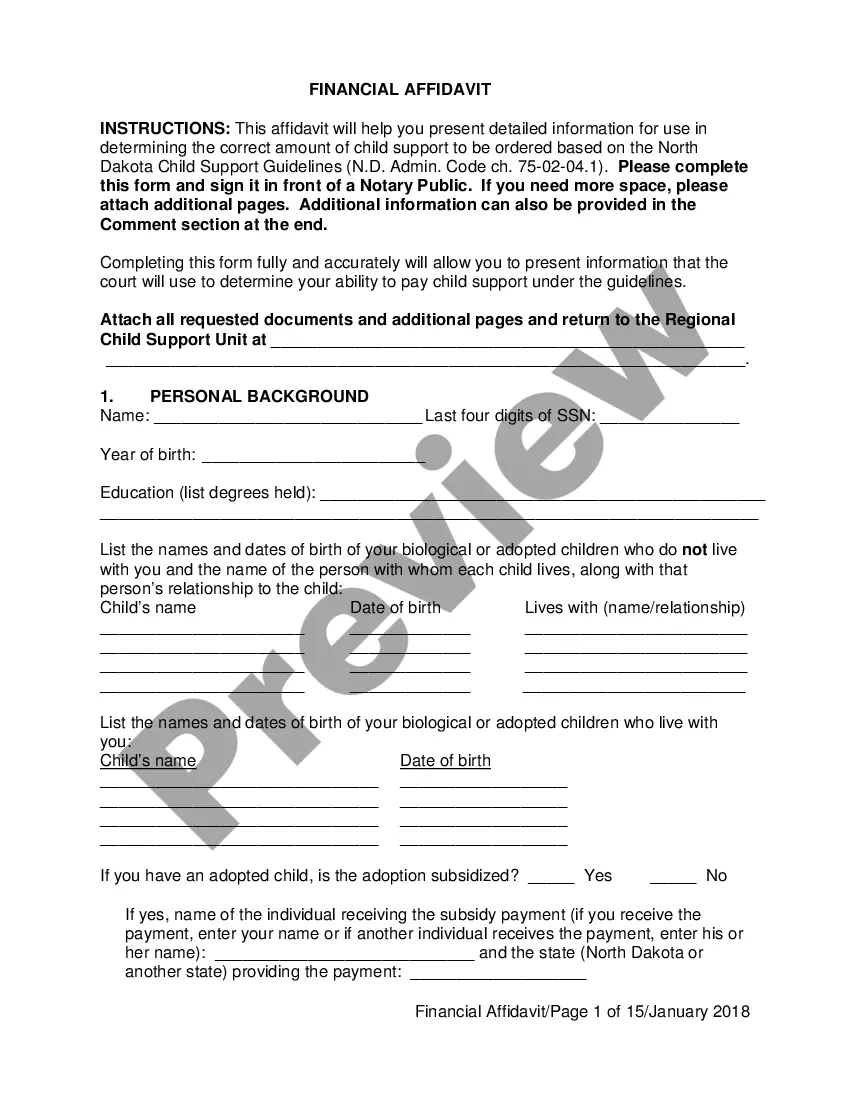

A Financial Affidavit is used to assist in presenting sufficient detailed financial information of each party. It is used to to determine the correct amount of child support to be ordered to the non-custodial parent.

North Dakota Financial Affidavit

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Dakota Financial Affidavit?

Among numerous paid and complimentary examples available online, you cannot be assured of their trustworthiness. For instance, who designed them or if they have the necessary qualifications to handle your requirements.

Stay composed and utilize US Legal Forms! Explore North Dakota Financial Affidavit templates crafted by skilled attorneys and sidestep the costly and lengthy process of searching for a lawyer and subsequently compensating them to create a document for you that you can obtain independently.

If you possess a subscription, Log In to your account and locate the Download button adjacent to the file you are seeking. You will also have access to all your previously obtained documents in the My documents section.

Once you have registered and purchased your subscription, you can use your North Dakota Financial Affidavit as often as necessary or for as long as it remains active in your state. Modify it with your preferred online or offline editor, complete it, sign it, and produce a hard copy. Achieve more for less with US Legal Forms!

- Ensure that the document you find is valid in your residing state.

- Examine the template by reviewing the description using the Preview feature.

- Click Buy Now to initiate the purchasing procedure or search for another sample through the Search field located in the header.

- Select a pricing option and set up an account.

- Make the payment for the subscription via your credit/debit card or PayPal.

- Download the form in the desired file format.

Form popularity

FAQ

Docket number and name of the case, including names of both parties. Your income from all sources, including overtime, bonuses, social security, tips, interest, other spousal support, and commissions.

In its simplest sense, fair market value (FMV) is the price that an asset would sell for on the open market.

RECOMMENDATION 1. The federal Department of Justice recommends that the child support tables be updated every five years, or sooner when changes in federal, provincial, or territorial tax regimes would have a significant impact on table amounts.

The main purpose of a financial affidavit is to provide the court with an explanation of a party's financial circumstances. Without this information, the court would be unable to make financial orders or orders concerning property distribution.

The court estimates that the cost of raising one child is $1,000 a month. The non-custodial parent's income is 66.6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

What Is a Financial Affidavit? A financial affidavit, which has different names in each state, is a statement showing your income, expenses, debts and assets. It allows a court to figure out how much spousal support and child support it should award.

If you lie on this document, you are lying to the court.Depending on how serious your untruth, lying on a financial affidavit could mean that your spouse is awarded a larger portion of the marital assets, something that could negatively impact your financial situation for many years to come.

Fair market value example If given a gift of stock, the fair market value of that stock on the day you received it will determine the taxes you pay when it is sold. The calculations for most property taxes are based on fair market value. Insurance claims on any asset are based on fair market value, at least in part.

Past history. If you reported your expenses for recent past history, say for six months or a year, those expenses would show what you and your spouse expended together; they will have little relevance to what you need as a separated individual. Future expenses. Interim expenses.