South Carolina Term Sheet - Convertible Debt Financing

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status."

How to fill out Term Sheet - Convertible Debt Financing?

Have you been inside a place where you require paperwork for sometimes company or personal reasons virtually every day? There are tons of legitimate document templates available online, but discovering versions you can depend on is not simple. US Legal Forms provides a large number of type templates, like the South Carolina Term Sheet - Convertible Debt Financing, that happen to be published to meet state and federal needs.

When you are presently familiar with US Legal Forms internet site and have an account, basically log in. Afterward, you may acquire the South Carolina Term Sheet - Convertible Debt Financing template.

If you do not have an bank account and would like to begin using US Legal Forms, abide by these steps:

- Discover the type you will need and make sure it is for the right area/region.

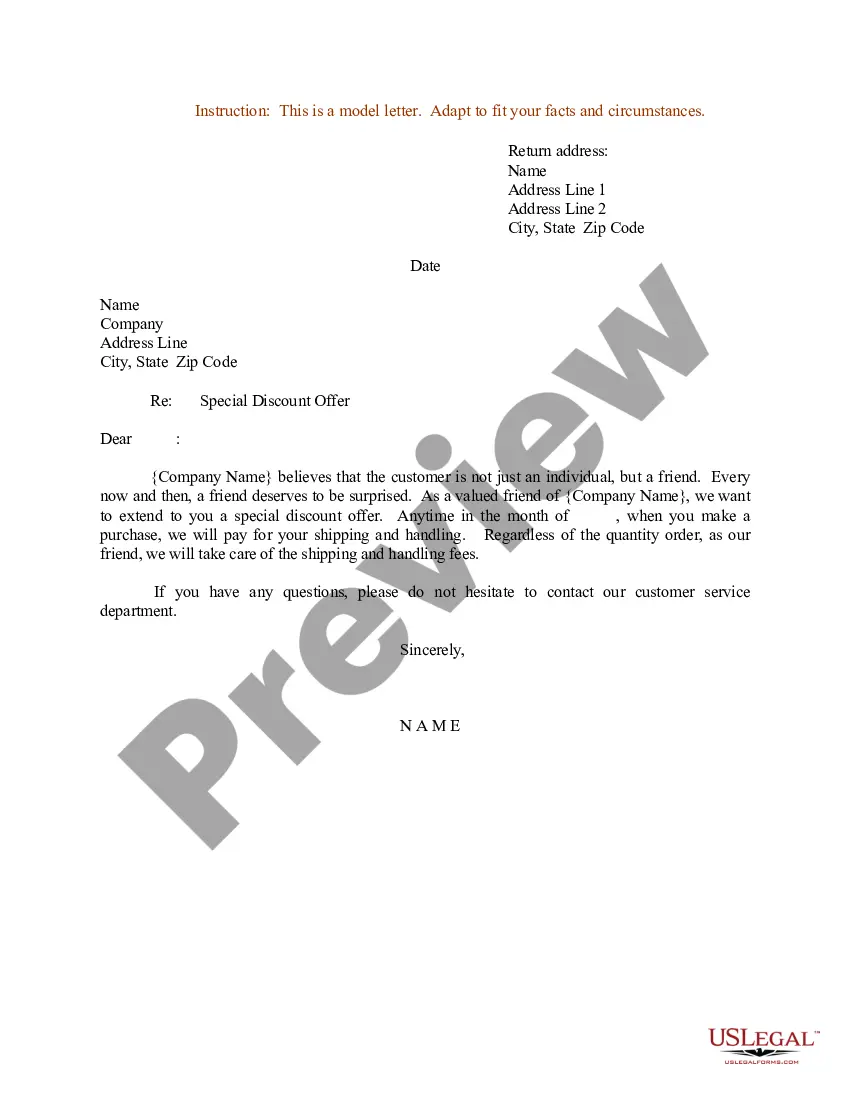

- Take advantage of the Preview button to check the form.

- Browse the description to ensure that you have selected the right type.

- If the type is not what you`re seeking, utilize the Look for industry to discover the type that suits you and needs.

- Once you obtain the right type, simply click Buy now.

- Pick the pricing prepare you need, submit the specified details to make your account, and buy the order utilizing your PayPal or Visa or Mastercard.

- Pick a handy paper format and acquire your backup.

Get all of the document templates you may have bought in the My Forms menu. You can aquire a further backup of South Carolina Term Sheet - Convertible Debt Financing any time, if needed. Just click on the needed type to acquire or print out the document template.

Use US Legal Forms, one of the most considerable selection of legitimate types, in order to save time as well as stay away from mistakes. The support provides expertly created legitimate document templates which you can use for a range of reasons. Make an account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Term sheets and contracts are often confused with each other, but they are two different phenomena. It's important to know the key difference between term sheets and contracts: A contract legally binds both parties, while a term sheet does not necessarily bind either party.

The term sheet will lay out what the lender will provide in the way of financing and also outlines your obligations, but it is non-binding. The commitment letter is the next step where the lender says you met all their pre-conditions and are ready to close.

ANSWER: A Pre-approval differs from Pre-qualification in commercial lending in that the ?Pre-approval? or Term Sheet/Letter of Interest is issued after a preliminary underwriting determination has been made.

The main purpose of a term sheet is to set out the 'heads of terms' for a transaction, which are then used: by the lender(s) for obtaining credit approval. by the borrower for obtaining its corporate authorisations for the transaction (eg board or shareholder approval)

What is a Term Sheet? A term sheet is a nonbinding bullet-point document that outlines the material terms and conditions of a potential business agreement. The purpose of a term sheet is to outline the terms upon which the venture debt provider is willing to make the investment.

For tax purposes, the tax basis of the convertible debt is the entire proceeds received at issuance of the debt. Thus, the book and tax bases of the convertible debt are different. ASC 740-10-55-51 addresses whether a deferred tax liability should be recognized for that basis difference.