Direct Deposit Form for IRS

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

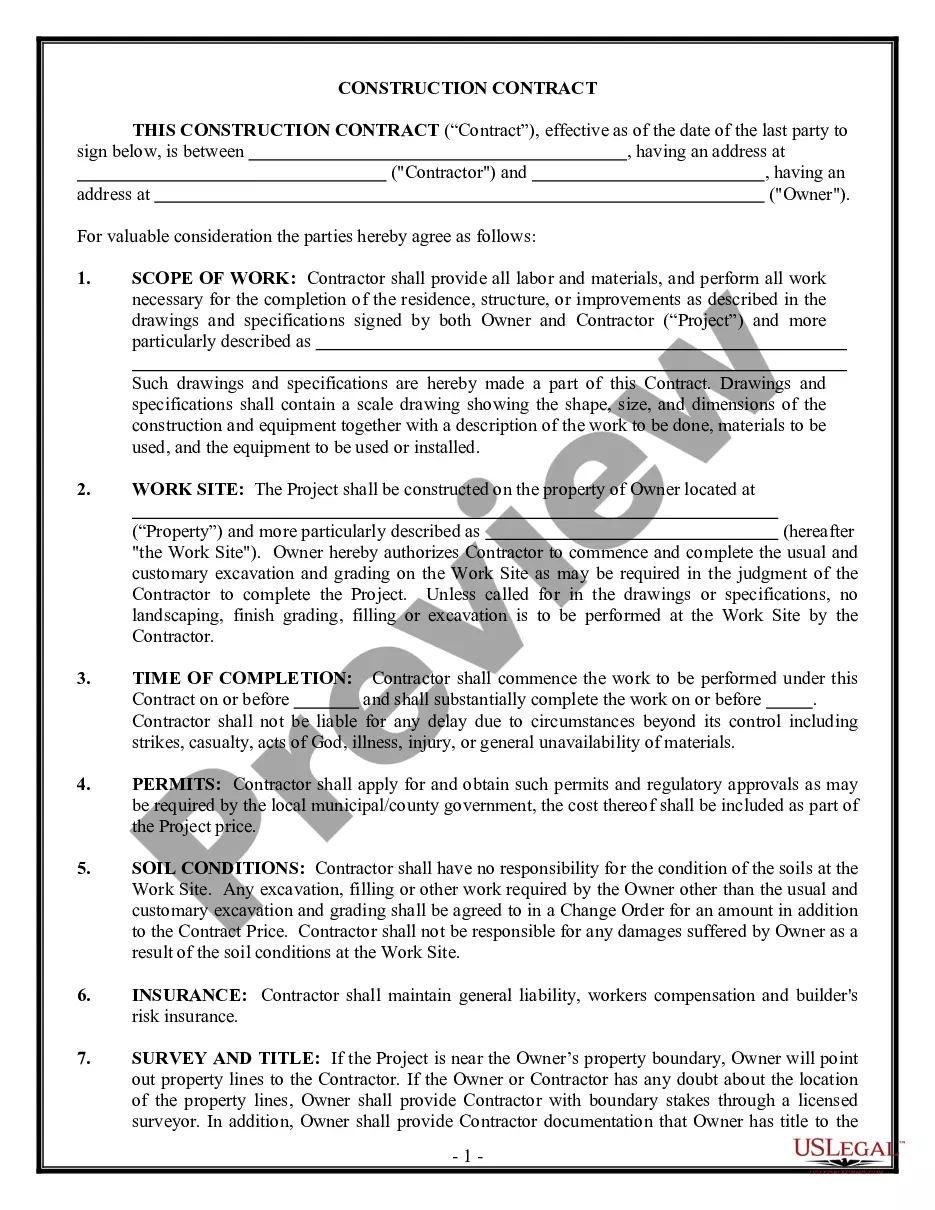

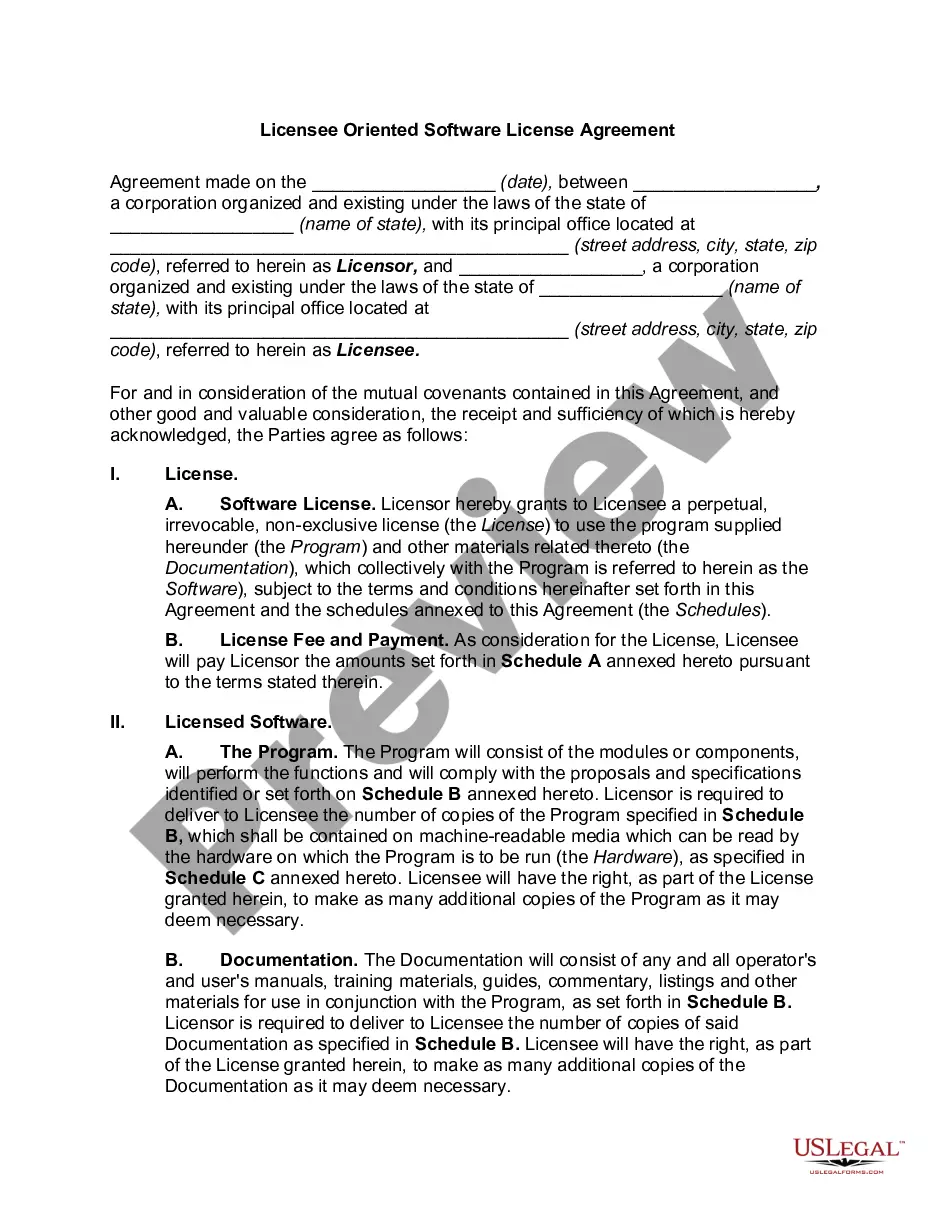

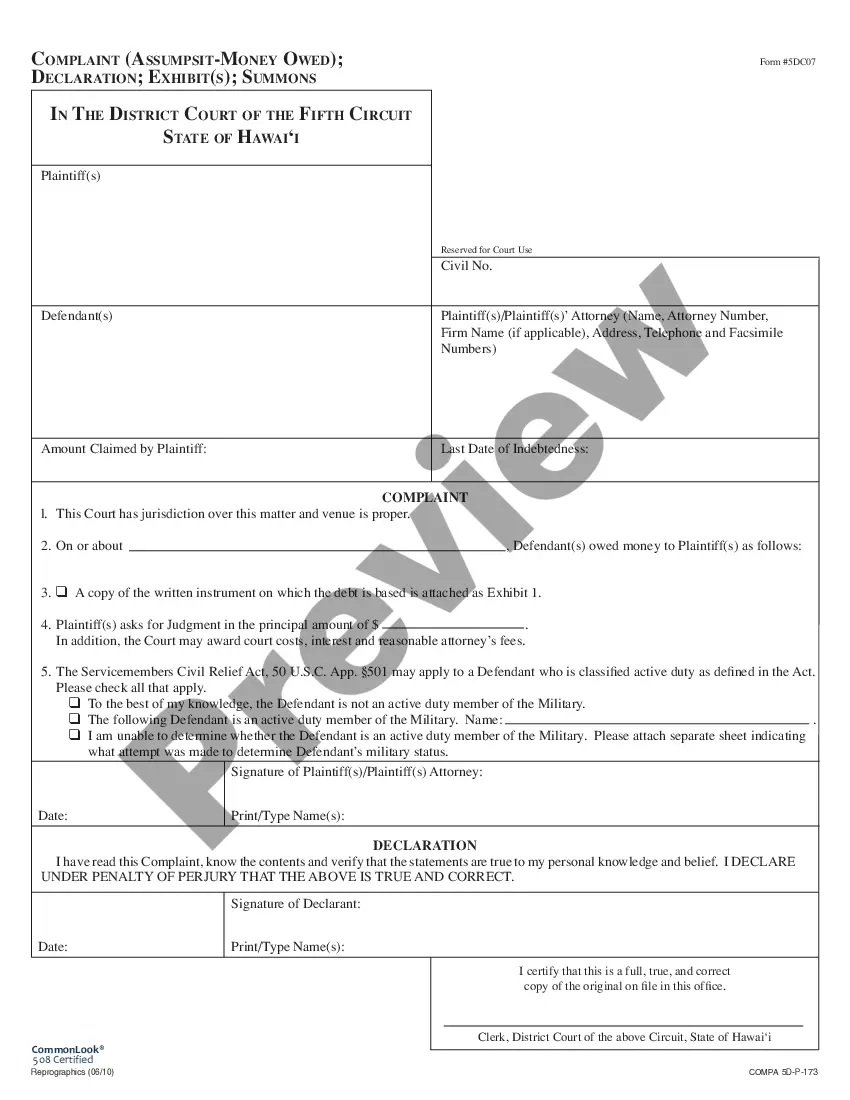

Looking for another form?

How to fill out Direct Deposit Form For IRS?

Use US Legal Forms to get a printable Direct Deposit Form for IRS. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms library online and offers cost-effective and accurate samples for consumers and attorneys, and SMBs. The documents are grouped into state-based categories and a few of them might be previewed prior to being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Hit Download next to any form you want and find it in My Forms.

For those who do not have a subscription, follow the tips below to easily find and download Direct Deposit Form for IRS:

- Check out to make sure you have the proper template with regards to the state it is needed in.

- Review the form by looking through the description and by using the Preview feature.

- Hit Buy Now if it is the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search engine if you need to find another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Direct Deposit Form for IRS. Above three million users already have utilized our platform successfully. Choose your subscription plan and get high-quality documents in just a few clicks.

Form popularity

FAQ

Your bank account information cannot be changed. The bank account information in Get My Payment came from one of the following sources: Your 2020 tax return.

When prompted, enter your routing number and account number. Re-enter the same information to confirm. If you've already filed your return, you can review your direct deposit information on a copy of your return.If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040.

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper.

Use Form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United States. This form can also be used to buy up to $5,000 in paper series I savings bonds with your refund.

Unfortunately, since December 22, 2020, taxpayers can no longer change or share their direct deposit information with the IRS via the Get My Payment tool.