Ohio Log of Records Retention Requirements

Description

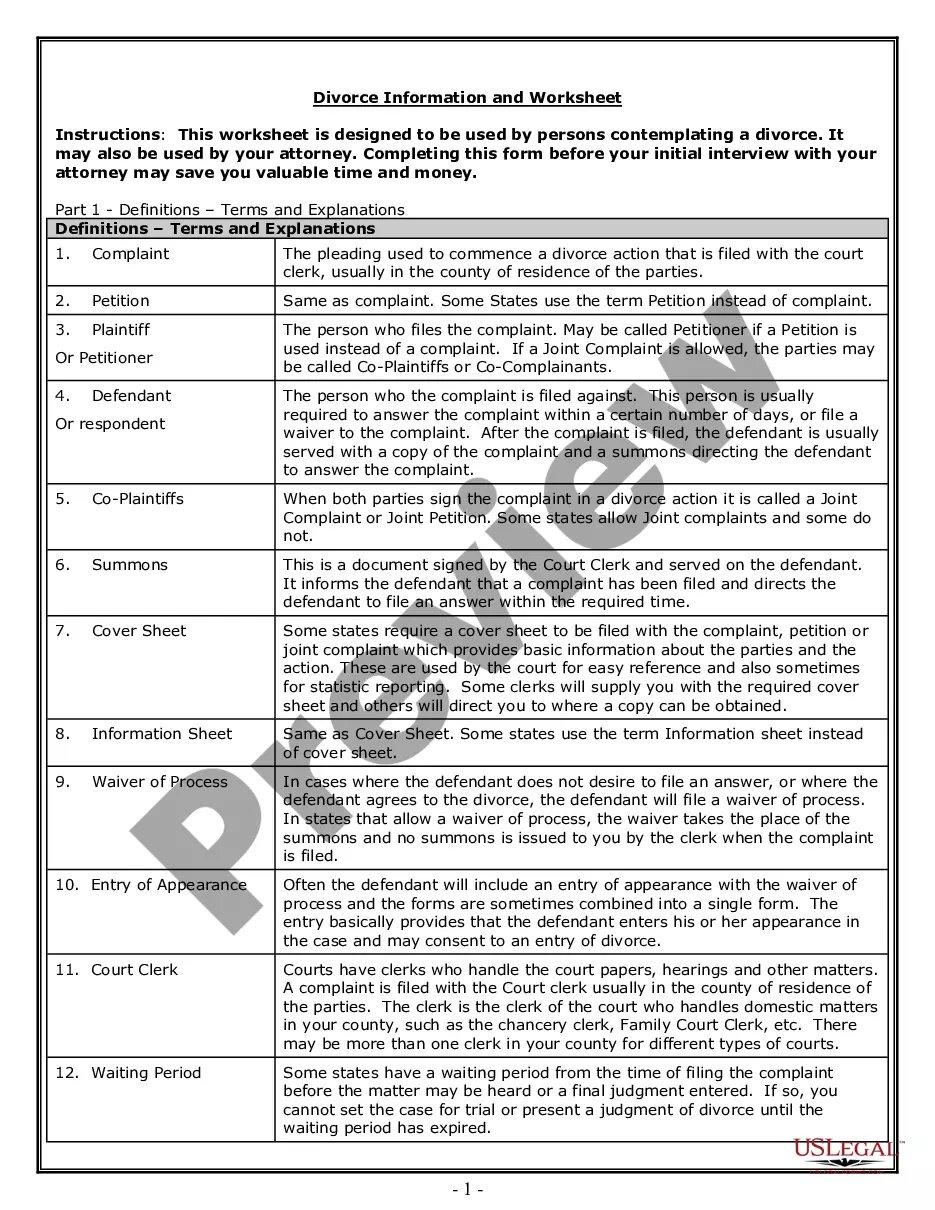

How to fill out Log Of Records Retention Requirements?

If you wish to finalize, acquire, or create sanctioned document templates, utilize US Legal Forms, the premier assortment of legal forms, readily accessible online.

Use the site’s user-friendly search function to find the documents you require.

Various templates for business and personal uses are categorized by types and states, or keywords.

Step 4. Once you have found the form you want, click on the Get Now button. Choose the pricing plan that suits you and provide your information to register for an account.

Step 5. Process the payment. You can utilize your credit card or PayPal account to finalize the transaction.

- Employ US Legal Forms to obtain the Ohio Log of Records Retention Requirements in just a few clicks.

- If you’re already a US Legal Forms user, Log In to your account and click on the Download button to get the Ohio Log of Records Retention Requirements.

- You can also access forms you previously saved under the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for your specific city/state.

- Step 2. Use the Preview option to review the details of the form. Don’t forget to read the description.

- Step 3. If the form does not meet your expectations, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In Ohio, medical records must generally be kept for a minimum of 7 years after the last treatment date. This follows the Ohio Log of Records Retention Requirements, which emphasize the importance of retaining patient records for quality care and legal protection. Understanding these timelines is crucial for healthcare providers to ensure compliance and protect patient rights. For assistance in managing medical records and other legal documentation, US Legal Forms can be an excellent resource.

Most states, including Ohio, do not have a general state law that requires records be kept for a minimum length of time. Ohio Revised Code §2913.40 (D) mandates the retention of records associated with Medicaid for a period of at least six (6) years after reimbursement for the claim is received by the physician.

A regulated member must ensure patient records are retained and accessible for a minimum of: ten (10) years from the date of last record entry for an adult patient; and.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

Please consider the following: Medicaid Patients: Ohio Revised Code §2913.40 (D) mandates that a health care provider retain all records dealing with the treatment of a Medicaid patient for a period of a least six (6) years.

Five years is a good rule thumb for most health and safety records.

For example, the Ohio Constitution requires employers to maintain a record of the name, address, occupation, pay rate, hours worked for each day worked and each amount paid an employee for a period of not less than three years following the last date the employee was employed. Ohio Const.

In accordance with 42 CFR 164.530(j)(2), all patient records must be retained for 6 years from the date of patient's discharge, transfer, or death.

Medicaid Patients: Ohio Revised Code §2913.40 (D) mandates that a health care provider retain all records dealing with the treatment of a Medicaid patient for a period of a least six (6) years.

Destroy paper and electronic personnel records and confidential employee data after the retention deadlines have passed. Because employment records contain confidential and sensitive information, employers should establish specific policies and procedures for disposing of records safely.