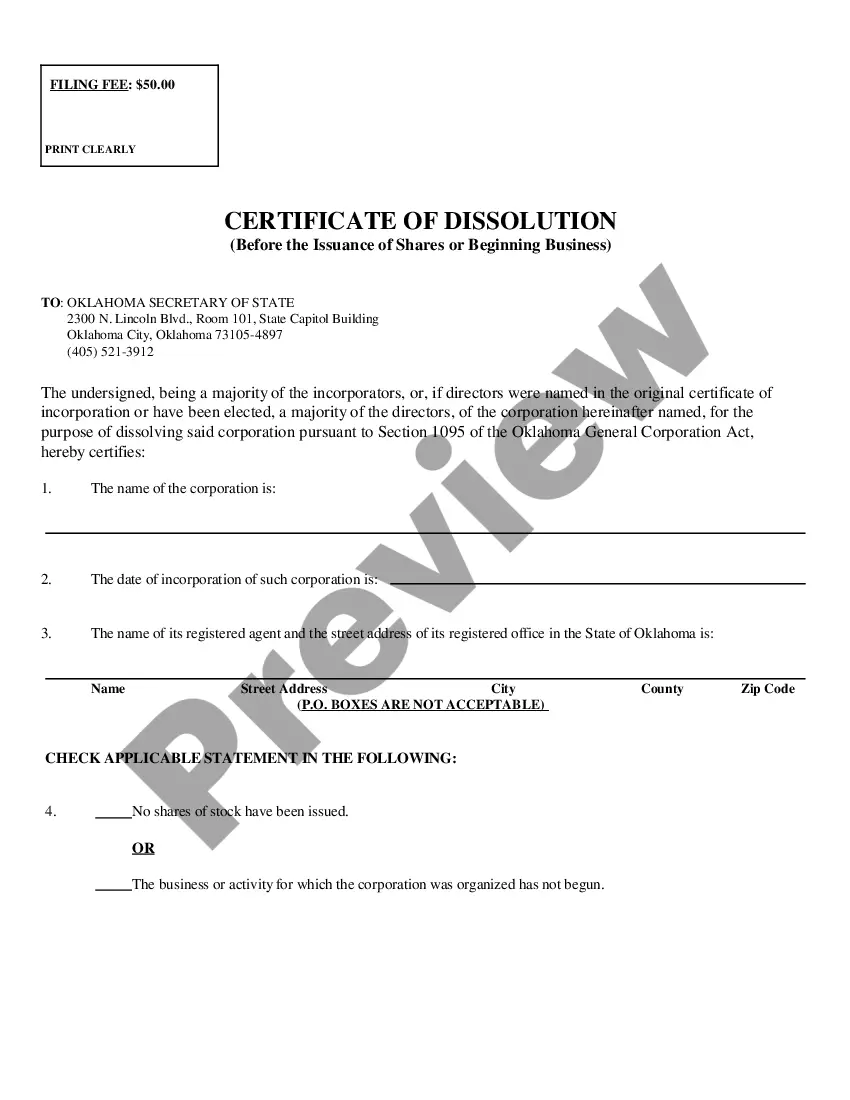

An Oklahoma Certificate of Dissolution before beginning business (profit) is an official document from the State of Oklahoma that officially dissolves a business corporation. This document must be filed with the Oklahoma Secretary of State in order to end a business’s legal existence in the state. There are two types of Oklahoma Certificate of Dissolution before beginning business (profit): Domestic Corporation Certificate of Dissolution and Foreign Corporation Certificate of Dissolution. A Domestic Corporation Certificate of Dissolution is necessary for any business that is incorporated in the State of Oklahoma and has not yet begun operations. A Foreign Corporation Certificate of Dissolution is necessary for any business that has been incorporated in another state but is registered to do business in Oklahoma. Both types of certificates must include the name of the corporation, a statement that the corporation is voluntarily dissolving, and the signature of an officer or authorized representative of the corporation.

Oklahoma Certificate of Dissolution, before beginning business (profit)

Description

Key Concepts & Definitions

Certificate of Dissolution: A legal document filed with a state government to formally dissolve a corporation. In the context of nonstock corporations and businesses in Delaware, this certificate signifies the cessation of all business activities and legal operations. Nonstock Corporation: A type of corporation in the U.S. that does not issue stock to its members. These are often nonprofits or associations. Delaware Short Form: A streamlined version of filing documents, including for dissolution, used predominantly in Delaware, known for its business-friendly laws.

Step-by-Step Guide to Filing a Certificate of Dissolution in Delaware

- Review the Corporation's Governing Documents: Ensure all conditions noted for dissolution, especially for nonstock corporations, are met.

- Board Resolution: Conduct a formal vote with the corporation's board to agree on dissolution.

- Filing Requirements: Prepare necessary documents, including the Delaware short form for dissolution, if applicable. These forms can often be filed online and are available for free download.

- Settle Debts and Obligations: Clear any outstanding debts or legal obligations, including those linked to real estate held by the corporation.

- File the Certificate of Dissolution: Submit the completed form to the Delaware Division of Corporations. Utilize lawyer services if necessary to ensure compliance with state laws.

- Notify Affected Parties: Inform all stakeholders, including creditors, employees, and clients, about the dissolution.

Risk Analysis

Filing a certificate of dissolution before beginning any business activities can lead to legal complications, such as breaches of contract or unmet obligations. Additionally, improper filing without settling obligations, especially in real estate or other substantial assets, can result in financial liabilities or legal actions against former corporate officers or directors.

Industry Trends & Future Insights

The trend towards digital transformation has simplified the dissolution process with features like file online options and electronic notifications. Future insights indicate a possible increase in the use of AI and machine learning to automate and error-proof the dissolution filings, particularly in complex jurisdictions like Delaware.

Best Practices

- Early Preparation: Begin the process of dissolution well in advance to ensure all legal and financial obligations are met.

- Legal Consultation: Use reputable lawyer services to navigate the complex legal environment, especially when dissolving a corporation in Delaware.

- Transparency: Maintain clear communication with all stakeholders throughout the dissolution process to minimize potential disputes or misunderstandings.

FAQ

1. Can I file a Certificate of Dissolution online?

Yes, many states including Delaware offer online filing options. Documents can often be downloaded for free and filed electronically.

2. What happens if a corporation doesn't properly dissolve?

Failure to properly dissolve a corporation can lead to continued taxation and legal liabilities for directors and officers.

How to fill out Oklahoma Certificate Of Dissolution, Before Beginning Business (profit)?

How much time and resources do you usually spend on drafting official documentation? There’s a greater option to get such forms than hiring legal specialists or spending hours browsing the web for a proper blank. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, like the Oklahoma Certificate of Dissolution, before beginning business (profit).

To obtain and prepare an appropriate Oklahoma Certificate of Dissolution, before beginning business (profit) blank, adhere to these easy steps:

- Look through the form content to make sure it complies with your state regulations. To do so, read the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your needs, find another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Oklahoma Certificate of Dissolution, before beginning business (profit). If not, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally secure for that.

- Download your Oklahoma Certificate of Dissolution, before beginning business (profit) on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trusted web services. Join us now!

Form popularity

FAQ

This is a formal process for closing and if followed, should provide some protection for the owners of the company. Written Resolution.Pay creditors.Distribute to Members.Complete Articles of Dissolution.File with Secretary of State.File with Oklahoma Tax Commission.File with IRS.Unemployment Authority.

The cost to dissolve an LLC in Oklahoma is $50 online. You can find the forms to do so on the Oklahoma Secretary of State's website. Your LLC will be officially dissolved once you've completed and submitted the forms.

To dissolve/terminate your domestic LLC in Oklahoma, you must submit the completed Articles of Dissolution of an Oklahoma Limited Liability Company form to the Oklahoma Secretary of State by mail, in person or by fax along with the filing fee. If you file by fax, include a cover sheet with all credit card information.

To dissolve your corporation in Oklahoma, you submit the completed Oklahoma Certificate of Dissolution form by mail, in person or by fax to the Secretary of State along with the filing fee.

To cancel your EIN and close your IRS business account, you need to send us a letter that includes: The complete legal name of the business. The business EIN. The business address.

To dissolve your corporation in Oklahoma, you submit the completed Oklahoma Certificate of Dissolution form by mail, in person or by fax to the Secretary of State along with the filing fee.

To dissolve/terminate your domestic LLC in Oklahoma, you must submit the completed Articles of Dissolution of an Oklahoma Limited Liability Company form to the Oklahoma Secretary of State by mail, in person or by fax along with the filing fee. If you file by fax, include a cover sheet with all credit card information.

Dissolution. The first step to closing up shop is receiving shareholder approval to formally close the corporation. The board of directors should adopt a resolution to dissolve the corporation and receive approval for the action.

To close their business account, a sole proprietor needs to send the IRS a letter that includes the complete legal name of their business, the EIN, the business address and the reason they wish to close their account.