Assignment of a Specified Amount of Wages

Understanding this form

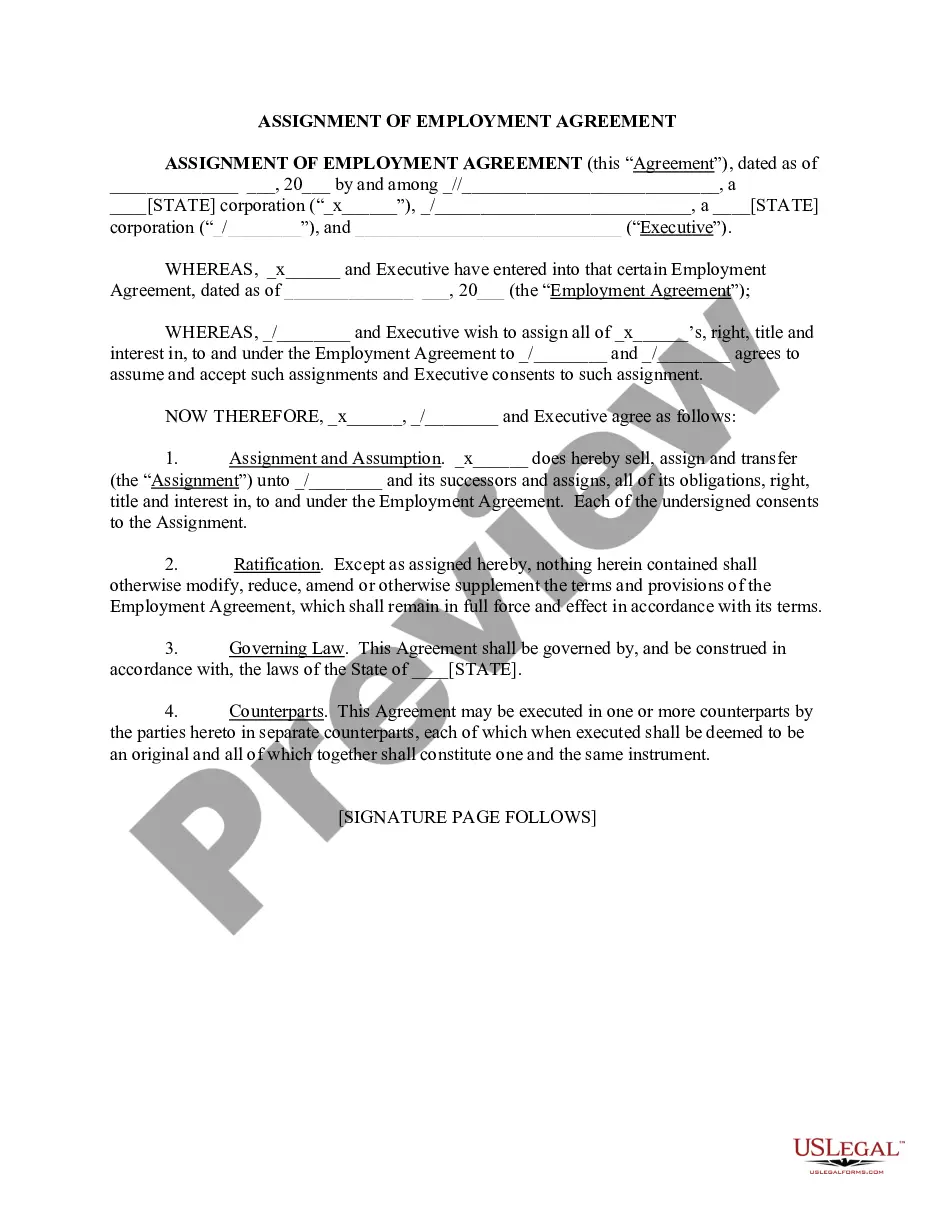

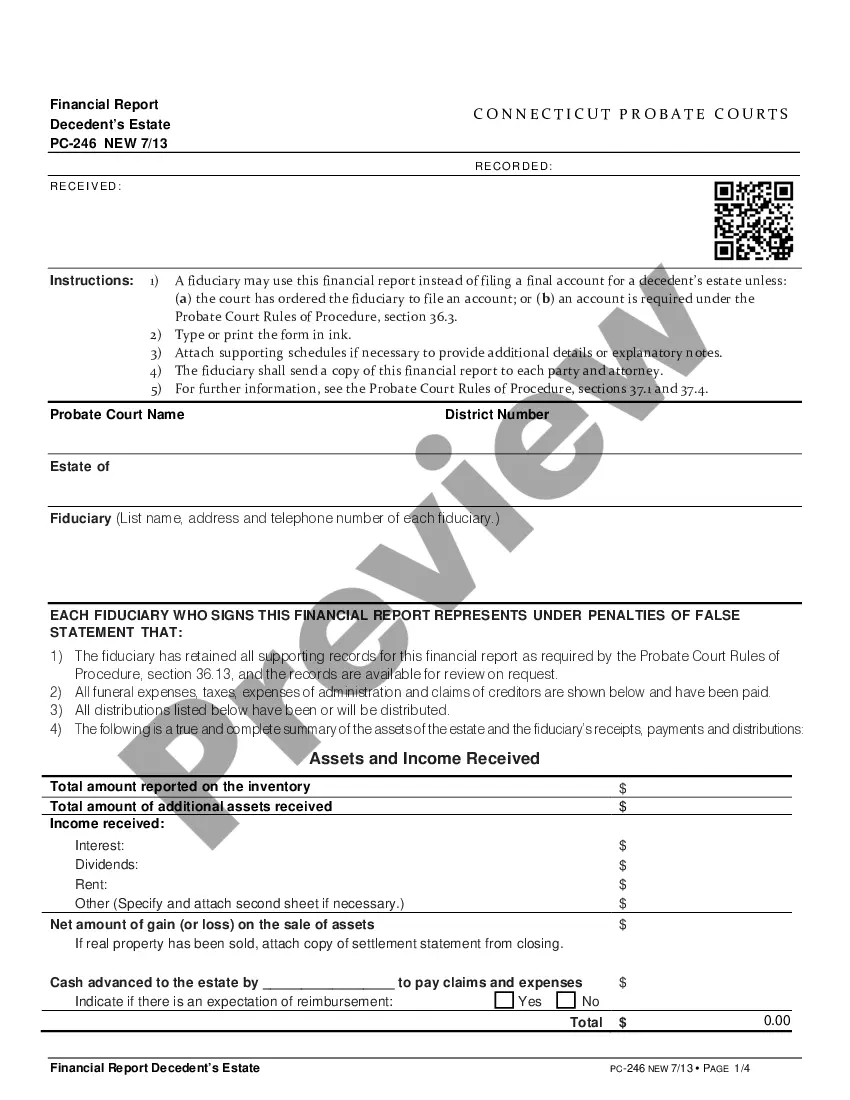

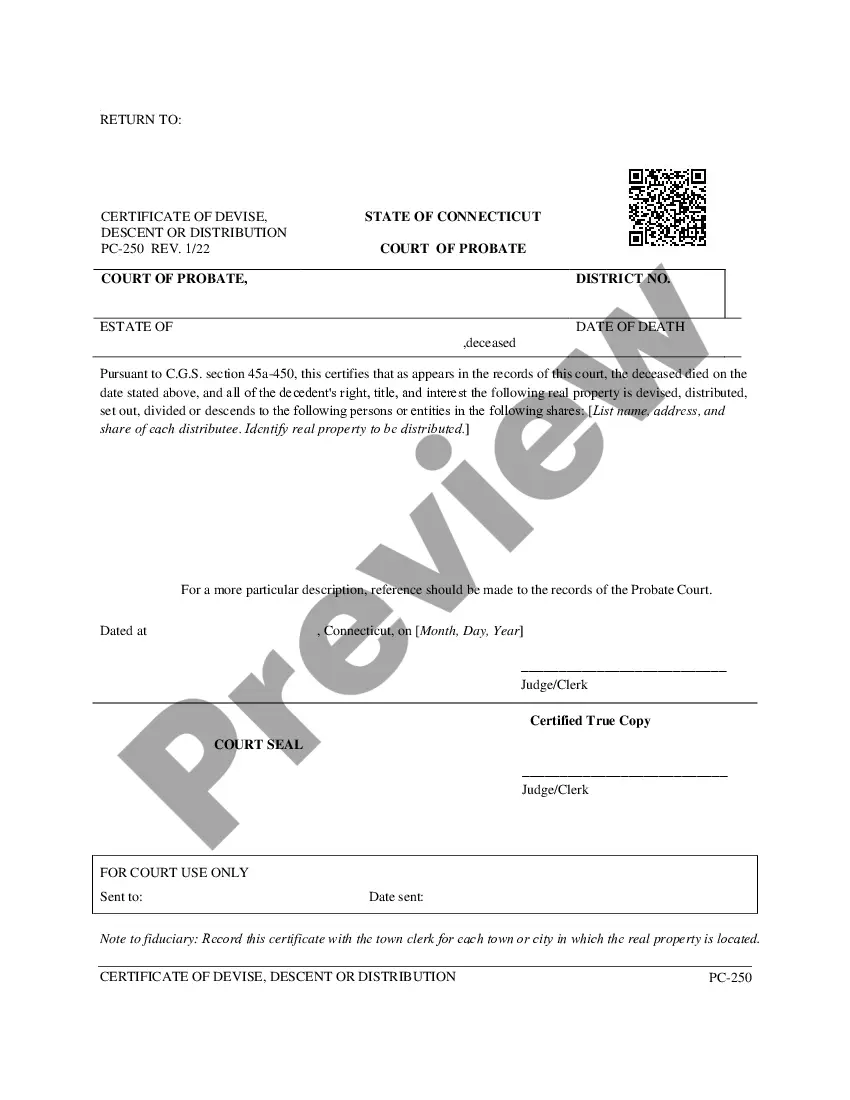

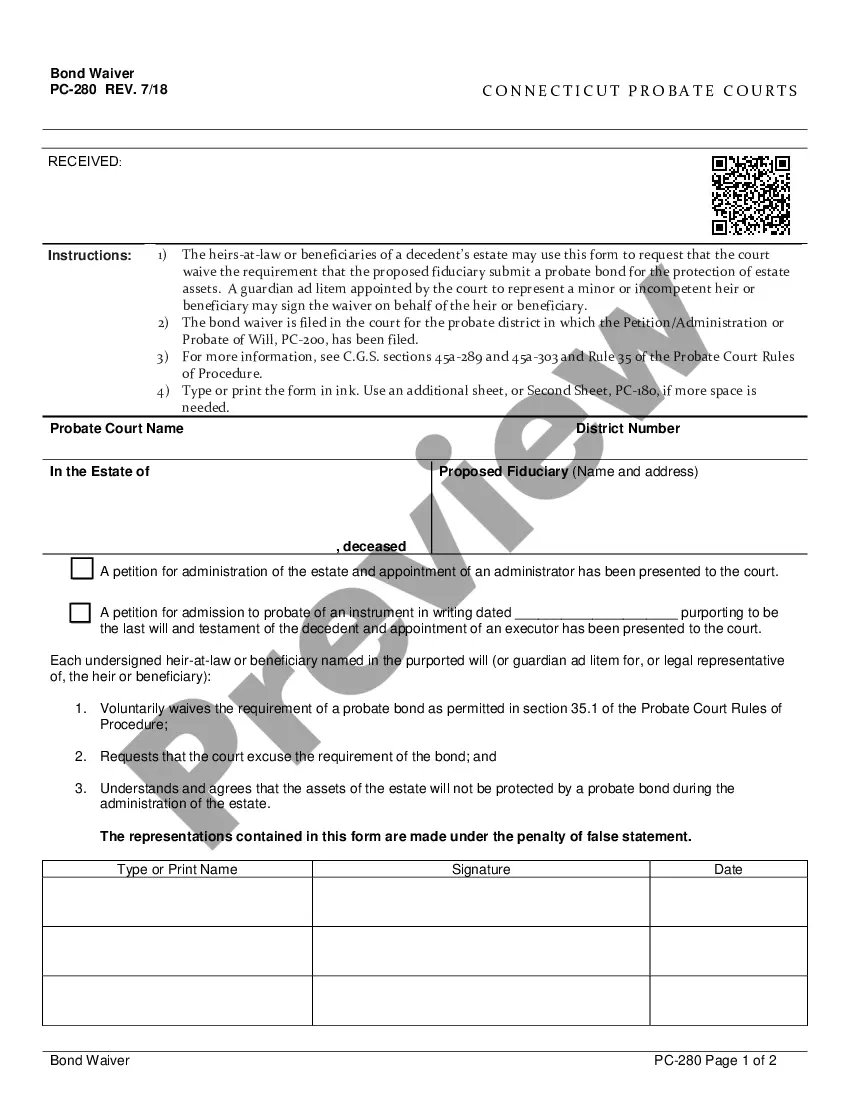

The Assignment of a Specified Amount of Wages is a legal document used to formally assign a portion of an individual's earnings to another party. This form ensures that the assignor, the person earning wages, authorizes the employer to pay a specified amount directly to the assignee. This differs from other wage assignment forms by focusing specifically on a fixed amount of wages related to a particular transaction, ensuring clarity on the obligations and rights of both parties involved.

Key components of this form

- Identification of the assignor and assignee, including their contact information.

- Details on the wages being assigned, including the time frame and employer information.

- Authorization section for the employer to pay the assignee directly.

- Warranties made by the assignor regarding their age, indebtedness, and the absence of other assignments.

- Governing law and arbitration clause for resolving disputes related to the assignment.

Common use cases

This form is useful in situations where an employee wishes to assign a specific portion of their wages to a creditor or individual. Common scenarios include debt repayment arrangements, securing a loan, or when a court has mandated wage assignments due to legal obligations. It is essential whenever a clear and legal documentation of a wage assignment is needed to avoid misunderstandings or disputes in the future.

Who this form is for

- Employees who want to assign a part of their wages to another person or entity.

- Employers who need clear documentation before processing wage assignments.

- Creditors seeking to collect debts through wage assignment agreements.

- Individuals and entities involved in contractual agreements requiring payment of wages as part of the arrangement.

Instructions for completing this form

- Fill in the date of the assignment and the names and addresses of both the assignor and assignee.

- Specify the amount of wages to be assigned and the applicable dates along with the position and employer details.

- Authorize the employer to remit payment to the assignee directly by signing the authorization section.

- Review the warranties and confirm that all conditions have been met before signing.

- Sign and date the form, ensuring all parties have the correct copies for their records.

Does this document require notarization?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Common mistakes

- Failing to specify the exact amount of wages being assigned.

- Not including or incorrectly filling out the employer's information.

- Neglecting to sign the assignment, making it unenforceable.

- Overlooking the warranties which can lead to legal complications if not adhered to.

Benefits of completing this form online

- Convenience of completing the form from home without the need for an appointment.

- Editability allows users to customize the document as needed before downloading.

- Access to attorney-drafted templates ensures legal compliance and clarity.

- Immediate download options save time compared to traditional methods.

State-specific requirements

This form is a general template that may be used in several states. Because requirements differ, review your state’s laws and adjust the document before using it.

Form popularity

FAQ

No assignment of wages is valid in California unless certain conditions are met. In addition, only a certain percentage of an employee's disposable wages can be withheld from each paycheck. Unlike a garnishment order, which is required to be honored by law, an employer has no obligation to honor an assignment.

In every case ordering spousal or partner support, the court will order that an earnings assignment (also called wage garnishment) be issued and served. The earnings assignment tells the employer of the person ordered to pay support to take the support payments out that person's wages.

25aa A wage assignment is an order that the paying party's employer send money from the paying party's. paycheck to the receiving party. 25aa If there is only a support order and no wage assignment then the paying party is to pay support directly to. the receiving party.

Court orders, such as an order to garnish your wages, will show up as part of a background check, since court records are public records.

A salary assignment arises out of an agreement between an employee (assigning debtor) and a third party (assignee creditor) who agree that the latter will acquire ownership of the assignable part of the compensation that the employer (the assigned) owes to their employee.

A wage assignment is a voluntary agreement between the employee and creditor where an amount is withheld from the employee's paycheck to satisfy a debt owed to a third-party recipient, whereas under a wage garnishment, the amount withheld from the employee's check is typically obtained through a court order initiated

Wage Assignment: Voluntary In a voluntary wage assignment, a worker asks their employer to withhold a portion of their paycheck and send it to a creditor to pay off a debt.Payday lenders often include voluntary wage assignments into their loan agreements to better their chances of being repaid.

A wage assignment is a voluntary agreement between the employee and creditor where an amount is withheld from the employee's paycheck to satisfy a debt owed to a third-party recipient, whereas under a wage garnishment, the amount withheld from the employee's check is typically obtained through a court order initiated

Employees cannot be fired because their wages are garnished. Federal law protects you from being fired simply because your wages are being garnished for a single debt. However, if your wages are being garnished for two or more debts, your employer can fire you if it decides to do so.