South Carolina Senior Debt Term Sheet

Description

How to fill out Senior Debt Term Sheet?

US Legal Forms - one of several biggest libraries of lawful types in the United States - provides a wide array of lawful papers themes you can down load or produce. Making use of the web site, you can find 1000s of types for enterprise and personal purposes, sorted by categories, states, or keywords.You can get the latest versions of types just like the South Carolina Senior Debt Term Sheet within minutes.

If you currently have a monthly subscription, log in and down load South Carolina Senior Debt Term Sheet through the US Legal Forms collection. The Obtain switch can look on every single type you look at. You get access to all earlier delivered electronically types inside the My Forms tab of the account.

If you would like use US Legal Forms for the first time, listed here are basic guidelines to get you started:

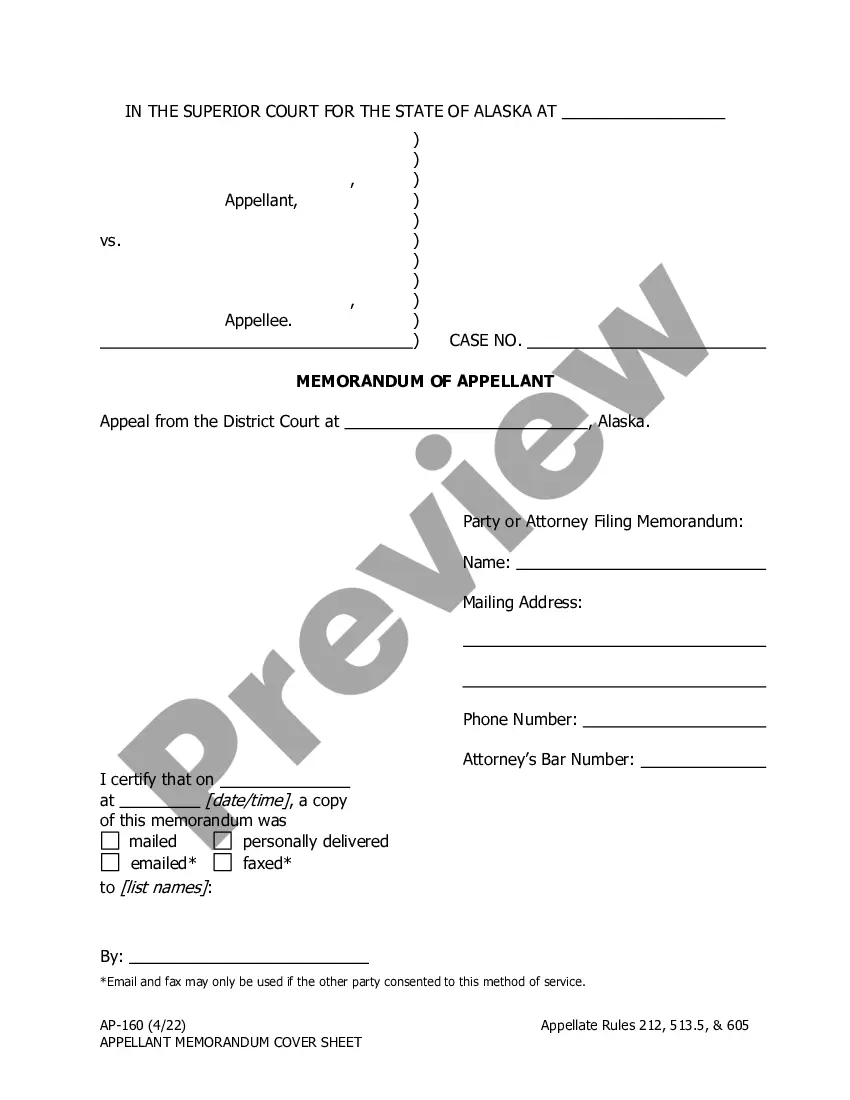

- Be sure to have picked out the proper type for the area/region. Click on the Preview switch to check the form`s information. Browse the type outline to ensure that you have chosen the appropriate type.

- When the type doesn`t fit your needs, utilize the Lookup discipline towards the top of the monitor to find the the one that does.

- When you are pleased with the form, validate your choice by simply clicking the Acquire now switch. Then, select the rates program you favor and supply your credentials to register for the account.

- Procedure the purchase. Make use of charge card or PayPal account to perform the purchase.

- Select the format and down load the form on your system.

- Make modifications. Fill out, modify and produce and sign the delivered electronically South Carolina Senior Debt Term Sheet.

Every design you included in your money lacks an expiry time and it is the one you have permanently. So, if you wish to down load or produce another duplicate, just proceed to the My Forms area and click on on the type you want.

Gain access to the South Carolina Senior Debt Term Sheet with US Legal Forms, one of the most substantial collection of lawful papers themes. Use 1000s of professional and express-particular themes that fulfill your business or personal demands and needs.

Form popularity

FAQ

Venture debt is a term loan typically structured over a four-to-five-year amortization period, usually with a period of time to draw the loan down, such as 9-12 months. Interest-only periods of 3-12 months are common. When is Venture Debt right for your business? | Silicon Valley Bank svb.com ? startup-insights ? when-is-venture... svb.com ? startup-insights ? when-is-venture...

Hear this out loud PauseAfter agreement on the terms has been reached and formalized in a signed term sheet, legal documents (commonly called ?long-form docs? or ?final docs?) are prepared, reviewed, and executed to finalize the investment.

Hear this out loud PauseDon't fixate (too much) on valuation This is one of the most important parts of the term sheet. Depending on the valuation of your startup, venture investors in a Series A round could receive preferred stock equal to anywhere between 20% and 50%, typically, of your company's shares.

Hear this out loud PauseTerm sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.

Elements of a Term Sheet General Information. The top of a term sheet will outline general information such as the company name, investor name, date, and currency of the transaction. Amount. This section provides the amount of funding the investor and investee have tentatively agreed upon. ... Structure. ... Interest Rate. A Complete Venture Debt Term Sheet Walkthrough Flow Capital ? venture-debt-term-sheet Flow Capital ? venture-debt-term-sheet

Hear this out loud PauseANSWER: A Pre-approval differs from Pre-qualification in commercial lending in that the ?Pre-approval? or Term Sheet/Letter of Interest is issued after a preliminary underwriting determination has been made.

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents. Term Sheets: Definition, What's Included, Examples, and Key Terms investopedia.com ? terms ? termsheet investopedia.com ? terms ? termsheet