Pennsylvania Business Deductibility Checklist

Description

How to fill out Business Deductibility Checklist?

US Legal Forms - one of the most notable collections of legal documents in the USA - offers a broad variety of legal paper templates that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, arranged by categories, states, or keywords. You can obtain the latest forms such as the Pennsylvania Business Deductibility Checklist within minutes.

If you currently possess a subscription, Log In and download the Pennsylvania Business Deductibility Checklist from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously saved forms from the My documents tab of your account.

Complete the transaction. Use Visa or Mastercard or a PayPal account to finalize the transaction.

Choose the format and download the form onto your device. Edit. Fill out, amend, and print and sign the saved Pennsylvania Business Deductibility Checklist. Every template you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the form you desire. Access the Pennsylvania Business Deductibility Checklist with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you wish to use US Legal Forms for the first time, here are quick guidelines to get started.

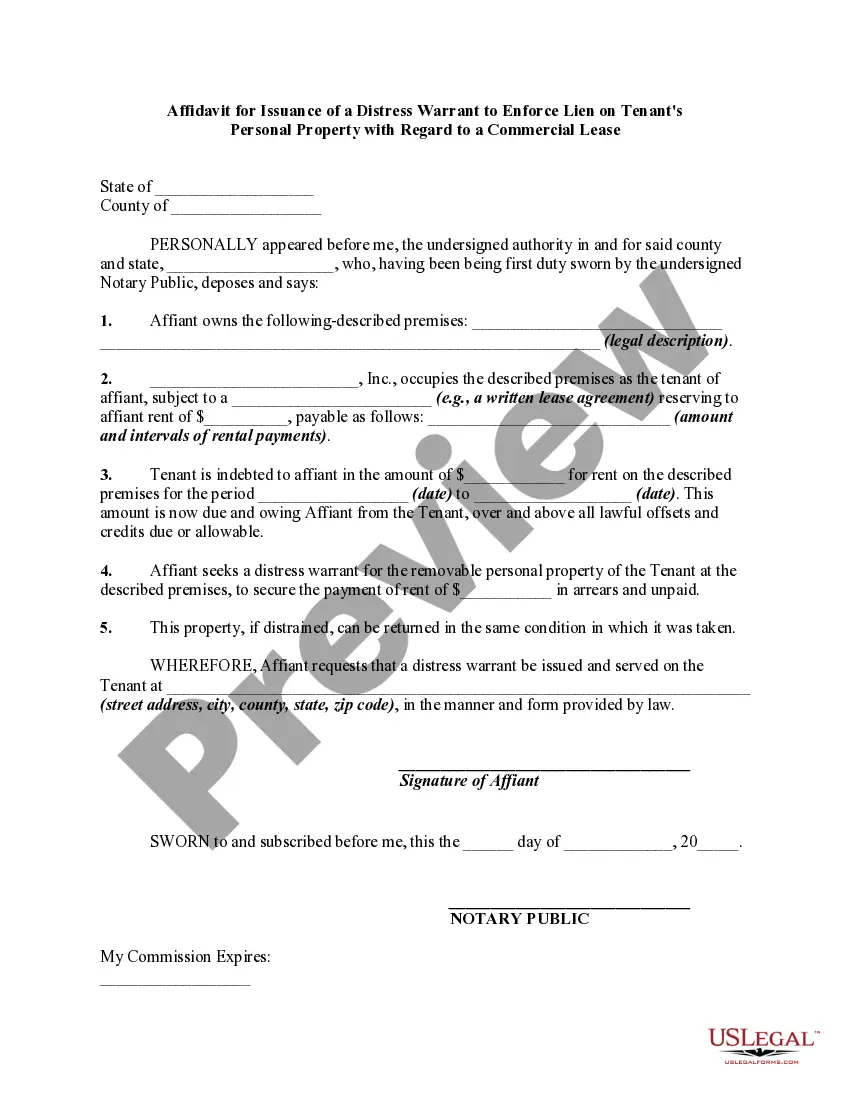

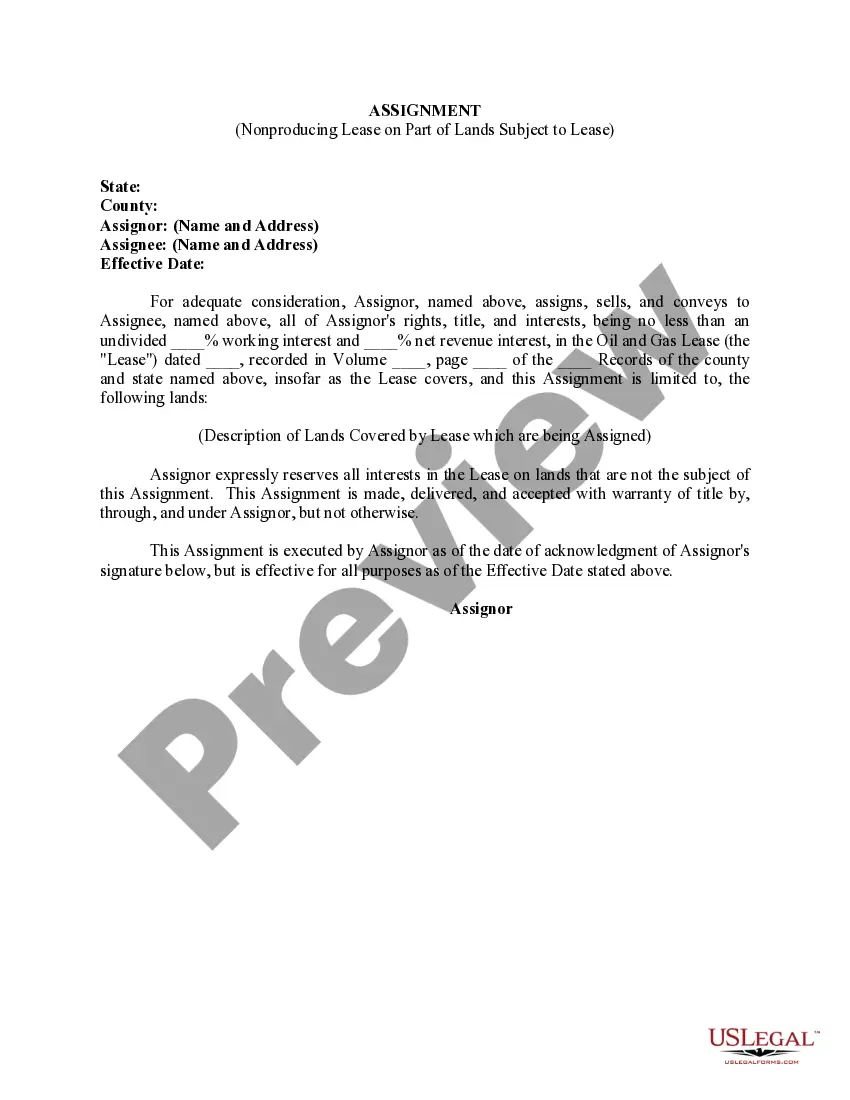

- Ensure you have selected the correct form for the city/state. Click the Preview button to review the form's content.

- Examine the form description to confirm that you have selected the appropriate form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Next, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

To qualify for deductibility, business expenses must be ordinary, necessary, and directly related to your business activities. It's crucial to maintain accurate records and receipts for all these expenses. For more clarity on what qualifies as a deductible business expense, refer to the Pennsylvania Business Deductibility Checklist.

Pennsylvania Personal Income Tax law permits a taxpayer to claim certain unreimbursed employee business expenses, including a deduction for home office expenses.

Itemized deductions include expenses that are not otherwise deductible, including mortgage interest you paid on up to two homes, state and local income or sales taxes, property taxes, medical and dental expenses that exceed 7.5 percent of your adjusted gross income and any charitable donations you may make.

21 Small-business tax deductionsStartup and organizational costs. Our first small-business tax deduction comes with a caveat it's not actually a tax deduction.Inventory.Utilities.Insurance.Business property rent.Auto expenses.Rent and depreciation on equipment and machinery.Office supplies.More items...

Itemized deductions include amounts you paid for state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest, and disaster losses. You may also include gifts to charity and part of the amount you paid for medical and dental expenses.

Common expenses for running a business for which you can take a deduction include advertising, employee benefits, insurance, legal and professional services, telephone and utilities, rent, office supplies, wages, dues to professional associations, and subscriptions to business publications.

Top 25 Tax Deductions for Small BusinessBusiness Meals. As a small business, you can deduct 50 percent of food and drink purchases that qualify.Work-Related Travel Expenses.Work-Related Car Use.Business Insurance.Home Office Expenses.Office Supplies.Phone and Internet Expenses.Business Interest and Bank Fees.More items...?

However, there are 12 states and Washington, D.C., that will allow you to itemize on your state tax return only if you itemize on your federal, said Rigney. Those 12 are Colorado, Georgia, Kansas, Maine, Maryland, Missouri, Nebraska, North Dakota, Oklahoma, South Carolina, Utah and Virginia, he said.

Disallowed deductions include the federal standard deduction and itemized deductions (with the limited exception for unreimbursed employee business expenses deducted from gross compensation). Additionally, Pennsylvania does not allow a deduction for the personal exemption.

That rate is 3.07%. That does not mean that taxpayers in Pennsylvania have lower tax bills, however. For starters, unlike many other states that collect an income tax, Pennsylvania has no standard deduction or exemption.