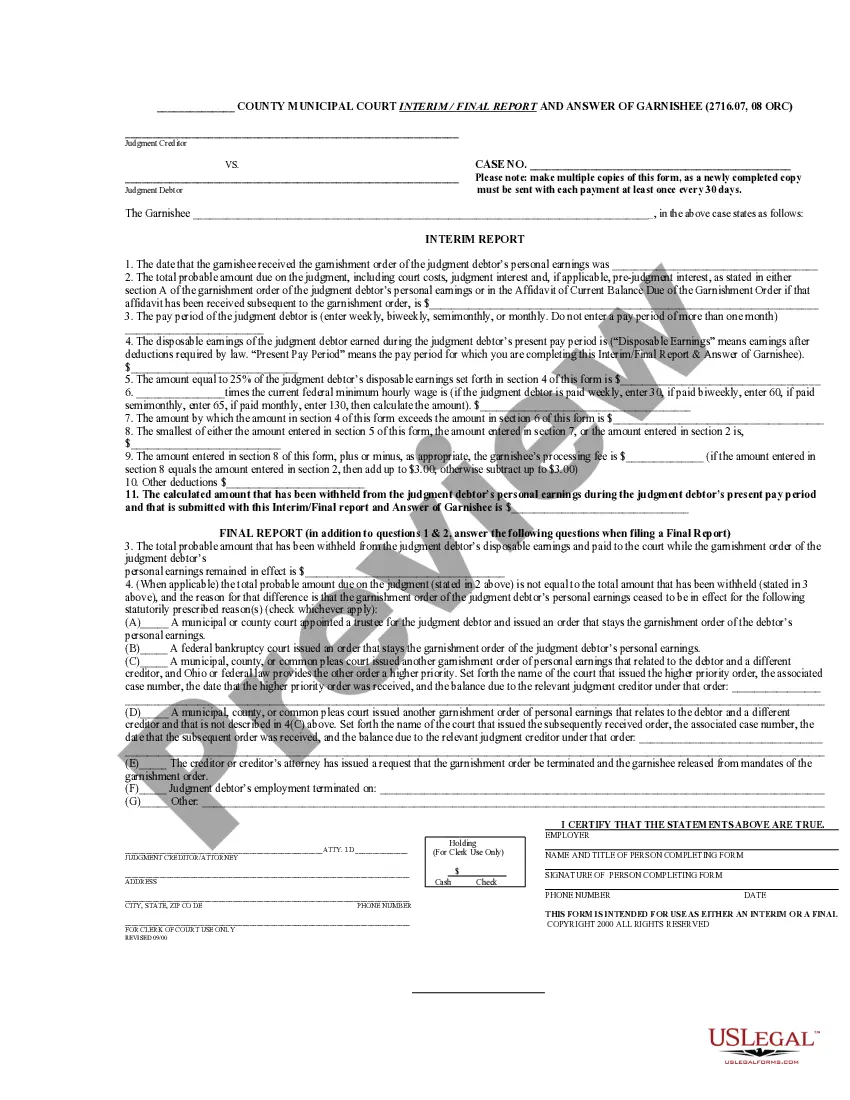

The Ohio Interim Final Report and Answer of Garnishee (Municipal) is a document used when a creditor attempts to collect a debt from the debtor or a third party (known as a garnishee). This document must be filed by the garnishee in a court proceeding in order to answer the creditor's questions regarding the garnishee's assets and liabilities, as well as any money owed to the debtor. There are two types of Ohio Interim Final Report and Answer of Garnishee (Municipal): the initial report and the final report. The initial report must be filed within twenty days of the citation of the garnishee and must include information about the garnishee's assets and liabilities, as well as any money owed to the debtor. The final report must be filed within thirty days of the initial report and must include any additional information requested by the creditor. Both reports must be signed and sworn to by the garnishee.

Ohio Interim Final Report And Answer Of Garnishee (Municipal)

Description

How to fill out Ohio Interim Final Report And Answer Of Garnishee (Municipal)?

How much time and resources do you often spend on drafting official documentation? There’s a better opportunity to get such forms than hiring legal experts or spending hours browsing the web for a proper template. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, like the Ohio Interim Final Report And Answer Of Garnishee (Municipal).

To get and complete a suitable Ohio Interim Final Report And Answer Of Garnishee (Municipal) template, follow these simple steps:

- Look through the form content to ensure it complies with your state requirements. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t satisfy your needs, locate a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Ohio Interim Final Report And Answer Of Garnishee (Municipal). Otherwise, proceed to the next steps.

- Click Buy now once you find the correct document. Choose the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely secure for that.

- Download your Ohio Interim Final Report And Answer Of Garnishee (Municipal) on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously acquired documents that you safely store in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most reliable web solutions. Join us today!

Form popularity

FAQ

Section 2716.041 Order of garnishment of personal earnings to be continuous.

The total amount garnished cannot be more than 25% of the employee's monthly disposable earnings. Exemptions from garnishment, including, but not limited to, worker's compensation, unemployment compensation, disability payments, OWF payments, or child support or spousal support, and most pensions.

The Interim Report and Answer of the Garnishee accompanies the payment that the employer makes to the court. The payment and the Interim Report and Answer of Garnishee shall be made to the court within 30 days after the end of each employee pay period.

With your demand letter or notice, you will get a form titled ?Payment to Avoid Garnishment.? Complete the form and return it to the creditor within 15 days and you can make periodic payments without having to go through the formal garnishment process.

The total amount garnished cannot be more than 25% of the employee's monthly disposable earnings. Exemptions from garnishment, including, but not limited to, worker's compensation, unemployment compensation, disability payments, OWF payments, or child support or spousal support, and most pensions.

The Demand Letter and Wage Garnishment When a creditor gets a court order against you for collection, it must send you a letter between 15 and 45 days after the judgment informing you of the judgment and listing your options: pay the debt or expect wage garnishment.

The garnishee shall be discharged from liability to the judgment debtor for money so paid and shall not be subjected to costs beyond those caused by the garnishee's resistance of the claims against the garnishee.