This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of All Of Expected Interest In Estate In Order To Pay Indebtedness?

Aren't you tired of choosing from countless samples each time you want to create a Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness? US Legal Forms eliminates the lost time numerous Americans spend searching the internet for suitable tax and legal forms. Our professional crew of lawyers is constantly updating the state-specific Samples collection, so that it always has the proper documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have a subscription should complete quick and easy steps before being able to download their Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness:

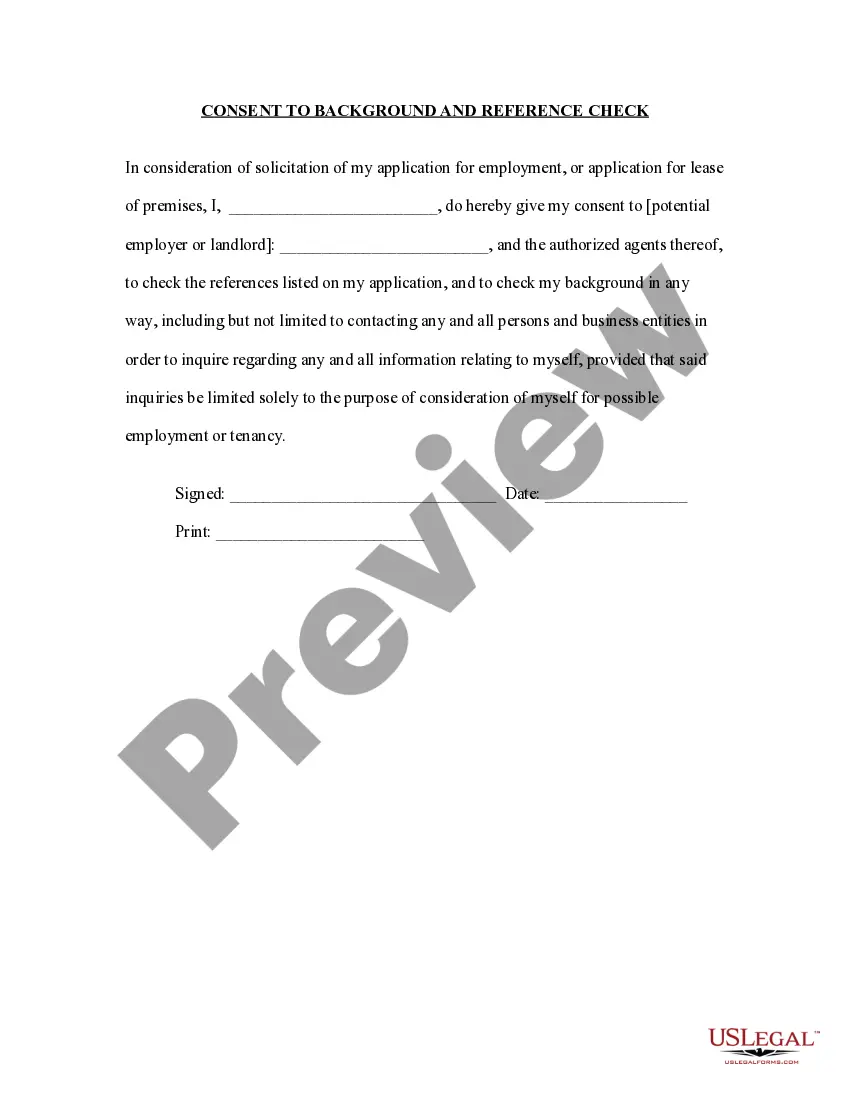

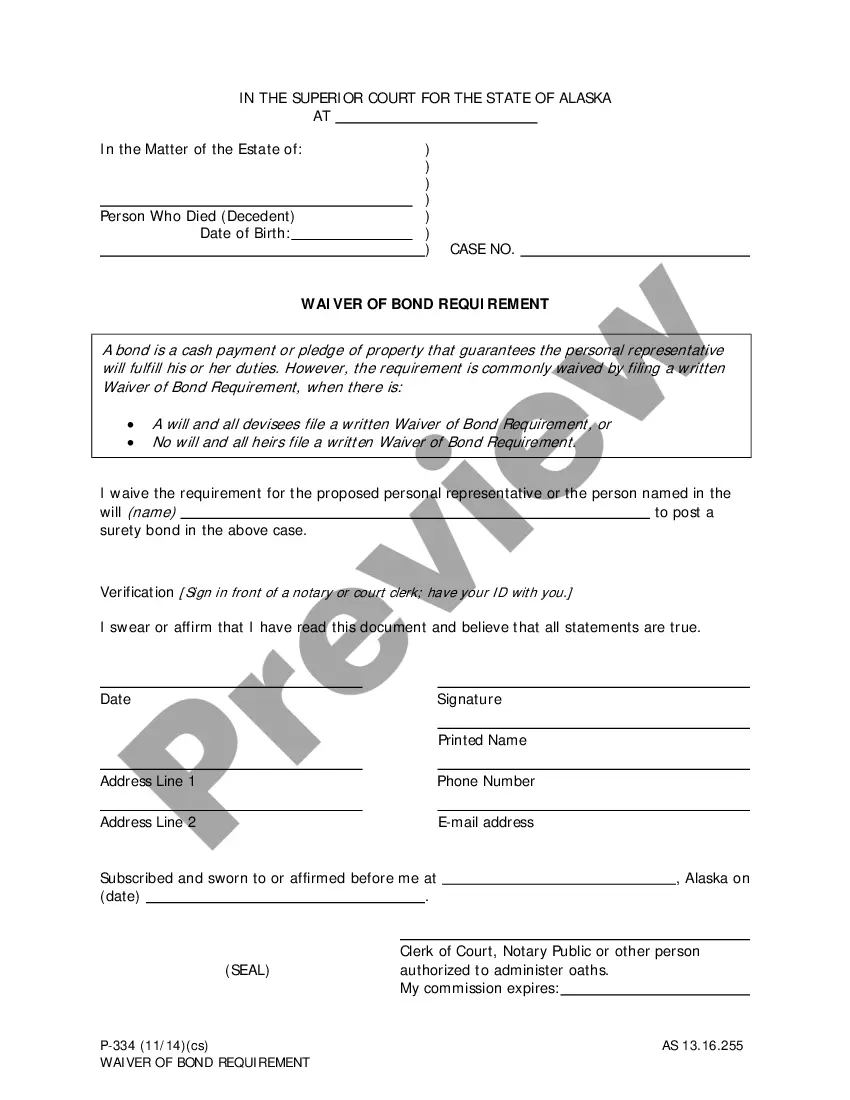

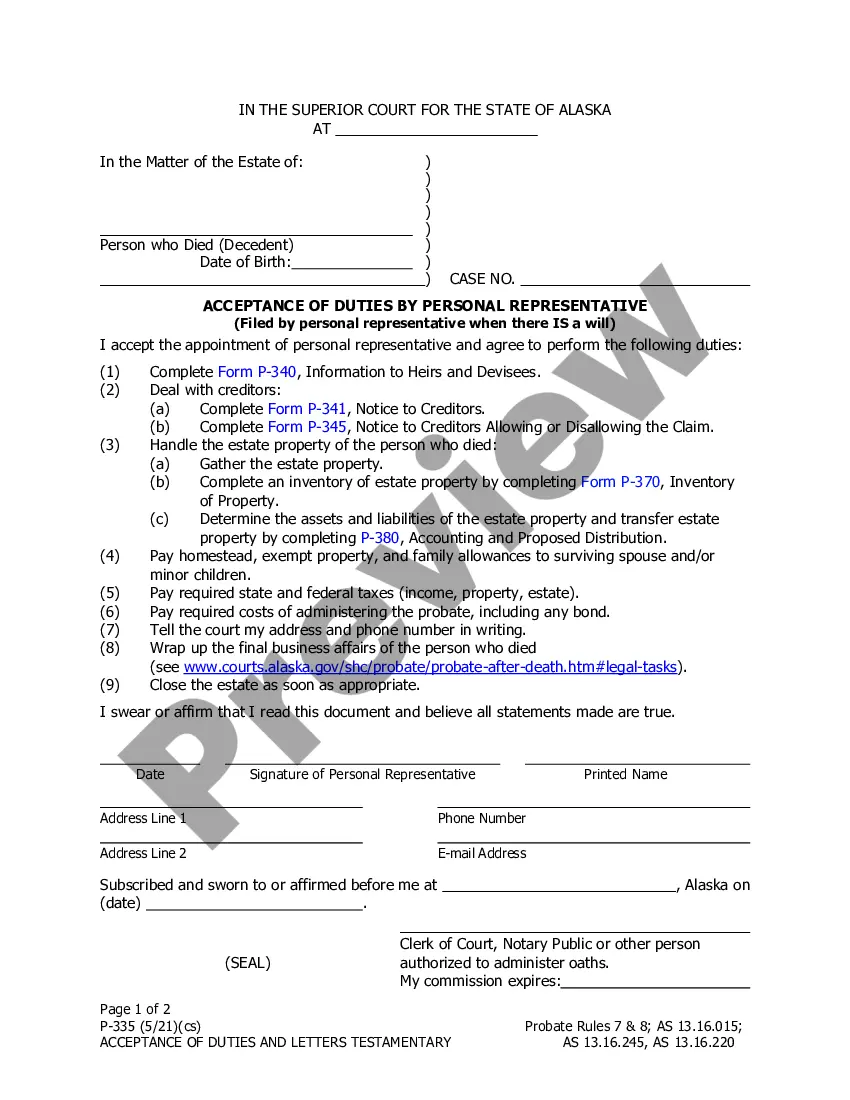

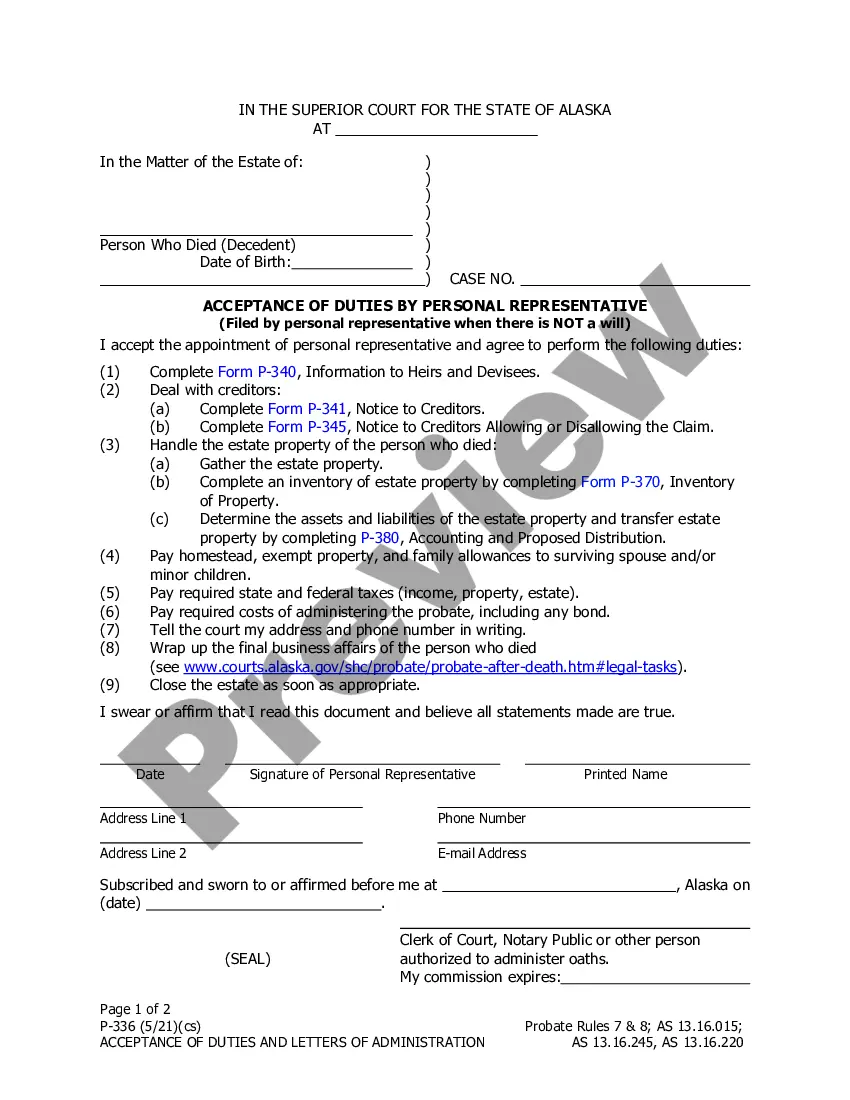

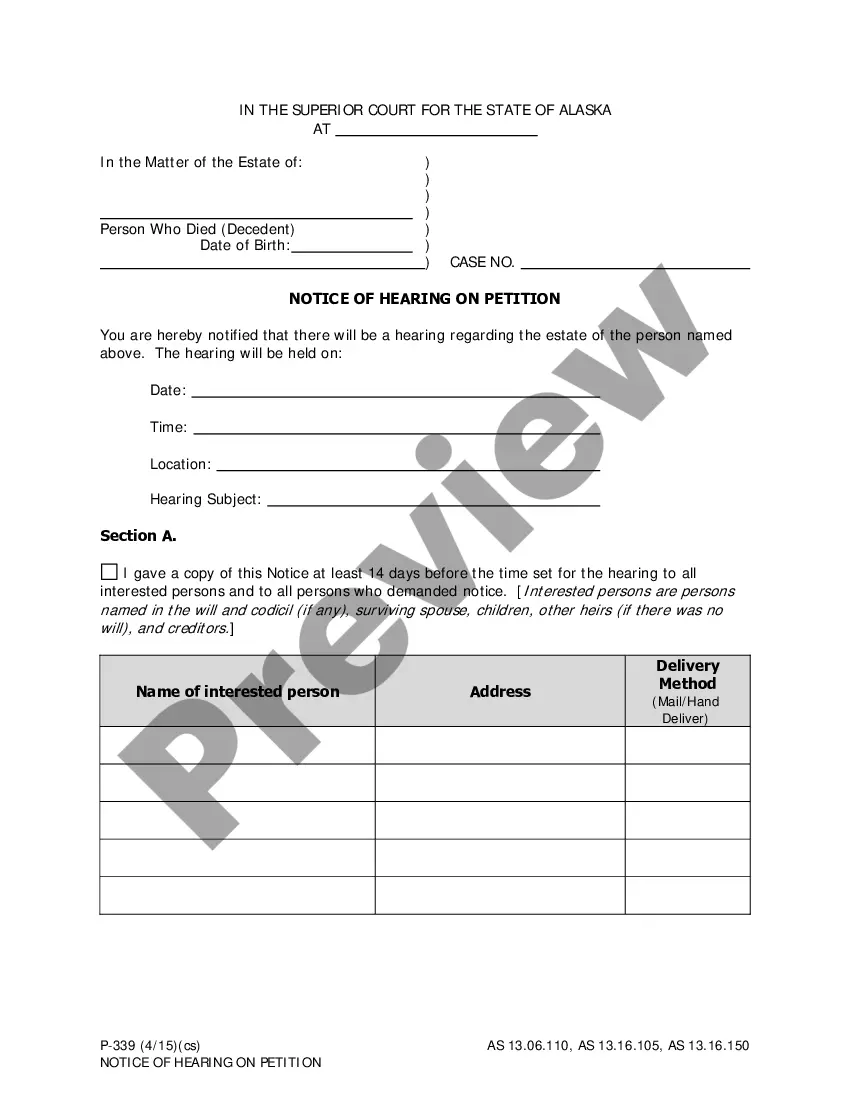

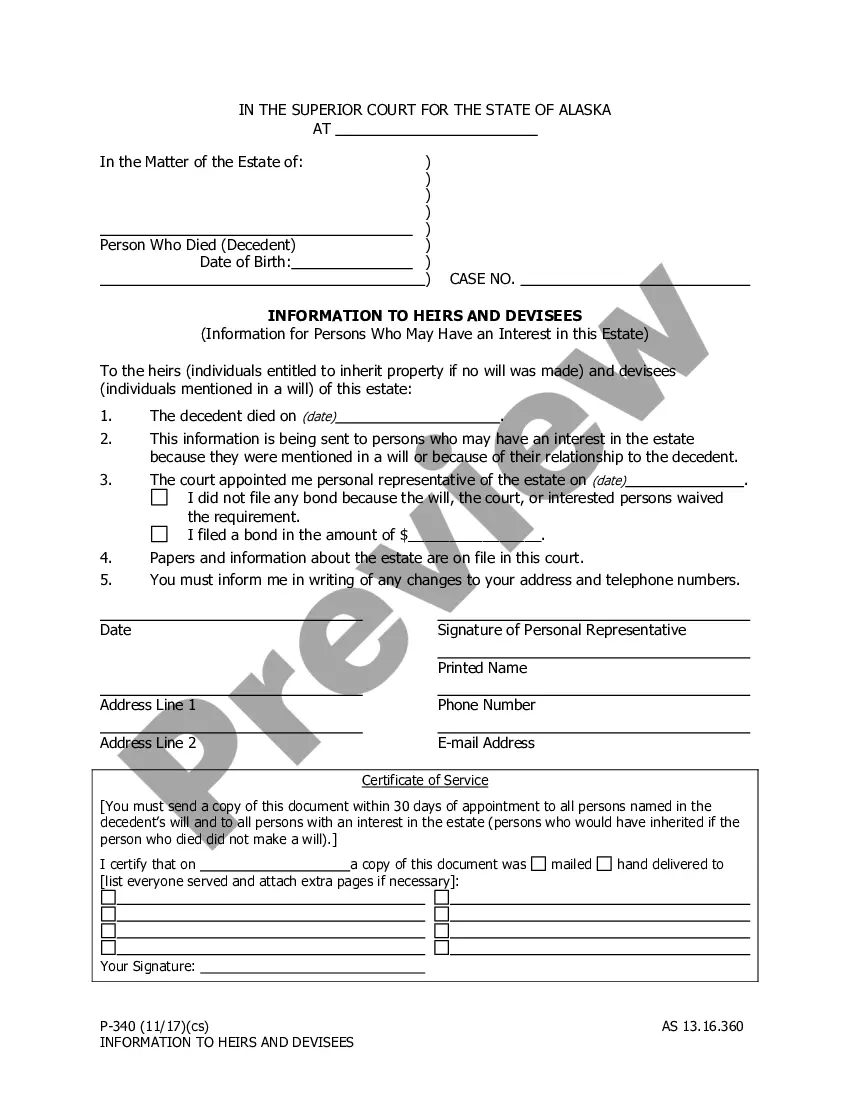

- Utilize the Preview function and read the form description (if available) to be sure that it is the correct document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the right template for your state and situation.

- Make use of the Search field at the top of the site if you have to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your file in a convenient format to complete, create a hard copy, and sign the document.

Once you have followed the step-by-step guidelines above, you'll always be capable of sign in and download whatever document you will need for whatever state you need it in. With US Legal Forms, completing Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness templates or any other legal documents is simple. Get started now, and don't forget to look at the examples with certified attorneys!

Form popularity

FAQ

A beneficiary can also transfer his interest in the trust property and every person to whom a beneficiary transfers his interest acquires the rights and liabilities of the beneficiary at the date of the transfer.

If there is insufficient money or assets in the estate to pay off all the debts, then the debts would be paid in priority order until the money or assets run out. Any remaining debts are likely to be written off. If no estate is left, then there is no money to pay off the debts and the debts will usually die with them.

If the estate has sufficient funds to pay all debts of the estate: The debts will paid first; and then. The remainder of the estate will be distributed to the beneficiaries in accordance with the wishes of the deceased in their will.

Final bills are bills for which the full amount can only be paid once the probate process is complete, such as taxes, credit card bills, and medical bills. These bills should only be paid by the executor using money from the estate once probate has concluded.

Claims filed within a six-month timeframe of the estate being opened are usually paid in order of priority. Typically, fees such as fiduciary, attorney, executor and estate taxes are paid first, followed by burial and funeral costs.

Married couples and civil partners are allowed to pass their estate to their spouse tax-free when they die. In other words, the surviving spouse can inherit the entire estate without having to pay Inheritance Tax (IHT). They can also pass on their unused tax-free allowance to their surviving spouse or civil partner.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution.

Beneficiaries RightsBeneficiaries under a will have important rights including the right to receive what was left to them, to receive information about the estate, to request a different executor, and for the executor to act in their best interests.

In regard to the question posed, the short answer is: No, all of the beneficiaries do not have to agree to the terms of the contract for a real estate contract to be legally binding.