New York Revocable Trust for Real Estate

Description

How to fill out Revocable Trust For Real Estate?

US Legal Forms - one of the largest collections of official documents in the USA - provides a vast array of legal document templates that you can obtain or print. By using the site, you can find thousands of forms for both business and individual purposes, sorted by categories, states, or keywords.

You can access the latest versions of forms such as the New York Revocable Trust for Real Estate in moments.

If you already possess a subscription, Log In to retrieve the New York Revocable Trust for Real Estate from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded New York Revocable Trust for Real Estate. Each form you add to your account does not expire and is yours indefinitely. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the content of the form.

- Check the form description to confirm it is the appropriate one.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose your payment plan and provide your information to register for an account.

Form popularity

FAQ

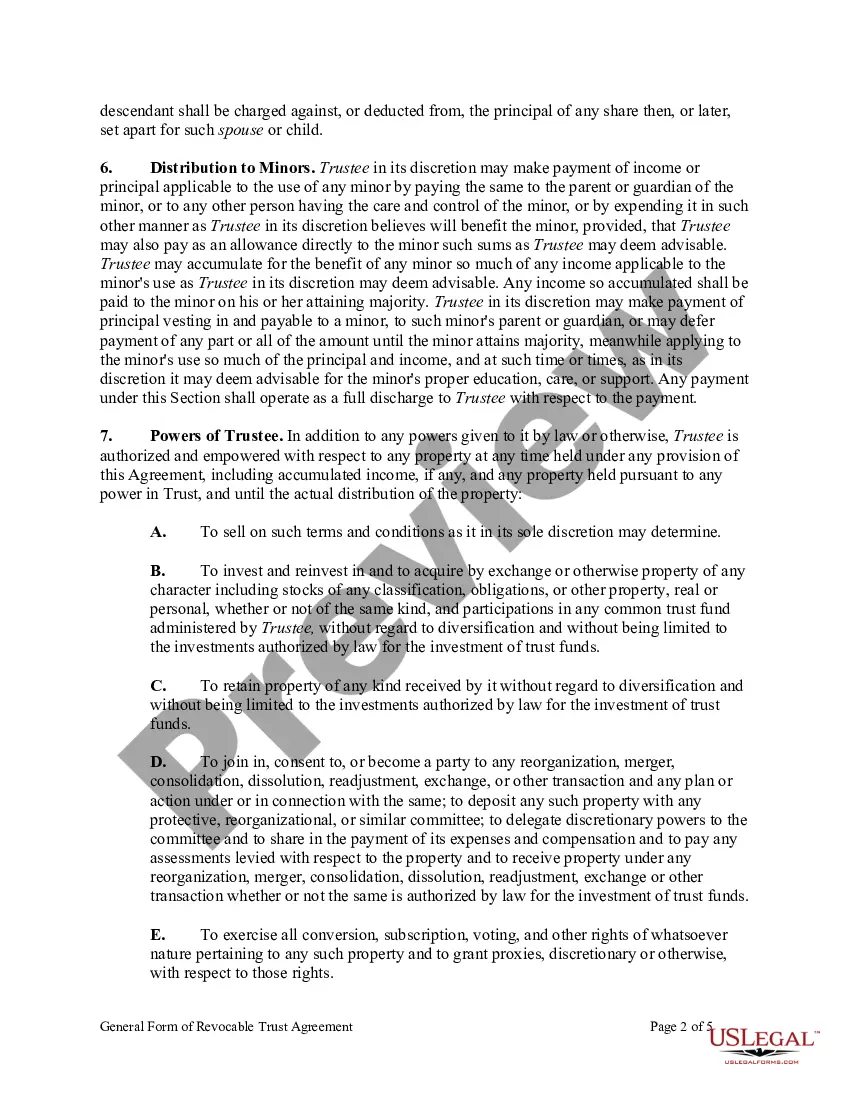

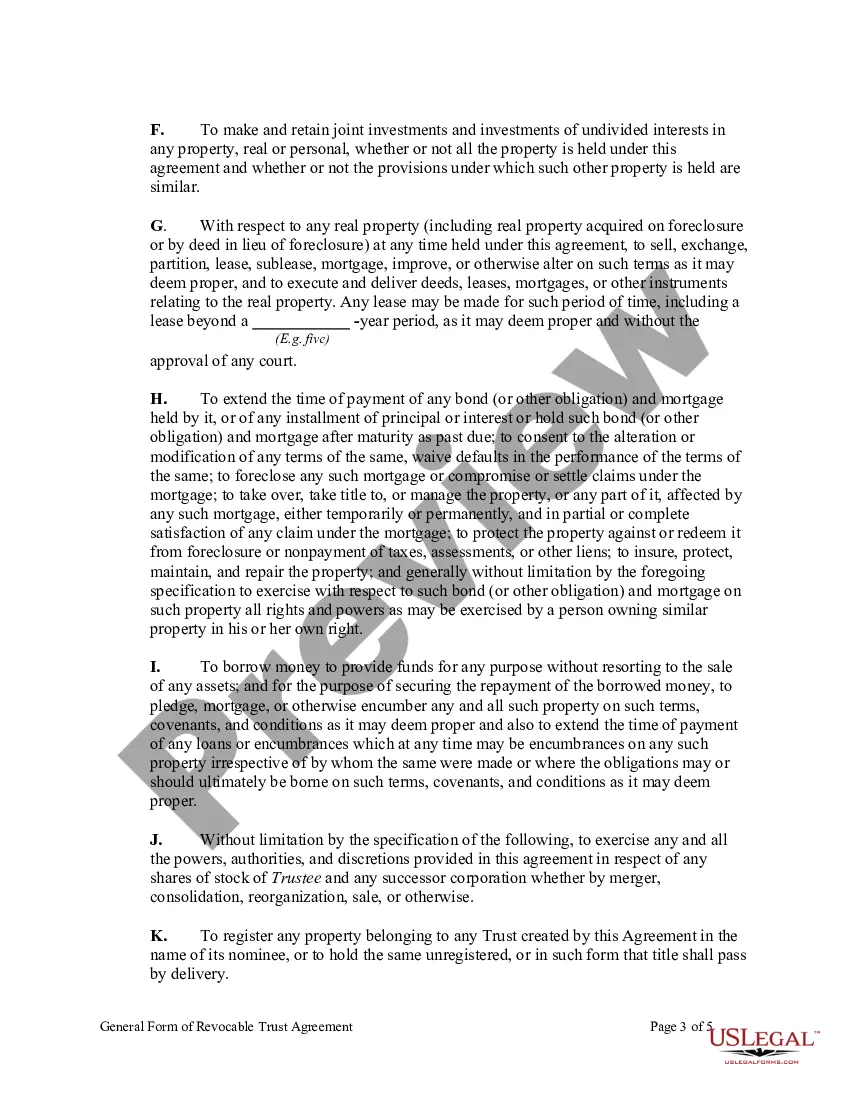

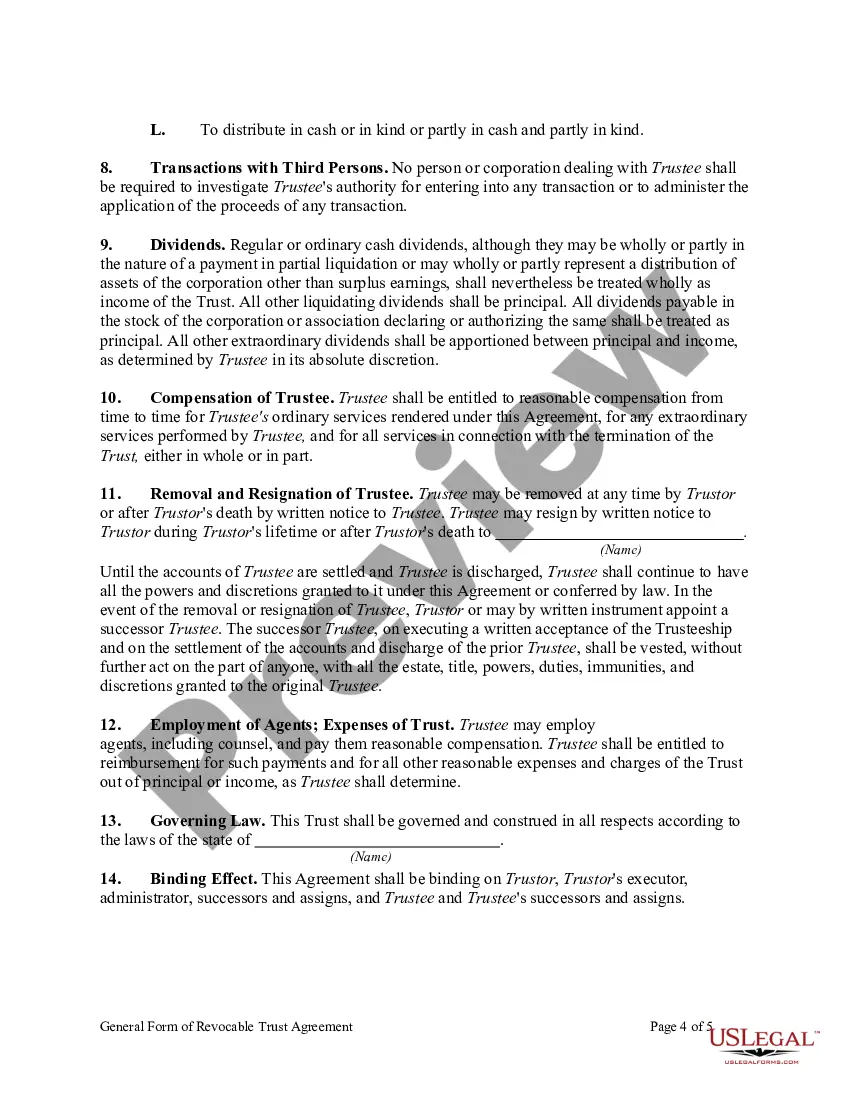

One downside of a revocable trust is that it does not provide asset protection from creditors or legal judgments. Additionally, the trust requires ongoing management, which can involve costs for legal help and paperwork. While the New York Revocable Trust for Real Estate offers benefits, it is essential to weigh these against potential downsides. Understanding these factors can help you make informed decisions about your estate planning.

In New York, a revocable trust operates as a flexible estate planning tool that allows the grantor to maintain control over the assets. You can modify or revoke the trust at any time while you are alive, making it a convenient option. When you pass away, the New York Revocable Trust for Real Estate simplifies the property transfer process, helping your heirs avoid lengthy probate. This feature ensures a smoother transition of assets.

To place your house in a trust in New York, start by drafting a trust agreement that outlines the terms. After establishing the New York Revocable Trust for Real Estate, you will need to execute a new deed conveying your property to the trust. It’s advisable to file this deed with the local county clerk to officially transfer ownership. This process ensures your property is managed according to your wishes.

One of the biggest mistakes parents make when establishing a trust fund is not clearly defining their intentions. Without a well-drafted plan, family disputes can arise, undermining the trust's purpose. It is crucial to prioritize communication with beneficiaries so that everyone understands the goals of the New York Revocable Trust for Real Estate. Consulting with experts can help set clear guidelines.

One disadvantage of a family trust, such as a New York Revocable Trust for Real Estate, is that it can complicate the management of family dynamics. Family members may have differing opinions on asset distribution or management. Additionally, the setup and ongoing maintenance of the trust may require time and investment, which could be challenging for some families. Understanding these factors can assist in making a more informed decision about establishing a family trust.

Certain assets may be better off outside a New York Revocable Trust for Real Estate, including retirement accounts, life insurance policies, and certain types of mineral rights. These assets may have specific beneficiary designations or tax implications that can complicate their inclusion in a trust. Furthermore, your primary residence and bank accounts could require special consideration. Always consult with an expert to optimize your estate plan.

A significant disadvantage of a New York Revocable Trust for Real Estate is that it does not provide asset protection from creditors. While a revocable trust allows you to manage your assets during your lifetime, creditors can still claim against these assets in case of debts. Additionally, if you need access to funds in case of emergencies, the process to withdraw from a trust may take longer than direct ownership. For this reason, consider the balance between convenience and protection.

Deciding whether to place assets in a New York Revocable Trust for Real Estate may depend on your family's financial situation and future goals. A trust can help streamline the management of your parents' assets and facilitate the transfer of wealth. However, it is essential to consider their unique needs and discuss this option with a trusted advisor or attorney. Doing so can lead to better financial planning and peace of mind.

One major downfall of having a New York Revocable Trust for Real Estate is the potential for increased initial costs. Setting up a trust often involves legal fees and administrative expenses. Additionally, while a trust can provide flexibility, it also requires ongoing management. You need to remain vigilant about funding the trust and ensuring that all property transfers are properly documented.

A New York Revocable Trust for Real Estate provides several benefits. One key advantage is the avoidance of probate, which can be a lengthy and costly process. Furthermore, this type of trust allows you to maintain control over your assets while providing a smooth transition for your heirs. Platforms like uslegalforms can assist you in setting up a trust tailored to your needs.