This is an official form from the New York State Unified Court, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by New York statutes and law.

New York Petition For Review of Failure of Material Condition In Conditional Surrender

Description

How to fill out New York Petition For Review Of Failure Of Material Condition In Conditional Surrender?

When it comes to submitting New York Petition for Review of Substantial Failure of Material Condition in Conditional Surrender or Violation of Post-Adoption Contact Agreement - Prior to Adoption Finalization, you almost certainly visualize a long process that involves finding a appropriate sample among a huge selection of similar ones and then needing to pay legal counsel to fill it out to suit your needs. On the whole, that’s a slow-moving and expensive option. Use US Legal Forms and pick out the state-specific document in a matter of clicks.

For those who have a subscription, just log in and then click Download to find the New York Petition for Review of Substantial Failure of Material Condition in Conditional Surrender or Violation of Post-Adoption Contact Agreement - Prior to Adoption Finalization form.

If you don’t have an account yet but need one, stick to the point-by-point manual below:

- Be sure the document you’re downloading is valid in your state (or the state it’s needed in).

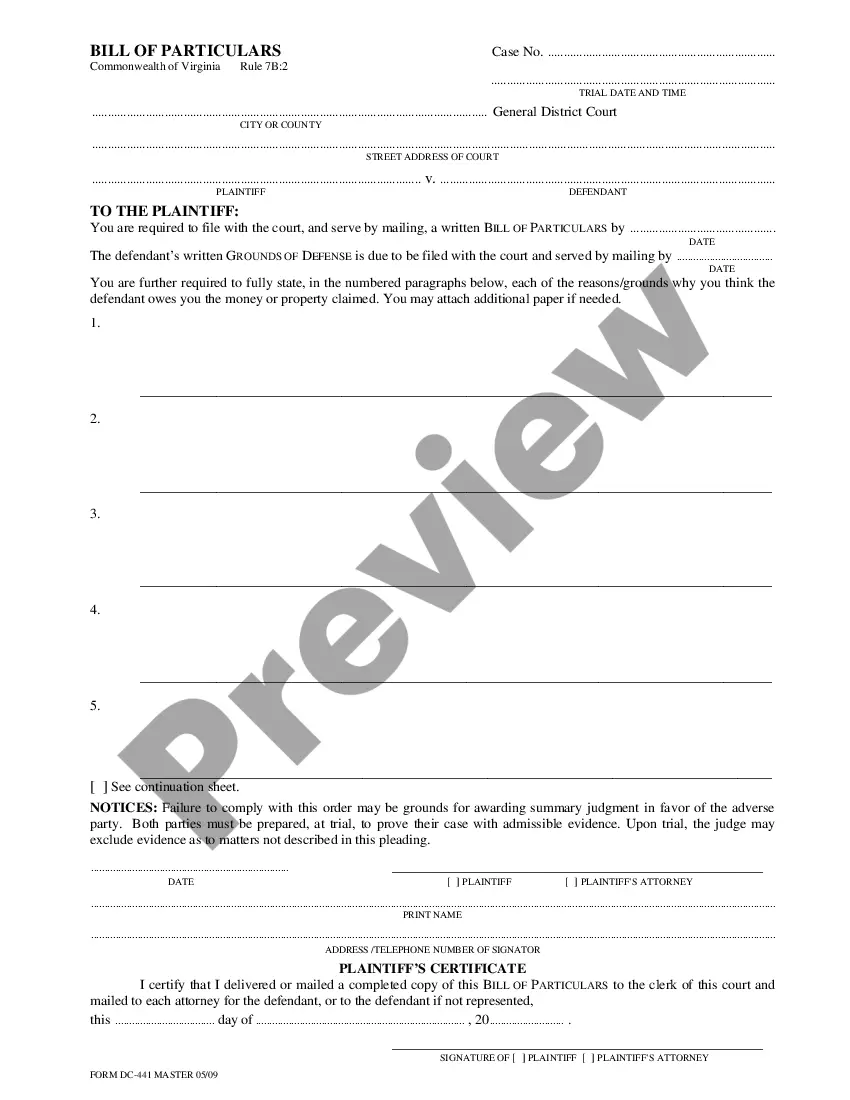

- Do this by reading the form’s description and also by clicking the Preview option (if offered) to view the form’s content.

- Simply click Buy Now.

- Find the appropriate plan for your budget.

- Sign up for an account and choose how you want to pay: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Find the file on the device or in your My Forms folder.

Skilled lawyers draw up our samples to ensure that after saving, you don't have to bother about enhancing content material outside of your personal details or your business’s details. Join US Legal Forms and receive your New York Petition for Review of Substantial Failure of Material Condition in Conditional Surrender or Violation of Post-Adoption Contact Agreement - Prior to Adoption Finalization example now.

Form popularity

FAQ

You must file Form IT-201, Resident Income Tax Return, if you were a New York State resident for the entire year.

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

IT-203 (Fill-in) IT-203-I (Instructions) Nonresident and Part-Year Resident Income Tax Return; Description of Form IT-203. This is the only return for taxpayers who are nonresidents or part-year residents of New York State, whether they are itemizing their deductions or claiming the standard deduction.

Form NYS-1, Return of Tax Withheld, must be filed and the total tax withheld paid after each payroll that caused the total accumulated withholding tax to equal or exceed $700. If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45.

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

Form IT-558 is a new form for tax year 2020, which adjusts your federal adjusted gross income.For distributions taken from retirement plans, NY is requiring that the entire amount be added back to federal AGI, and then taxpayers will subtract out any taxable amount already included in federal AGI.

The state as a whole has a progressive income tax that ranges from 4.00% to 8.82%, depending on an employee's income level. There is also a supplemental withholding rate of 9.62% for bonuses and commissions.

Generally, you must file a New York State income tax return if you're a New York State resident and are required to file a federal return. You may also have to file a New York State return if you're a nonresident of New York and you have income from New York State sources.

The IT-201 is a New York State income tax return form. If you are filing state taxes for New York this year, then yes you will need this form and you want to make sure that you fill it out entirely. Turbo Tax would have a copy of your 2015 IT-201 only if you filed state taxes for the state of New York last year.

You must file Form IT-201, Resident Income Tax Return, if you were a New York State resident for the entire year.