Ohio Job Description Format III

Description

How to fill out Job Description Format III?

If you desire to finalize, acquire, or generate authentic document templates, utilize US Legal Forms, the largest collection of authentic forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you require. Many templates for professional and personal purposes are organized by categories and jurisdictions, or keywords.

Use US Legal Forms to obtain the Ohio Job Description Format III with just a few clicks.

Each authentic form you purchase is yours for a lifetime. You have access to all forms you saved in your account.

Be proactive and download, and print the Ohio Job Description Format III with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms subscriber, Log In to your account and then click the Obtain button to access the Ohio Job Description Format III.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the appropriate form for your city/state.

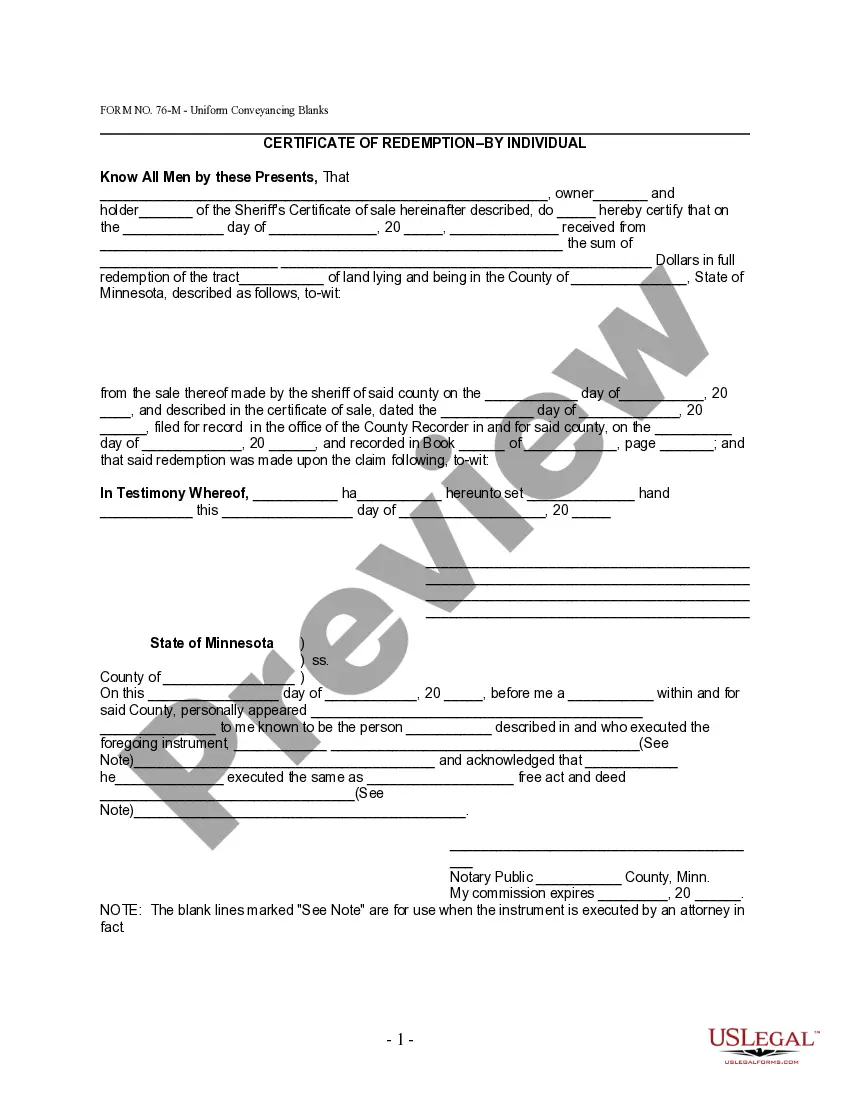

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the authentic form template.

- Step 4. Once you have identified the form you need, click the Buy now button. Choose your preferred pricing option and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the authentic form and download it onto your device.

- Step 7. Complete, edit, and print or sign the Ohio Job Description Format III.

Form popularity

FAQ

More than 21,000 Ohioans filed for their first unemployment benefits last week, but many of those applicants won't get checks.

If you quit your job, you won't be eligible for unemployment benefits unless you had just cause to leave your job. In general, just cause means that you had a compelling, job-related reason for leaving the position and a reasonably careful person would have done the same in your circumstances.

Once it receives your appeal, the ODJFS has 21 days to decide whether to issue a redetermination of your claim or refer your appeal to the Unemployment Compensation Review Commission (UCRC). If the ODJFS issues a redetermination, you will receive it by mail.

You may file your timely appeal online at between 6 a.m. and 6 p.m. daily, by mail or fax with the ODJFS processing center identified on your determination notice, or with any ODJFS claims processing center. You will receive a written confirmation when your appeal is received.

If your claim shows as "denied," each claim is different, but it could have been because you earned more money than your weekly benefit amount or because you did not select "yes" that you were physically able and available to work or.

This format is a national standard for unemployment insurance reporting, and provides for transmission of both employer tax data and employee wage data electronically. Reporting in this format eliminates the need for printing paper reports.

Ohio Employers who Fail to Respond to Requests for Separation Information may now Pay for It. Ohio recently warned employers that they could be charged for unemployment compensation benefits received by employees who obtained them fraudulently.

Unemployed Ohioans will have to resume searching for work if they want to continue to collect unemployment benefits, the state said Monday. The change applies to applications for benefits beginning the week of May 23. From mid-March 2020 through Dec.

If a claim for unemployment compensation (UC) benefits is filed and the claimant lists your business as a recent employer, you will receive a Request to Employer for Separation Information - with a response deadline of 10 business days. ODJFS offers various methods of completing this request for information.

On the contrary, if an employer ignores these claims, they may find their unemployment taxes eating into their bottom line. If the employer does not respond or responds too late, the worker could automatically get UI benefits, in most states.