Rhode Island Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller

Understanding this form

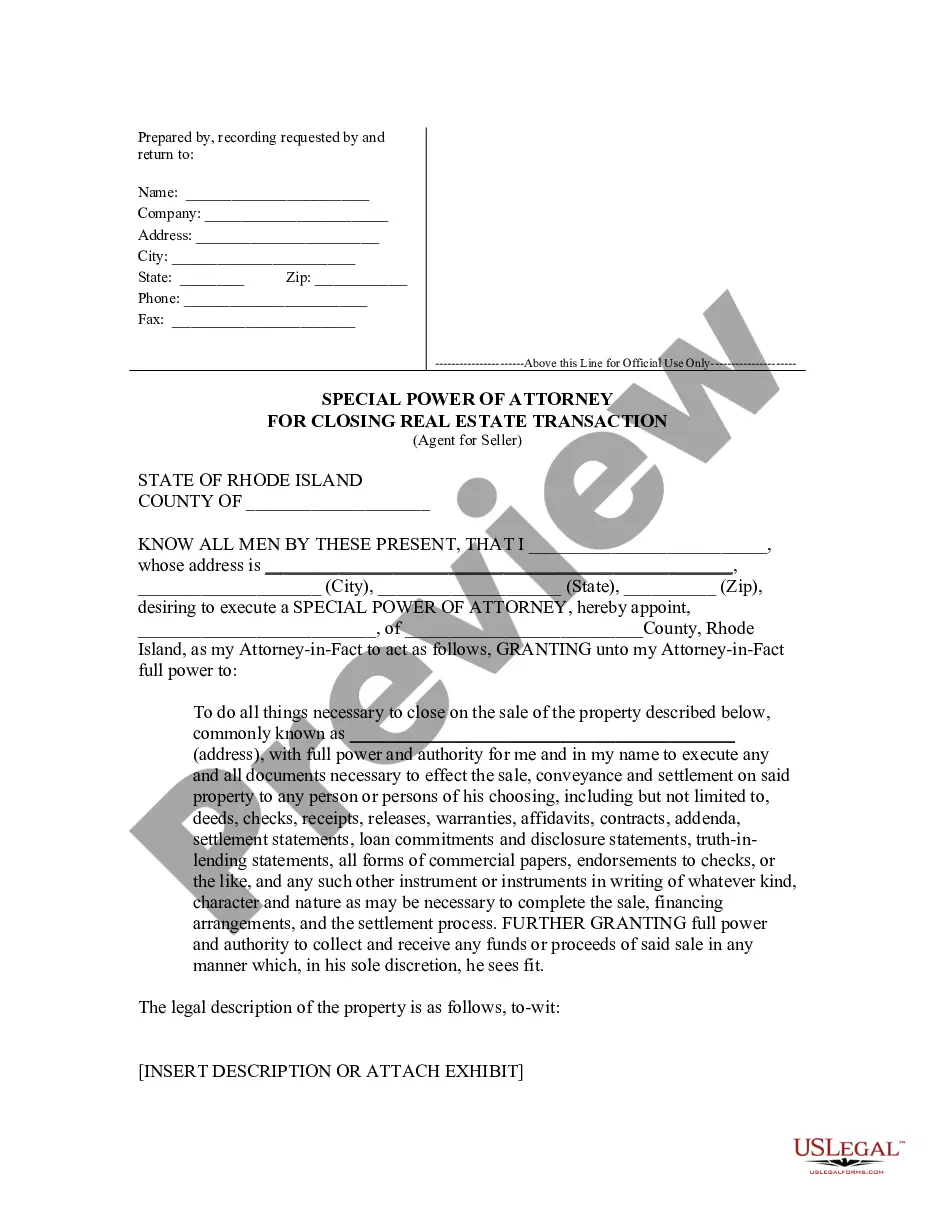

The Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller is a legal document that allows a seller to appoint an attorney-in-fact to handle matters related to the sale of a specific parcel of real estate. This form authorizes the agent to execute all necessary documents and perform actions required to complete the sale transaction, distinguishing it from broader powers of attorney that may cover various areas beyond real estate dealings.

Key components of this form

- Principal's information: The name and address of the seller granting the power.

- Attorney-in-fact's details: The name and county of the appointed agent.

- Property description: Specific details about the parcel of real estate being sold.

- Grant of authority: Empowering the attorney-in-fact to sign documents and collect proceeds from the sale.

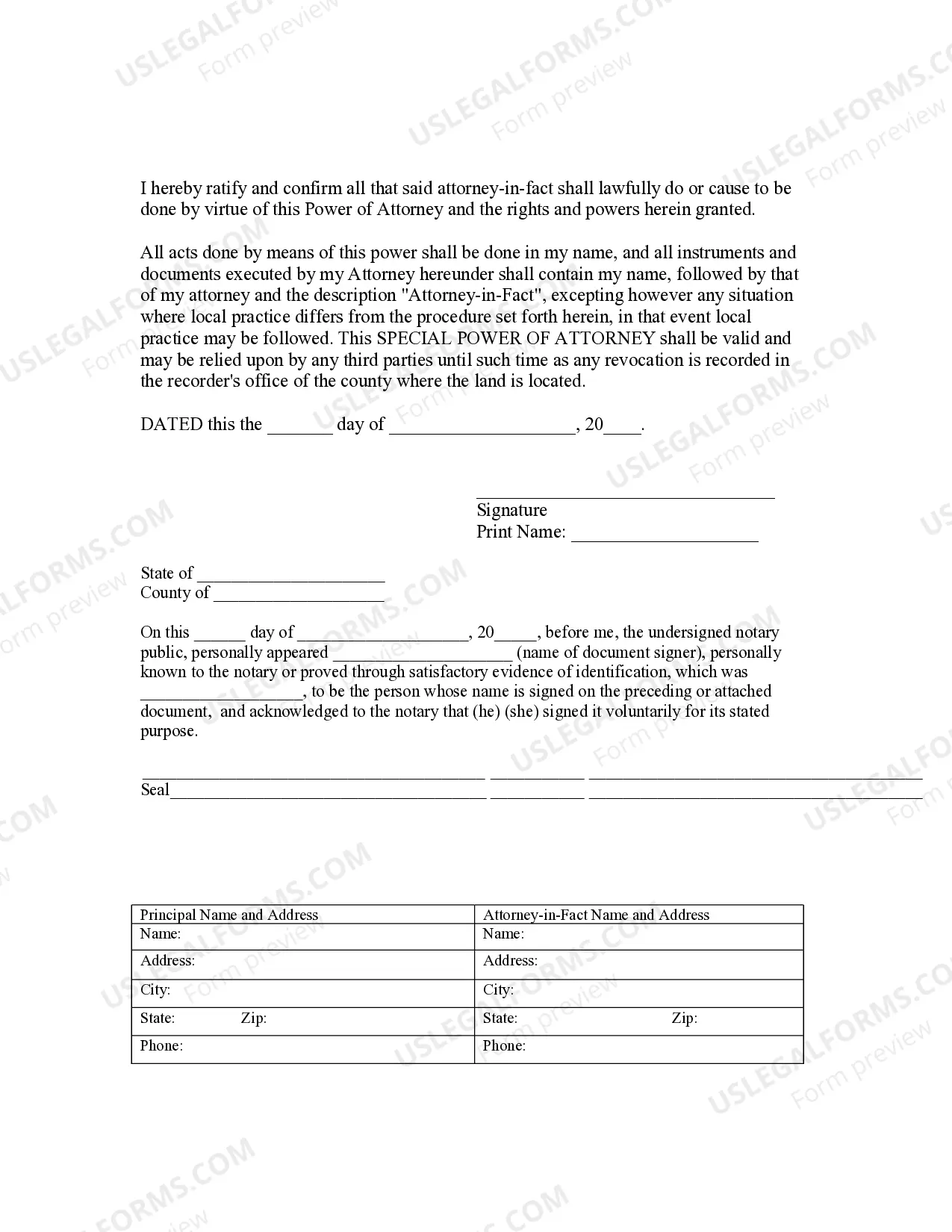

- Notarization section: Confirming the validity of the document through a notary public.

When to use this form

This form should be used when a seller needs someone else to act on their behalf in a real estate sales transaction. Common scenarios include situations where the seller is unable to attend the closing in person, such as being out of state or having health issues that prevent their physical presence. It is also useful when the seller wants to expedite the process by delegating authority to a trusted individual.

Intended users of this form

- Home sellers requiring assistance in finalizing a real estate transaction.

- Individuals who are unable to be present at the closing due to personal or logistical reasons.

- Real estate agents and attorneys representing sellers who need authority to sign documents on their behalf.

Instructions for completing this form

- Identify the principal: Fill in the seller's name and address.

- Appoint the attorney-in-fact: Specify the name and address of the individual authorized to act on your behalf.

- Describe the property: Provide the complete address and legal description of the real estate being sold.

- Grant authority: Clearly state the powers being delegated to the attorney-in-fact.

- Sign and date: The principal must sign the document, and it should be notarized if required.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Avoid these common issues

- Failing to properly identify the property being sold.

- Not including the full name and address of the attorney-in-fact.

- Missing the notarization requirement, which can invalidate the document.

- Leaving out signatures or dates, leading to potential delays in the transaction.

Why complete this form online

- Convenience of downloading and completing the form at your own pace.

- Access to templates prepared by licensed attorneys, ensuring legal accuracy.

- Editability allows you to customize details as needed, streamlining the process.

- Immediate availability of the form without the need for in-person meetings.

Form popularity

FAQ

By giving someone the power to sign on their behalf, the Principal is giving the attorney-in-fact power to make decisions for them. When signing a POA, the Principal's signature must be notarized at the time and place it is signed. A local notary in any state of the U.S. is acceptable.

The non-durable power of attorney is used only for a set period of time and usually for a particular transaction in which you grant your agent authority to act on your behalf. Once the transaction is completed, or should the principal become incapacitated during this time, the non-durable power of attorney ceases.

The durable power of attorney is almost always required. This instrument gives another person specific powers to sign for an individual in a real estate transaction where the exact name and description of the property is stated in the document.

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.

Before death, a person doesn't have an executor (although the person may have granted the power of attorney to someone to act on his behalf).An ill, elderly parent who plans to sell or give away his or her principal residence would be well advised to consult with a lawyer who does Medicaid planning.

Remember that all of the authorized agents under the power of attorney or representatives in an estate must sign the listing agreement, disclosure documents, etc. For example, when there are two executors in an estate, then they both must sign the Listing Contract.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

Step 1: Bring Your Power of Attorney Agreement and ID. Step 2: Determine the Preferred Signature Format. Step 3: Sign as the Principal. Step 4: Sign Your Own Name. Step 5: Express Your Authority as Attorney-in-Fact. Step 6: File the Documentation Somewhere Safe.