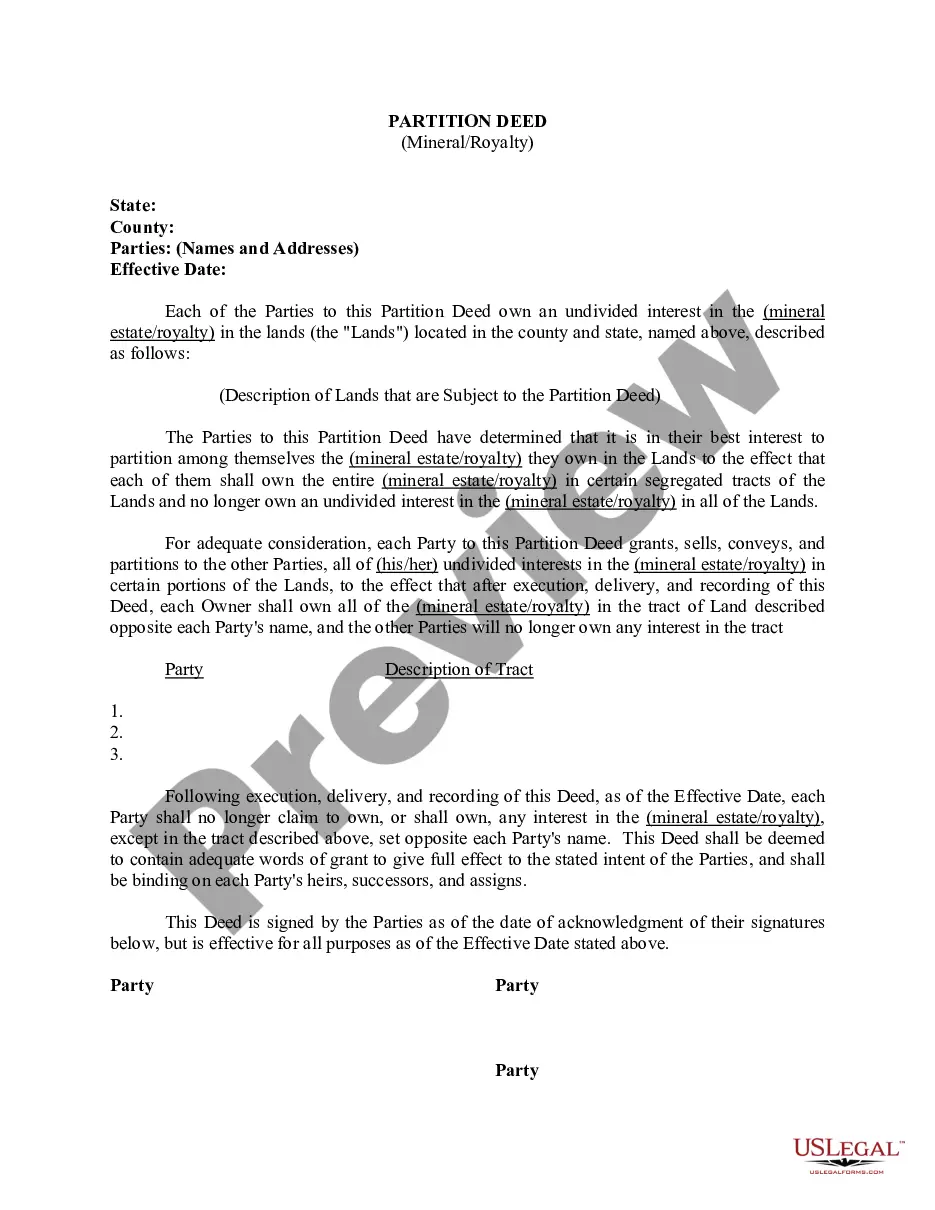

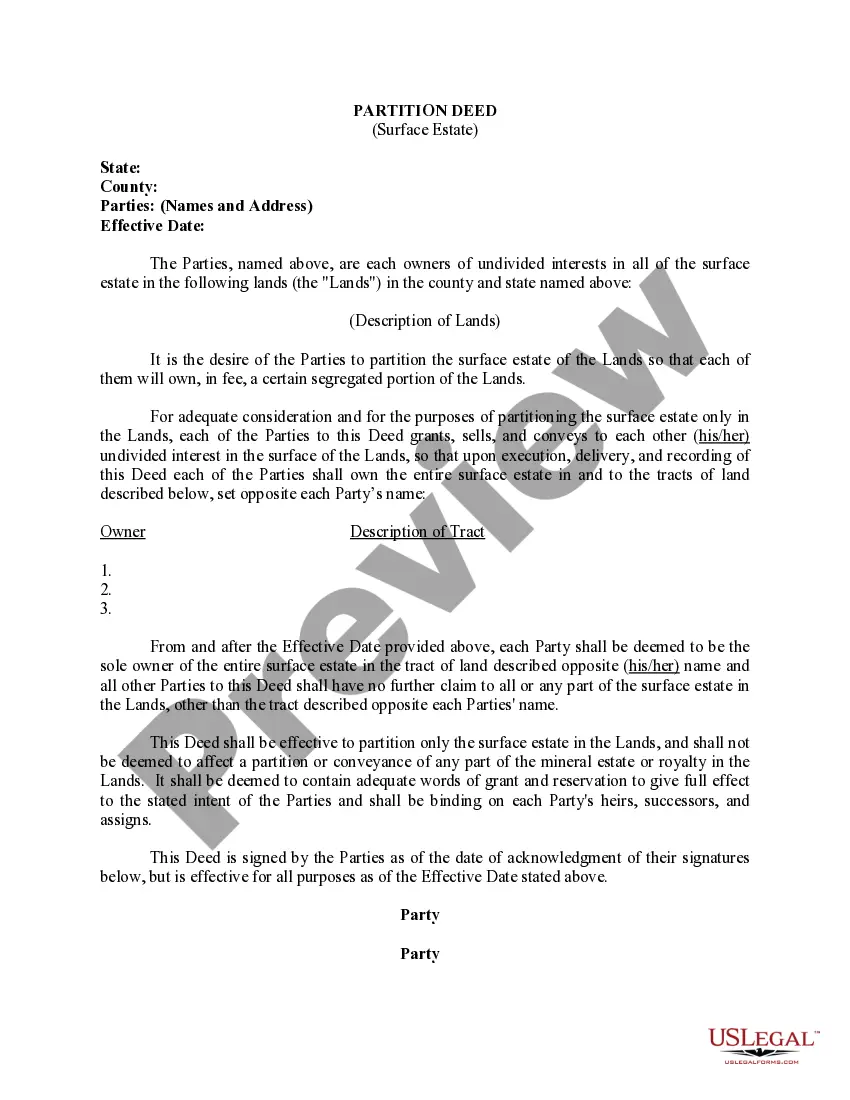

Tennessee Partition Deed for Mineral / Royalty Interests

Description

How to fill out Partition Deed For Mineral / Royalty Interests?

If you have to full, acquire, or print authorized document themes, use US Legal Forms, the biggest selection of authorized varieties, that can be found online. Make use of the site`s basic and practical research to discover the paperwork you want. Numerous themes for enterprise and person uses are sorted by groups and says, or keywords. Use US Legal Forms to discover the Tennessee Partition Deed for Mineral / Royalty Interests in just a handful of mouse clicks.

If you are previously a US Legal Forms client, log in in your profile and click on the Down load key to find the Tennessee Partition Deed for Mineral / Royalty Interests. You can also entry varieties you formerly saved inside the My Forms tab of your own profile.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for the right metropolis/nation.

- Step 2. Take advantage of the Review solution to look through the form`s articles. Do not forget to learn the explanation.

- Step 3. If you are unhappy together with the develop, make use of the Look for area at the top of the monitor to get other variations in the authorized develop format.

- Step 4. Upon having located the shape you want, click the Purchase now key. Choose the pricing program you choose and add your credentials to sign up for an profile.

- Step 5. Method the financial transaction. You can use your bank card or PayPal profile to finish the financial transaction.

- Step 6. Select the format in the authorized develop and acquire it on the system.

- Step 7. Comprehensive, modify and print or sign the Tennessee Partition Deed for Mineral / Royalty Interests.

Each authorized document format you get is the one you have permanently. You have acces to every develop you saved within your acccount. Select the My Forms area and pick a develop to print or acquire again.

Contend and acquire, and print the Tennessee Partition Deed for Mineral / Royalty Interests with US Legal Forms. There are millions of skilled and state-distinct varieties you can use to your enterprise or person needs.

Form popularity

FAQ

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

Taxes: The #1 reason for selling mineral rights is taxes. If you inherited mineral rights and then sold them for $100,000, you could pay only $5,250 in taxes and keep $94,750. If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect.

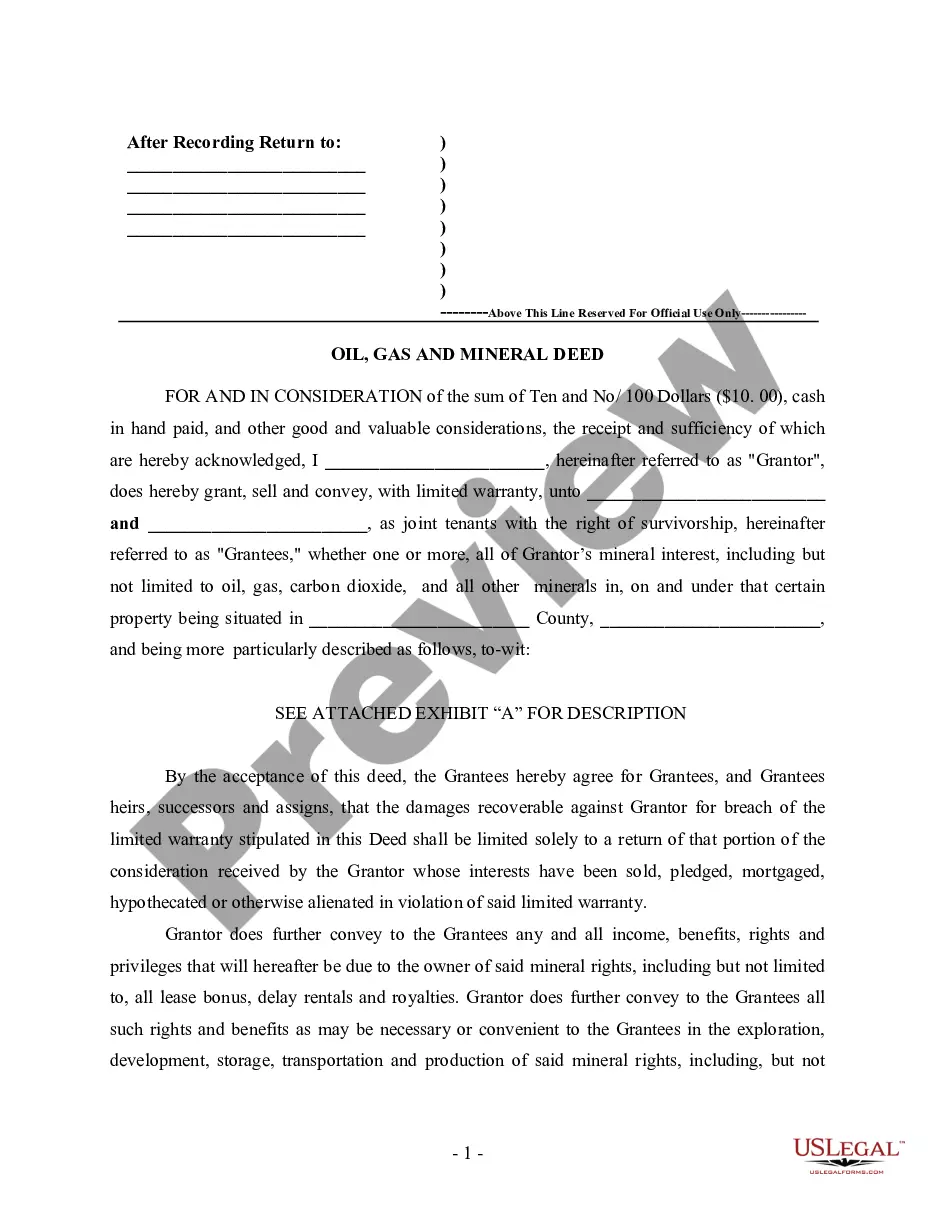

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Mineral Interest (MI) When the mineral rights are conveyed to another person or entity, they are ?severed? from the land, and a separate chain of title begins. When a person owns less than 100% of the minerals, they are said to own a fractional or undivided mineral interest.

Unsolicited purchase offers are happening in greater numbers and for greater ? sometimes much greater ? amounts than in the past. The upshot? Sometimes selling makes good sense. Indeed, depending on your situation, the sale of your mineral rights can represent a prudent ? and even compelling ? opportunity.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

(c) Any interest in coal, oil and gas, and other minerals shall, if unused for a period of twenty (20) years, be extinguished, unless a statement of claim is filed in ance with subsection (d), and the ownership of the mineral interest shall revert to the owner of the surface.