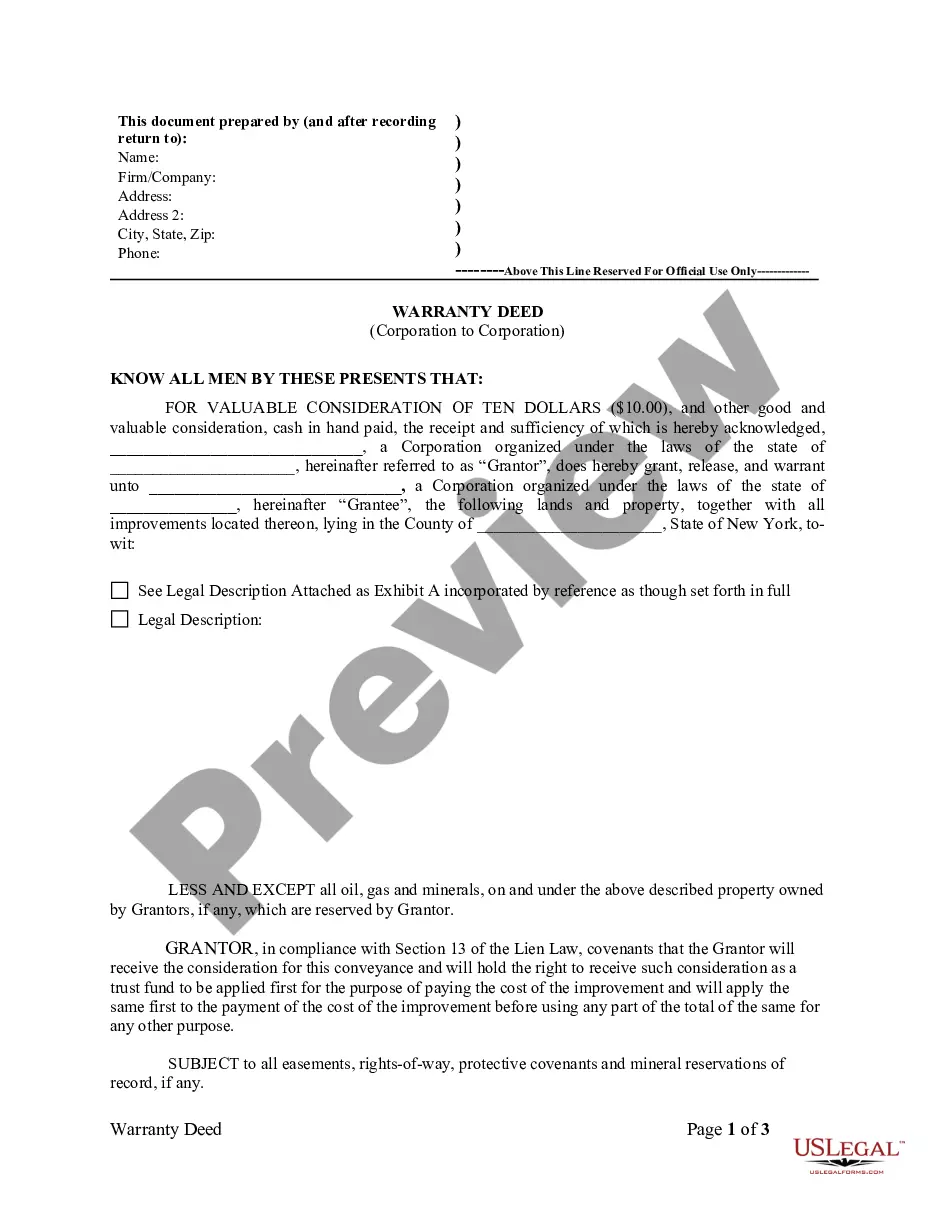

New York Warranty Deed from Corporation to Corporation

Understanding this form

The Warranty Deed from Corporation to Corporation is a legal document used to transfer property ownership from one corporation to another. This specific type of warranty deed ensures that the grantor (the transferring corporation) guarantees that they have clear title to the property and the right to convey it. Unlike other forms of deeds, this document explicitly specifies that oil, gas, and mineral rights are reserved by the grantor, making it distinct in its terms and conditions.

Form components explained

- Legal description of the property being transferred.

- Clause indicating the reservation of oil, gas, and mineral rights.

- Covenant ensuring the grantor is lawfully seized of the property.

- Statement of warranty defending the title against all claims.

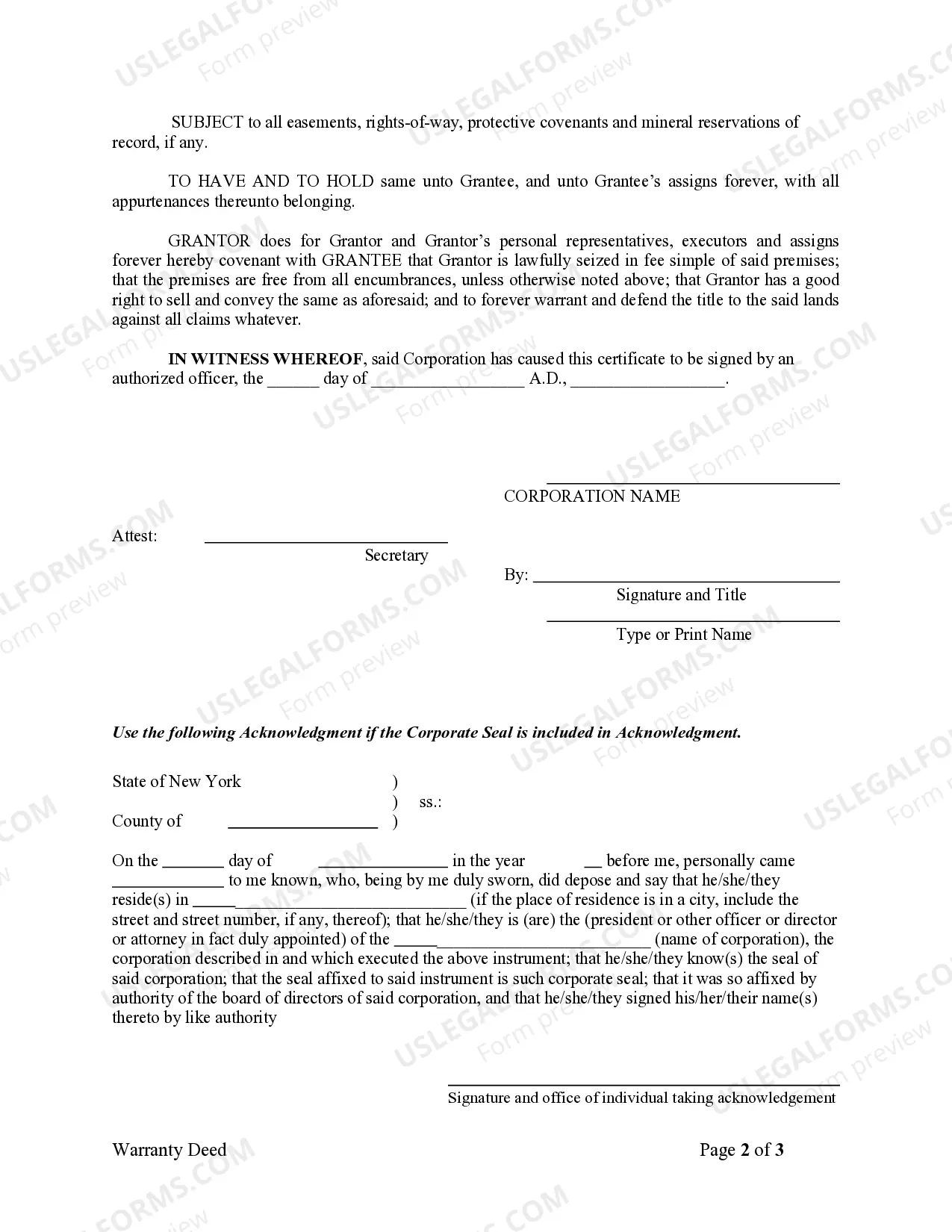

- Signature line for a representative of the grantor corporation.

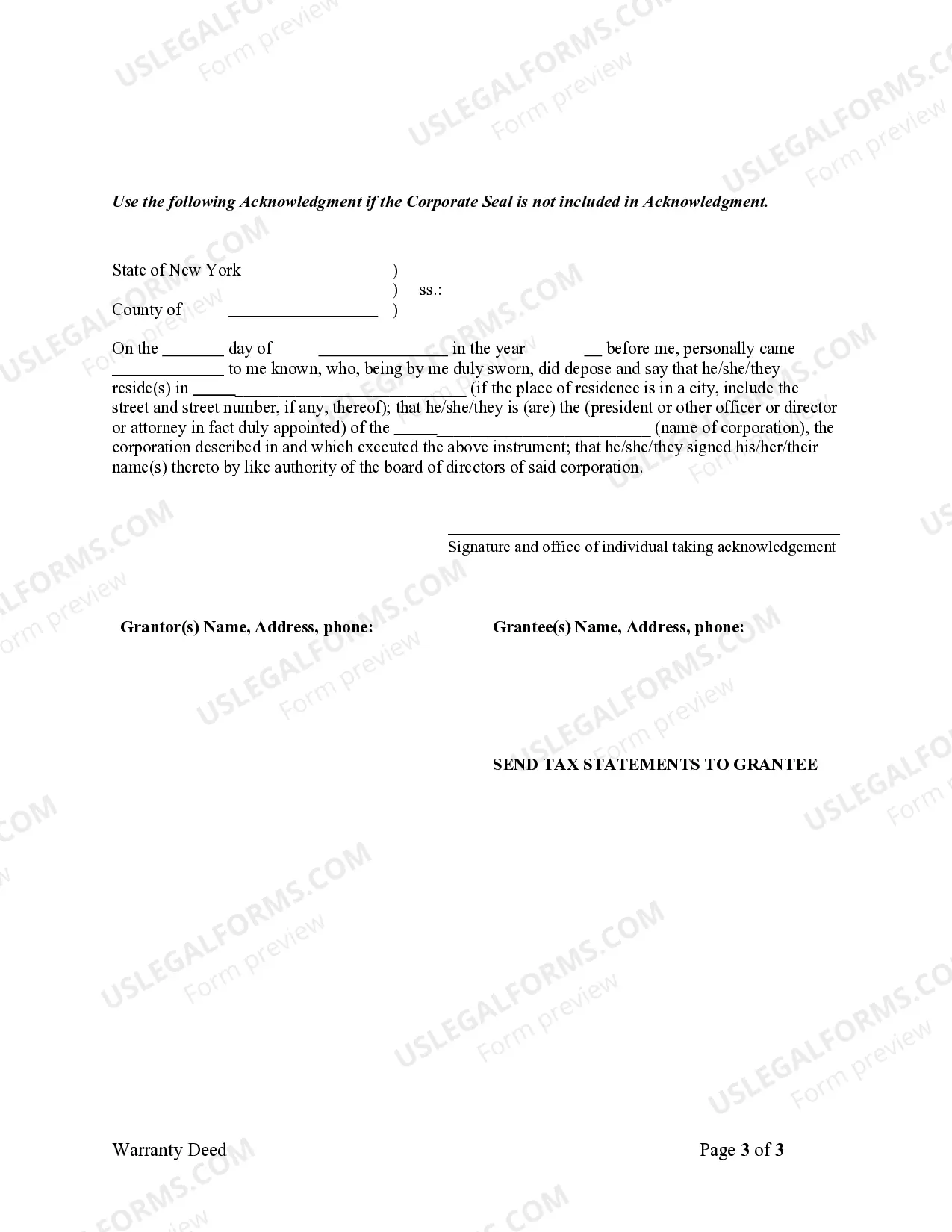

- Notary acknowledgment to validate the document.

When to use this document

This warranty deed is typically used in real estate transactions where one corporation is selling or transferring property to another corporation. It is essential when the property involved has significant value or when specific mineral rights are to be reserved. This form is also necessary when the parties wish to establish clear ownership and avoid disputes regarding property rights in the future.

Who this form is for

This form is suitable for:

- Corporations engaged in real estate transactions.

- Corporate entities looking to transfer ownership of property.

- Corporate officers authorized to execute property transfers.

Instructions for completing this form

- Identify the parties involved: the grantor and grantee corporations.

- Clearly describe the property being transferred, including legal descriptions.

- Specify any rights, such as oil, gas, and mineral reservations.

- Ensure that a corporate officer signs the deed under authority from the Board of Directors.

- Complete the notary acknowledgment section for legal validation.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Common mistakes

- Failing to include a complete legal description of the property.

- Not reserving mineral rights correctly if applicable.

- Allowing unauthorized individuals to sign the document.

- Neglecting to have the document notarized, if required by state law.

Why use this form online

- Immediate access: Download and complete the form at your convenience.

- Editability: Make necessary changes easily to suit your specific transaction.

- Reliability: Forms drafted by licensed attorneys ensure legal compliance.

Summary of main points

- The warranty deed transfers property ownership from one corporation to another.

- It includes important legal assurances regarding property title and rights.

- Notarization is required for this form to be legally effective.

Form popularity

FAQ

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

A quitclaim deed transfers real estate interests from one party to another. It is a special type of deed in which the grantee takes ownership of the interests the grantor has at the time of the deed's execution whether or not the grantor is the actual property owner. A quitclaim deed offers zero protection to buyers.

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.

Contains the strongest and broadest form of guarantee of title of any type of deed, and provides the greatest protection of any deed to the grantee. In this type of deed, the grantor makes various covenants, or warranties.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.