Oregon Statement to Add to Credit Report

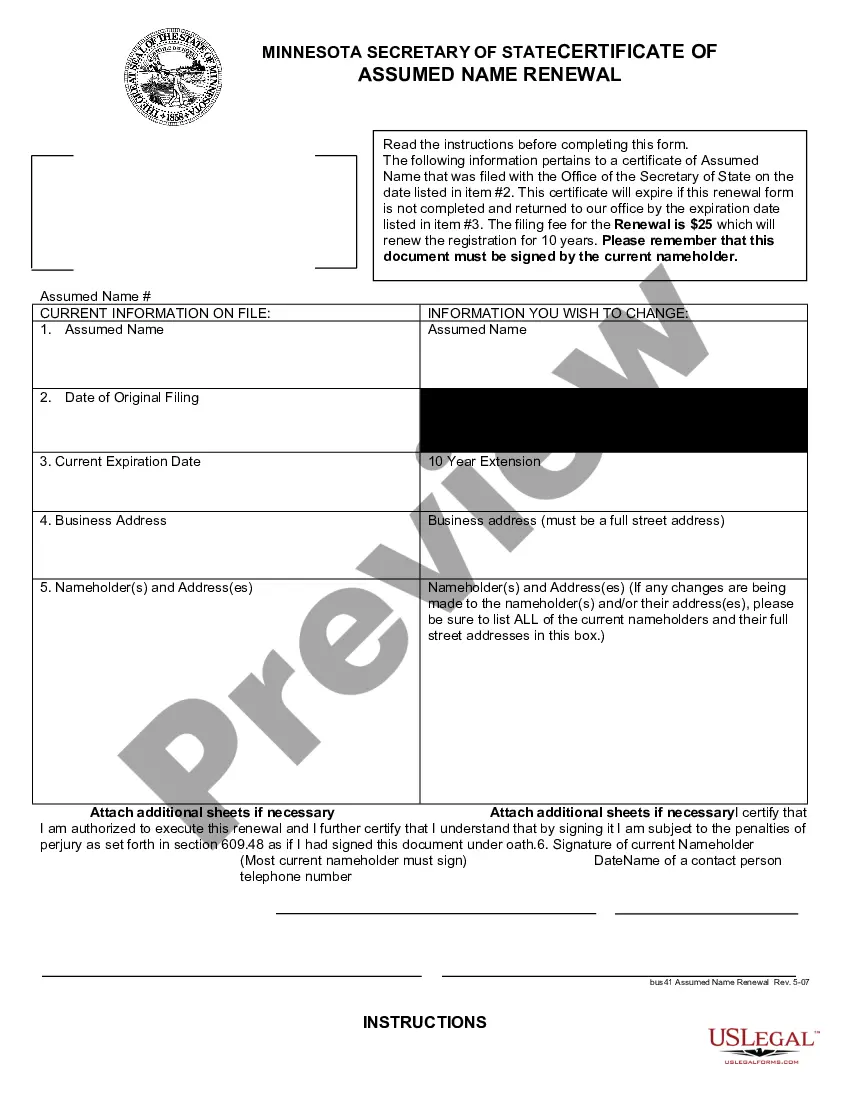

Description

How to fill out Statement To Add To Credit Report?

It is feasible to invest numerous hours online looking for the legal document template that meets the federal and state requirements you require.

US Legal Forms offers a vast array of legal forms that have been reviewed by professionals.

You can download or print the Oregon Statement to Add to Credit Report from their service.

If available, use the Preview option to examine the document template as well. If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you desire, click Purchase now to proceed. Select the pricing plan you want, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make changes to your document if necessary. You can complete, edit, sign, and print the Oregon Statement to Add to Credit Report. Download and print numerous document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and then click the Download option.

- After that, you can complete, modify, print, or sign the Oregon Statement to Add to Credit Report.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, visit the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/state of your choice.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

To fill out a withholding exemption, you will need to complete the appropriate section of your W4 form, ensuring that you meet the criteria for claiming exempt status. This includes confirming that you did not owe taxes in the prior year and expect none for the current year. Properly managing your withholding exemption is vital for maintaining an accurate Oregon Statement to Add to Credit Report. If you're unsure, consider using USLegalForms for assistance.

Determining how many allowances to claim in Oregon requires careful consideration of your income and family situation. Generally, more allowances mean less tax withholding, which can lead to a higher paycheck. However, claiming too many can result in owing taxes at the end of the year. Balancing your allowances is essential for your financial health and can positively impact your Oregon Statement to Add to Credit Report.

Filling out the Oregon withholding statement and exemption certificate involves providing accurate information about your income, filing status, and the number of allowances you wish to claim. Ensure you follow the instructions carefully, as mistakes can affect your tax withholding and overall financial health. This process is crucial for maintaining an accurate Oregon Statement to Add to Credit Report. If needed, USLegalForms can assist you with the correct forms and guidance.

To claim exempt on your W4 in Oregon, you must meet specific criteria, such as not owing any federal income tax in the previous year and expecting none for the current year. You should write 'Exempt' in the appropriate box on your W4 form. This option affects your paycheck and overall tax obligations, which can be significant when managing an Oregon Statement to Add to Credit Report. Be sure to review your financial situation carefully before claiming exempt status.

When deciding whether to put 0 or 1 for withholding allowances, it's essential to evaluate your financial situation. Generally, if you want more taxes withheld from your paycheck, you might choose 0. However, if you prefer a smaller withholding amount, then 1 could be the better choice. This decision can impact your overall tax return and might relate to your Oregon Statement to Add to Credit Report.

The 200 day rule in Oregon refers to a specific timeframe within which certain actions must be taken regarding your credit report. If you have a negative item on your credit report, you may need to address it within 200 days to have a chance to improve your credit score. Understanding this rule is crucial when considering an Oregon Statement to Add to Credit Report. Timely action can help you manage your credit effectively.

To manually update your credit report, start by identifying the errors or outdated information you want to correct. You need to contact the credit reporting agency directly, providing them with the necessary documentation to support your request. Incorporating the Oregon Statement to Add to Credit Report can also help clarify any discrepancies. Using uslegalforms can streamline this process and guide you through the steps required for a successful update.

Yes, you can add a statement to your credit report. This allows you to explain any circumstances or provide context for negative information. It is beneficial to use the Oregon Statement to Add to Credit Report, as it helps creditors understand your situation better. Consider using resources like uslegalforms to simplify the process and ensure your statement is clear and effective.

To add a statement to your credit report, you first need to contact the credit reporting agency and request the addition. You can provide your explanation or context regarding any negative items on your report. The Oregon Statement to Add to Credit Report is an effective way to ensure your perspective is included. Platforms like uslegalforms can assist you in drafting a clear statement that complies with reporting standards.

Building your credit from a score of 500 to 700 can take several months to a few years, depending on your financial habits and credit management. You should focus on paying bills on time, reducing debt, and monitoring your credit report regularly. Using the Oregon Statement to Add to Credit Report can help provide context for any negative marks, which can be beneficial as you work to improve your score. Remember, consistency is key in this journey.