Pennsylvania Checklist for Proving Entertainment Expenses

Description

How to fill out Checklist For Proving Entertainment Expenses?

Have you ever found yourself needing documentation for various business or personal motives almost daily.

There are numerous legal document templates accessible on the web, but finding reliable ones is challenging.

US Legal Forms offers thousands of template options, such as the Pennsylvania Checklist for Proving Entertainment Expenses, designed to meet state and federal requirements.

Access all the document templates you have purchased in the My documents section.

You can download an additional copy of the Pennsylvania Checklist for Proving Entertainment Expenses anytime, if necessary. Simply follow the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Subsequently, you can download the Pennsylvania Checklist for Proving Entertainment Expenses template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these steps.

- Locate the form you need and confirm it is pertinent to your specific city/state.

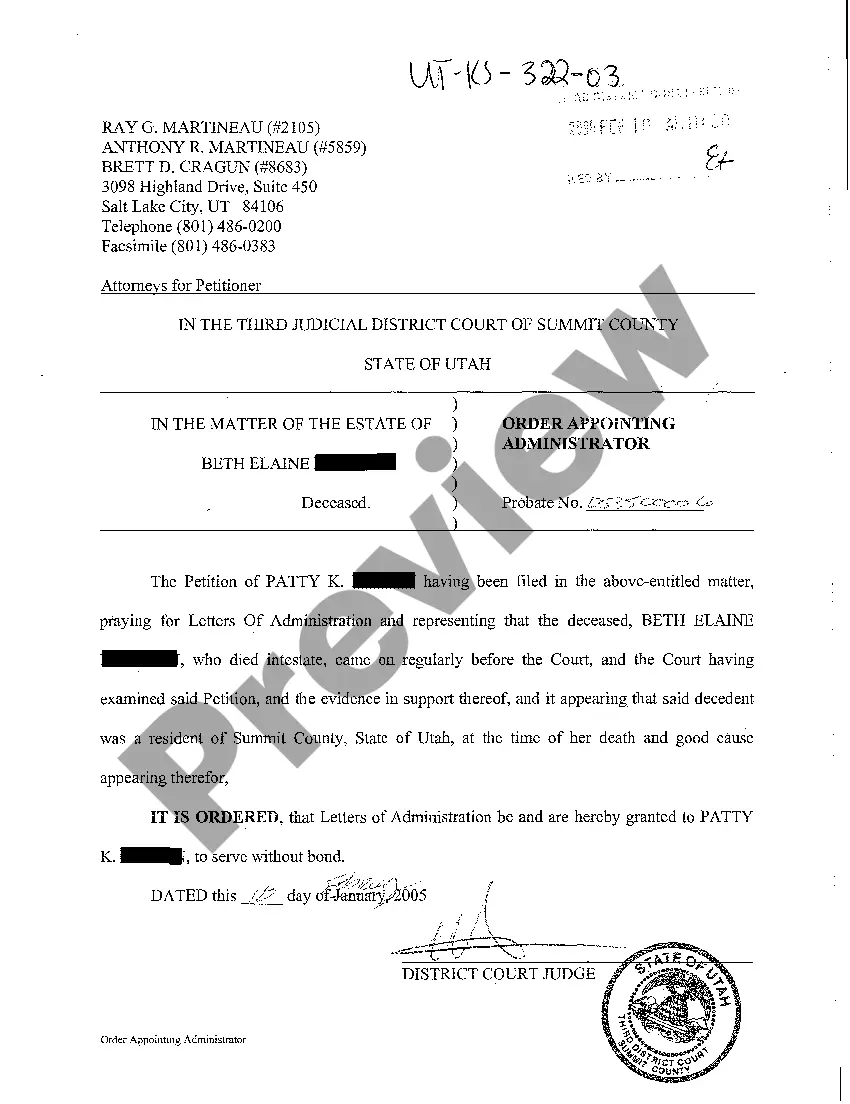

- Utilize the Preview feature to inspect the form.

- Review the information to ensure you have selected the correct form.

- If the form does not meet your requirements, use the Search field to find the form that fulfills your needs and specifications.

- When you find the appropriate form, click Get now.

- Choose the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Travel by airplane, train, bus, or car between your home and your business destination. expenses or the standard mileage rate. If you lease a car while away from home on business, you can deduct only the business-use portion of the lease.

Meals and entertainment are deductible expenses for Pennsylvania purposes. However, the taxpayer must be able to show that the expenses claimed are ordinary, actual, reasonable and necessary.

Providing entertainment means: providing entertainment by way of food, drink or recreation....What is tax-exempt body entertainment?the cost of meals provided to employees in a staff cafeteria (not including social functions)the cost of meals at certain business seminars.meals on business travel overnight.

Documents for expenses include the following:Canceled checks or other documents reflecting proof of payment/electronic funds transferred.Cash register tape receipts.Account statements.Credit card receipts and statements.Invoices.

Entertainment expenses include the cost of entertaining customers or employees at social and sports events, restaurant meals and theater tickets, among other things. You may deduct business entertainment expenses subject to certain conditions.

Food and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022. Entertaining clients (concert tickets, golf games, etc.) Wondering how this breaks down? If you're dining out with a client at a restaurant, you can consider that meal 100% tax-deductible.

Entertainment expenses, like a sporting event or tickets to a show, are still non-deductible. However, team-building activities for employees are deductible.

Entertainment expenses, like a sporting event or tickets to a show, are still non-deductible. However, team-building activities for employees are deductible.

Yes, meals and entertainment expenses are 100 percent allowable.