved in the lease of oil, gas, and mineral properties. This form serves as a framework for the obligations set during a lease term, distinguishing itself from other real estate forms by its focus on lease-related transactions specifically within the oil and gas industry.

Form components explained

- Property identification details including ID and location

- Information on mineral owners with addresses and tax ID

- Specific oil and gas lease details including effective dates and terms

- Overview of rental payment structures and special lease provisions

- Attachments for plat, deed, and other pertinent documents

- Lease status and assignment history records

When to use this form

This form is utilized when entering into a legally binding agreement to sell and purchase oil, gas, or mineral rights during a lease period or at its expiration. It's important for parties involved in oil and gas transactions to clearly document the terms and details outlined in this report to avoid misunderstandings or disputes in the future.

Intended users of this form

- Individuals or companies involved in the sale or purchase of mineral rights

- Landowners leasing their property for oil and gas extraction

- Investors looking to acquire rights in oil and gas holdings

- Lawyers and legal professionals managing lease agreements

How to prepare this document

- Identify the property by entering the property ID and address information.

- List the mineral owners' details, including names, addresses, and tax IDs.

- Document the lease information, specifying start and expiration dates.

- Detail the rental agreement sections, including amounts and payment schedules.

- Attach necessary documents such as plats or deeds for reference.

Does this form need to be notarized?

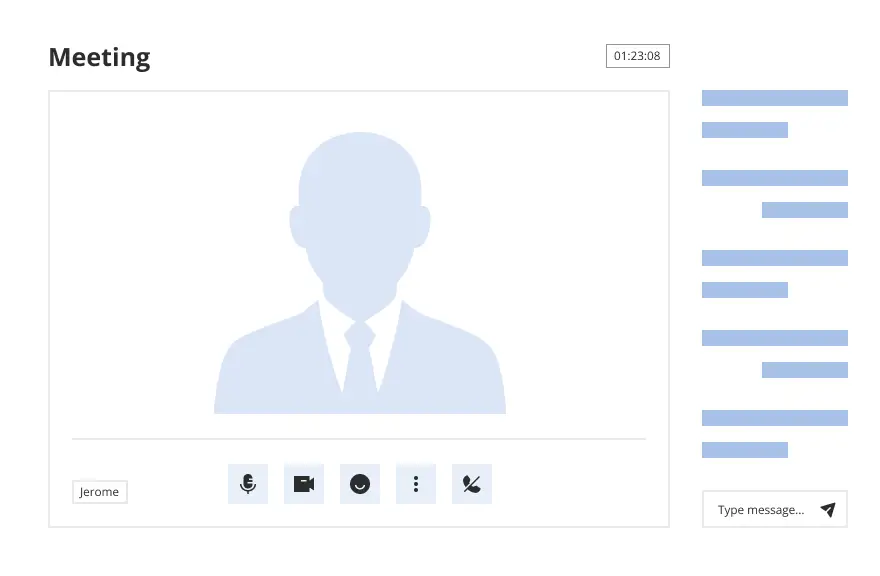

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

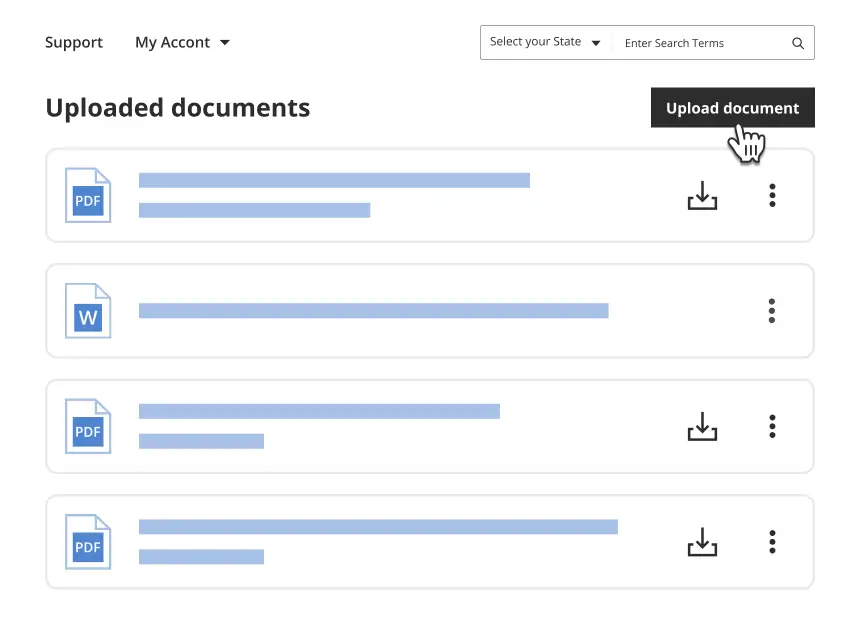

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide accurate property identification details.

- Omitting important dates related to the lease term.

- Not including all required attachments such as legal descriptions.

- Neglecting to update the form when assignments or amendments occur.

Why use this form online

- Convenient access from any device, allowing for easy completion and storage.

- Editable fields for personalized information and adjustments.

- Generated by licensed attorneys to ensure legal compliance and validity.

Summary of main points

- The Lease Purchase Report Form 2 is essential for documenting oil and gas property transactions.

- Accuracy in completing the form is critical to ensure all parties' legal obligations are understood.

- Online access to the form enhances convenience and compliance with legal standards.

Looking for another form?

Form popularity

FAQ

Verbal contracts in Texas are legally binding and enforceable, provided they meet certain legal requirements like specificity and adequate consideration. A consideration is said to be adequate if either: It involves mutual exchange between the parties (after having bargained for it) It has a legal value.

The difference between a lease option and lease purchase agreement is that the lease option only obligates the seller to sell. A lease purchase agreement commits both parties to the sale barring breach of contract or the buyer's inability to secure a mortgage.

A lease-option-to-buy arrangement can be a solution for some potential homebuyers, but it's not right for everyone. If you're not certain that you're going to be able to purchase the rental home at the end of the lease period, you might be better served with a standard rental agreement.

Make no mistake, one can still do a lease-option in Texas, but many requirements now exist that did not apply before 2005. Property Code Sections 5.069 and 5.070 contain a number of these requirements, which must be met before the executory contract is signed by the purchaser (i.e., before and not at closing).

Rent-to-own agreements include a standard lease agreement and also an option to buy the property at a later time. Lease-option contracts give you the right to buy the home when the lease expires, while lease-purchase contracts require you to buy it.

"Contracts for Deed" - Contracts for deed, sometimes referred to as "rent to own" financing arrangements, are legal in Texas.Under a contract for deed, the buyer only has an equity interest after they have paid 40% of the loan or more, or have made 48 monthly payments.

What is a lease-option-to-buy? A lease-option is a contract in which a landlord and tenant agree that, at the end of a specified period, the renter can buy the property. The tenant pays an up-front option fee and an additional amount each month that goes toward the eventual down payment.

No, lease agreements do not need to be notarized in Texas. Signatures on the lease do not need to be witnessed.

In general, option fees are non-refundable.If you want to demand a refund to an option fee, you may choose to ask the seller to apply the amount to closing.