An assignment consists of a transfer of property or some right or interest in property from one person to another. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the interest or thing assigned. Unless there is a statute that requires that certain language be used in an assignment or that the assignment be in writing, there are really no formal requirements for an assignment. Any words which show the intent to transfer rights under a contract are sufficient to constitute an assignment.

Ohio Assignment of Accounts Receivable Regarding Manufactured Goods with Warranty of Assignor

Description

How to fill out Assignment Of Accounts Receivable Regarding Manufactured Goods With Warranty Of Assignor?

You may devote hrs on-line searching for the authorized papers template that meets the federal and state specifications you require. US Legal Forms provides 1000s of authorized types that are evaluated by professionals. You can easily acquire or printing the Ohio Assignment of Accounts Receivable Regarding Manufactured Goods with Warranty of Assignor from my service.

If you already possess a US Legal Forms account, you may log in and then click the Down load button. After that, you may comprehensive, edit, printing, or indicator the Ohio Assignment of Accounts Receivable Regarding Manufactured Goods with Warranty of Assignor. Every authorized papers template you get is yours forever. To acquire one more duplicate of the purchased form, check out the My Forms tab and then click the related button.

If you use the US Legal Forms internet site for the first time, keep to the simple directions under:

- Initial, be sure that you have chosen the best papers template for that county/area of your liking. See the form description to make sure you have picked out the correct form. If available, use the Review button to check through the papers template too.

- In order to discover one more edition of the form, use the Look for field to get the template that suits you and specifications.

- Upon having located the template you need, just click Acquire now to move forward.

- Find the pricing strategy you need, type in your credentials, and register for your account on US Legal Forms.

- Full the deal. You can use your bank card or PayPal account to fund the authorized form.

- Find the structure of the papers and acquire it to your product.

- Make modifications to your papers if needed. You may comprehensive, edit and indicator and printing Ohio Assignment of Accounts Receivable Regarding Manufactured Goods with Warranty of Assignor.

Down load and printing 1000s of papers layouts using the US Legal Forms web site, which offers the biggest collection of authorized types. Use professional and express-specific layouts to tackle your company or specific requirements.

Form popularity

FAQ

How to Set Up Accounting for Factoring Receivables Create an account for factored invoices. In your Chart of Account, create a liabilities account just for factored invoices. ... Create an account for factoring fees. ... Create an invoice. ... Record a deposit. ... Record the fee. ... Record the received payment. ... Apply payment to loan.

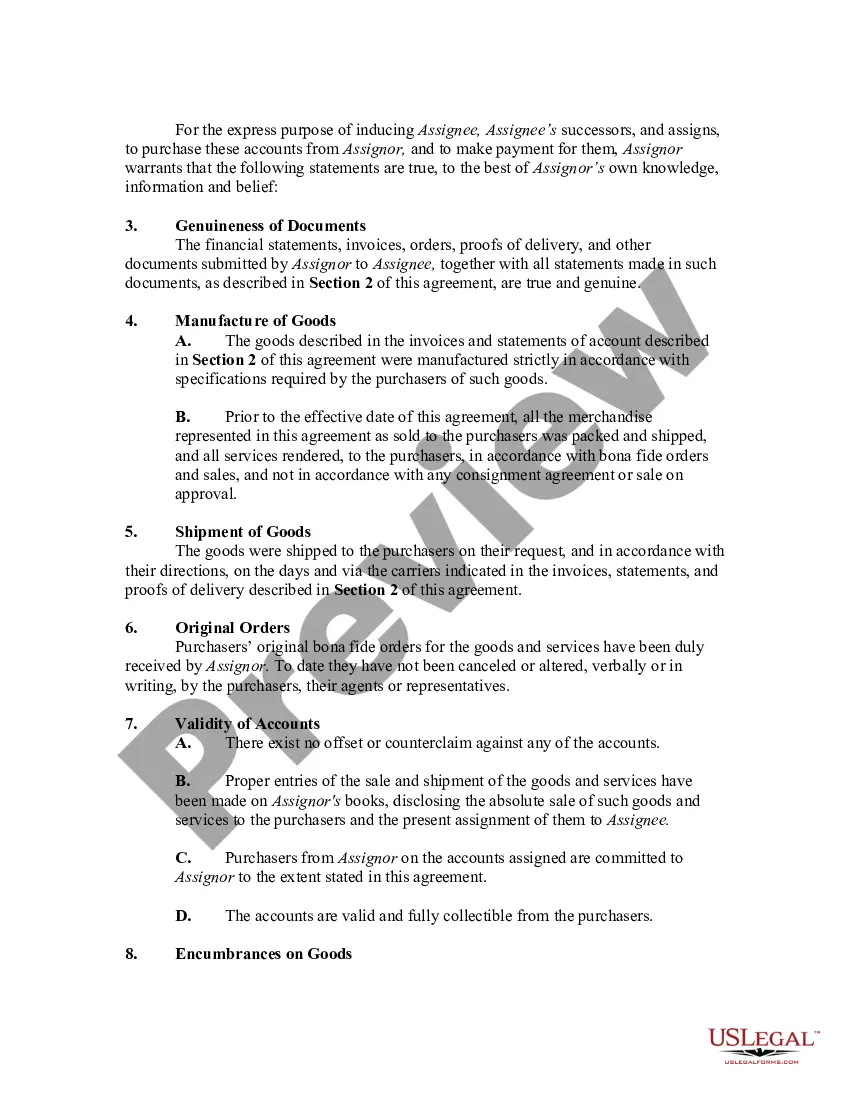

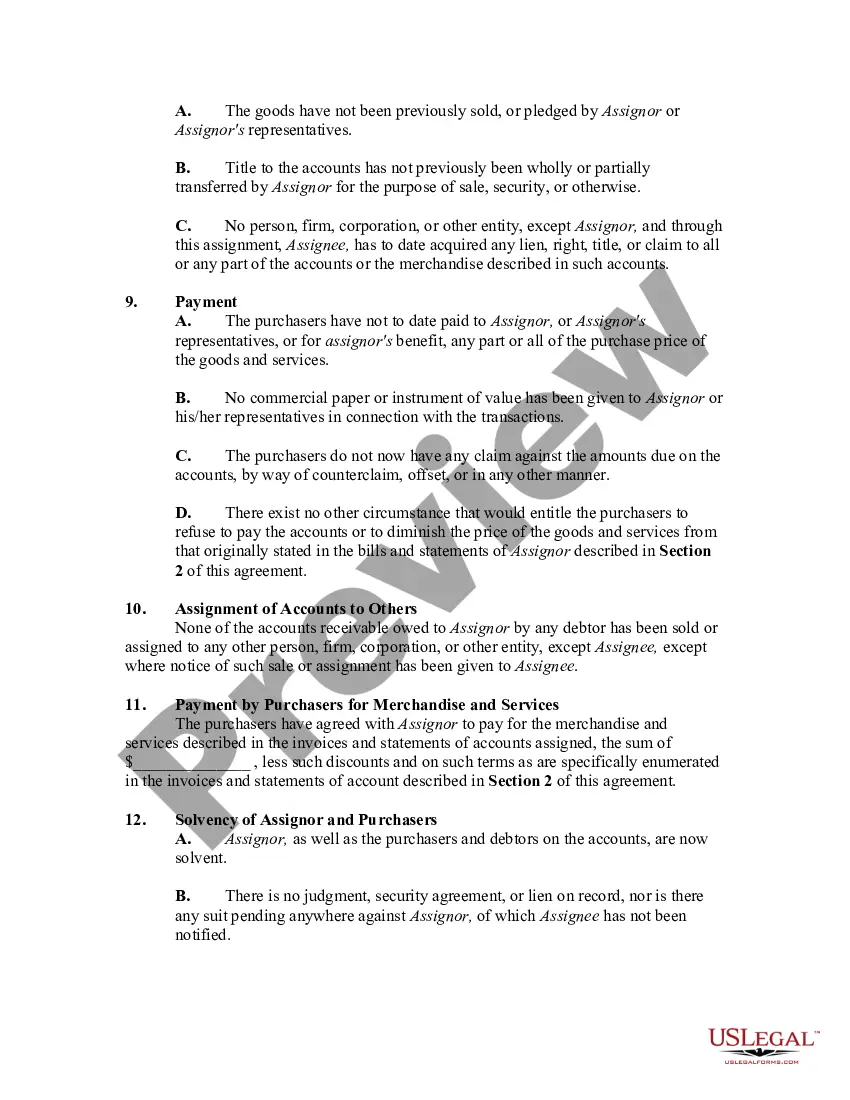

A receivable assignment agreement is an agreement by which a creditor ? the ?assignor? ? assigns to another person ? the ?assignee? ? a receivable it holds against a third person ? the ?assigned debtor?. The assigned debtor is not a party to the assignment agreement.

In the accounts receivable assignment process, a company assigns receivables to a lending institution to borrow money. The borrower pays interest plus additional fees. The borrowing company retains ownership of the accounts receivable and collects payment from its customers.

What is the appropriate treatment for receivable assignment transaction? In a receivables financing transaction, the assignment of the debt by the seller to the financier is treated as a true sale: it does not secure payment or performance of an obligation.

In the accounts receivable assignment process, a company assigns receivables to a lending institution to borrow money. The borrower pays interest plus additional fees. The borrowing company retains ownership of the accounts receivable and collects payment from its customers.

Example of the Assignment of Accounts Receivable ABC Corp. approaches XYZ Bank to obtain financing using its accounts receivable as collateral. XYZ Bank agrees to provide a loan of 85% of the total accounts receivable value, which amounts to $170,000 (85% of $200,000).

What are the journal entries for assigning Accounts Receivable as collateral for a loan? The entry to record assignment of Accounts Receivable as collateral would be a credit to cash, and a debit to assign Accounts Receivable. The cash account is debited because the company gave up the assigned receivables.