Pennsylvania Quitclaim Deed from Individual to Husband and Wife

Overview of this form

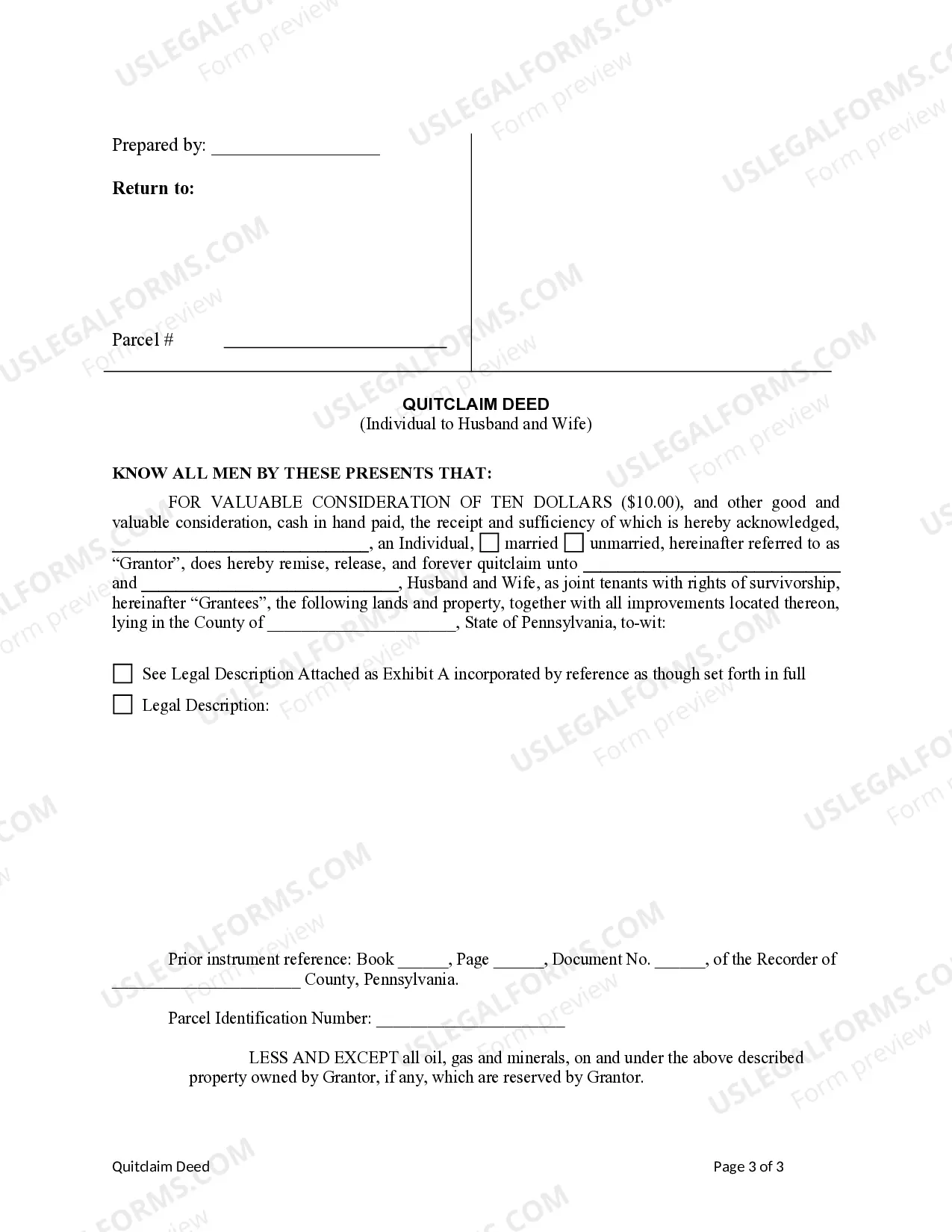

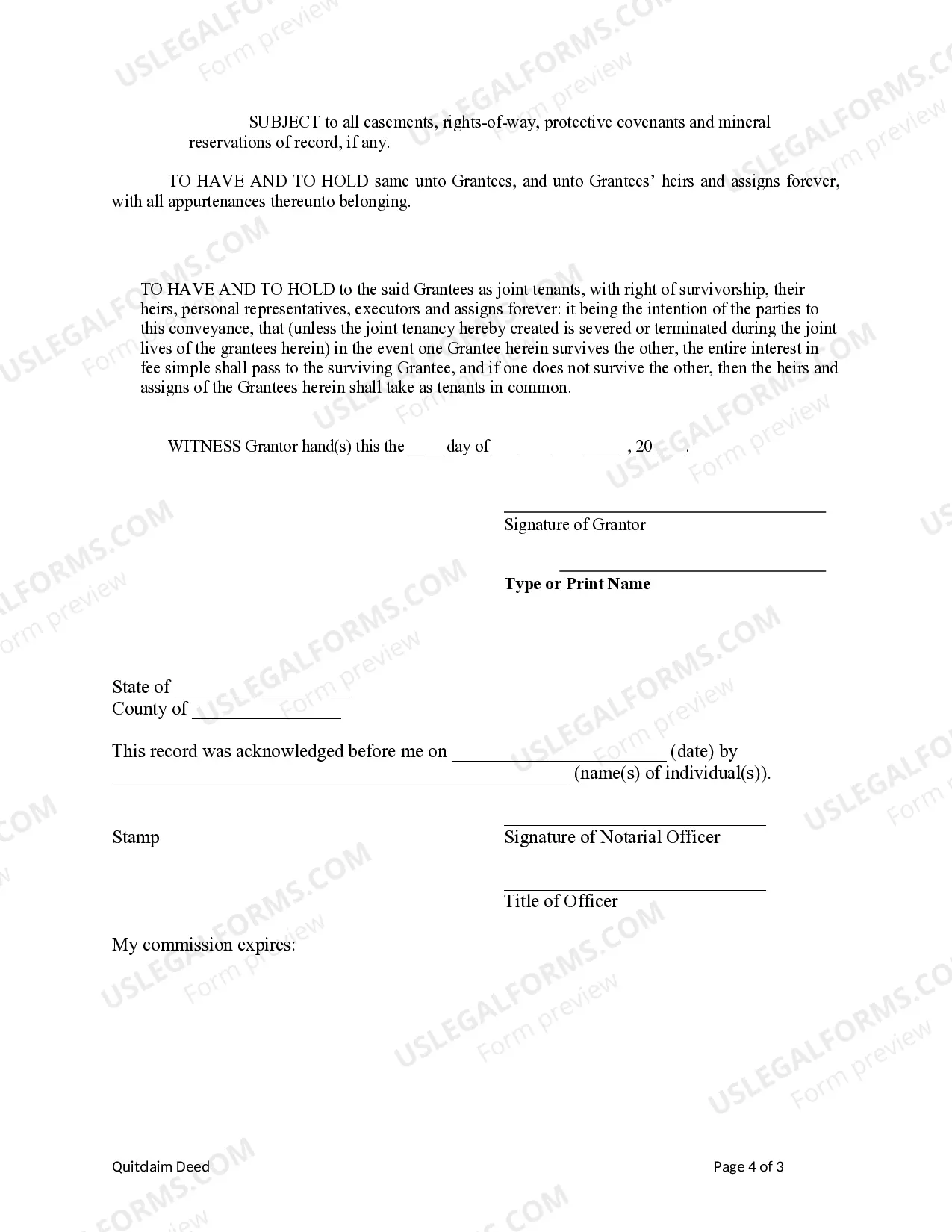

The Quitclaim Deed from Individual to Husband and Wife is a legal document that allows an individual (the Grantor) to convey ownership of a property to a married couple (the Grantees). This type of quitclaim deed differs from other property transfer forms by specifically designating the recipients as joint tenants, which provides them with rights of survivorship. This means that if one spouse passes away, the surviving spouse automatically inherits the full property interest without the need for probate. The form complies with the legal requirements of the state of Pennsylvania and contains important clauses regarding the reservation of mineral rights and easements.

Key components of this form

- Identification of the Grantor (individual) and the Grantees (husband and wife).

- Specification of the property being transferred, along with an attached legal description.

- Reservation clause outlining any retained rights to minerals or resources beneath the property.

- Creation of joint tenancy with rights of survivorship to the Grantees.

- Clauses for accepting the property subject to existing easements and covenants.

State law considerations

This form is tailored to meet the legal standards set by the state of Pennsylvania. Ensure that any specific local laws or additional requirements are reviewed before use.

When this form is needed

This quitclaim deed is typically used when an individual wants to transfer their interest in a property to their spouse, thereby formalizing shared ownership. Situations may include marriage, family estate planning, or simply a transfer of property for financial reasons. This form is also suitable when the Grantor wishes to simplify property ownership by consolidating it into joint tenancy with rights of survivorship.

Who should use this form

- Individuals who are looking to transfer real estate to their spouse.

- Married couples seeking to establish joint ownership of a property.

- Individuals involved in family estate planning.

- Homeowners wanting to consolidate property titles.

Instructions for completing this form

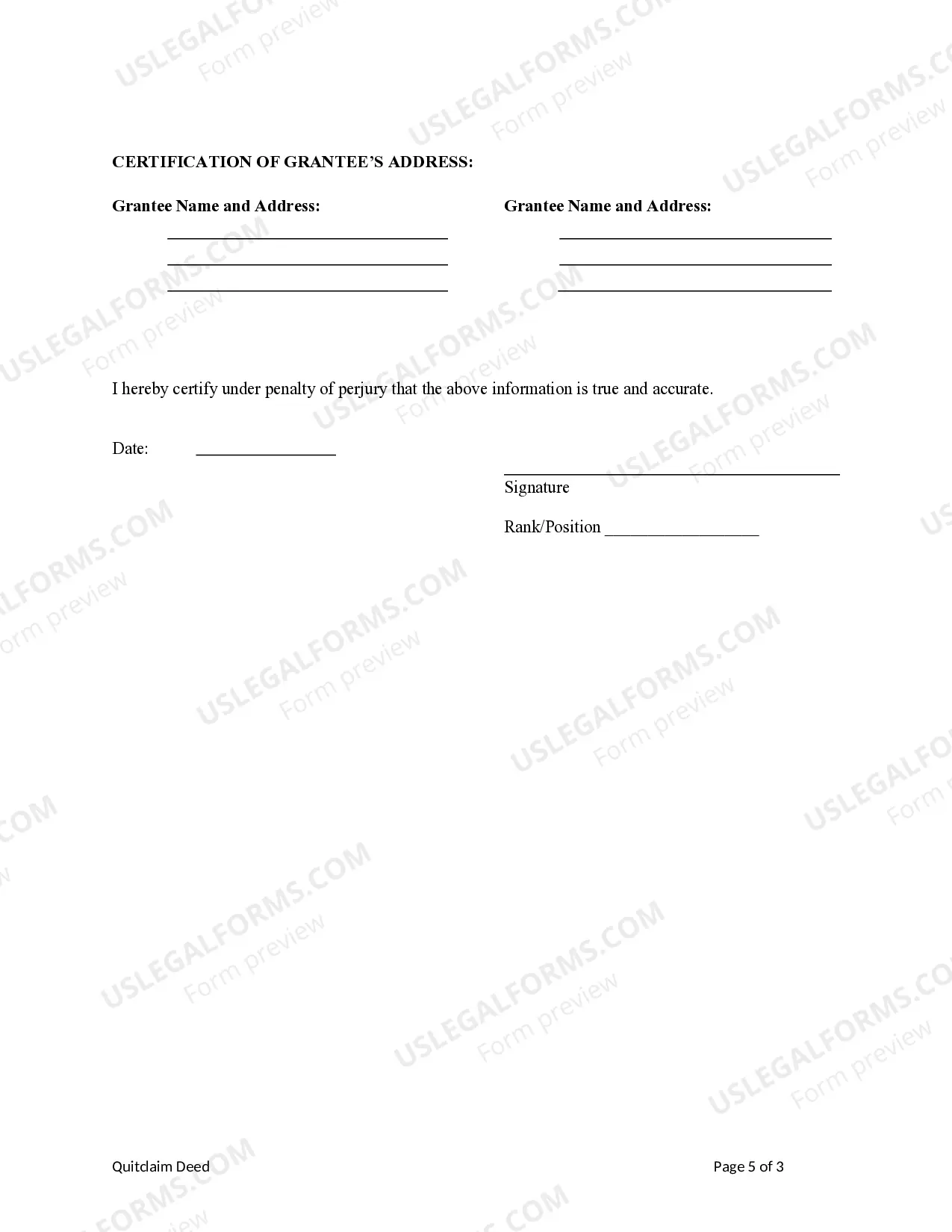

- Identify the Grantor by entering their full name and marital status.

- Specify the Grantees by entering the names of the husband and wife.

- Detail the property being transferred, including a complete legal description.

- Include the reservation clause regarding oil, gas, and mineral rights.

- Sign and date the document in the presence of a notary public if required.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Mistakes to watch out for

- Failing to provide a complete legal description of the property.

- Not including the reservation of mineral rights if applicable.

- Inaccurate identification of the Grantor or Grantees.

- Neglecting to sign or date the document.

Why use this form online

- Convenient access to fillable forms that can be completed on your computer.

- Editable fields allow for quick and accurate information entry.

- Immediate download option for printing or sharing as needed.

- Access to forms drafted by licensed attorneys, ensuring legal compliance.

Form popularity

FAQ

A quitclaim deed doesn't always need to be signed before the divorce is final. Your divorce judgment will detail the terms of your property settlement agreement, and the requirement for transferring title will likely be incorporated into this agreement.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

The State of Pennsylvania charges 1% of the sales price and the municipality and school district USUALLY charge 1% between them for a total of 2% (i.e. 2% X 100,000 = $2,000). By custom, the buyer and seller split the cost. 1% to buyer, 1% to seller; however payment is dictated by the sales contract.

A quitclaim deed is a deed (proof of ownership) that is passed from a grantor (the existing property owner) to a grantee (the new property owner) that does not have a warranty.A quitclaim deed has no guarantees for the grantor or grantee.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.