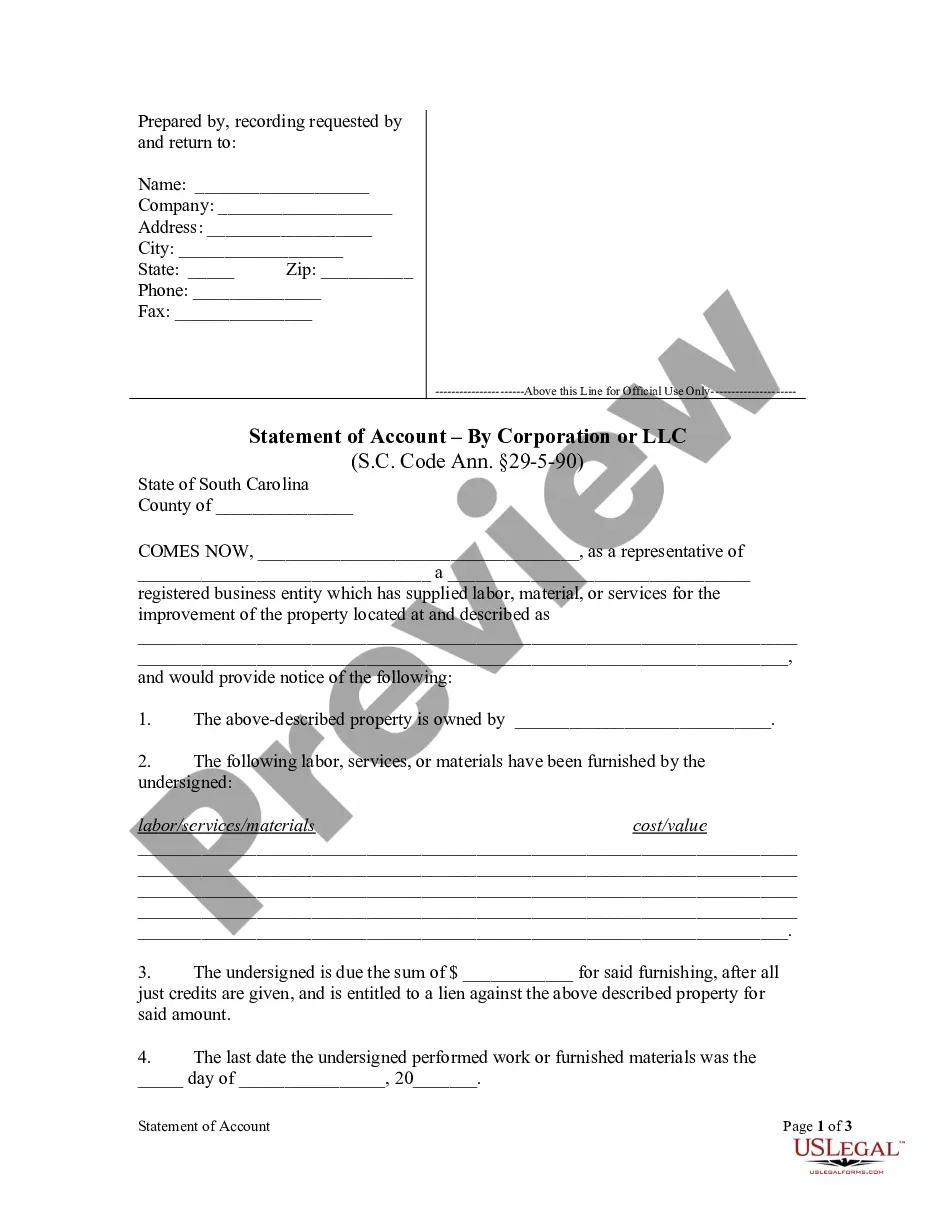

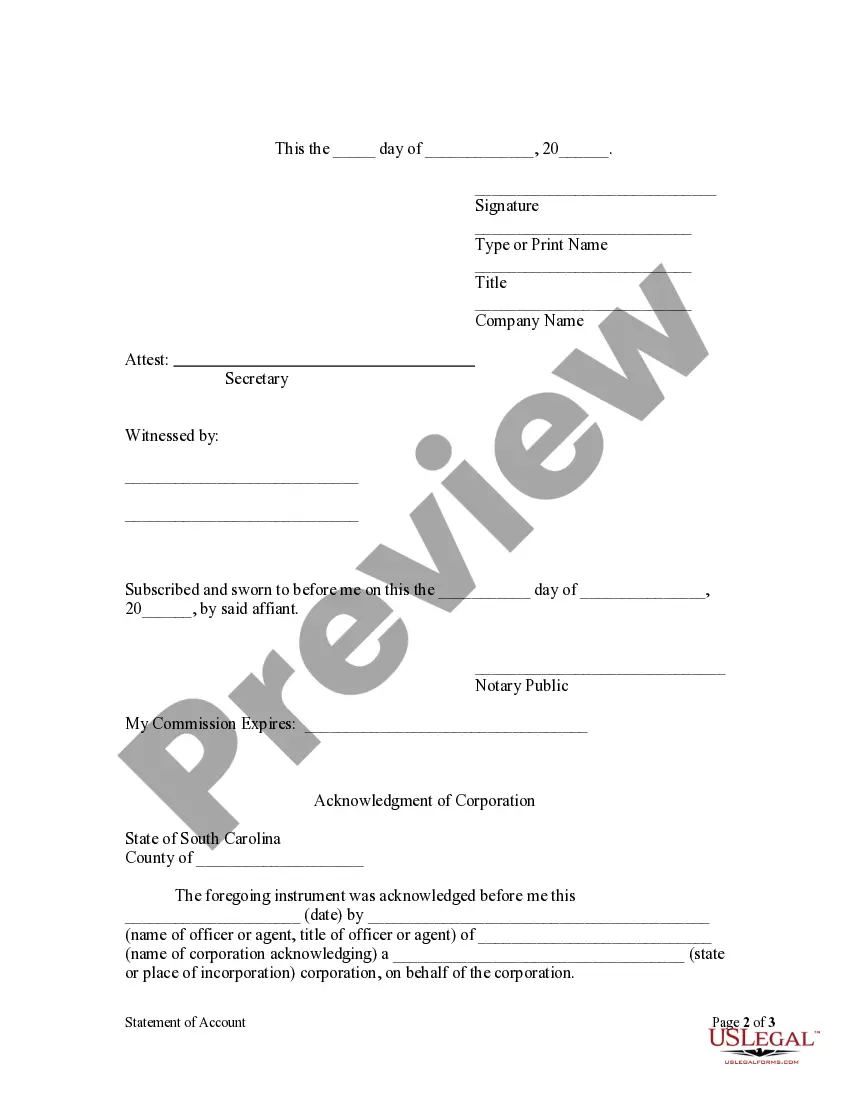

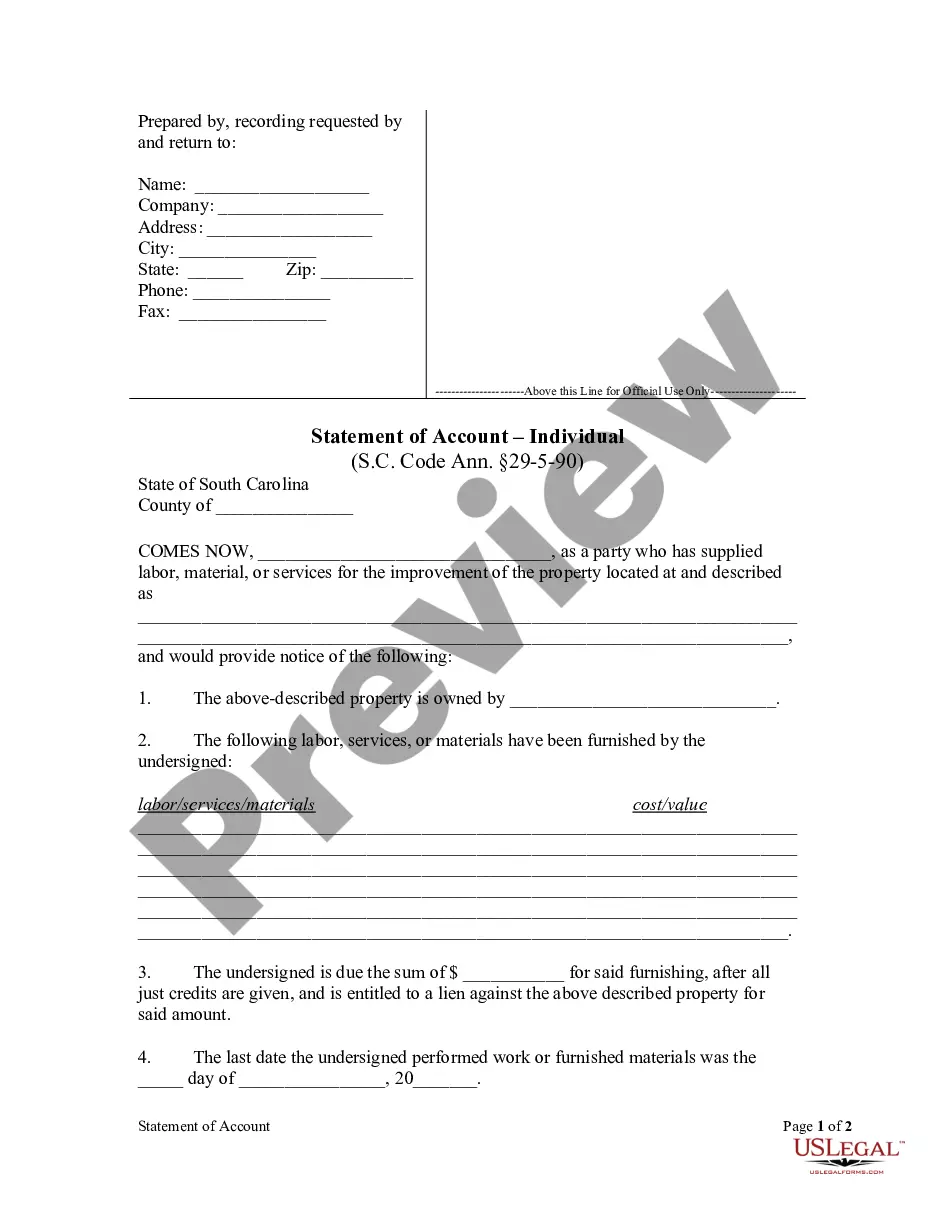

A lien shall be dissolved unless the person desiring to avail himself thereof, within ninety days after he ceases to labor on or furnish labor or materials for such building or structure, serves upon the owner or, in the event the owner cannot be found, upon the person in possession and files in the office of the register of deeds or clerk of court of the county in which the building or structure is situated a statement of a just and true account of the amount due him, with all just credits given, together with a description of the property intended to be covered by the lien sufficiently accurate for identification, with the name of the owner of the property, if known, which certificate shall be subscribed and sworn to by the person claiming the lien or by someone in his behalf and shall be recorded in a book kept for the purpose by the register or clerk who shall be entitled to the same fees therefor as for recording mortgages of equal length.

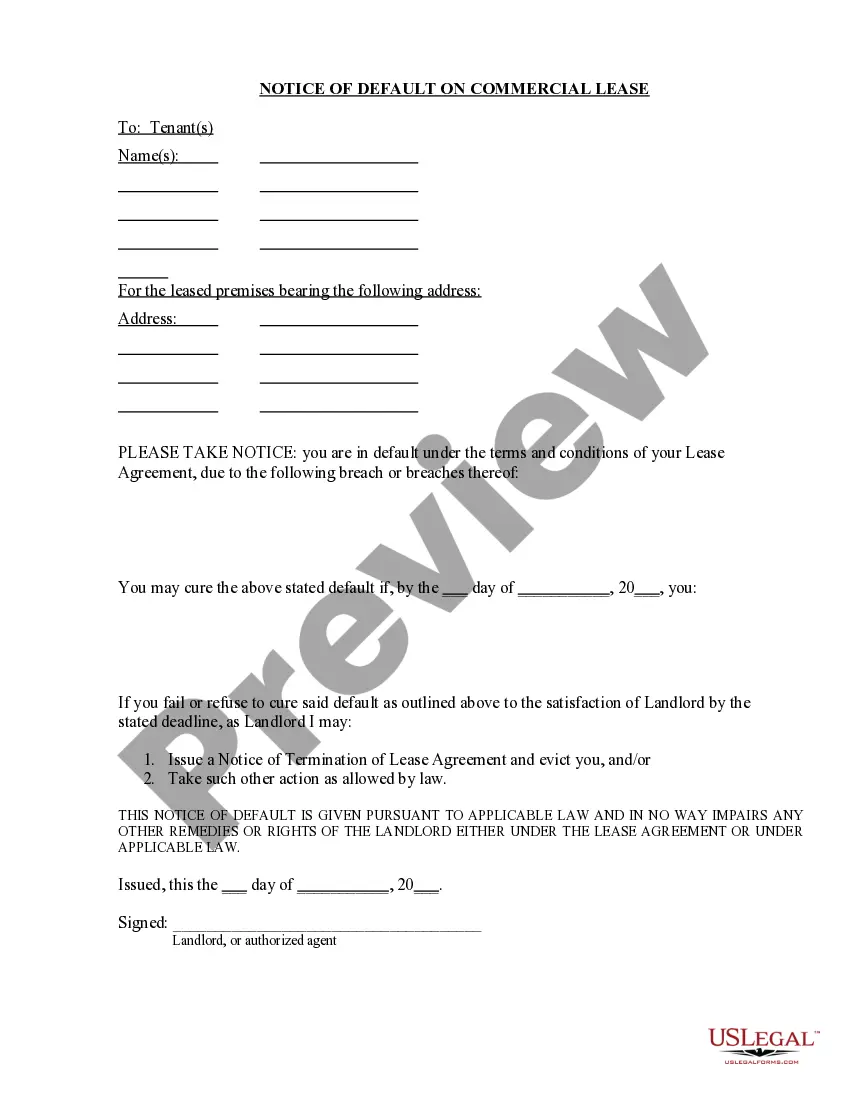

South Carolina Statement of Account by Corporation

Description

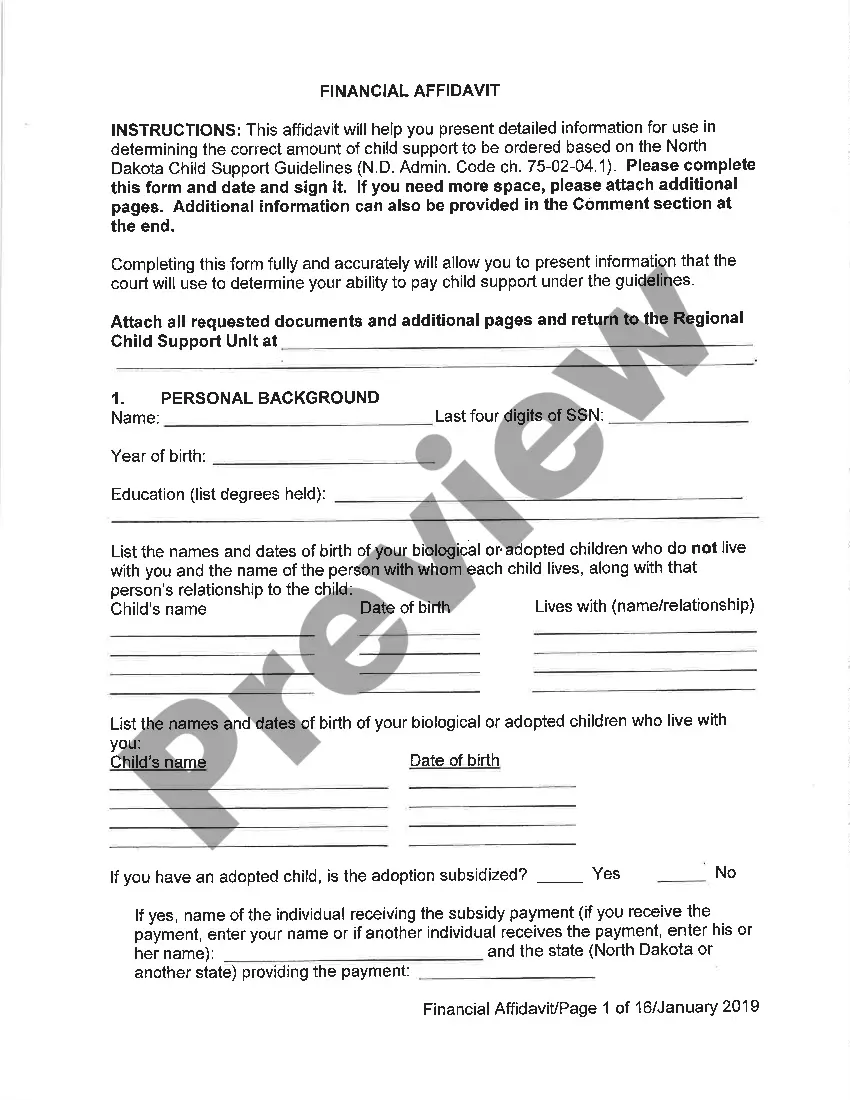

How to fill out South Carolina Statement Of Account By Corporation?

The work with papers isn't the most uncomplicated process, especially for people who rarely deal with legal papers. That's why we recommend making use of correct South Carolina Statement of Account by Corporation templates made by professional lawyers. It gives you the ability to avoid difficulties when in court or handling formal institutions. Find the templates you want on our site for high-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will automatically appear on the template web page. Right after accessing the sample, it’ll be saved in the My Forms menu.

Users with no an active subscription can easily create an account. Utilize this brief step-by-step help guide to get your South Carolina Statement of Account by Corporation:

- Ensure that the sample you found is eligible for use in the state it’s necessary in.

- Confirm the document. Use the Preview option or read its description (if offered).

- Buy Now if this form is the thing you need or use the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a required format.

After doing these straightforward actions, you can fill out the sample in a preferred editor. Double-check completed information and consider asking an attorney to review your South Carolina Statement of Account by Corporation for correctness. With US Legal Forms, everything gets easier. Test it now!

Form popularity

FAQ

If you are a Limited Liability Company (LLC), professional organization, or other association taxed as a corporation and not exempt under SC Code Section 12-20-110, you must submit a CL-1 and include a $25 payment.

Aside from that, just about anyone can legally serve as an LLC organizer.The most common options are a member/owner of the LLC, the LLC's registered agent, a lawyer, an accountant, and online business formation services. In our experience, we highly prefer having someone with experience serve as your LLC organizer.

Businesses operating in South Carolina will file their annual report along with their tax returns the form itself is essentially a tax return that also renews your business' status in the state. To file, complete your taxes and determine what must be paid.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.The annual report (Schedule D) is part of the corporate tax return.

Step 1: Visit the Business Name Database. Go to the South Carolina Secretary of State website. Step 2: Search your Business Name. Enter the name you would like to use in the Search by Business Name field. Step 3: Review Results.

How much does it cost to form an LLC in South Carolina? The South Carolina Secretary of State charges a $110 fee to file the Articles of Organization. You can reserve your LLC name with the South Carolina Secretary of State for $25.

The State of South Carolina recognizes the Federal tax extension (IRS Form 4868).Remember to attach a copy of your state extension to your South Carolina return when it's filed. A tax extension gives you more time to file, but it does not give you more time to pay.

A federal extension will be accepted if all corporations filing in South Carolina are included in one or more federal extensions.There is no extension of time for payment of Corporate Income Tax or License Fee. Any Income Tax or License Fee due must be paid by the due date to avoid late penalties and interest.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.The annual report (Schedule D) is part of the corporate tax return.