A lien shall be dissolved unless the person desiring to avail himself thereof, within ninety days after he ceases to labor on or furnish labor or materials for such building or structure, serves upon the owner or, in the event the owner cannot be found, upon the person in possession and files in the office of the register of deeds or the clerk of court of the county in which the building or structure is situated a statement of a just and true account of the amount due him, with all just credits given, together with a description of the property intended to be covered by the lien sufficiently accurate for identification, with the name of the owner of the property, if known, which certificate shall be subscribed and sworn to by the person claiming the lien or by someone in his behalf and shall be recorded in a book kept for the purpose by the register or clerk who shall be entitled to the same fees therefor as for recording mortgages of equal length.

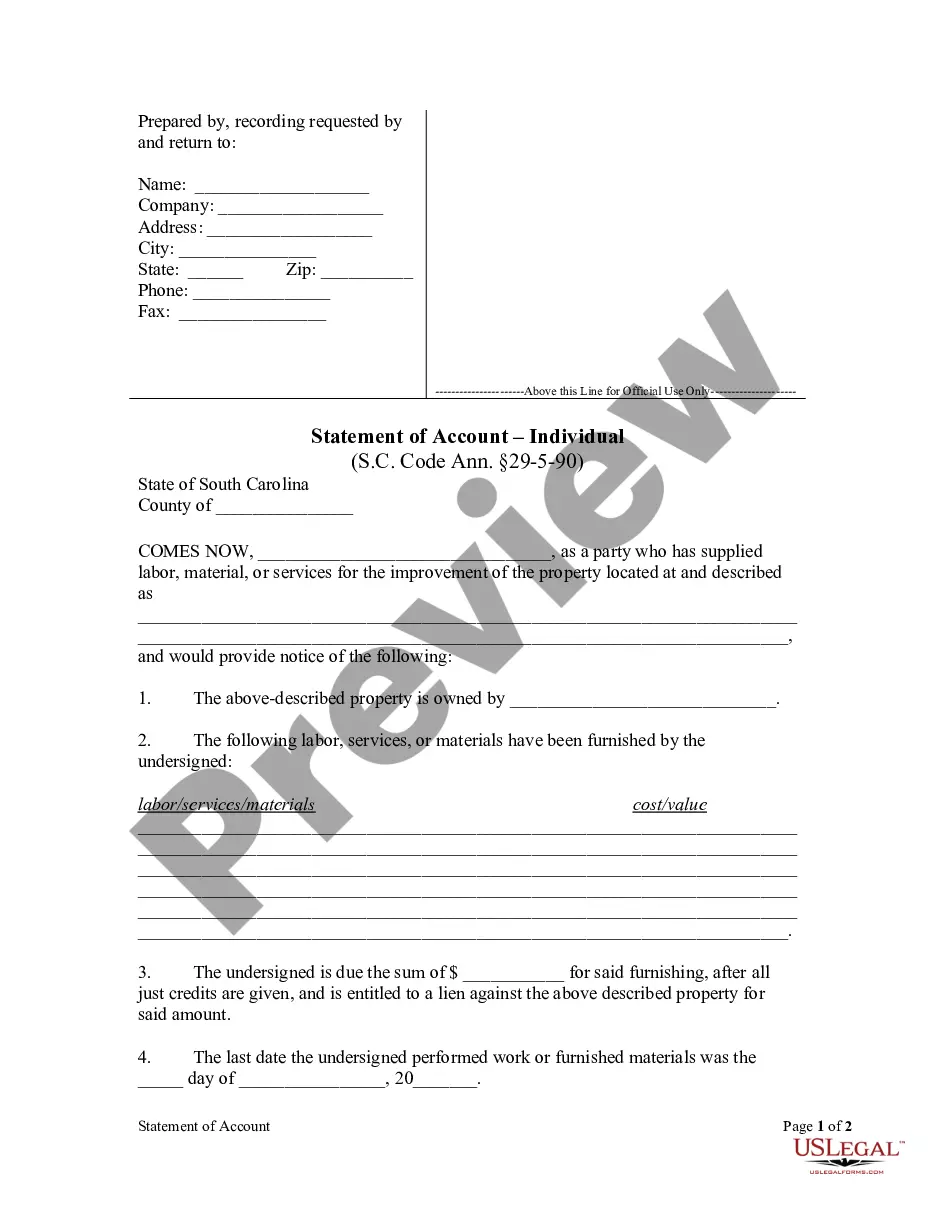

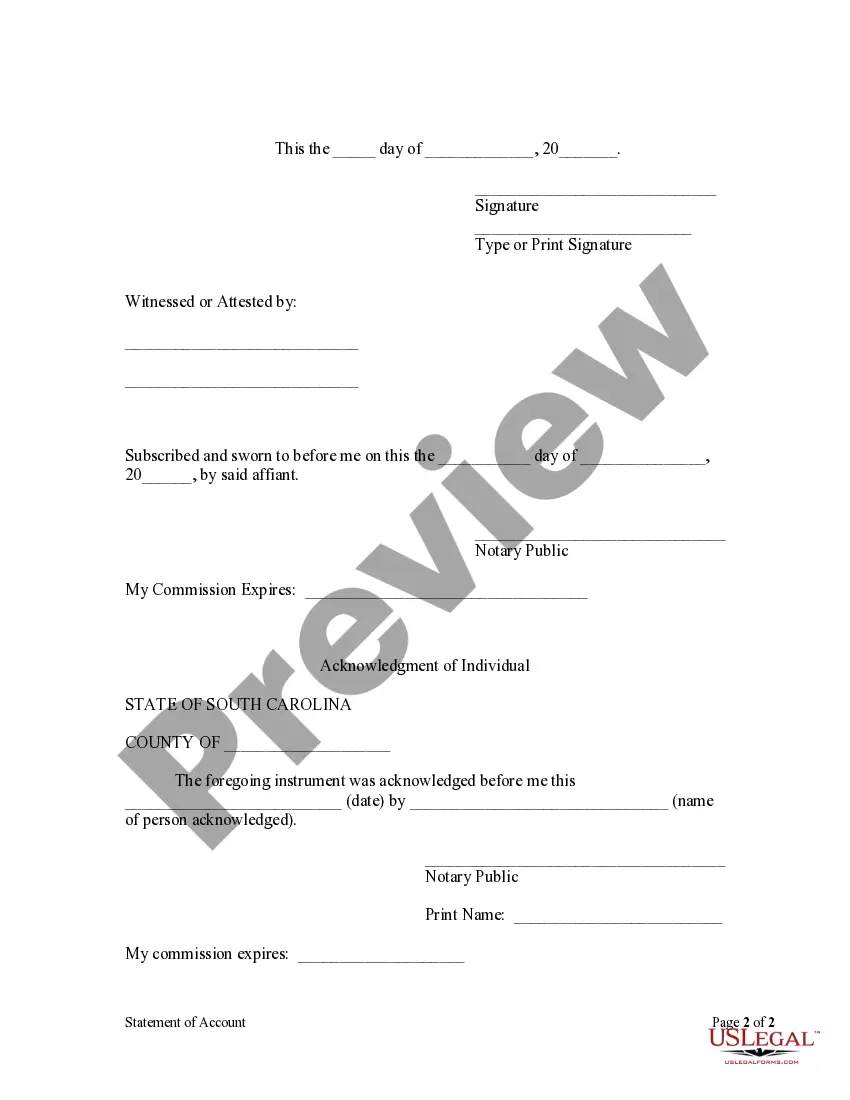

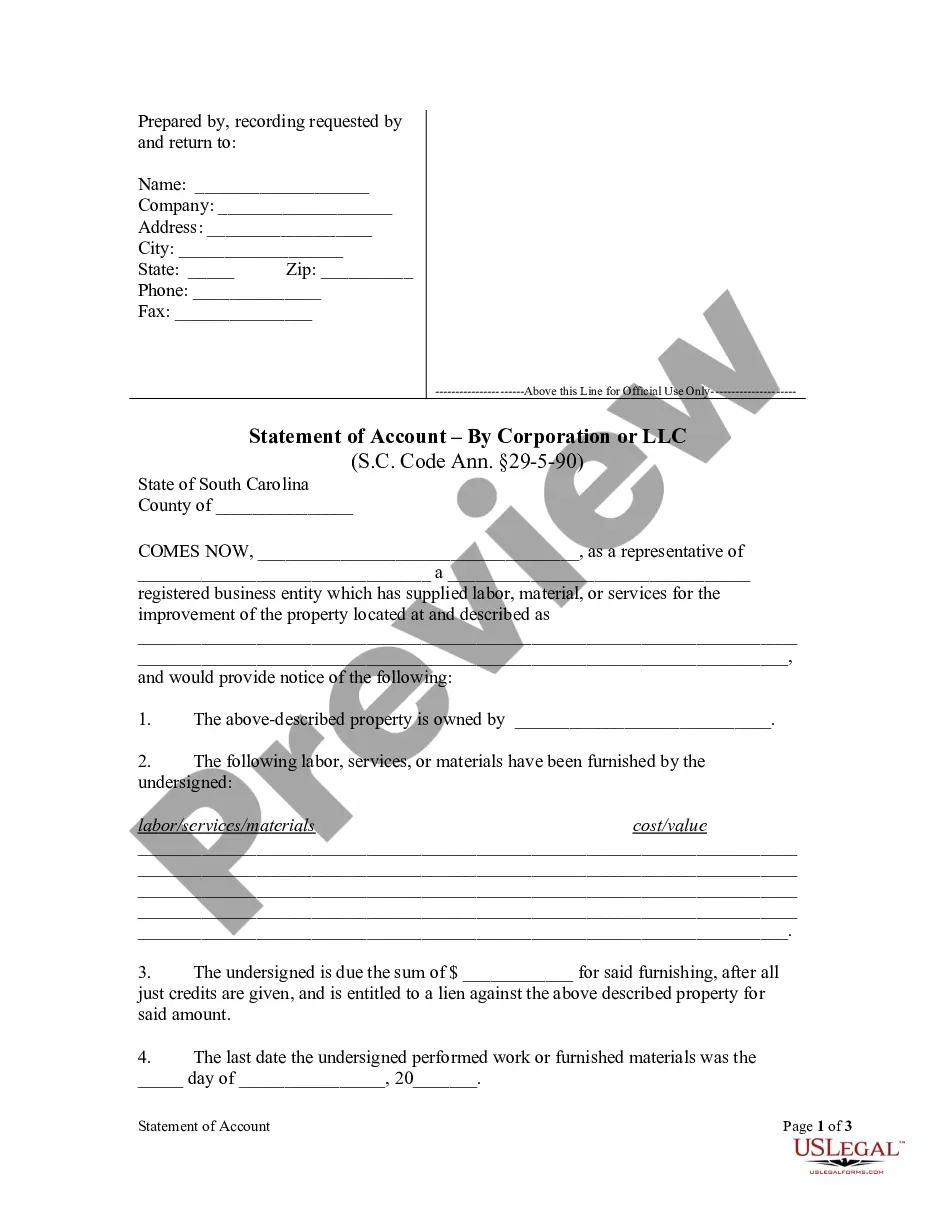

South Carolina Statement of Account - Individual

Description

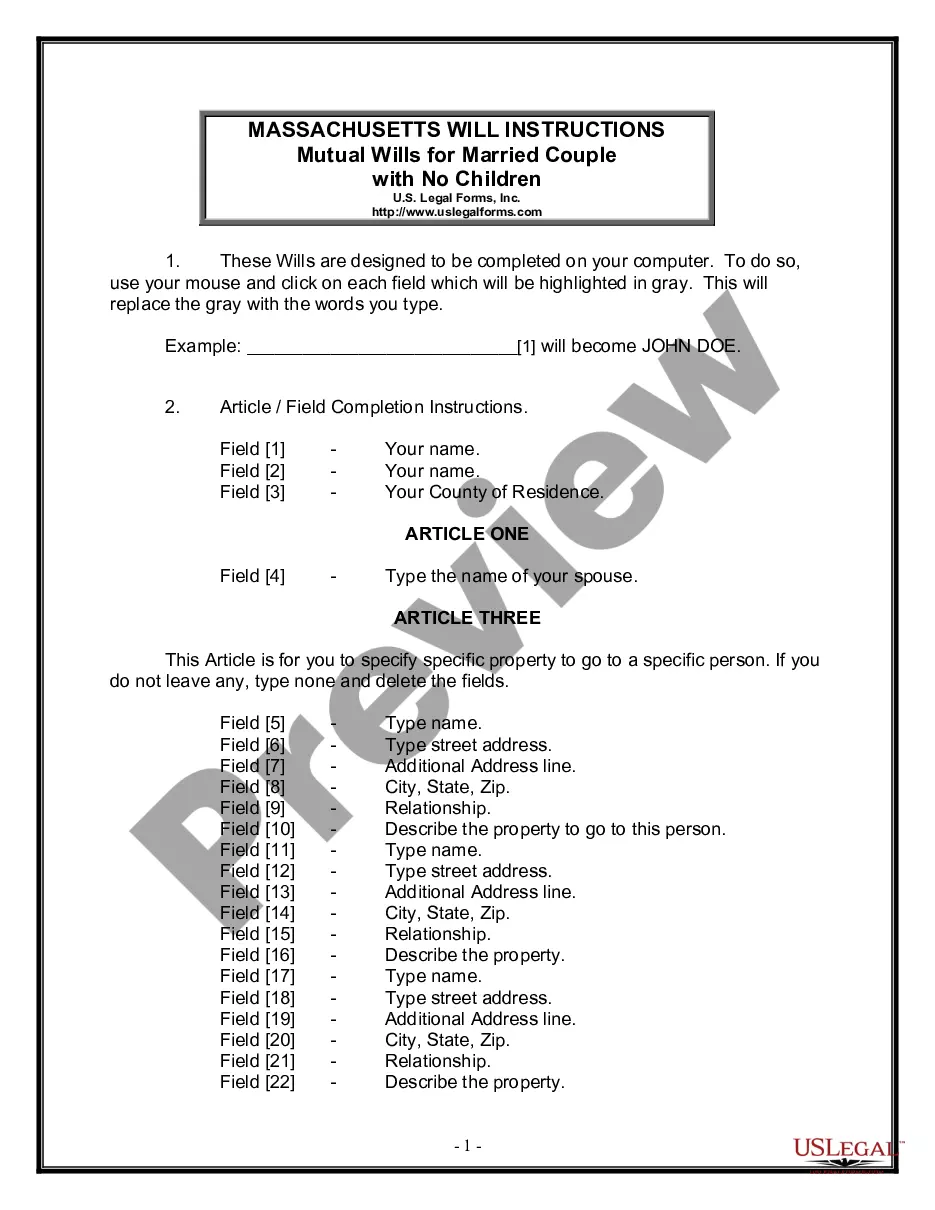

How to fill out South Carolina Statement Of Account - Individual?

The work with papers isn't the most easy process, especially for those who almost never deal with legal papers. That's why we advise using accurate South Carolina Statement of Account - Individual templates created by professional attorneys. It gives you the ability to stay away from difficulties when in court or working with formal organizations. Find the samples you want on our website for top-quality forms and correct descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you are in, the Download button will immediately appear on the file page. After downloading the sample, it will be stored in the My Forms menu.

Customers without a subscription can easily create an account. Look at this brief step-by-step guide to get your South Carolina Statement of Account - Individual:

- Ensure that the form you found is eligible for use in the state it is necessary in.

- Confirm the file. Make use of the Preview feature or read its description (if offered).

- Click Buy Now if this sample is what you need or return to the Search field to get a different one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after completing these simple actions, it is possible to fill out the sample in a preferred editor. Recheck completed info and consider requesting a legal representative to review your South Carolina Statement of Account - Individual for correctness. With US Legal Forms, everything becomes much easier. Give it a try now!

Form popularity

FAQ

If you did not receive a Form 1099-G, check with the government agency that made the payments to you. If you received a state or local income tax refund for 2012 and you reside in Conn., Mo., N.J., N.Y. or Penn your Form 1099-G may be available to you only in an electronic format.

A 1099-G is the form used by the SCDOR to notify taxpayers of refunds or rebates. If you received a South Carolina tax refund or rebate during 2019 and you itemized your deductions on your 2018 return, you should receive a 1099-G from the SCDOR.

Taxpayers receive 1099-G forms if they received unemployment compensation payments, state or local income tax refunds, or certain other payments from a government or government agency. If you receive Form 1099-G, you may need to report some of the information on your income tax return.

The most common uses of the 1099-G is to report unemployment compensation, as well as any state or local income tax refunds you received that year. If you received a 1099-G Form this year from a government agency, you may need to report some of the information it contains on your tax return.

Phone. Call our Interactive Voice Response (IVR) System at 1-866-333-4606 and follow the instructions to get your Form 1099G information or to request that your 1099G be mailed to you. This option is available 24 hours a day, 7 days a week. Form 1099G tax information is available for up to five years.

The 1099-G/INT is a statement showing the amount of refund, credit, or interest issued to you in a calendar year. It is not a bill, a check, or an additional refund. It does not mean you owe the state any additional tax. Any amounts shown as refunds have already been issued to you.

File SC1040, including all federal taxable income, and attach SC1040TC to claim a credit for taxes paid to another state.

Your 1099-G shows the unemployment compensation and state and local income tax refunds you received during the past year. According to the South Carolina Department of Employment and Workforce, 1099-Gs were sent out during the last week of January but can also be downloaded from DEW's unemployment benefits portal.