Michigan Dissolution Package to Dissolve Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Dissolution Package To Dissolve Corporation?

Obtain any type of document from 85,000 legal papers including the Michigan Dissolution Package to Dissolve Corporation online with US Legal Forms.

Each template is crafted and refreshed by state-certified attorneys.

If you already possess a subscription, Log In. Once you access the form’s page, click on the Download button and proceed to My documents to retrieve it.

With US Legal Forms, you will consistently have instant access to the appropriate downloadable template. The platform grants you access to forms and organizes them into categories to enhance your search experience. Use US Legal Forms to obtain your Michigan Dissolution Package to Dissolve Corporation quickly and effortlessly.

- Verify the state-specific criteria for the Michigan Dissolution Package to Dissolve Corporation you wish to utilize.

- Review the description and preview the sample document.

- Once you are assured that the sample fits your requirements, click Buy Now.

- Select a subscription plan that truly fits your financial plan.

- Establish a personal account.

- Complete the payment through one of the two available methods: by card or using PayPal.

- Pick a format to download the file in; two formats are offered (PDF or Word).

- Save the document to the My documents section.

- After your reusable form is downloaded, either print it or store it on your device.

Form popularity

FAQ

To close a C corporation, begin by holding a board meeting to officially approve the dissolution. Next, file the necessary dissolution documents with the state of Michigan. In addition, settle any outstanding debts and obligations to ensure a smooth closure. Using a Michigan Dissolution Package to Dissolve Corporation can simplify this process, guiding you through each step with clarity and efficiency.

Dissolving a business refers to the formal process of ending its legal existence, while terminating may imply ceasing operations without completing formal dissolution. In essence, dissolution is a legal procedure that must be recognized by state authorities, ensuring that all debts are settled and obligations fulfilled. Understanding this distinction is important, especially when using a Michigan Dissolution Package to Dissolve Corporation, which defines the necessary steps.

The process of dissolving a corporation typically starts with board and shareholder approval. Next, formalize the decision by filing the Articles of Dissolution with state authorities. After that, resolve debts, notify employees, and settle any remaining obligations. You can simplify this multi-step process with a Michigan Dissolution Package to Dissolve Corporation that guides you from start to finish.

To notify the IRS of your corporation's dissolution, you should complete and file your final tax return, marking the box for 'final return.' Additionally, state the date of dissolution on the return. Keeping this step in mind is crucial, and using a Michigan Dissolution Package to Dissolve Corporation can help you address this notification effectively and ensure all necessary forms are correctly completed.

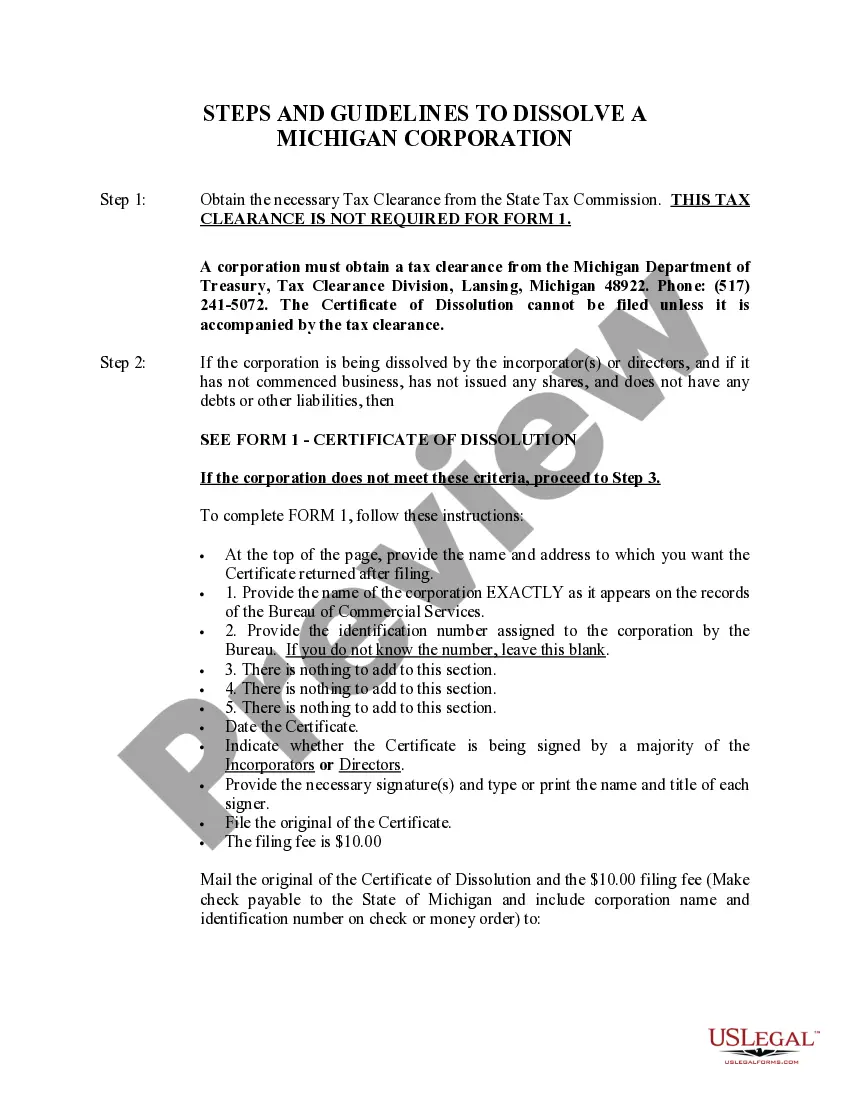

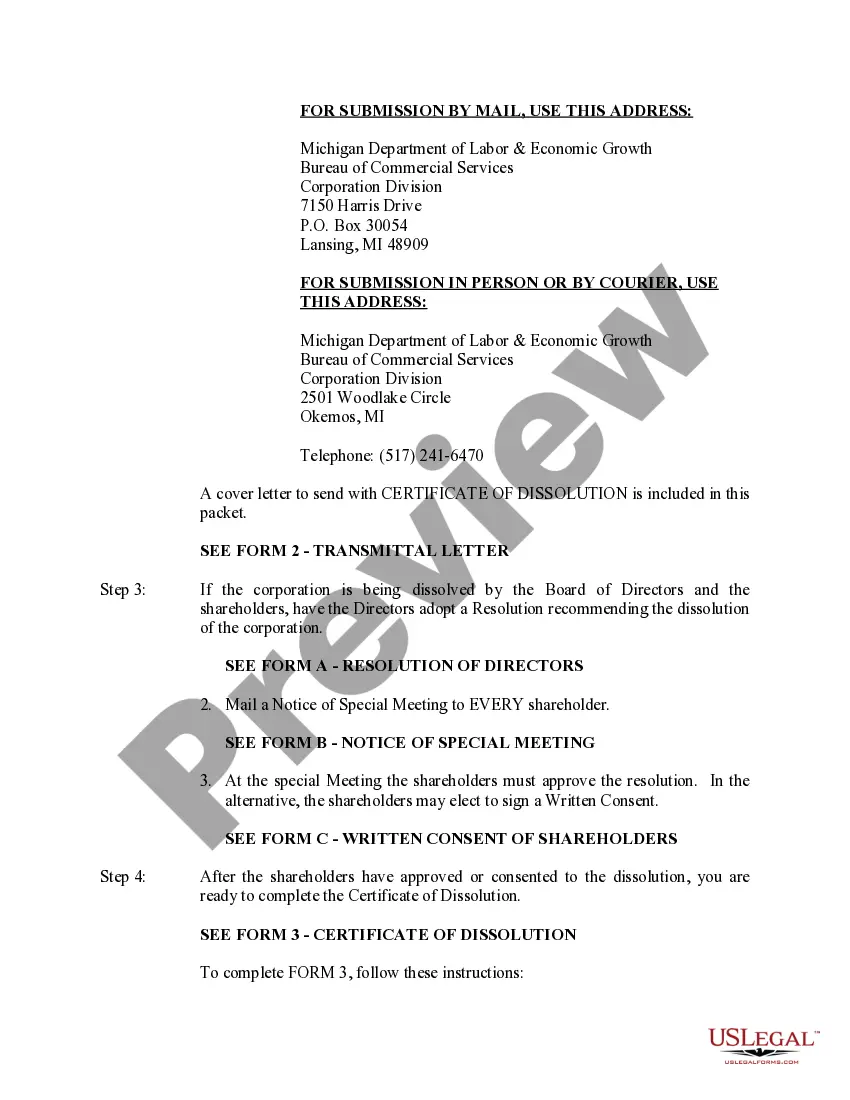

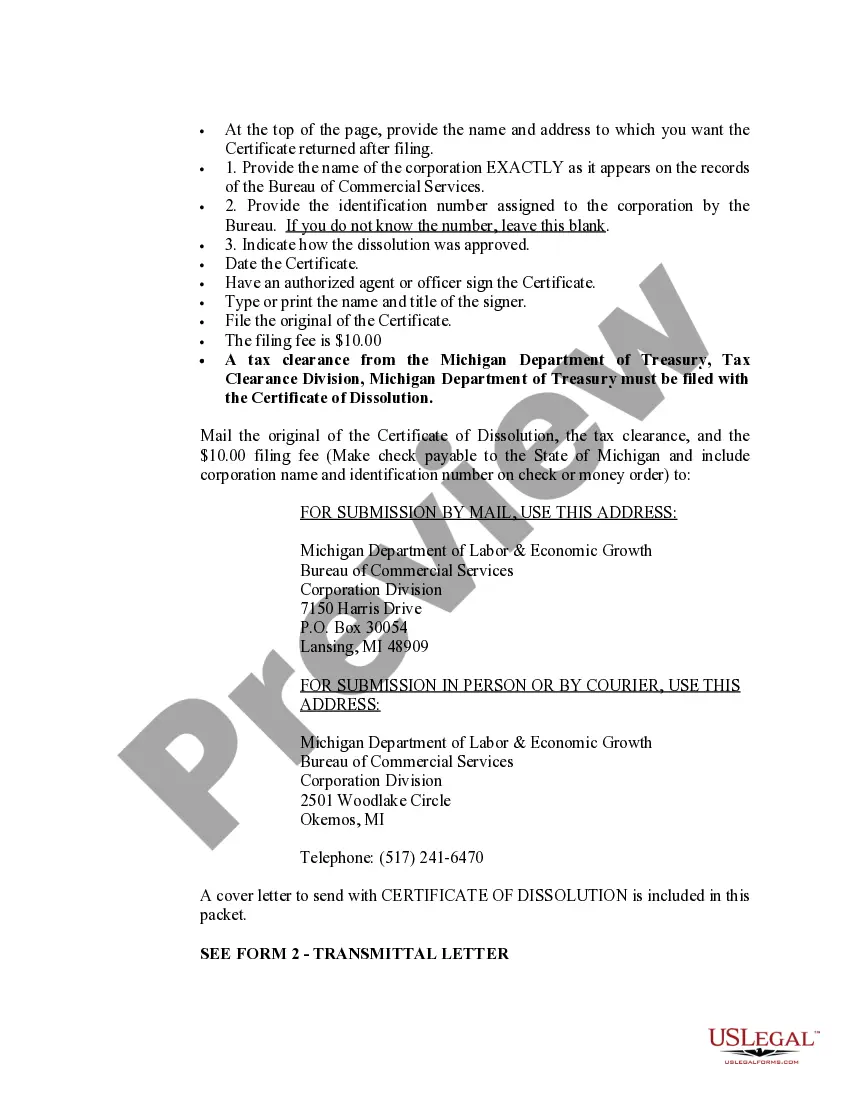

Dissolving a Michigan corporation requires a structured approach. Start by getting the necessary approvals during a board meeting and, if applicable, a shareholder vote. Afterward, file the required Articles of Dissolution with the state and ensure all financial obligations are met. Consider a Michigan Dissolution Package to Dissolve Corporation for a thorough and guided dissolution.

To dissolve a corporation, you will generally need the approval of the board and shareholders. Prepare to gather key documents, including the Articles of Dissolution and financial statements showing settled debts. Having a Michigan Dissolution Package to Dissolve Corporation at hand can streamline the collection of these documents and ensure compliance with state regulations.

To dissolve a Michigan corporation, begin by organizing a board meeting for approval. Following this, you will need to file the Articles of Dissolution with the state. Moreover, it's essential to clear any outstanding debts and taxes your corporation owes. You may find that utilizing a Michigan Dissolution Package to Dissolve Corporation simplifies this process tremendously.

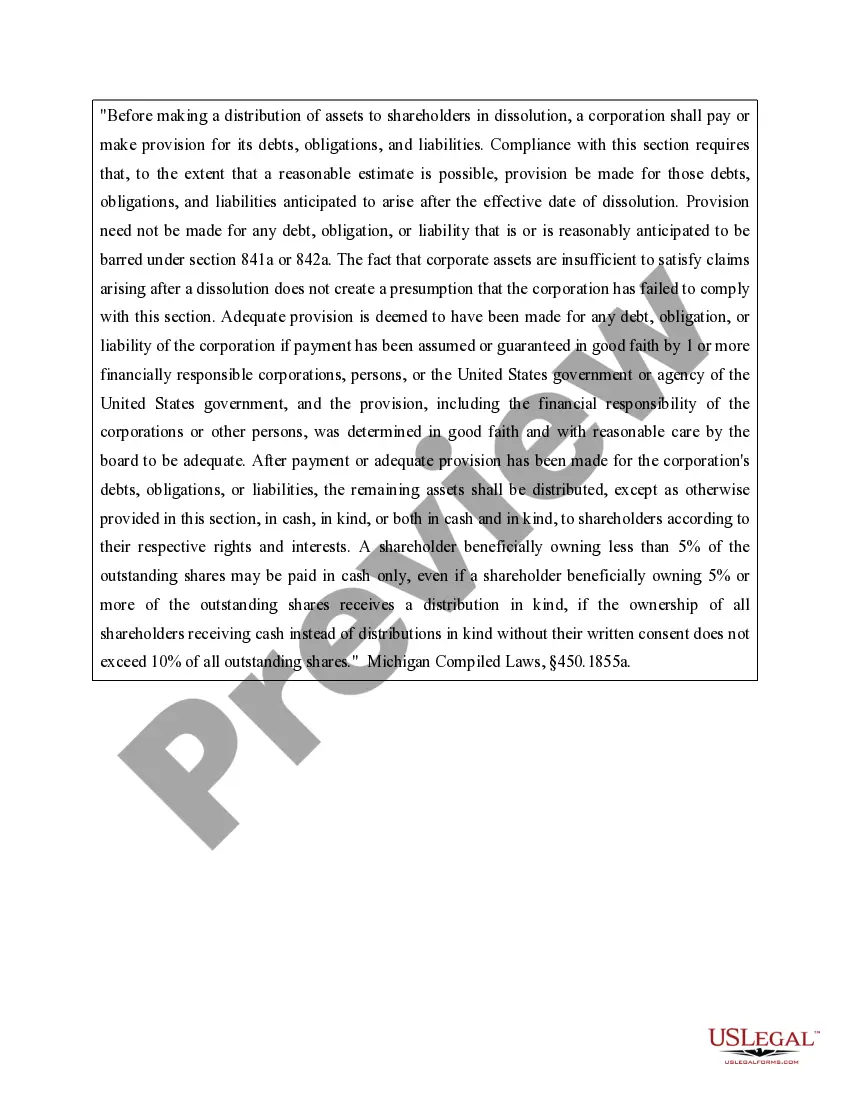

Dissolving a corporation in Michigan involves several clear steps. First, you must hold a board meeting to approve the dissolution, followed by obtaining shareholder consent. Next, file the Articles of Dissolution with the Michigan Department of Licensing and Regulatory Affairs. Finally, settle any debts, notify existing employees, and ensure you've completed all necessary paperwork, ideally using a Michigan Dissolution Package to Dissolve Corporation for efficiency.