Pennsylvania Loan Agreement - Short Form

Description

How to fill out Loan Agreement - Short Form?

If you wish to complete, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly and efficient search to locate the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to find the Pennsylvania Loan Agreement - Short Form with just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal document and download it to your device. Step 7. Fill out, edit, and print or sign the Pennsylvania Loan Agreement - Short Form. Each legal document format you buy is yours permanently. You have access to every form you downloaded in your account. Choose the My documents section and select a form to print or download again. Be proactive and acquire, and print the Pennsylvania Loan Agreement - Short Form with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to access the Pennsylvania Loan Agreement - Short Form.

- You can also view forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the content of the form. Remember to read through the summary.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the page to find other versions of the legal document format.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

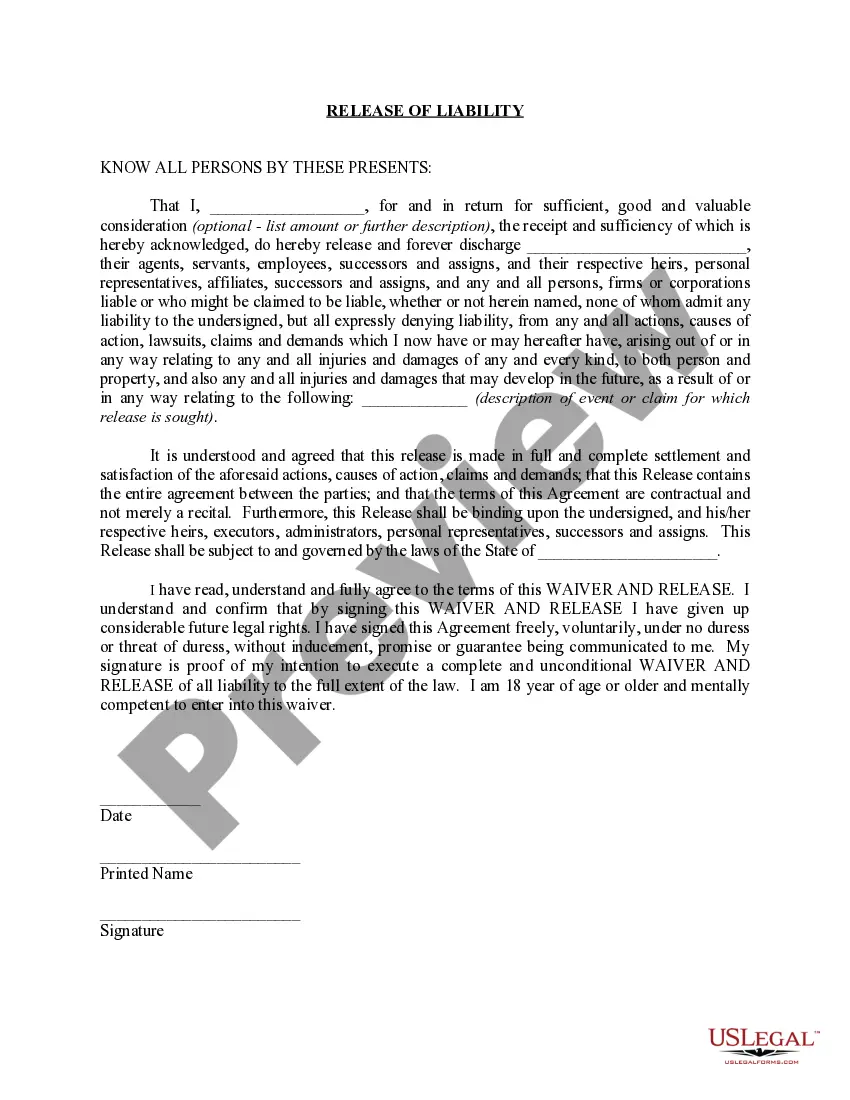

A promissory note is a written agreement between a borrower and a lender saying that the borrower will pay back the amount borrowed plus interest. The promissory note is issued by the lender and is signed by the borrower (but not the lender).

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.