This handbook describes the Fair Debt Collection Practices Act (FDCPA) and discusses how to negotiate with debt collectors and creditors. The handbook is divided into 4 sections. Section 1 briefly describes how consumer credit got started. Section 2 describes how to deal with debt collectors. Section 3 provides a detailed overview of the FDCPA. Finally, Section 4 is a journal for you to use to document your communicatioins with debt collectors.

Arkansas Fair Debt Collection Practices Act Handbook

Description

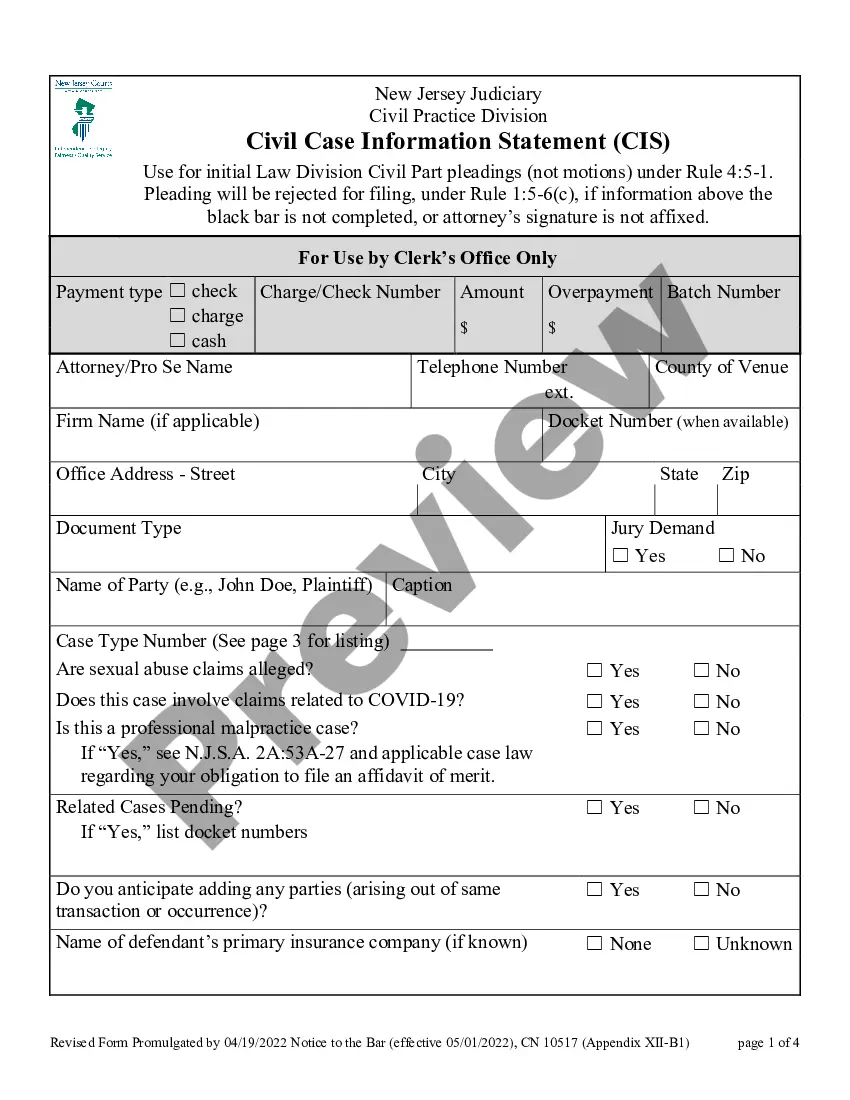

How to fill out Fair Debt Collection Practices Act Handbook?

You can dedicate numerous hours online searching for the legal document template that meets the state and federal requirements you will require.

US Legal Forms offers thousands of legal forms that have been vetted by experts.

You can download or print the Arkansas Fair Debt Collection Practices Act Handbook from the service.

If available, utilize the Review button to preview the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, alter, print, or sign the Arkansas Fair Debt Collection Practices Act Handbook.

- Every legal document template you purchase is yours to keep for an extended period.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions outlined below.

- First, ensure that you have selected the correct document template for your state/city of preference.

- Review the form description to ensure you have chosen the appropriate document.

Form popularity

FAQ

The statute of limitations in Arkansas for the typical credit card debt is 5 years. Any promise to the creditor to pay even a reduced payment may revive the debt so that the statute of limitations no longer bars collection.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

In cases against consumers for unpaid debts, the statute of limitations is three years in Arkansas. To achieve this short statute of limitations period, it must be filed as breach of contract claims, and there cannot be proof in writing, under A.C.A. 16- 56-105.

Although rarely asserted in the context of a collection action, under Arkansas law, an individual who is married or is the head of a family may claim as exempt up to $500 of their personal property (up to $200 if they are not married or the head of a family). Ark.

Here are five ways the Fair Debt Collection Practices Act protects you and what to do if your rights are violated:You control communication with debt collectors.You're protected from harassing or abusive practices.Debt collectors must be truthful.Unfair practices are prohibited.Collectors must validate your debt.More items...

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.