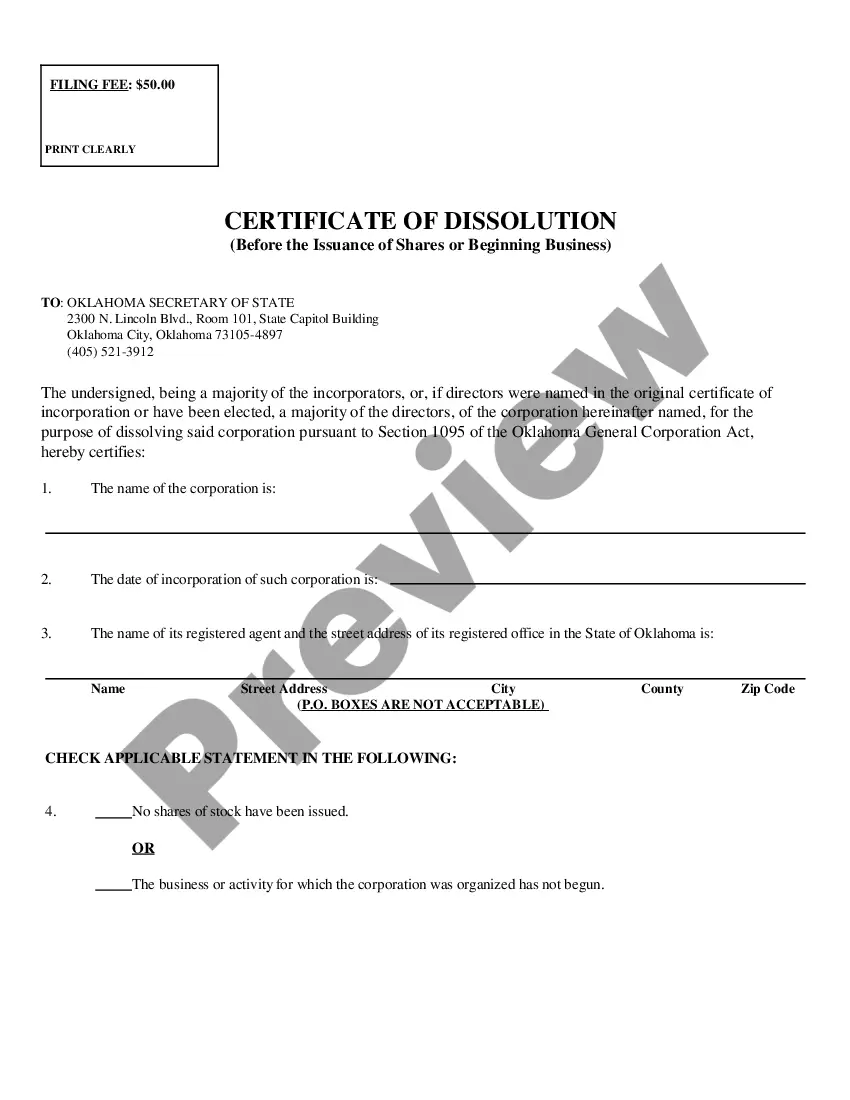

An Oklahoma Certificate of Dissolution before business has begun (nonstick) is an official document filed with the Oklahoma Secretary of State to formally dissolve an Oklahoma business that has not yet begun operating. This document must be completed and submitted by the company's owner or registered agent, and must include the name of the company, legal address, and identification number. There are two types of Oklahoma Certificate of Dissolution before business has begun (nonstick): Articles of Dissolution and Certificate of Dissolution. The Articles of Dissolution must be signed and notarized by the company's owner or registered agent, and must include the company's name, legal address, and identification number. The Certificate of Dissolution must be signed and notarized by the company's owner or registered agent, and must include the company's name, legal address, and identification number, as well as a statement of dissolution.

Oklahoma Certificate of Dissolution, before business has begun (nonstock)

Description

How to fill out Oklahoma Certificate Of Dissolution, Before Business Has Begun (nonstock)?

US Legal Forms is the most straightforward and affordable way to find appropriate legal templates. It’s the most extensive web-based library of business and personal legal documentation drafted and verified by lawyers. Here, you can find printable and fillable templates that comply with national and local laws - just like your Oklahoma Certificate of Dissolution, before business has begun (nonstock).

Obtaining your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Oklahoma Certificate of Dissolution, before business has begun (nonstock) if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make sure you’ve found the one meeting your demands, or find another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you like most.

- Register for an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your Oklahoma Certificate of Dissolution, before business has begun (nonstock) and download it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more efficiently.

Benefit from US Legal Forms, your reputable assistant in obtaining the required official documentation. Try it out!

Form popularity

FAQ

To dissolve your corporation in Oklahoma, you submit the completed Oklahoma Certificate of Dissolution form by mail, in person or by fax to the Secretary of State along with the filing fee.

Steps to dissolve, surrender, or cancel a California business entity File all delinquent tax returns and pay all tax balances, including any penalties, fees, and interest. File the final/current year tax return.Cease doing or transacting business in California after the final taxable year.

Steps to dissolving a nonprofit File a final form. In this type of dissolution, the IRS mandates that the board of directors of the nonprofit organization complete certain requirements to "dissolve," or shut down, the 501(c)(3).Vote for dissolution.File Form 990.File the paperwork.

Steps to dissolving a nonprofit File a final form. In this type of dissolution, the IRS mandates that the board of directors of the nonprofit organization complete certain requirements to "dissolve," or shut down, the 501(c)(3).Vote for dissolution.File Form 990.File the paperwork.

Complete Schedule N (Form 990 or 990-EZ), Liquidation, Termination, Dissolution or Significant Disposition of Assets. Include a description of the assets and any transaction fees, the date of distribution, the fair market value of the assets and information about the recipients of the assets.

Federal law requires a tax-exempt charitable nonprofit that is dissolving to distribute its remaining assets ONLY to another tax-exempt organization or to the federal government or a state or local government for a public purpose.

Dissolving a 501(c)(3) is the process of disbanding an organization and ending its non- profit status. Regardless of the reasons for dissolving its 501(c)(3) status, an organization must follow a series of steps with the state and the Internal Revenue Service (IRS) for the action to officially occur.

Dissolution. The first step to closing up shop is receiving shareholder approval to formally close the corporation. The board of directors should adopt a resolution to dissolve the corporation and receive approval for the action.