New York 359-f(2) Exemption Instruction Sheet is a form used by taxpayers in New York to claim an exemption from the state's sales and use tax law. The form is used to claim an exemption for tangible personal property or services purchased for a business purpose. There are three types of New York 359-f(2) Exemption Instruction Sheet: Form ST-119.1, Form ST-119.2, and Form ST-119.3. Form ST-119.1 is used for purchases made from a vendor; Form ST-119.2 is used for purchases made from a catalog or mail order; and Form ST-119.3 is used for purchases made from an out-of-state vendor. The form must be completed and signed by the purchaser and the vendor and must include an explanation of the exemption being claimed, as well as the purchaser's name, address, and tax identification number.

New York 359-f(2) Exemption Instruction Sheet

Description

How to fill out New York 359-f(2) Exemption Instruction Sheet?

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state regulations and are verified by our specialists. So if you need to complete New York 359-f(2) Exemption Instruction Sheet, our service is the best place to download it.

Obtaining your New York 359-f(2) Exemption Instruction Sheet from our library is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they locate the correct template. Afterwards, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a quick guide for you:

- Document compliance verification. You should carefully examine the content of the form you want and make sure whether it satisfies your needs and fulfills your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable template, and click Buy Now when you see the one you want.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your New York 359-f(2) Exemption Instruction Sheet and click Download to save it on your device. Print it to fill out your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Widely considered to be the most severe blue sky law in the U.S, the Martin Act has been used to bring charges against some of the largest financial institutions in the world. It should be noted that there is no New York State requirement for registering securities before selling them.

It is unlawful for any broker or dealer to employ a salesman unless the salesman is registered. The registration of a salesman is suspended during any period when he is not associated with a particular broker or dealer registered under this act or a particular issuer.

Policy Statement 104 provides an exemption application from the filing requirements of GBL section 352-e for certain offerings that fall within the statutory subcategories of GBL section 359-f(2).

SECTION 4(a)(2) of the Securities Act of 1933 (the ?Act?) exempts from registration ?transactions by an issuer not involving any public offering.? It is section 4(a) (2) that permits an issuer to sell securities in a ?private placement? without registration under the Act.

FINRA broker-dealers must register by filing Form BD through the Central Registration Depository (CRD) online portal. All correspondence to FINRA should be sent to: P.O. Box 9401, Gaithersburg MD 20898-9401. All pertinent information is received through the CRD by the New York State Department of Law.

It shall be unlawful for any dealer, broker or salesman to sell or offer for sale to or purchase or offer to purchase from the public within or from this state, any securities issued or to be issued, unless and until such dealer, broker or salesman shall have filed with the department of law a registration statement as

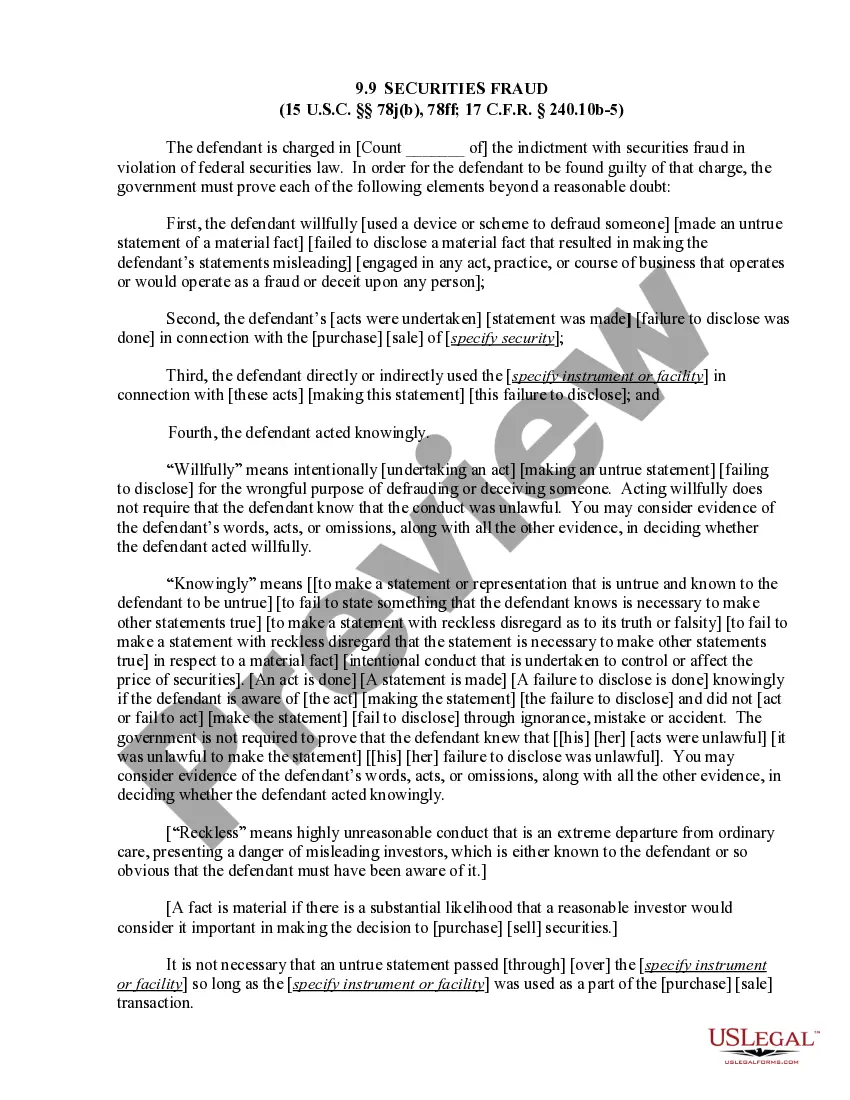

New York securities fraud laws provide the state's attorney general with the power to investigate and sue any person, partnership, or corporation that employs any device or scheme to defraud or to obtain money or property by means of any false pretense, representation, or promise.