Puerto Rico Accounts Receivable Monthly Customer Statement

Description

How to fill out Accounts Receivable Monthly Customer Statement?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the latest versions of forms such as the Puerto Rico Accounts Receivable Monthly Customer Statement in moments.

If you already have a monthly subscription, Log In and download the Puerto Rico Accounts Receivable Monthly Customer Statement from your US Legal Forms library. The Download button will be visible on each document you view. You have access to all previously saved forms in the My documents section of your account.

Select the format and download the form to your device.

Make adjustments. Fill out, modify, print, and sign the saved Puerto Rico Accounts Receivable Monthly Customer Statement. Each template you have added to your account does not expire and is yours indefinitely. Therefore, to download or print another copy, simply navigate to the My documents section and click on the form you need. Gain access to the Puerto Rico Accounts Receivable Monthly Customer Statement with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

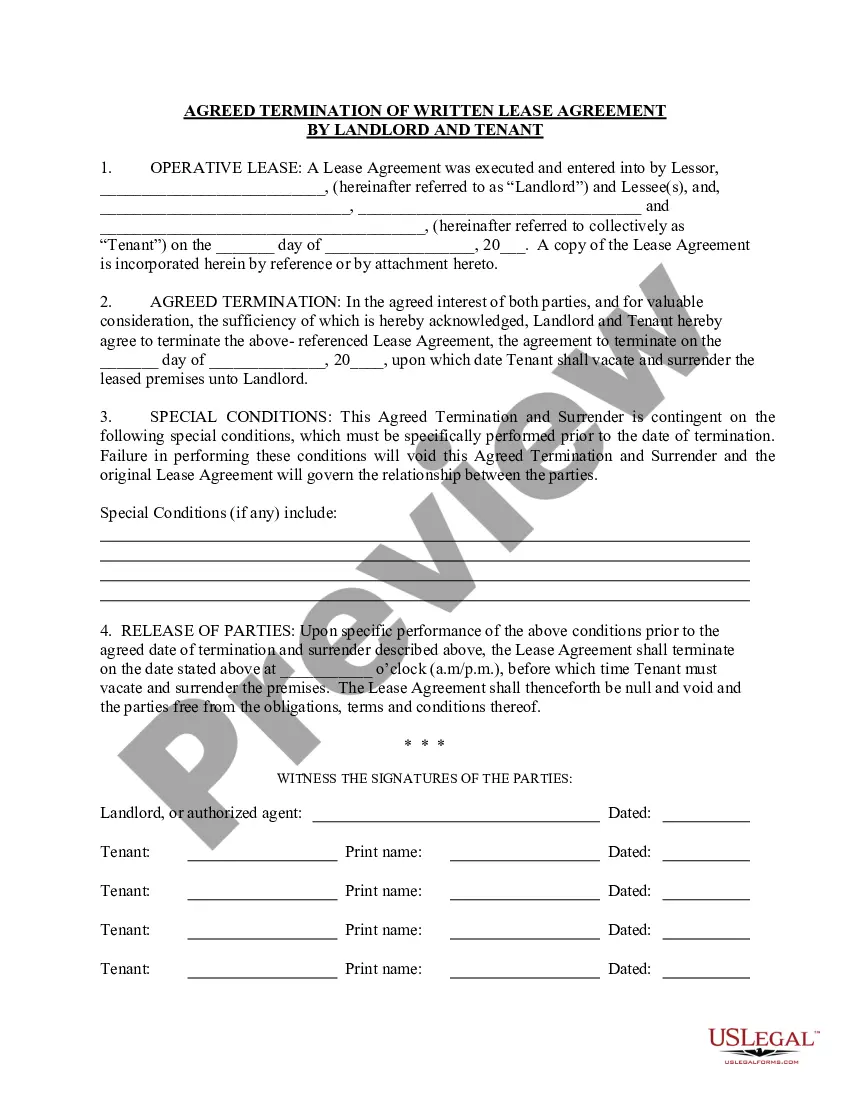

- Ensure you have selected the correct form for your city/county. Click the Preview button to check the form's details.

- Review the form summary to confirm that you have chosen the appropriate form.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Get now button.

- Next, choose the pricing plan you prefer and provide your details to sign up for an account.

- Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Form popularity

FAQ

Yes, Puerto Rico follows Generally Accepted Accounting Principles (GAAP) for financial reporting. This ensures that businesses maintain consistency and transparency in their financial statements. When you utilize the Puerto Rico Accounts Receivable Monthly Customer Statement, you can trust that it aligns with GAAP standards, providing clarity and reliability in your financial records. This adherence to GAAP is important for compliance and investor confidence.

You can find accounts receivable listed on the balance sheet under current assets. This section shows the total amount your customers owe you, which is crucial for understanding your liquidity. The Puerto Rico Accounts Receivable Monthly Customer Statement complements this by providing a detailed breakdown of each customer's outstanding balance. This helps you make informed decisions about credit management.

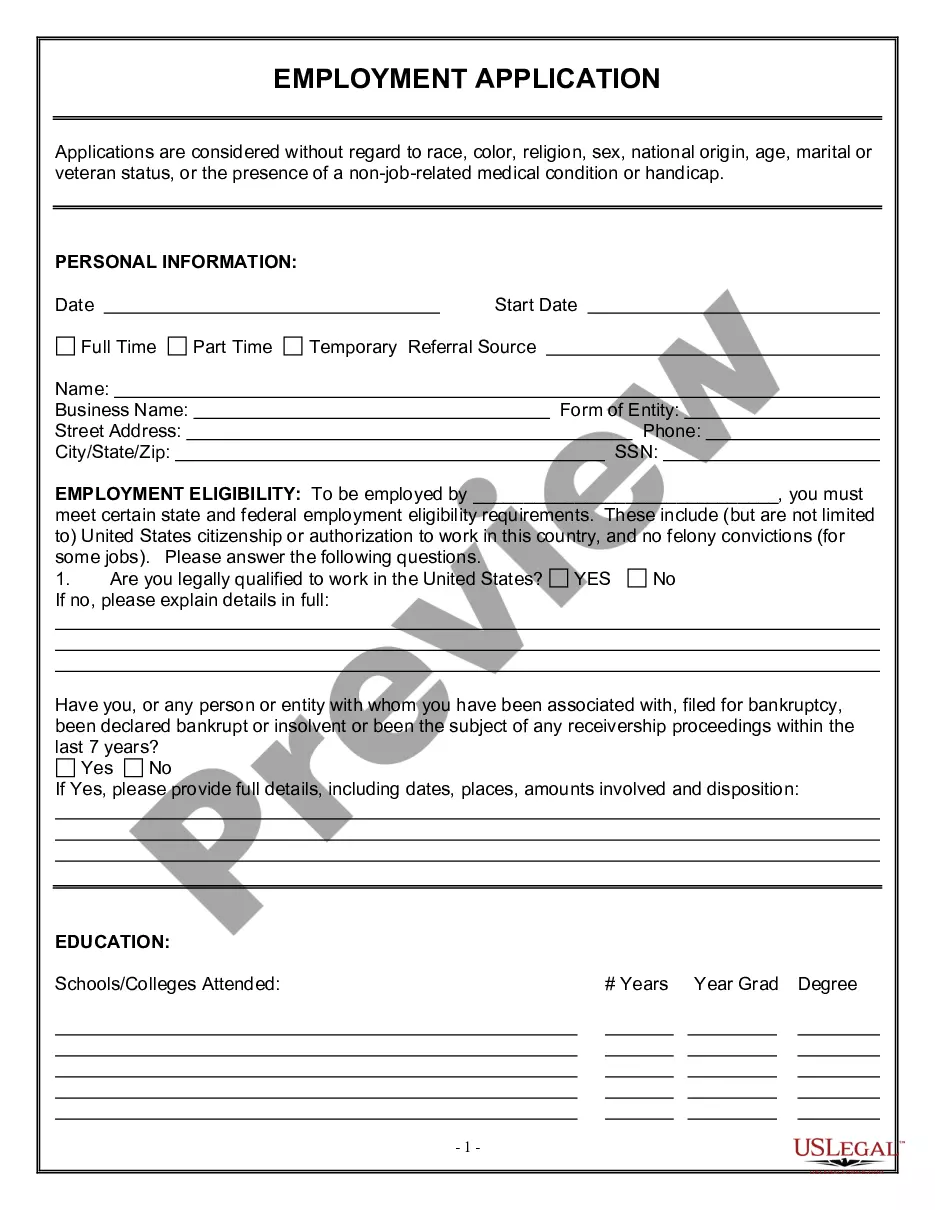

Preparing a monthly statement of account involves compiling all transactions for each customer during the month. Begin by listing all invoices issued, payments received, and any adjustments made. Finally, format this information into a clear and concise Puerto Rico Accounts Receivable Monthly Customer Statement, which you can easily share with your customers to keep them informed about their account status.

To prepare an accounts receivable report, start by gathering all relevant data, including invoices, payments received, and outstanding balances. Next, organize this information into a structured format that highlights key metrics such as total receivables and aging accounts. Utilizing a platform like USLegalForms can help streamline the creation of your Puerto Rico Accounts Receivable Monthly Customer Statement, ensuring accuracy and efficiency in your reporting process.

A customer's statement should include the customer's name, account number, invoice dates, total amounts due, and any outstanding balances. Additionally, it should present a clear breakdown of transactions, including payments and credits applied. By ensuring your Puerto Rico Accounts Receivable Monthly Customer Statement meets these requirements, you maintain transparency and foster trust with your clients.

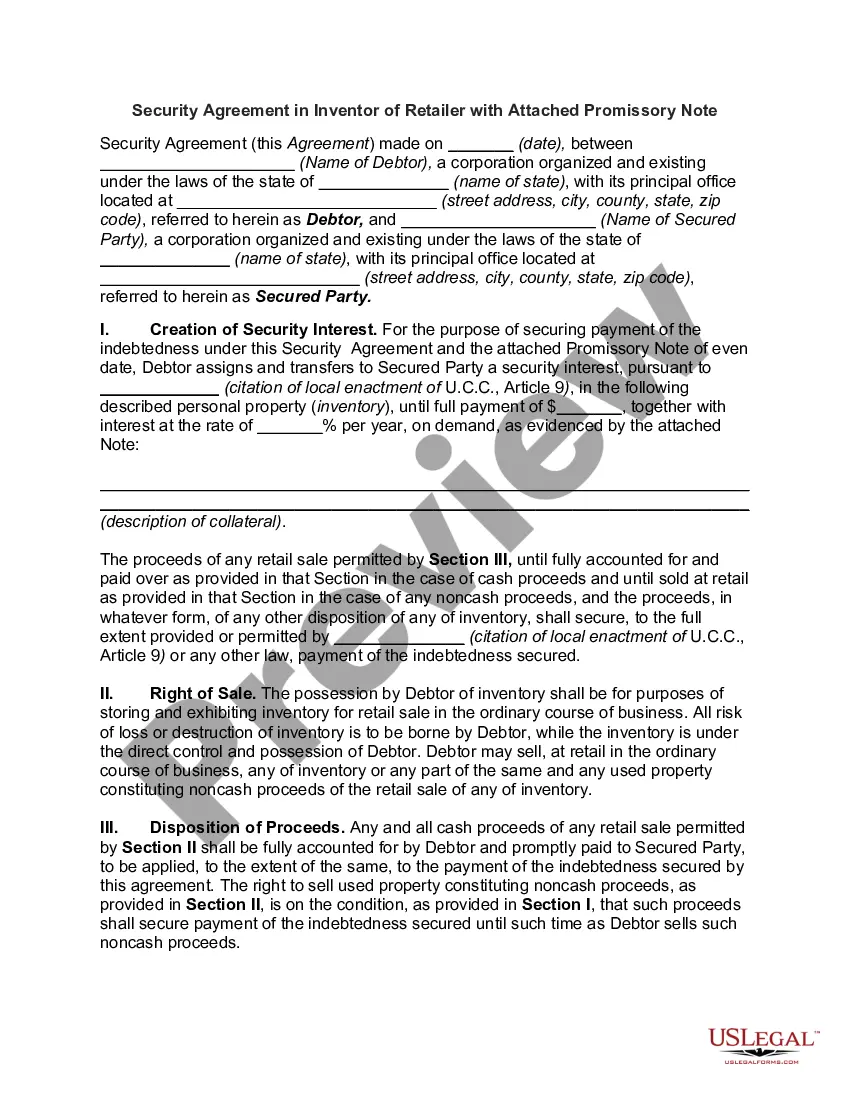

Puerto Rico is a US territory, but it is treated as international for shipping purposes. This means that certain customs regulations apply, and you will need to prepare the necessary documentation, such as a commercial invoice. Understanding this distinction is essential for ensuring that your Puerto Rico Accounts Receivable Monthly Customer Statement accurately reflects your shipping and sales activities. Always verify shipping requirements before sending items.

Puerto Rico does require a commercial invoice for shipments, particularly for customs purposes. This invoice helps to ensure that the items being shipped are properly declared and valued. Keeping a commercial invoice on hand aids in accurate reporting on your Puerto Rico Accounts Receivable Monthly Customer Statement. It simplifies the process of tracking your sales and inventory.

Yes, a commercial invoice is generally required for shipments to Puerto Rico. It serves as a critical document for customs clearance and itemizes the goods being sent. By including a commercial invoice, you can better organize your financial records and keep your Puerto Rico Accounts Receivable Monthly Customer Statement in order. This practice aids in smooth transactions and compliance.

A commercial invoice is often necessary for international shipments, including to Puerto Rico. This document provides essential information for customs clearance and ensures accurate record-keeping. Including a commercial invoice will help you maintain precise records in your Puerto Rico Accounts Receivable Monthly Customer Statement, reflecting all sales and transactions. Always check the specific requirements for your shipping method.

Residents of Puerto Rico are generally not required to file a US tax return if they meet certain criteria. However, they may still need to file a Puerto Rico tax return and report their income. If you receive income from sources outside of Puerto Rico, you may need to consider how this impacts your Puerto Rico Accounts Receivable Monthly Customer Statement. Consulting a tax professional can provide clarity on your specific situation.